Paperwork

7 Years Paperwork

Introduction to 7 Years Paperwork

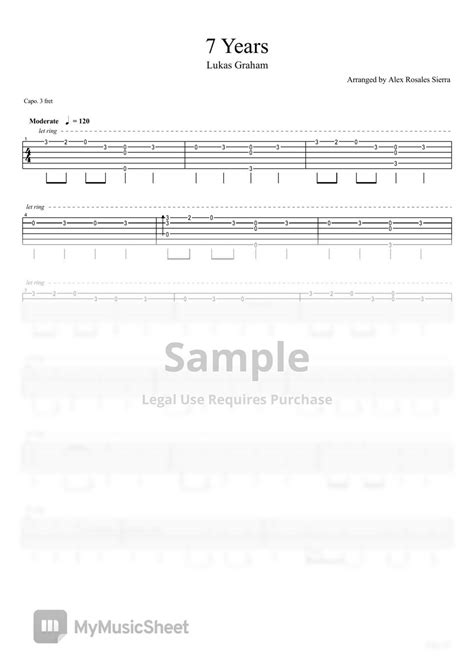

When it comes to managing personal or business finances, one of the most critical aspects is maintaining accurate and comprehensive records. This is where the concept of 7 years paperwork comes into play. Keeping financial records for 7 years is a common recommendation, especially for tax purposes and potential audits. In this article, we will delve into the reasons behind this timeframe, the types of documents that should be kept, and how to efficiently manage these records.

Why 7 Years?

The 7-year guideline primarily stems from the statute of limitations for tax audits and the potential for amendments to tax returns. In many countries, the tax authority has the right to audit and reassess tax returns within a certain number of years from the date of filing. While this period can vary, 7 years is a commonly cited benchmark to ensure that individuals and businesses are prepared in case of an audit or if they need to reference past financial transactions for any reason.

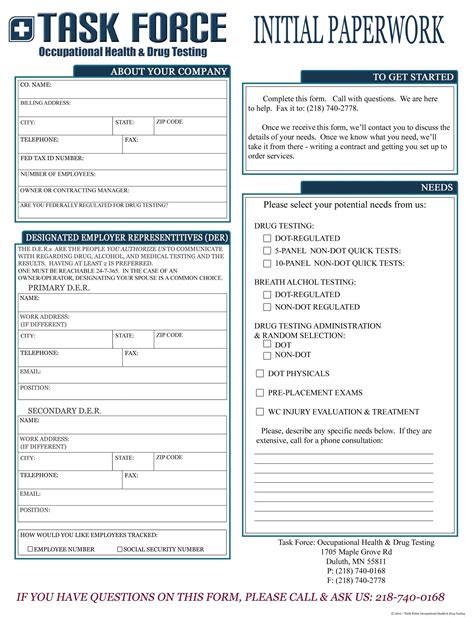

Types of Documents to Keep

Understanding which documents to keep for 7 years is crucial. These typically include: - Tax returns: Original copies of filed tax returns, including all supporting documentation. - Receipts and invoices: Records of all business-related expenses, which can be used for deductions. - Bank statements: Monthly statements from all bank accounts, including checking, savings, and investment accounts. - Employment records: Pay stubs, W-2 forms, and any other documentation related to employment income. - Investment records: Statements and transaction records for stocks, bonds, and other investments. - Real estate documents: Deeds, property tax records, and any documents related to the purchase or sale of real estate.

Management and Storage

With the vast amount of paperwork that accumulates over 7 years, managing and storing these documents efficiently is essential. Here are some strategies: - Digital storage: Scanning physical documents and storing them digitally can save space and make it easier to organize and retrieve files. - Cloud storage services: Utilizing cloud services like Dropbox, Google Drive, or Microsoft OneDrive can provide secure, accessible storage. - File organization: Implementing a clear filing system, whether physical or digital, helps in quickly locating specific documents. - Security: Ensuring that stored documents, especially digital ones, are protected with strong passwords and encryption to prevent unauthorized access.

Best Practices for Maintenance

Maintaining 7 years of paperwork requires ongoing effort. Here are some best practices: - Regularly review and update records: Ensure all documents are accurate and up-to-date. - Create a routine for filing: Set aside time regularly to organize and file new documents. - Consider professional assistance: For complex financial situations, consulting with a financial advisor or accountant can be beneficial.

📝 Note: It's essential to check with local tax authorities for specific guidelines on document retention, as requirements can vary by jurisdiction.

Conclusion and Future Planning

In summary, keeping 7 years of financial records is a prudent practice for both personal and business finance management. By understanding the importance of this timeframe, identifying which documents to retain, and implementing efficient storage and management strategies, individuals can better prepare themselves for audits, financial planning, and long-term security. As financial landscapes continue to evolve, adopting flexible and secure document management practices will remain a cornerstone of responsible financial stewardship.

What is the primary reason for keeping financial records for 7 years?

+

The primary reason is to be prepared in case of a tax audit and to have records for potential amendments to tax returns within the statute of limitations.

What types of documents should be kept for 7 years?

+

Documents to keep include tax returns, receipts and invoices, bank statements, employment records, investment records, and real estate documents.

How can digital storage help with managing paperwork?

+

Digital storage saves physical space, makes organization easier, and allows for quick retrieval of files. Cloud storage services provide additional security and accessibility.