Paperwork

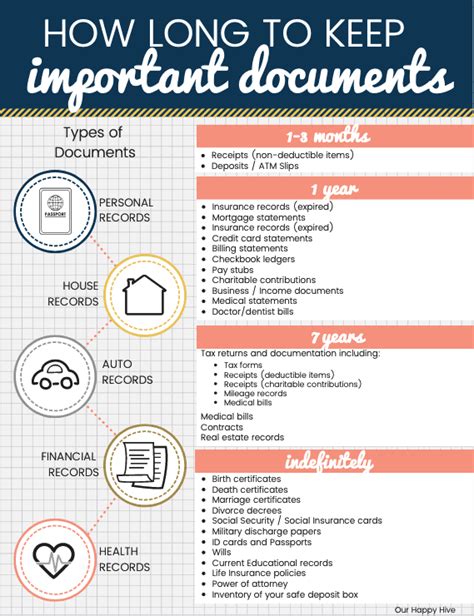

Years of Paperwork to Keep

Introduction to Record Keeping

Managing paperwork and maintaining accurate records is a crucial aspect of both personal and professional life. It involves keeping track of various documents, receipts, invoices, and other papers that are essential for financial, legal, and administrative purposes. The task of organizing and storing these documents can be overwhelming, especially when considering the years of paperwork that need to be kept. In this blog post, we will discuss the importance of record keeping, the types of documents that should be kept, and provide tips on how to manage paperwork effectively.

Why Keep Records?

Keeping records is essential for several reasons. Financial records, such as receipts, invoices, and bank statements, are necessary for tax purposes and to track expenses. Legal documents, like contracts, agreements, and wills, are critical for protecting one’s rights and interests. Additionally, medical records and insurance documents are vital for health and financial security. Maintaining accurate and up-to-date records can help individuals and businesses make informed decisions, avoid disputes, and ensure compliance with laws and regulations.

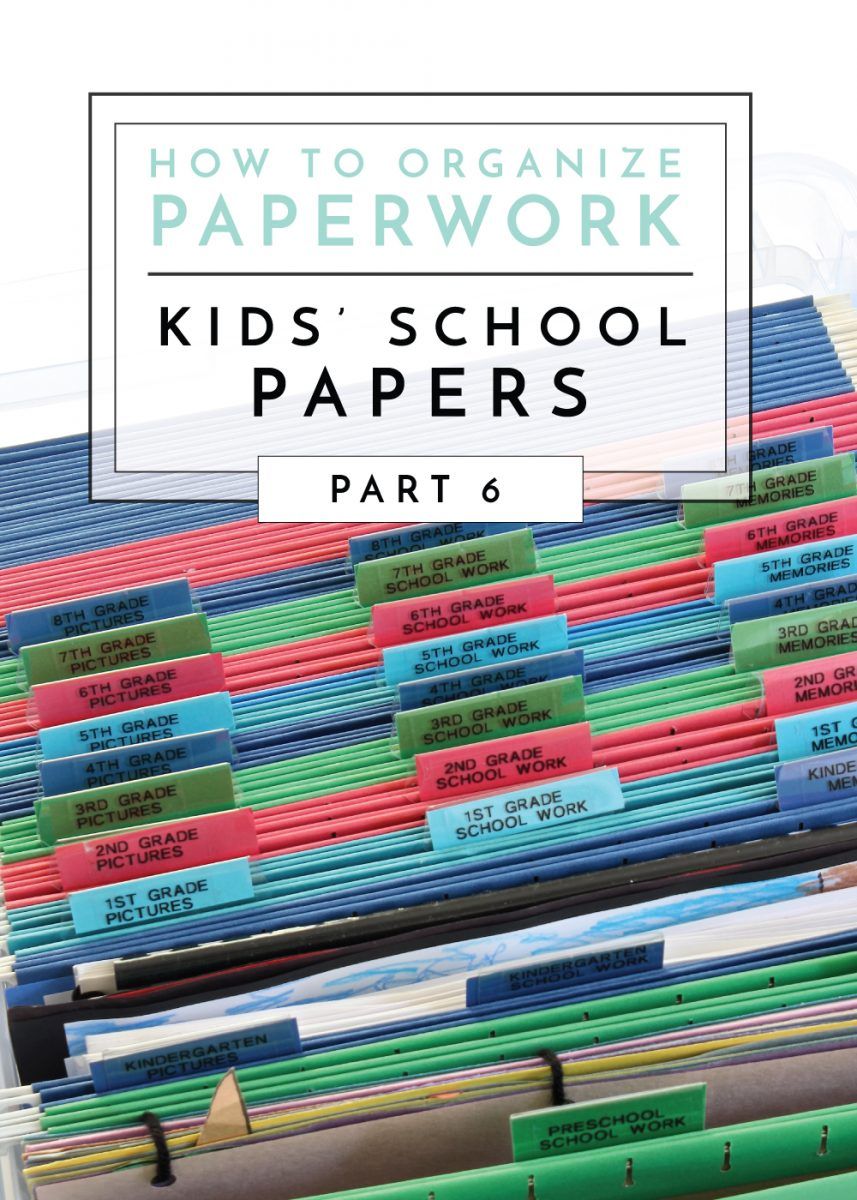

Types of Documents to Keep

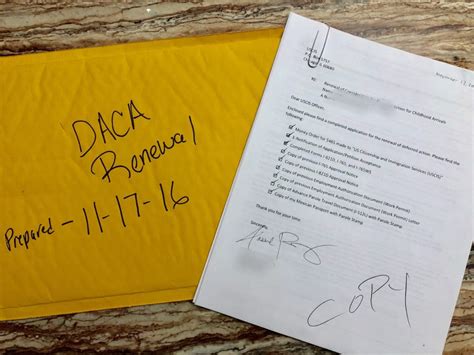

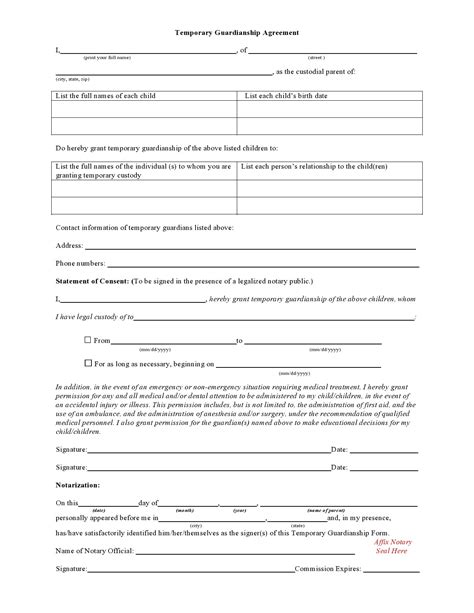

There are various types of documents that should be kept, including: * Financial records: receipts, invoices, bank statements, tax returns * Legal documents: contracts, agreements, wills, divorce papers * Medical records: medical bills, prescriptions, test results * Insurance documents: health, life, auto, home insurance policies * Personal documents: identification, birth certificates, marriage licenses * Business documents: business licenses, permits, employee records

How Long to Keep Records

The length of time to keep records varies depending on the type of document and its purpose. Here are some general guidelines: * Financial records: 3-7 years * Tax records: 3-7 years * Medical records: 5-10 years * Insurance documents: as long as the policy is active * Business records: 3-10 years

📝 Note: It's essential to check with local authorities and professionals to determine the specific record-keeping requirements for your area and industry.

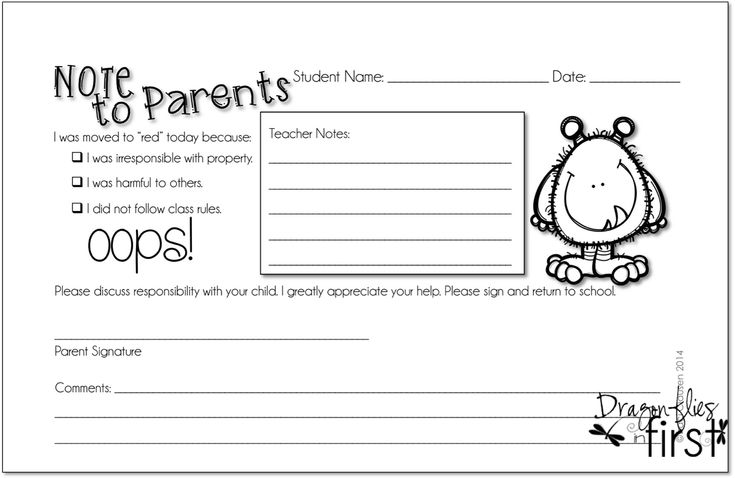

Effective Record Keeping Tips

To manage paperwork effectively, consider the following tips: * Create a filing system: use folders, labels, and categories to organize documents * Use a digital storage system: scan documents and store them electronically * Set up a regular review process: schedule regular reviews to update and purge records * Consider hiring a professional: if you’re overwhelmed, consider hiring a record-keeping service or consultant

Best Practices for Digital Record Keeping

Digital record keeping offers several advantages, including reduced storage space, increased accessibility, and improved security. To ensure effective digital record keeping, follow these best practices: * Use secure storage: use encrypted storage devices or cloud storage services * Create backups: regularly back up digital records to prevent data loss * Use password protection: protect digital records with strong passwords and access controls * Implement version control: track changes and updates to digital records

Conclusion

In summary, keeping years of paperwork can be a daunting task, but it’s essential for personal and professional purposes. By understanding the importance of record keeping, the types of documents to keep, and implementing effective management strategies, individuals and businesses can maintain accurate and up-to-date records. Remember to always check with local authorities and professionals to determine specific record-keeping requirements, and consider digital record keeping for improved accessibility and security.

What is the best way to organize financial records?

+

The best way to organize financial records is to create a filing system with categories and labels, and consider using a digital storage system for easy access and security.

How long should I keep tax records?

+

It’s recommended to keep tax records for 3-7 years, depending on the type of tax and the specific requirements of your local authorities.

What are the benefits of digital record keeping?

+

The benefits of digital record keeping include reduced storage space, increased accessibility, and improved security, as well as the ability to easily backup and version control digital records.