Car Financing Paperwork Fee Cost

Understanding Car Financing Paperwork Fee Costs

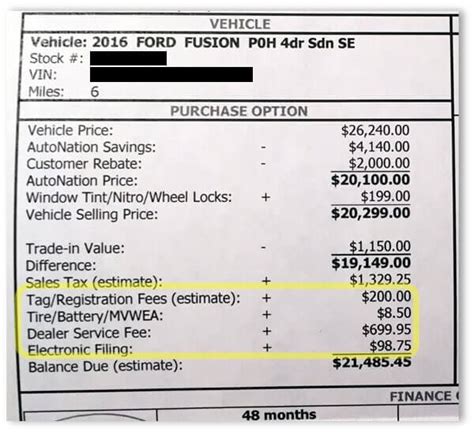

When purchasing a vehicle, buyers often focus on the sticker price, negotiations, and financing terms. However, there are additional costs associated with car financing that can add up quickly. One such cost is the paperwork fee, also known as the documentation fee or doc fee. This fee is charged by dealerships to cover the costs of preparing and processing the sales contract and other paperwork. In this article, we will delve into the world of car financing paperwork fee costs, exploring what they are, how they are calculated, and what buyers can expect to pay.

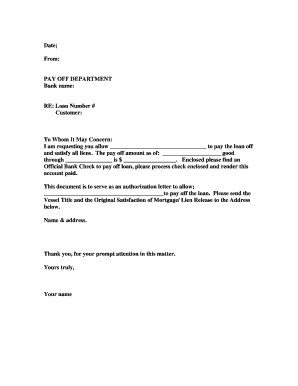

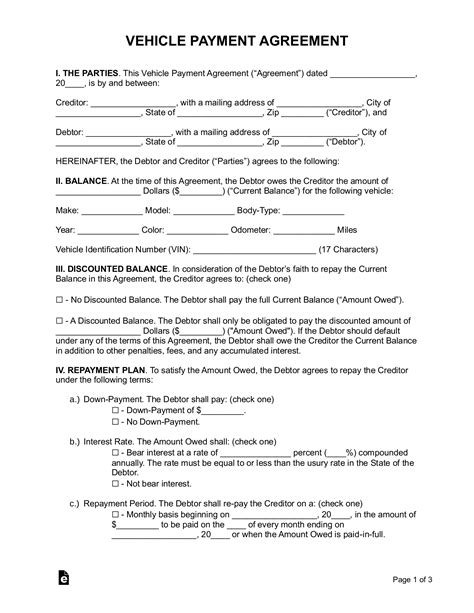

What is a Paperwork Fee?

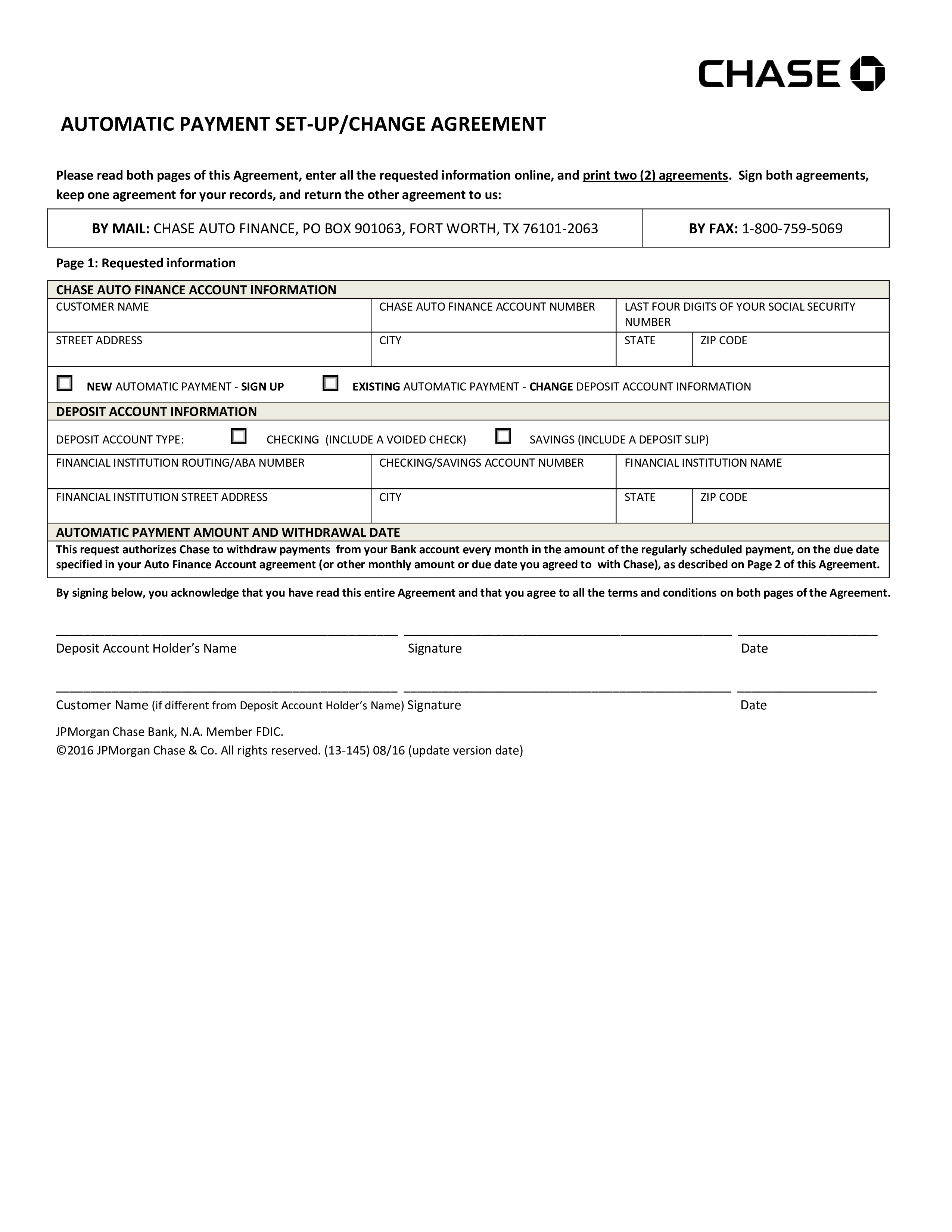

A paperwork fee is a charge imposed by dealerships to cover the costs of preparing and processing the sales contract, title, registration, and other documents required for the sale of a vehicle. This fee can vary significantly from one dealership to another and can range from *100 to 500 or more. The fee is usually paid by the buyer and is typically included in the total purchase price of the vehicle.

How is the Paperwork Fee Calculated?

The paperwork fee is not regulated by federal or state laws, which means that dealerships have the freedom to set their own fees. The calculation of the paperwork fee can vary depending on the dealership and the state in which the vehicle is being purchased. Some dealerships may charge a flat fee, while others may charge a percentage of the purchase price. Buyers should be aware that the paperwork fee is negotiable, and they should not hesitate to ask the dealer to waive or reduce the fee.

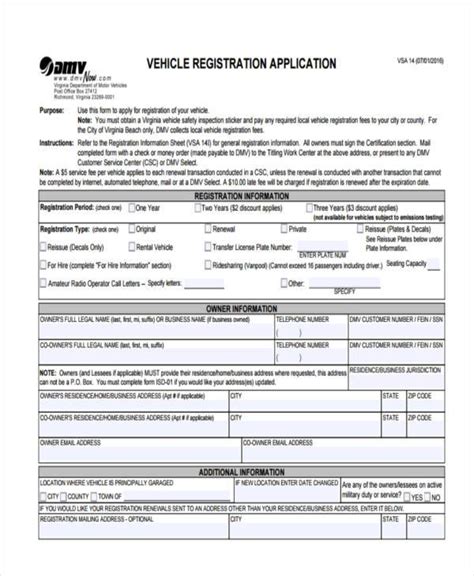

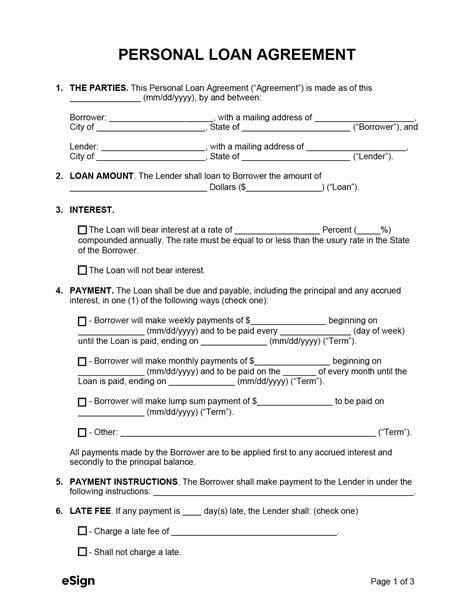

What Do Paperwork Fees Cover?

Paperwork fees are intended to cover the costs associated with preparing and processing the sales contract and other documents. These costs can include: * Preparing and printing the sales contract * Processing the title and registration * Obtaining any necessary permits or licenses * Filing paperwork with the state DMV * Paying for any required inspections or tests

Can You Negotiate the Paperwork Fee?

Yes, the paperwork fee is negotiable. Buyers should not assume that the fee is non-negotiable and should be prepared to ask the dealer to waive or reduce the fee. It is essential to research the average paperwork fee in your state and to compare fees among different dealerships. This will give you a basis for negotiation and help you to avoid paying excessive fees.

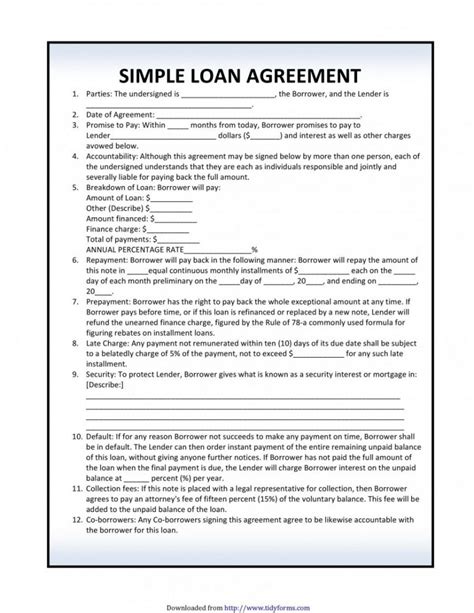

Tips for Avoiding Excessive Paperwork Fees

To avoid paying excessive paperwork fees, buyers should: * Research the average paperwork fee in your state * Compare fees among different dealerships * Ask the dealer to waive or reduce the fee * Carefully review the sales contract and ensure that all fees are disclosed * Consider purchasing from a dealership that offers a low or no paperwork fee

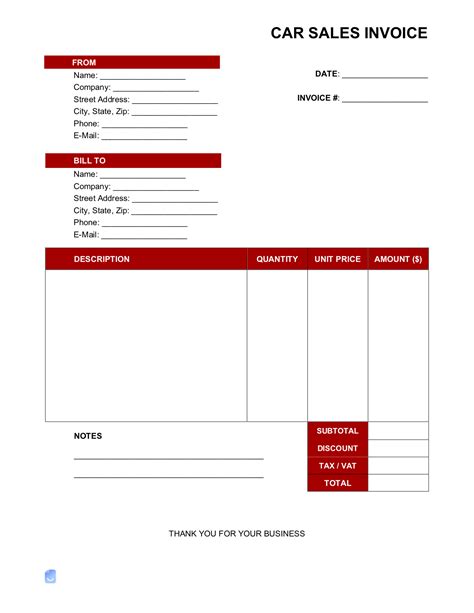

State Regulations and Paperwork Fees

Some states have regulations that limit the amount of paperwork fees that dealerships can charge. For example, in California, the maximum paperwork fee is 80</i>, while in <i>Florida</i>, the maximum fee is <i>700. Buyers should be aware of the regulations in their state and should not hesitate to report any excessive fees to the relevant authorities.

| State | Maximum Paperwork Fee |

|---|---|

| California | $80 |

| Florida | $700 |

| New York | $175 |

| Texas | $300 |

🚨 Note: The maximum paperwork fees listed in the table are subject to change and may not be up-to-date. Buyers should research the current regulations in their state to ensure that they are aware of the maximum allowable paperwork fee.

As we near the end of our discussion on car financing paperwork fee costs, it is essential to summarize the key points. Car financing paperwork fees can add significant costs to the purchase of a vehicle. Buyers should be aware of the average paperwork fee in their state and should not hesitate to ask the dealer to waive or reduce the fee. By researching the regulations in their state and comparing fees among different dealerships, buyers can avoid paying excessive paperwork fees and ensure that they get the best possible deal on their vehicle.

What is a paperwork fee?

+

A paperwork fee is a charge imposed by dealerships to cover the costs of preparing and processing the sales contract and other documents required for the sale of a vehicle.

Can I negotiate the paperwork fee?

+

What do paperwork fees cover?

+

Paperwork fees cover the costs associated with preparing and processing the sales contract and other documents, including preparing and printing the sales contract, processing the title and registration, and obtaining any necessary permits or licenses.