Loan Payoff Paperwork Requirements

Introduction to Loan Payoff Paperwork

When it comes to paying off a loan, there are several steps that borrowers must take to ensure that the process is completed efficiently and effectively. One of the most critical aspects of loan payoff is the paperwork requirements. In this article, we will delve into the world of loan payoff paperwork, exploring the various documents and forms that are necessary to complete the process. We will also discuss the importance of accuracy and attention to detail when it comes to loan payoff paperwork, as well as the potential consequences of errors or omissions.

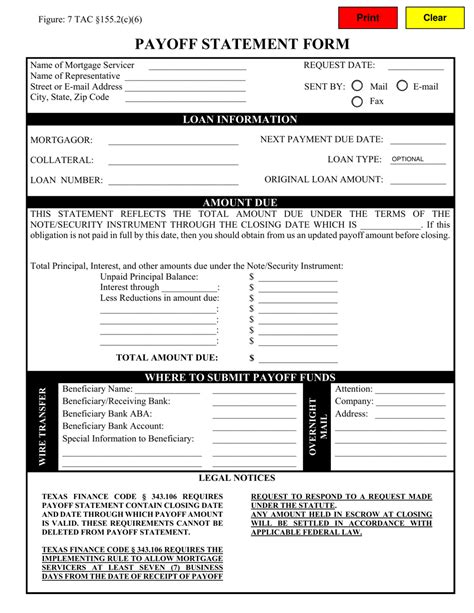

Types of Loan Payoff Paperwork

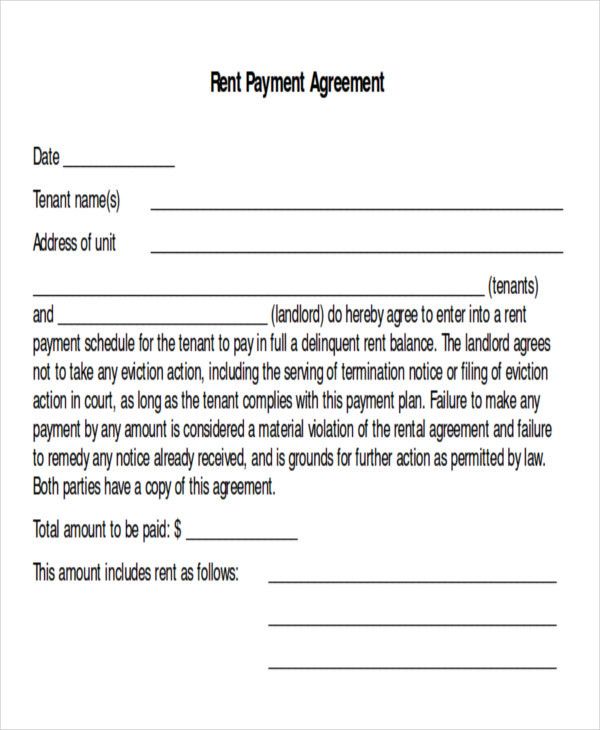

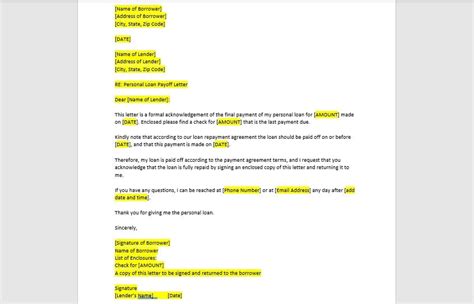

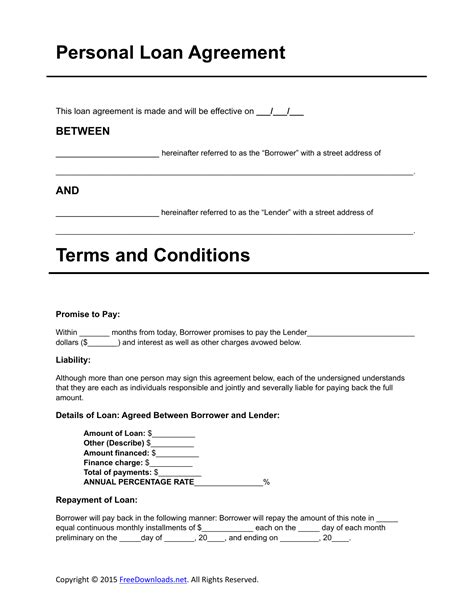

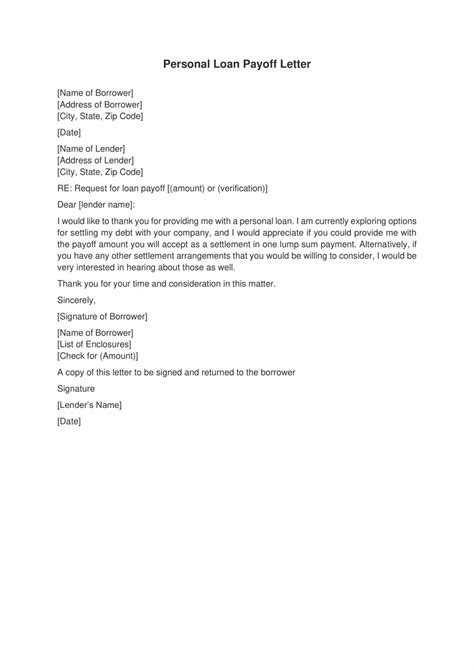

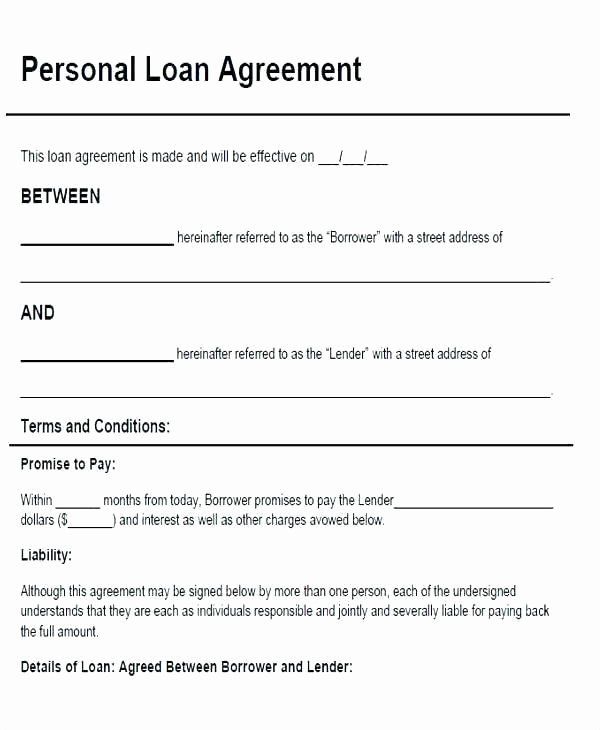

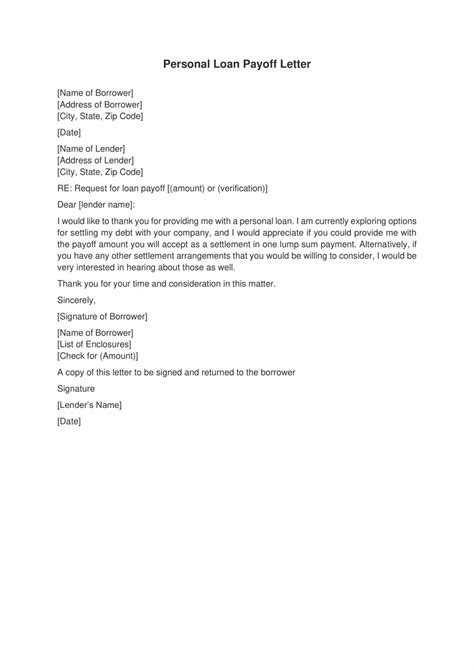

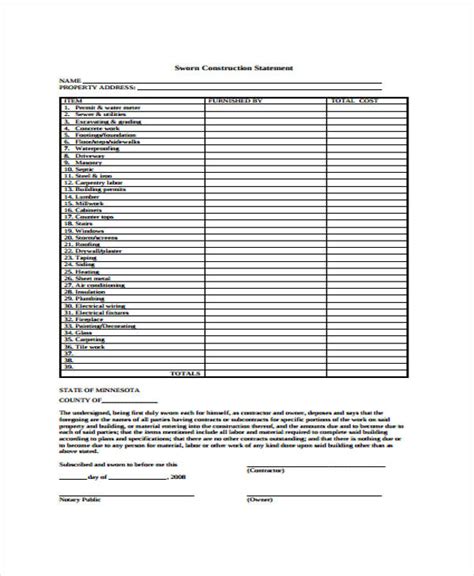

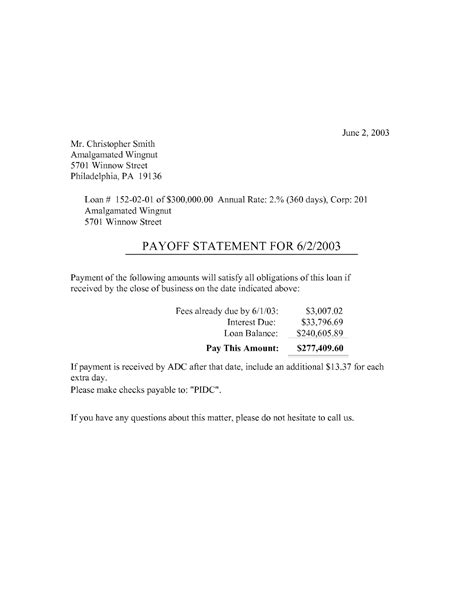

There are several types of loan payoff paperwork that borrowers may encounter, depending on the type of loan and the lender. Some of the most common types of loan payoff paperwork include: * Loan payoff statements: These statements provide a detailed breakdown of the loan balance, including the principal amount, interest, and any fees or charges. * Loan satisfaction forms: These forms confirm that the loan has been paid in full and release the borrower from any further obligations. * Release of lien forms: These forms release the lender’s lien on the collateral, allowing the borrower to take possession of the property. * Notarized letters: These letters may be required to confirm the borrower’s identity and acknowledge the loan payoff.

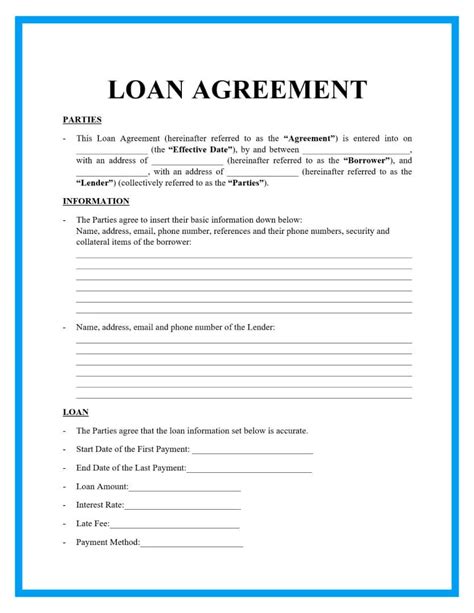

Required Documents for Loan Payoff

In order to complete the loan payoff process, borrowers will typically need to provide a range of documents, including: * Identification: A valid government-issued ID, such as a driver’s license or passport. * Loan documents: The original loan agreement, as well as any amendments or modifications. * Proof of payment: A receipt or confirmation of the loan payoff amount. * Notarized signatures: In some cases, borrowers may need to provide notarized signatures to confirm their identity and acknowledge the loan payoff.

Importance of Accuracy and Attention to Detail

When it comes to loan payoff paperwork, accuracy and attention to detail are crucial. Errors or omissions can lead to delays, additional fees, or even legal issues. Borrowers should carefully review all documents and forms to ensure that they are complete and accurate, and should seek clarification if they are unsure about any aspect of the process.

💡 Note: Borrowers should keep a copy of all loan payoff paperwork for their records, as this can help to prevent disputes or issues in the future.

Consequences of Errors or Omissions

If borrowers fail to provide accurate or complete loan payoff paperwork, they may face a range of consequences, including: * Delays in loan payoff: Errors or omissions can lead to delays in the loan payoff process, which can result in additional interest charges or fees. * Additional fees or charges: Borrowers may be liable for additional fees or charges if they fail to provide accurate or complete loan payoff paperwork. * Legal issues: In extreme cases, errors or omissions can lead to legal issues, such as disputes over the loan balance or the borrower’s obligations.

Best Practices for Loan Payoff Paperwork

To ensure that the loan payoff process is completed efficiently and effectively, borrowers should follow best practices, such as: * Carefully reviewing all documents and forms: Borrowers should take the time to carefully review all loan payoff paperwork to ensure that it is complete and accurate. * Seeking clarification if unsure: If borrowers are unsure about any aspect of the loan payoff process, they should seek clarification from the lender or a financial advisor. * Keeping a copy of all paperwork: Borrowers should keep a copy of all loan payoff paperwork for their records, as this can help to prevent disputes or issues in the future.

| Document | Description |

|---|---|

| Loan payoff statement | A detailed breakdown of the loan balance |

| Loan satisfaction form | A confirmation that the loan has been paid in full |

| Release of lien form | A release of the lender's lien on the collateral |

As borrowers navigate the loan payoff process, it is essential that they understand the importance of accurate and complete paperwork. By following best practices and seeking clarification if unsure, borrowers can ensure that the loan payoff process is completed efficiently and effectively, and that they are released from their obligations without issue. In the end, the key to a successful loan payoff is attention to detail and a thorough understanding of the paperwork requirements.

What is a loan payoff statement?

+

A loan payoff statement is a document that provides a detailed breakdown of the loan balance, including the principal amount, interest, and any fees or charges.

Why is it important to keep a copy of loan payoff paperwork?

+

Keeping a copy of loan payoff paperwork can help to prevent disputes or issues in the future, and can provide a record of the loan payoff in case of any errors or omissions.

What are the consequences of errors or omissions in loan payoff paperwork?

+

Errors or omissions in loan payoff paperwork can lead to delays, additional fees or charges, or even legal issues.