7 Tax Record Tips

Introduction to Tax Record Management

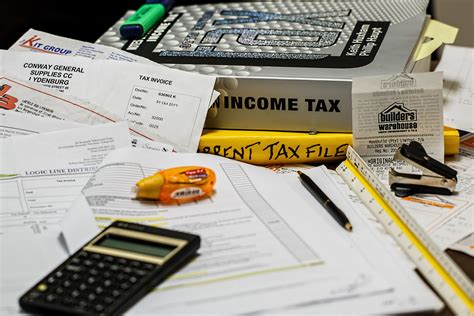

Managing tax records is a crucial aspect of personal and business finance. It involves keeping track of all financial transactions, including income, expenses, and tax-related documents. Effective tax record management helps individuals and businesses to stay organized, ensure compliance with tax laws, and make the most of available tax deductions. In this article, we will explore 7 tax record tips that can help you streamline your tax record-keeping process and minimize the risk of errors or audits.

Tip 1: Keep Accurate and Detailed Records

Keeping accurate and detailed records is the foundation of good tax record management. This includes income statements, expense reports, receipts, and bank statements. It is essential to maintain a record of every financial transaction, no matter how small it may seem. This will help you to stay organized and ensure that you do not miss any important tax deductions.

Tip 2: Implement a Filing System

A filing system is essential for keeping your tax records organized. This can be a physical file cabinet or a digital storage system. It is crucial to label each file clearly and store them in a secure location. You should also consider scanning your documents and storing them digitally to free up physical space and reduce the risk of damage or loss.

Tip 3: Use Tax Record Management Software

There are many tax record management software options available that can help you to streamline your tax record-keeping process. These software programs can help you to track your income and expenses, generate financial reports, and identify tax deductions. Some popular tax record management software options include TurboTax, QuickBooks, and Xero.

Tip 4: Keep Records of Charitable Donations

Charitable donations can be a significant tax deduction, but they require proper documentation. You should keep receipts for all charitable donations, including cash donations, goods donations, and volunteer work. It is also essential to obtain a written acknowledgement from the charitable organization for donations over $250.

Tip 5: Keep Records of Medical Expenses

Medical expenses can be a significant tax deduction, but they require proper documentation. You should keep receipts for all medical expenses, including doctor visits, hospital stays, and prescription medications. It is also essential to keep a record of your medical expenses throughout the year to ensure that you do not miss any eligible expenses.

Tip 6: Keep Records of Business Expenses

Business expenses can be a significant tax deduction, but they require proper documentation. You should keep receipts for all business expenses, including travel expenses, meals, and office supplies. It is also essential to keep a record of your business use percentage for expenses that are used for both business and personal purposes.

Tip 7: Keep Records of Home Office Expenses

Home office expenses can be a significant tax deduction, but they require proper documentation. You should keep receipts for all home office expenses, including rent, utilities, and office supplies. It is also essential to calculate your home office deduction using the simplified option or the actual expenses method.

| Tip | Description |

|---|---|

| Tip 1 | Keep accurate and detailed records |

| Tip 2 | Implement a filing system |

| Tip 3 | Use tax record management software |

| Tip 4 | Keep records of charitable donations |

| Tip 5 | Keep records of medical expenses |

| Tip 6 | Keep records of business expenses |

| Tip 7 | Keep records of home office expenses |

💡 Note: It is essential to keep your tax records organized and up-to-date to ensure compliance with tax laws and to minimize the risk of errors or audits.

In summary, managing tax records is a crucial aspect of personal and business finance. By following these 7 tax record tips, you can streamline your tax record-keeping process, ensure compliance with tax laws, and make the most of available tax deductions. Remember to keep accurate and detailed records, implement a filing system, use tax record management software, and keep records of charitable donations, medical expenses, business expenses, and home office expenses.

What is the importance of keeping tax records?

+

Keeping tax records is essential for ensuring compliance with tax laws, minimizing the risk of errors or audits, and making the most of available tax deductions.

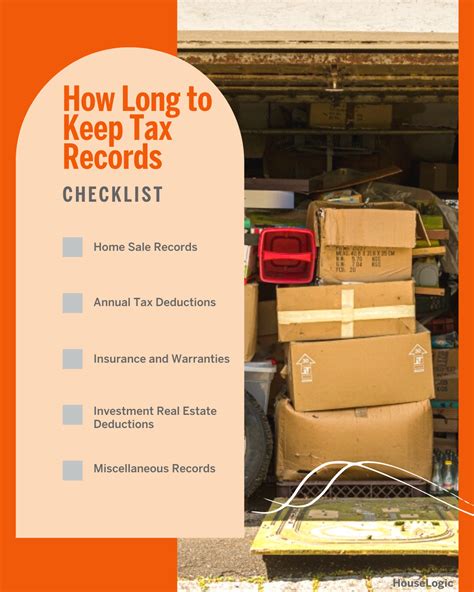

How long should I keep my tax records?

+

It is recommended to keep your tax records for at least 3 years from the date of filing, but it is best to keep them for 6 years or more to ensure that you have a complete record of your financial transactions.

Can I use tax record management software to streamline my tax record-keeping process?

+

Yes, there are many tax record management software options available that can help you to streamline your tax record-keeping process, including TurboTax, QuickBooks, and Xero.