Keep Tax Paperwork Years

Understanding the Importance of Keeping Tax Paperwork for Years

When it comes to tax season, one of the most critical aspects is maintaining accurate and detailed records. The question often arises about how long one should keep tax paperwork. The answer is not straightforward, as it depends on several factors, including the type of tax return, the presence of deductions or audits, and personal financial circumstances. Keeping tax records for an extended period can provide peace of mind and protect individuals from potential legal and financial issues.

Why Keep Tax Paperwork?

There are several reasons why keeping tax paperwork for years is advisable: - Audit Protection: In the event of an audit, having detailed records can help prove deductions and income, reducing the risk of penalties and fines. - Amended Returns: If there’s a need to file an amended return, having the original paperwork can make the process smoother. - Financial Records: Tax documents often contain valuable financial information that can be useful for future financial planning, loans, or other significant life events. - Business or Investment Tracking: For those with businesses or investments, tax records can provide a historical perspective on financial performance and growth.

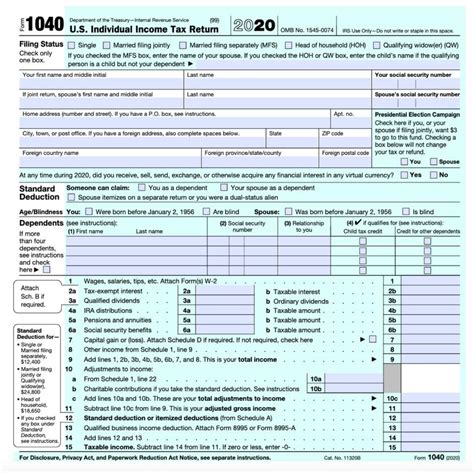

What to Keep and for How Long

The duration for keeping tax paperwork varies based on the content and purpose of the documents. Here are some guidelines: - Income Tax Returns: It’s recommended to keep income tax returns forever, as they provide a record of income and can be useful for future reference. - Supporting Documents: Keep supporting documents such as W-2s, 1099s, receipts for deductions, and records of charitable donations for at least three to seven years in case of an audit. - Business Records: For businesses, it’s crucial to keep detailed financial records, including tax returns, for the life of the business. This can help in tracking financial health, making future business decisions, and in case of audits. - Estate and Gift Tax Records: These should be kept indefinitely, as they can impact future estate planning and tax obligations.

How to Store Tax Paperwork

Given the importance of keeping tax paperwork for years, it’s equally important to store these documents securely and efficiently. Here are some tips: - Digital Storage: Consider scanning physical documents and storing them digitally. This can include external hard drives, cloud storage services, or encrypted digital vaults. - Physical Storage: For original documents that need to be kept in physical form, use a fireproof safe or a secure file cabinet. - Organization: Keep documents well-organized, either physically or digitally, for easy access when needed.

Best Practices for Managing Tax Paperwork

To make the process of keeping tax paperwork manageable, follow these best practices: - Create a System: Develop a consistent system for storing and retrieving tax documents. - Backup Regularly: If using digital storage, ensure that backups are made regularly to prevent data loss. - Review and Update: Annually review the stored documents to ensure they are up-to-date and to discard any that are no longer necessary.

📝 Note: Always check with a tax professional or financial advisor for specific guidance on keeping tax paperwork, as individual circumstances can affect the type and duration of record-keeping.

In essence, keeping tax paperwork for years is a prudent practice that can protect individuals and businesses from potential financial and legal repercussions. By understanding what to keep, how long to keep it, and implementing a secure storage system, individuals can ensure they are prepared for any situation that may arise.

As we reflect on the importance of maintaining detailed tax records, it becomes clear that this practice is not merely about compliance but also about personal and business financial health. By adopting a diligent approach to tax paperwork management, individuals can safeguard their financial future and navigate the complexities of tax obligations with confidence.

How long should I keep my tax returns?

+

It’s recommended to keep income tax returns forever, as they provide a record of income and can be useful for future reference.

What happens if I don’t keep my tax paperwork?

+

Failing to keep tax paperwork can lead to difficulties in audits, amended returns, and accessing financial information for loans or other significant life events.

Can I store my tax paperwork digitally?

+

Yes, digital storage is a convenient and secure way to keep tax paperwork. Consider using encrypted digital vaults or cloud storage services for added security.