5 I-9 Tips

Understanding the Importance of I-9 Compliance

The I-9 form is a crucial document for employers in the United States, as it verifies the identity and employment authorization of new hires. The U.S. Citizenship and Immigration Services (USCIS) requires all employers to complete an I-9 form for each employee, and failure to comply can result in significant fines and penalties. In this blog post, we will provide 5 essential I-9 tips to help employers navigate the complex process of I-9 compliance.

I-9 Tip 1: Ensure Accurate and Timely Completion

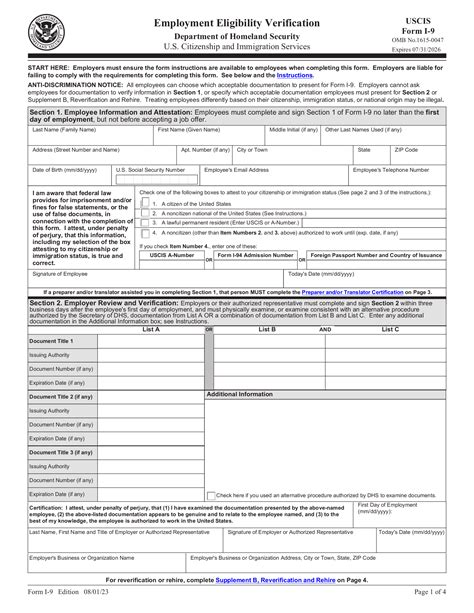

The I-9 form must be completed within three business days of the employee’s first day of work. It is essential to ensure that the form is filled out accurately and completely, as errors or omissions can lead to delays and potential penalties. Employers should designate a specific person or team to handle I-9 completion, and provide them with the necessary training and resources to ensure compliance.

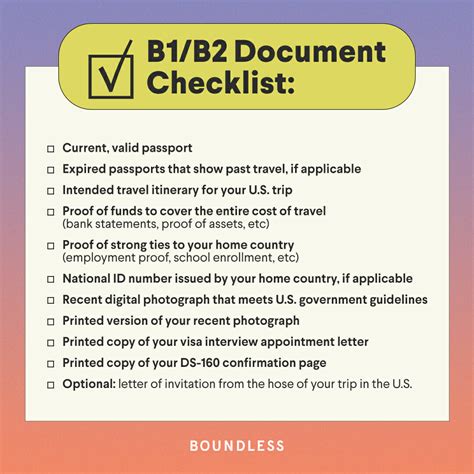

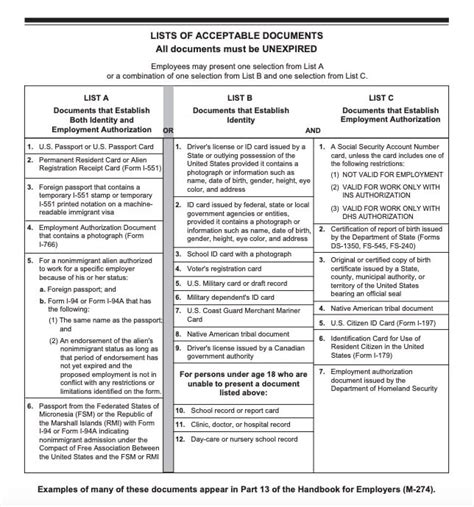

I-9 Tip 2: Verify Employee Documents

Employers must verify the identity and employment authorization of new hires by examining original documents. The USCIS provides a list of acceptable documents, which include passports, driver’s licenses, and social security cards. Employers should be aware of the different types of documents that are acceptable and ensure that they are verifying the correct documents. It is also essential to verify the authenticity of the documents and ensure that they are not expired.

I-9 Tip 3: Maintain I-9 Records

Employers are required to maintain I-9 records for all employees, including current and former employees. The records must be kept for at least three years from the date of hire or one year from the date of termination, whichever is later. Employers should store the I-9 forms in a secure and accessible location, such as a file cabinet or electronic database. It is also essential to ensure that the records are accurate and up-to-date, and that they are readily available for inspection by authorized government officials.

I-9 Tip 4: Conduct Regular I-9 Audits

Regular I-9 audits are essential to ensure compliance and prevent potential penalties. Employers should conduct internal audits on a regular basis, such as quarterly or annually, to ensure that I-9 forms are complete and accurate. The audits should include a review of I-9 forms, employee records, and other relevant documents. Employers should also consider hiring an external auditor to conduct a comprehensive review of their I-9 compliance program.

I-9 Tip 5: Provide Training and Resources

Employers should provide training and resources to employees who are responsible for completing I-9 forms. The training should include information on I-9 compliance, document verification, and record-keeping, as well as best practices for completing the I-9 form. Employers should also provide resources, such as the USCIS Handbook for Employers, to help employees understand the I-9 process and ensure compliance.

📝 Note: Employers should be aware of the potential risks and consequences of non-compliance, including fines and penalties, and take steps to ensure that their I-9 compliance program is effective and up-to-date.

The following table summarizes the key elements of I-9 compliance:

| Element | Description |

|---|---|

| Timely Completion | The I-9 form must be completed within three business days of the employee’s first day of work. |

| Document Verification | Employers must verify the identity and employment authorization of new hires by examining original documents. |

| Record-Keeping | Employers must maintain I-9 records for all employees, including current and former employees. |

| Audits | Employers should conduct regular internal audits to ensure compliance and prevent potential penalties. |

| Training and Resources | Employers should provide training and resources to employees who are responsible for completing I-9 forms. |

In summary, I-9 compliance is a critical aspect of employment verification, and employers must take steps to ensure that they are complying with the relevant laws and regulations. By following these 5 essential I-9 tips, employers can reduce the risk of non-compliance and ensure a smooth and efficient hiring process.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the identity and employment authorization of new hires in the United States.

How long must employers maintain I-9 records?

+

Employers must maintain I-9 records for at least three years from the date of hire or one year from the date of termination, whichever is later.

What are the potential consequences of non-compliance?

+

The potential consequences of non-compliance include fines and penalties, as well as damage to an employer’s reputation and business operations.