Paperwork

Trustee Fund Filing Fees

Understanding Trustee Fund Filing Fees

When dealing with bankruptcy cases, especially those involving Chapter 11, the payment of trustee fund filing fees is a crucial aspect that must be considered. These fees are associated with the administration of the bankruptcy estate and are typically paid to the trustee overseeing the case. In this context, understanding what these fees entail, how they are calculated, and their impact on the bankruptcy process is essential for all parties involved.

What are Trustee Fund Filing Fees?

Trustee fund filing fees are payments made to the trustee as part of the bankruptcy filing process. These fees are designed to cover the administrative costs associated with managing the bankruptcy estate, including the trustee’s compensation for their services. The fees can vary depending on the type of bankruptcy filing, the size of the estate, and the jurisdiction in which the bankruptcy is filed.

Calculation of Trustee Fund Filing Fees

The calculation of trustee fund filing fees can be complex and depends on several factors, including the type of bankruptcy case and the assets involved. For instance, in Chapter 11 cases, the fee is typically a percentage of the debtor’s quarterly income, which can include revenue from the sale of assets, operating income, and other sources. The U.S. Trustee Program, which is a component of the Department of Justice, is responsible for establishing and collecting these fees.

Purpose of Trustee Fund Filing Fees

The primary purpose of trustee fund filing fees is to ensure that the trustee has the necessary funds to administer the bankruptcy estate effectively. This includes tasks such as: - Overseeing the management of the estate’s assets - Reviewing and approving financial reports and plans - Ensuring compliance with bankruptcy laws and regulations - Facilitating communication among creditors, debtors, and other stakeholders

Impact on Bankruptcy Cases

The payment of trustee fund filing fees can have a significant impact on bankruptcy cases. For debtors, these fees represent an additional expense that must be factored into their financial planning and restructuring efforts. Failure to pay these fees can lead to delays or even dismissal of the bankruptcy case. For creditors, the fees help ensure that the trustee can effectively manage the estate and potentially increase the likelihood of recovery.

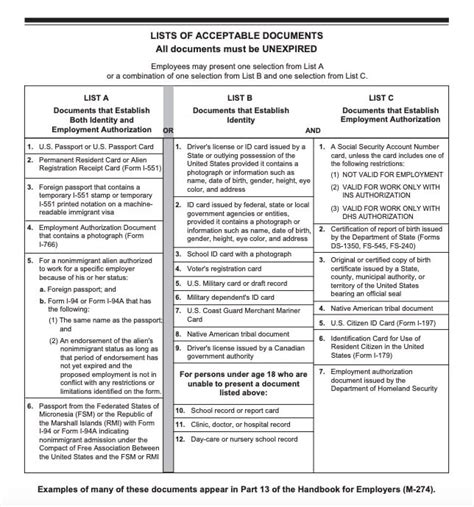

Comparison of Fees Across Different Types of Bankruptcy

Different types of bankruptcy filings have varying fee structures. For example: - Chapter 7 Bankruptcy: Involves a flat fee for filing, with potential additional costs for services like asset sales. - Chapter 11 Bankruptcy: Involves quarterly fees based on the estate’s income, as mentioned earlier. - Chapter 13 Bankruptcy: Typically involves a flat filing fee, with the trustee’s fees deducted from the debtor’s monthly payments.

| Bankruptcy Type | Filing Fee | Trustee Fee |

|---|---|---|

| Chapter 7 | Flat Fee | Varies |

| Chapter 11 | Flat Fee | Percentage of Quarterly Income |

| Chapter 13 | Flat Fee | Deducted from Monthly Payments |

📝 Note: The exact fees can vary and should be checked with the relevant bankruptcy court or legal advisor for the most accurate and up-to-date information.

Best Practices for Managing Trustee Fund Filing Fees

To navigate the complexities of trustee fund filing fees effectively, consider the following best practices: - Consult with a Bankruptcy Attorney: Legal counsel can provide guidance on fee structures and ensure compliance with all regulatory requirements. - Plan Ahead: Incorporate the anticipated fees into financial projections to avoid unexpected expenses. - Maintain Open Communication: Regular updates with the trustee and other stakeholders can help manage expectations and facilitate a smoother process.

Conclusion and Final Thoughts

In conclusion, trustee fund filing fees are a critical component of the bankruptcy process, serving to facilitate the administration of the bankruptcy estate. Understanding these fees, including how they are calculated and their impact on the case, is vital for debtors, creditors, and trustees alike. By recognizing the importance of these fees and following best practices for their management, parties can better navigate the complexities of bankruptcy and work towards a more favorable outcome.

What are trustee fund filing fees used for?

+

Trustee fund filing fees are used to cover the administrative costs associated with managing the bankruptcy estate, including the compensation of the trustee for their services.

How are trustee fund filing fees calculated in Chapter 11 bankruptcy cases?

+

In Chapter 11 cases, the fee is typically a percentage of the debtor’s quarterly income, which includes revenue from the sale of assets, operating income, and other sources.

What happens if a debtor fails to pay trustee fund filing fees?

+

Failure to pay these fees can lead to delays or even the dismissal of the bankruptcy case, emphasizing the importance of timely payment for the successful administration of the estate.