Paperwork

Wealth Investor Paperwork Needed

Introduction to Wealth Investing

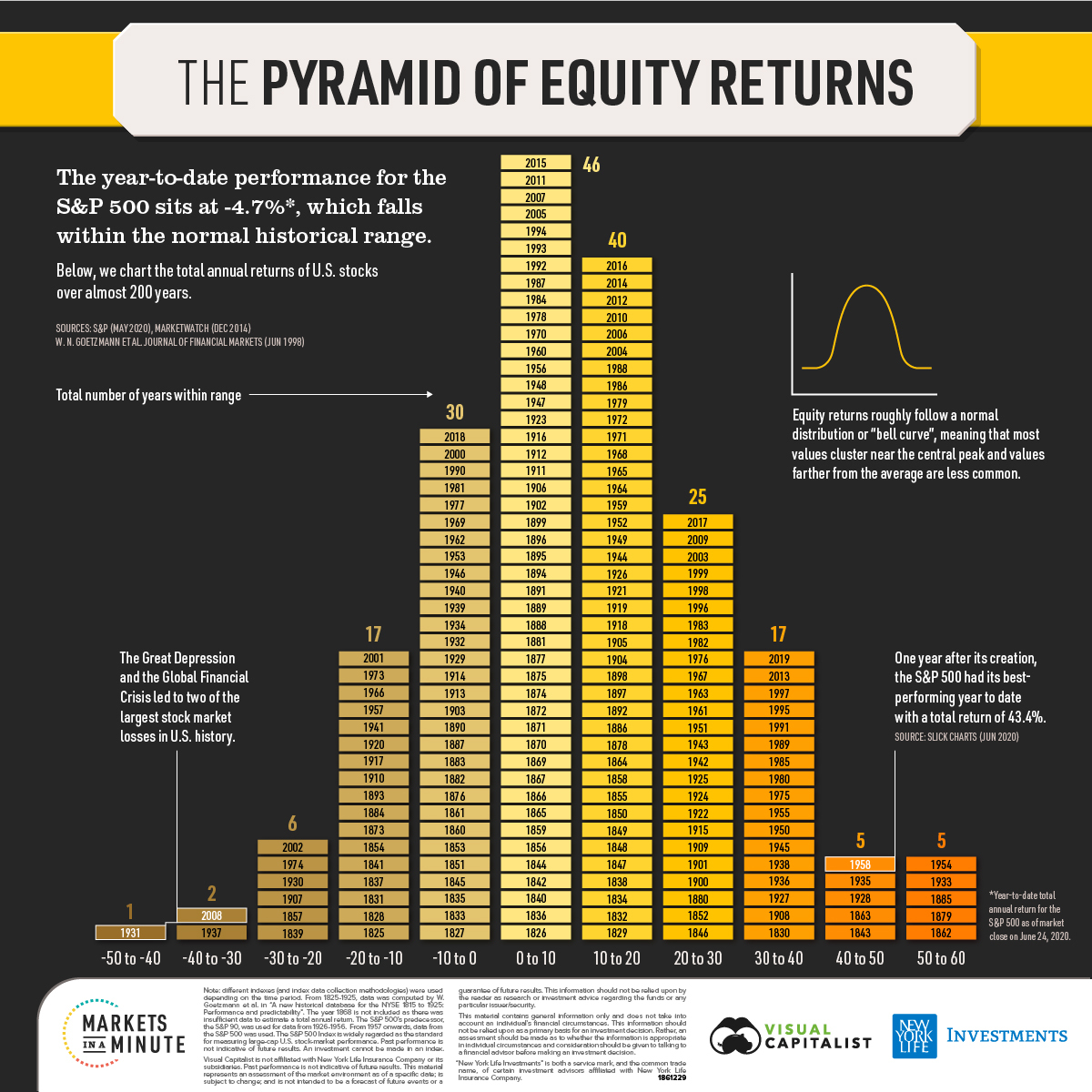

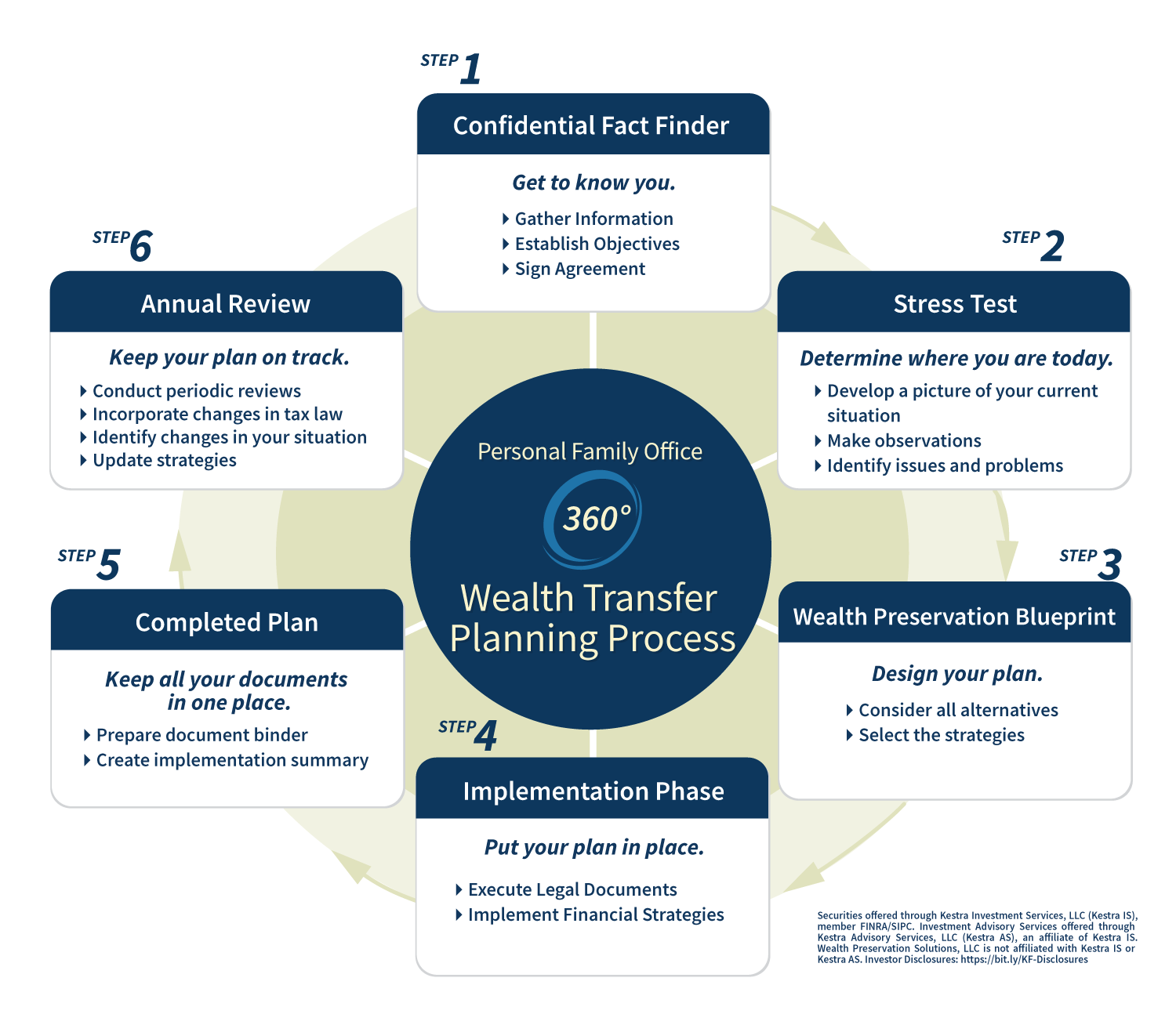

When it comes to investing in wealth, there are several factors to consider, including the type of investment, the risk involved, and the potential return on investment. One crucial aspect of wealth investing is the paperwork required to get started. In this article, we will explore the various types of paperwork needed for wealth investing and provide a comprehensive guide on how to navigate the process.

Types of Paperwork Needed

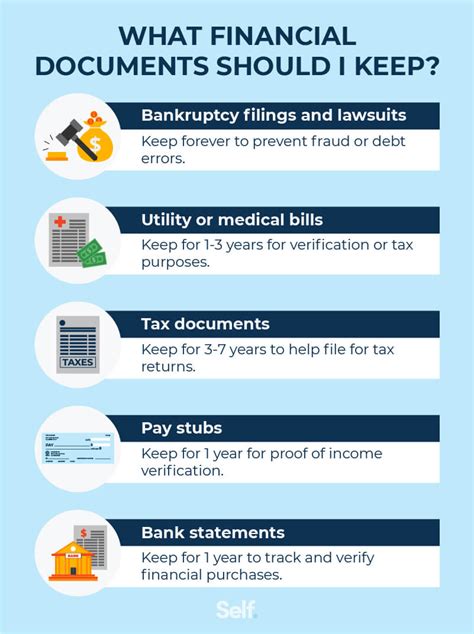

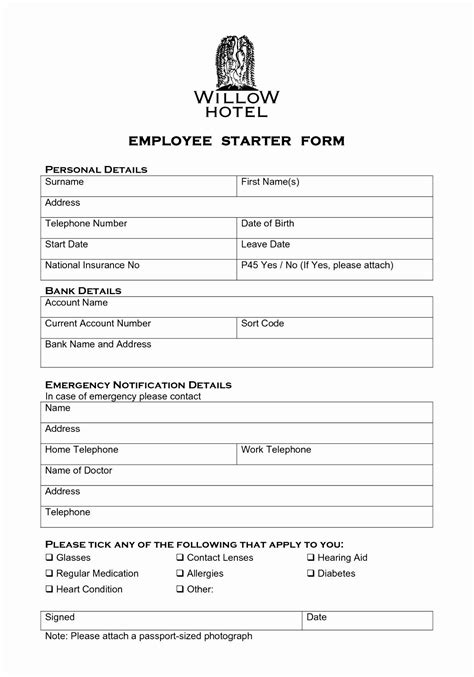

The type of paperwork required for wealth investing varies depending on the investment vehicle chosen. Some common types of paperwork needed include: * Account opening forms: These forms are required to open a new investment account, such as a brokerage account or a retirement account. * Identification documents: Investors may need to provide identification documents, such as a passport or driver’s license, to verify their identity. * Income verification documents: Some investments may require income verification documents, such as pay stubs or tax returns, to determine the investor’s eligibility. * Risk assessment forms: These forms are used to assess the investor’s risk tolerance and investment goals.

Investment Vehicles and Required Paperwork

Different investment vehicles require different types of paperwork. Here are some examples: * Stocks and Bonds: To invest in stocks and bonds, investors typically need to open a brokerage account, which requires account opening forms, identification documents, and income verification documents. * Real Estate: Investing in real estate requires a significant amount of paperwork, including property deeds, titles, and contracts. * Mutual Funds: To invest in mutual funds, investors typically need to complete a mutual fund application, which requires identification documents and income verification documents. * Retirement Accounts: To open a retirement account, such as a 401(k) or IRA, investors need to complete account opening forms and provide identification documents.

Table of Required Paperwork

The following table summarizes the types of paperwork required for different investment vehicles:

| Investment Vehicle | Required Paperwork |

|---|---|

| Stocks and Bonds | Account opening forms, identification documents, income verification documents |

| Real Estate | Property deeds, titles, contracts |

| Mutual Funds | Mutual fund application, identification documents, income verification documents |

| Retirement Accounts | Account opening forms, identification documents |

📝 Note: The required paperwork may vary depending on the specific investment vehicle and the investor's individual circumstances.

Navigating the Paperwork Process

Navigating the paperwork process for wealth investing can be complex and time-consuming. Here are some tips to help investors get started: * Research the investment vehicle: Before investing, research the investment vehicle and the required paperwork. * Consult with a financial advisor: A financial advisor can help investors navigate the paperwork process and ensure that all required documents are completed accurately. * Use online resources: Many investment companies offer online resources and tools to help investors complete the paperwork process.

Conclusion and Final Thoughts

In conclusion, the paperwork required for wealth investing can be complex and time-consuming. However, by understanding the types of paperwork needed and navigating the process carefully, investors can ensure that their investments are successful and profitable. It is essential to research the investment vehicle, consult with a financial advisor, and use online resources to get started. By following these tips and staying organized, investors can navigate the paperwork process with ease and achieve their financial goals.

What type of paperwork is required to open a brokerage account?

+

To open a brokerage account, investors typically need to complete account opening forms, provide identification documents, and verify their income.

Do I need to provide income verification documents to invest in mutual funds?

+

Yes, some mutual funds may require income verification documents to determine the investor’s eligibility.

Can I invest in real estate without completing any paperwork?

+

No, investing in real estate typically requires a significant amount of paperwork, including property deeds, titles, and contracts.