Paperwork

7 Years Tax Papers

Understanding the Importance of Maintaining 7 Years of Tax Papers

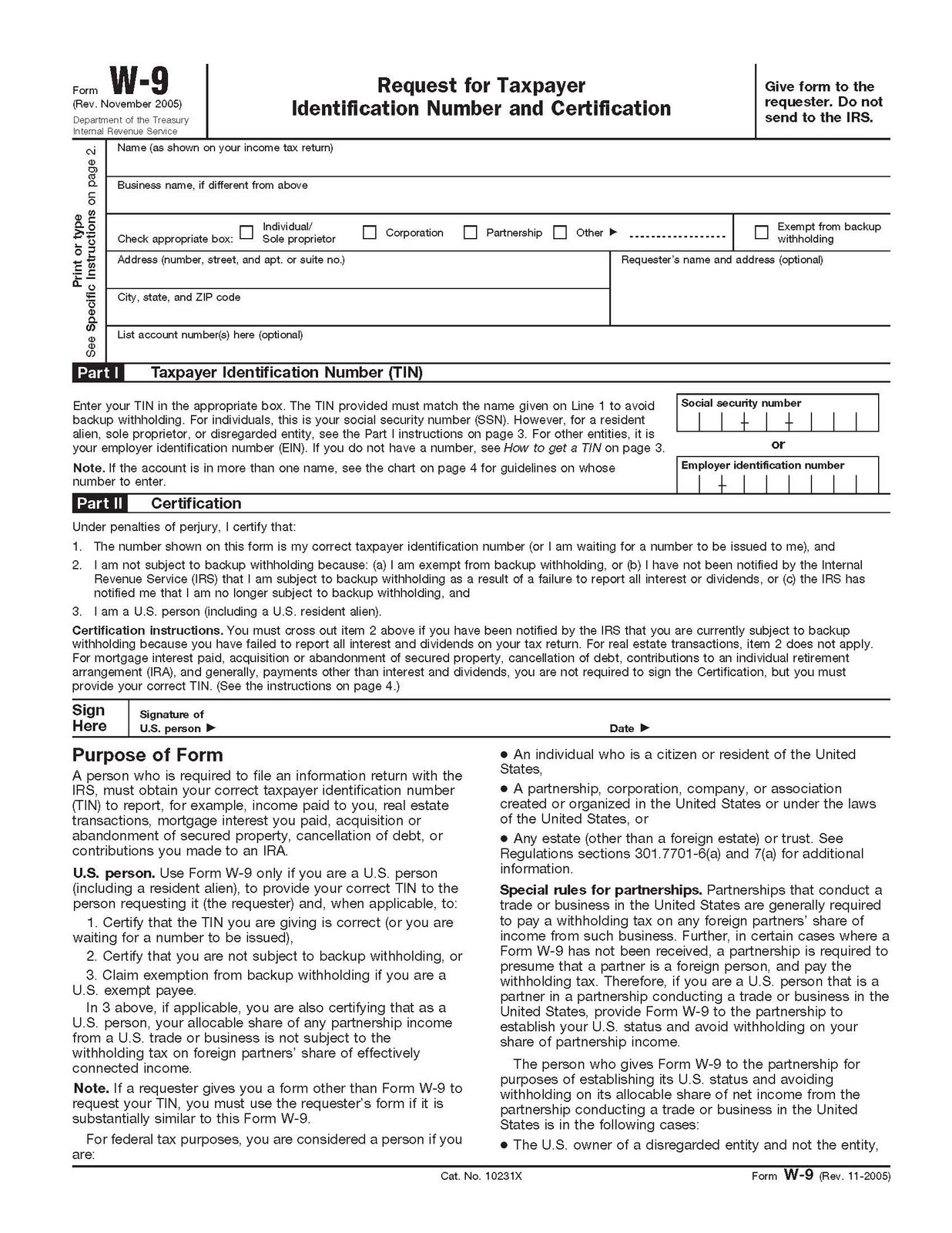

Maintaining a record of your tax papers for at least 7 years is a crucial aspect of financial management and tax compliance. This period is often recommended because the IRS has a window of 6 years to audit your tax return if they suspect a major error, and having these documents readily available can make a significant difference in case of an audit. Keeping detailed records can help you avoid potential penalties and ensure that you’re making the most of your tax deductions.

Why 7 Years?

The choice of 7 years is not arbitrary. It provides a buffer in case the IRS decides to conduct an audit. Generally, the IRS can include returns filed within the last three years in an audit. However, if they identify a substantial error, they may go back six years. Having an extra year’s worth of documents can provide peace of mind and ensure you have everything needed in case of a prolonged audit process.

What to Keep

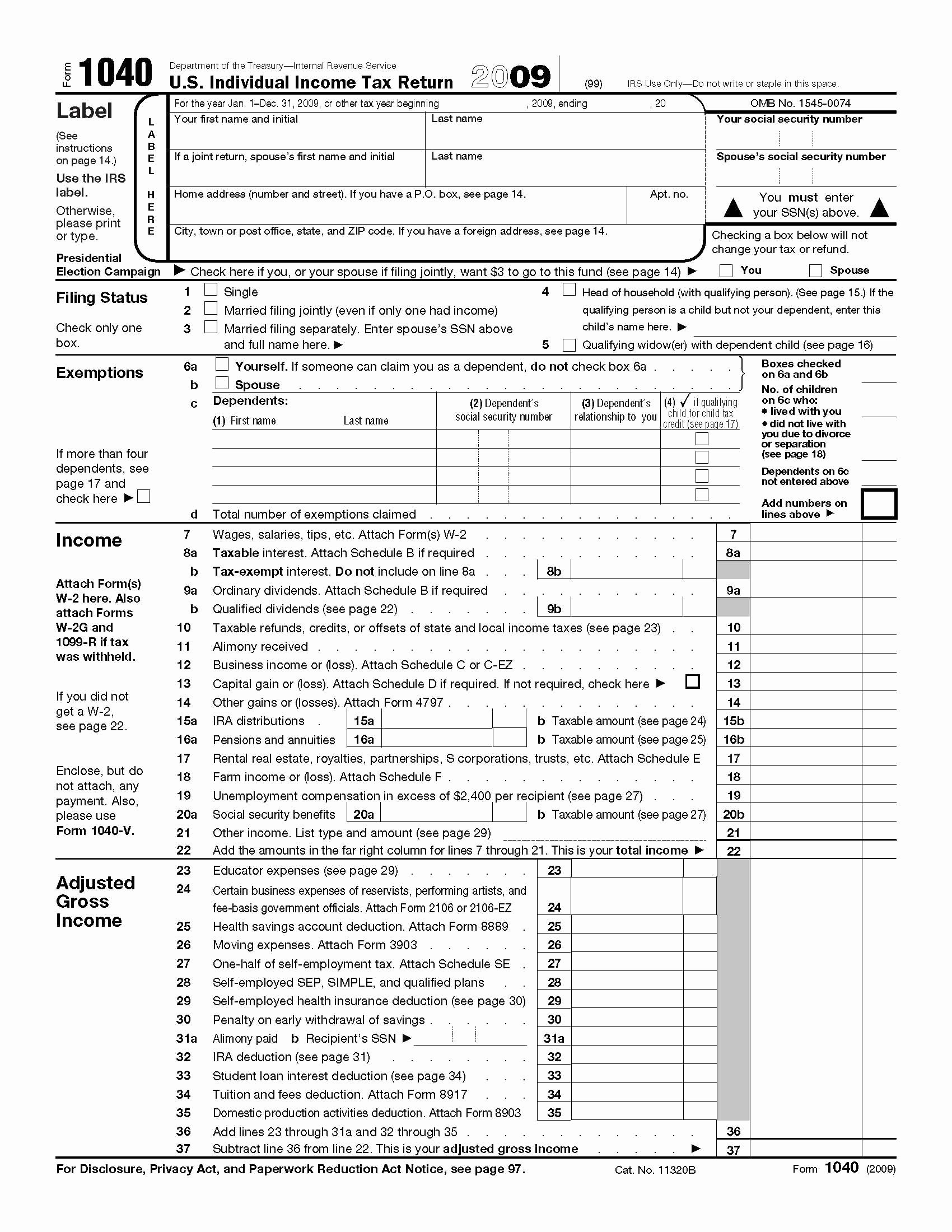

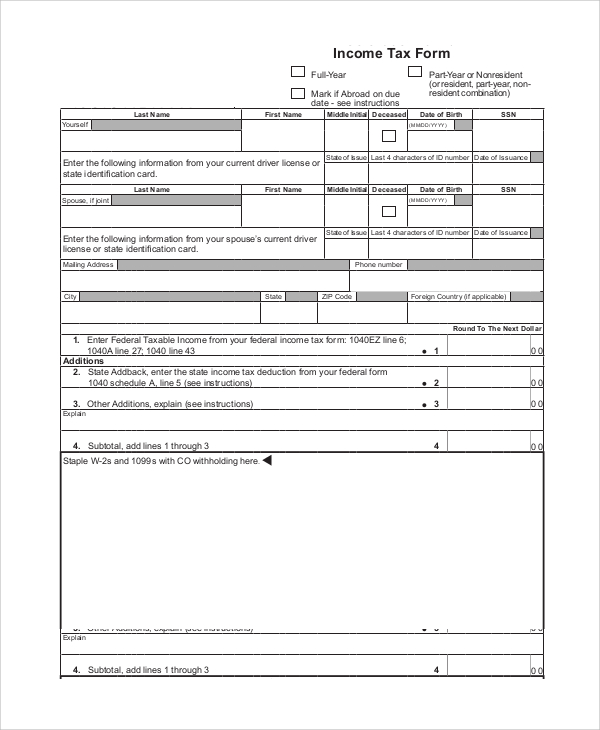

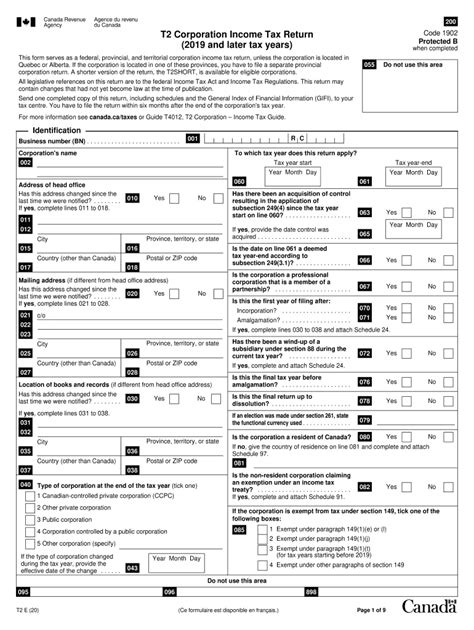

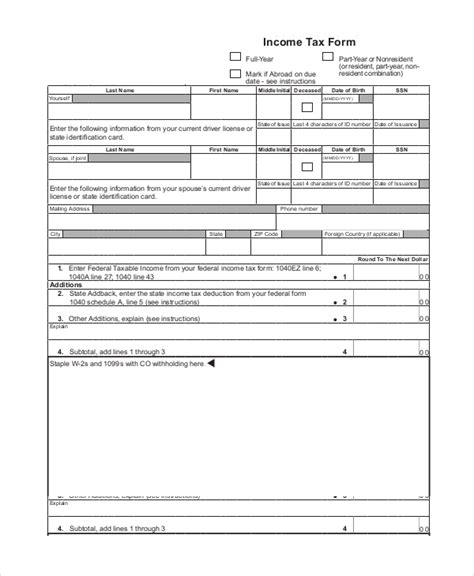

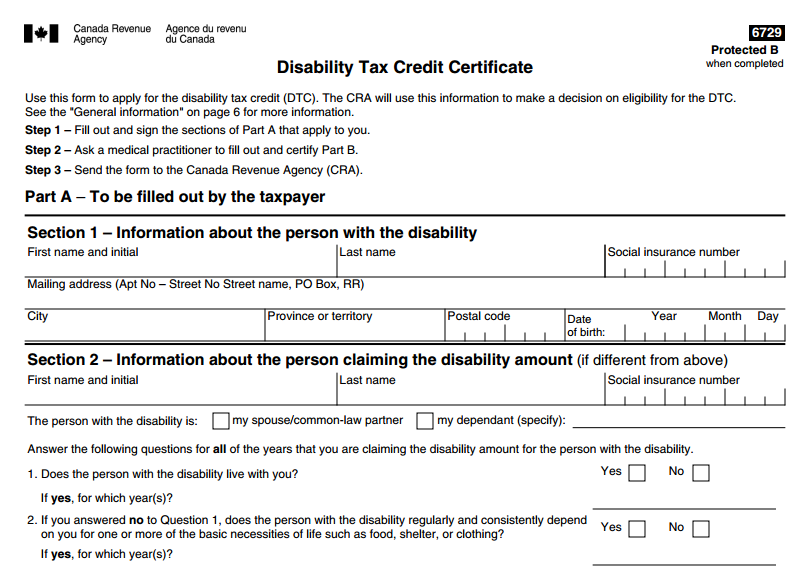

When it comes to tax papers, it’s essential to know what documents you should keep. Here’s a list of essential items: - Income-related documents: W-2 forms, 1099 forms for freelance or contract work, interest statements from banks (1099-INT), and dividend statements (1099-DIV). - Receipts for deductions: Keep receipts for charitable donations, medical expenses, home improvements (if you’re claiming a home office deduction), and business expenses if you’re self-employed. - Tax returns: Copies of your filed tax returns (Form 1040) for each year. - Proof of payment: Records of any tax payments you’ve made, including canceled checks or payment confirmations from the IRS website.

Organization Tips

To make the most of your 7-year tax paper collection, it’s vital to keep everything well-organized. Consider the following tips: - Use a filing system: Either physical or digital, a well-structured filing system can help you locate documents quickly. - Scan documents: Scanning your papers and saving them digitally can help reduce clutter and make it easier to find specific documents. - Back up your files: If you’re storing documents digitally, ensure you have a secure backup in case your primary storage is compromised.

Benefits of Digital Storage

Digital storage offers several benefits over traditional physical storage, including: - Space-saving: Digital files take up virtually no physical space. - Ease of access: You can access your files from anywhere, provided you have the right credentials. - Security: Digital files can be encrypted and protected with passwords, offering a high level of security. - Environmentally friendly: Reduces the need for physical paper and ink.

Common Mistakes to Avoid

When maintaining your tax papers, there are several common mistakes you should avoid: - Not keeping receipts: Failing to keep receipts for deductions can result in missed opportunities for tax savings. - Disorganizing documents: Poor organization can lead to lost documents and increased stress during tax season. - Not updating records: Failing to update your records annually can lead to inaccuracies and complications.

Tools for Tax Paper Management

Several tools are available to help manage your tax papers, including: - Cloud storage services like Dropbox, Google Drive, or Microsoft OneDrive for storing digital copies of your documents. - Scanner apps for digitizing physical receipts and documents. - Tax software that can help organize your tax information and provide guidance on what documents you need to keep.

📝 Note: Always ensure that any digital storage solution you choose is secure and compliant with data protection regulations to safeguard your sensitive financial information.

Conclusion and Final Thoughts

Maintaining 7 years of tax papers is a prudent financial habit that can protect you in case of an audit and ensure you’re maximizing your tax deductions. By understanding what documents to keep, how to organize them, and utilizing digital storage solutions, you can streamline your tax preparation process and reduce stress during tax season. Remember, being prepared is key to navigating the complexities of tax law and ensuring compliance.

What is the primary reason for keeping 7 years of tax papers?

+

The primary reason is to have a buffer in case the IRS decides to conduct an audit, as they generally have a window of 6 years to audit your tax return if they suspect a major error.

What types of documents should I keep for tax purposes?

+

You should keep income-related documents, receipts for deductions, copies of your tax returns, and proof of payment for any taxes owed.

Is digital storage a secure way to keep my tax papers?

+

Yes, digital storage can be a secure way to keep your tax papers, provided you use a secure service that encrypts your files and protects them with a password.