PA Paperwork Requirements

Introduction to PA Paperwork Requirements

When it comes to starting a business or expanding an existing one in Pennsylvania, understanding the PA paperwork requirements is crucial. The state has a set of regulations and requirements that businesses must comply with to operate legally. In this article, we will delve into the various paperwork requirements that businesses in Pennsylvania must adhere to, including registration, licensing, and taxation.

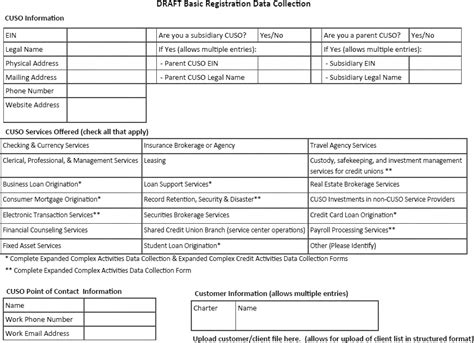

Business Registration Requirements

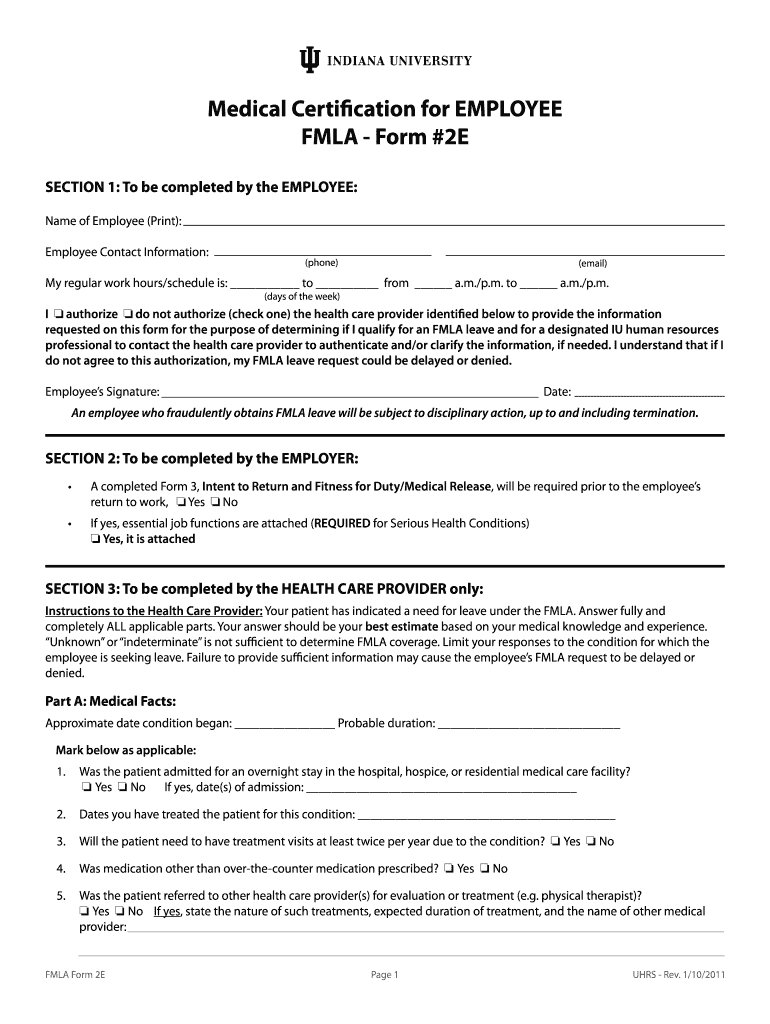

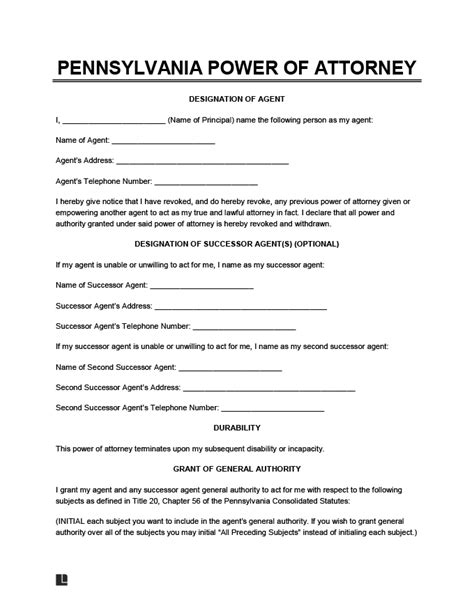

To operate a business in Pennsylvania, entrepreneurs must register their business with the state. This involves choosing a business structure, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation. Each business structure has its own set of requirements and benefits. For example, an LLC provides personal liability protection and tax benefits, while a corporation offers shareholder protection and access to capital. The registration process typically involves filing articles of organization or articles of incorporation with the Pennsylvania Department of State.

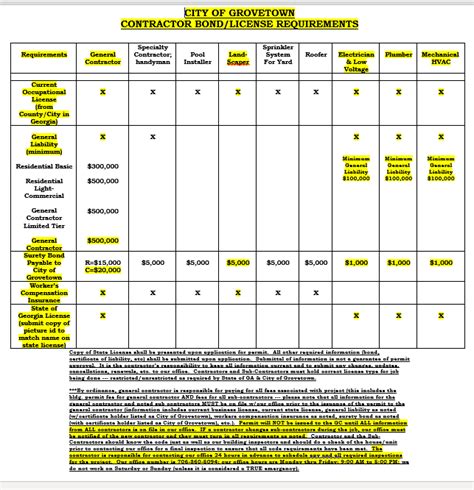

Licensing and Permit Requirements

In addition to registration, businesses in Pennsylvania may need to obtain licenses and permits to operate. These requirements vary depending on the type of business and its location. For example, food establishments need to obtain a food service permit from the Pennsylvania Department of Agriculture, while construction companies need to obtain a contractor’s license from the Pennsylvania Department of Labor and Industry. Businesses must also comply with local zoning regulations and obtain any necessary permits from their local government.

Taxation Requirements

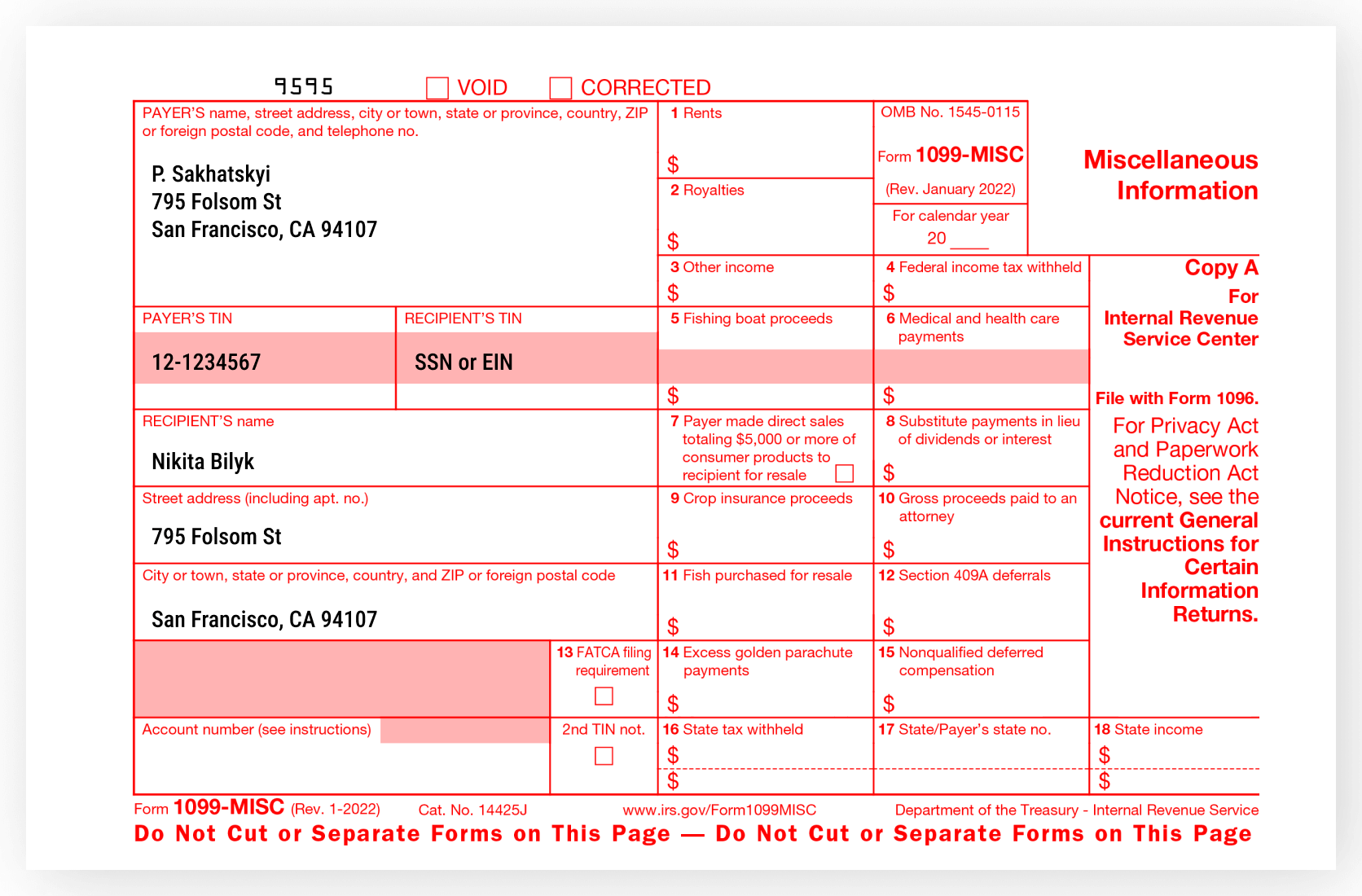

Businesses in Pennsylvania are subject to various taxation requirements, including income tax, sales tax, and employment tax. The Pennsylvania Department of Revenue requires businesses to file tax returns and make tax payments on a regular basis. Businesses must also withhold taxes from employee wages and pay unemployment compensation taxes. Failure to comply with taxation requirements can result in penalties and fines.

Other Paperwork Requirements

In addition to registration, licensing, and taxation requirements, businesses in Pennsylvania may need to comply with other paperwork requirements. For example, employment laws require businesses to maintain employee records and comply with wage and hour regulations. Businesses must also comply with environmental regulations and obtain any necessary permits from the Pennsylvania Department of Environmental Protection.

| Business Structure | Registration Requirements | Licensing and Permit Requirements | Taxation Requirements |

|---|---|---|---|

| Sole Proprietorship | None | Vary by industry | Income tax, self-employment tax |

| Partnership | None | Vary by industry | Income tax, self-employment tax |

| LLC | Articles of organization | Vary by industry | Income tax, employment tax |

| Corporation | Articles of incorporation | Vary by industry | Income tax, employment tax |

📝 Note: Businesses in Pennsylvania must comply with all applicable federal, state, and local regulations, including those related to employment, environment, and taxation.

In summary, businesses in Pennsylvania must comply with various paperwork requirements, including registration, licensing, and taxation. Understanding these requirements is crucial to operating a business legally and avoiding penalties and fines. By registering their business, obtaining necessary licenses and permits, and complying with taxation requirements, entrepreneurs can ensure that their business is in good standing and positioned for success.

What are the registration requirements for a business in Pennsylvania?

+

Businesses in Pennsylvania must register with the Pennsylvania Department of State by filing articles of organization or articles of incorporation, depending on the business structure.

What licenses and permits are required for a business in Pennsylvania?

+

Licenses and permits required for a business in Pennsylvania vary depending on the type of business and its location. Businesses must comply with state and local regulations, including those related to employment, environment, and taxation.

What are the taxation requirements for a business in Pennsylvania?

+

Businesses in Pennsylvania are subject to various taxation requirements, including income tax, sales tax, and employment tax. Businesses must file tax returns and make tax payments on a regular basis, and comply with all applicable federal, state, and local regulations.