5 Insurance Tips

Introduction to Insurance Tips

When it comes to protecting your assets and securing your financial future, insurance plays a vital role. With so many types of insurance available, it can be overwhelming to navigate the complex world of insurance policies. In this article, we will provide you with 5 essential insurance tips to help you make informed decisions and get the most out of your insurance coverage.

Tip 1: Assess Your Insurance Needs

Before purchasing any insurance policy, it is crucial to assess your insurance needs. Take into account your age, health, income, and assets. Consider the types of insurance that are essential for your situation, such as life insurance, health insurance, auto insurance, or homeowners insurance. Make a list of your priorities and research different insurance options to find the best fit for your needs.

Tip 2: Understand Your Policy

Once you have purchased an insurance policy, it is essential to understand what you are covered for. Read your policy documents carefully and ask questions if you are unsure about any aspect of your coverage. Pay attention to deductibles, limits, and exclusions. Make sure you understand how to file a claim and what to expect during the claims process.

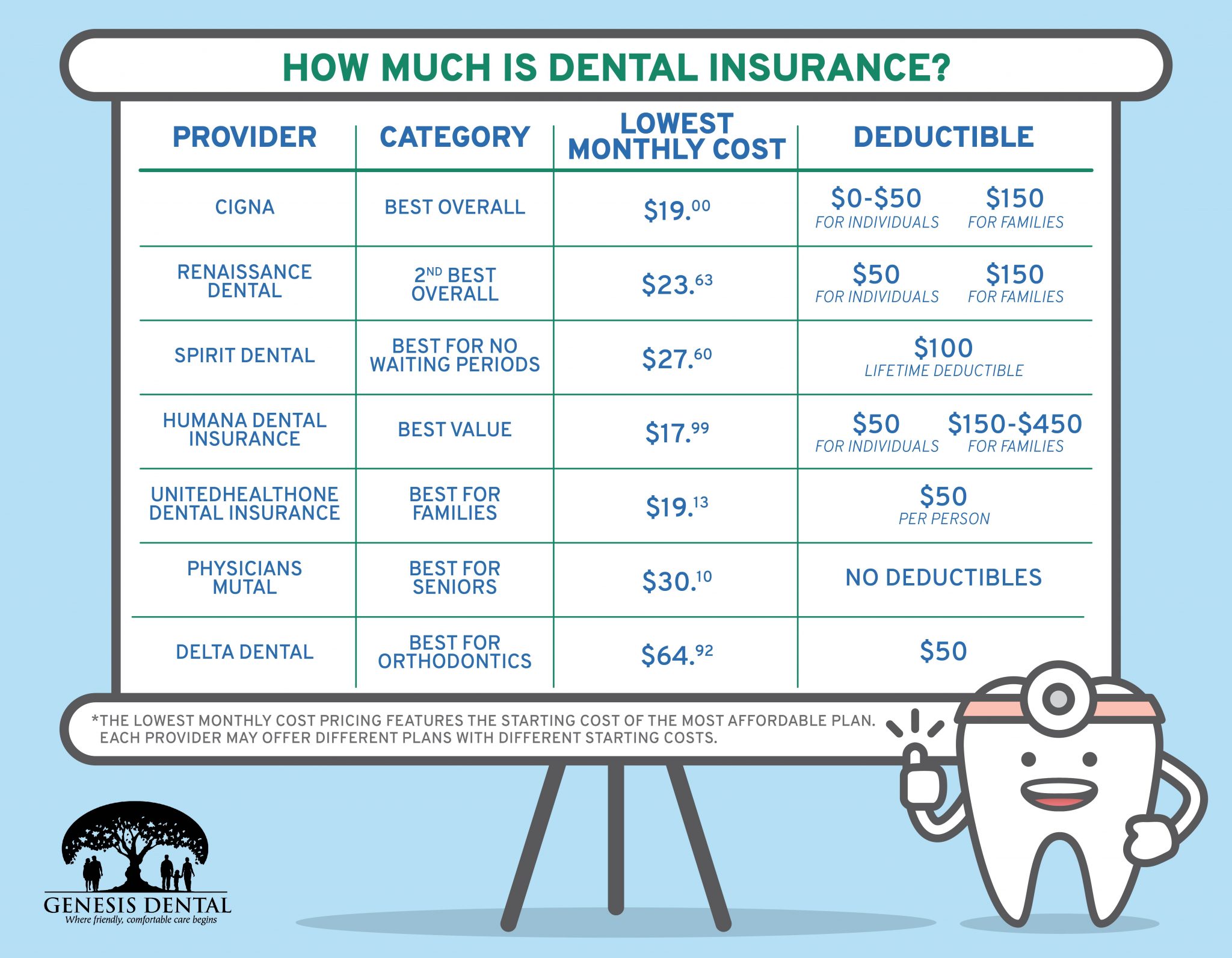

Tip 3: Shop Around and Compare Rates

Insurance rates can vary significantly between providers, so it is essential to shop around and compare rates. Get quotes from multiple insurance companies and compare their coverage options, premiums, and discounts. Consider working with an independent insurance agent who can help you navigate the market and find the best rates for your needs.

Tip 4: Take Advantage of Discounts

Many insurance companies offer discounts for safe driving, good grades, bundle policies, or loyal customers. Ask your insurance provider about available discounts and take advantage of them. You can also consider increasing your deductible or dropping unnecessary coverage to lower your premiums.

Tip 5: Review and Update Your Policies

Your insurance needs may change over time, so it is essential to review and update your policies regularly. Consider reviewing your policies every 6-12 months or when you experience a significant life event, such as a move, marriage, or birth of a child. Update your policies to ensure you have adequate coverage and are taking advantage of available discounts.

💡 Note: Always keep your insurance policy documents and contact information up to date to ensure you can easily access your policy details and get in touch with your insurance provider when needed.

In summary, by following these 5 insurance tips, you can make informed decisions about your insurance coverage and get the most out of your policies. Remember to assess your insurance needs, understand your policy, shop around and compare rates, take advantage of discounts, and review and update your policies regularly. By taking control of your insurance, you can protect your assets, secure your financial future, and enjoy peace of mind.

What is the best way to compare insurance rates?

+

The best way to compare insurance rates is to get quotes from multiple insurance companies and compare their coverage options, premiums, and discounts. Consider working with an independent insurance agent who can help you navigate the market and find the best rates for your needs.

How often should I review my insurance policies?

+

You should review your insurance policies every 6-12 months or when you experience a significant life event, such as a move, marriage, or birth of a child. This will ensure you have adequate coverage and are taking advantage of available discounts.

What are some common discounts offered by insurance companies?

+

Common discounts offered by insurance companies include discounts for safe driving, good grades, bundle policies, or loyal customers. You can also consider increasing your deductible or dropping unnecessary coverage to lower your premiums.