Paperwork

1099 Employee Paperwork Requirements

Introduction to 1099 Employee Paperwork Requirements

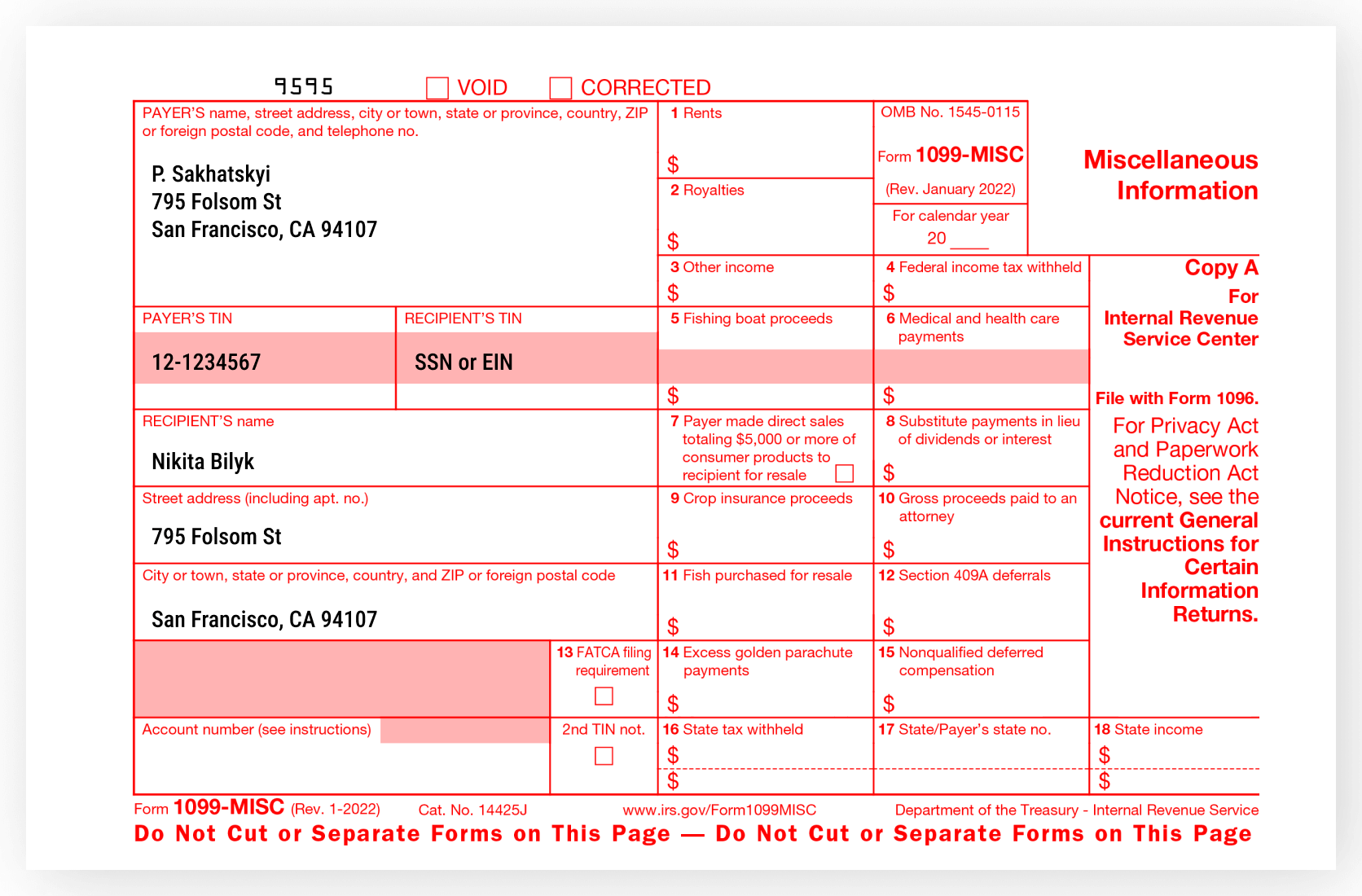

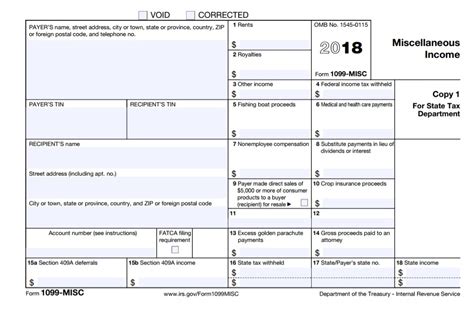

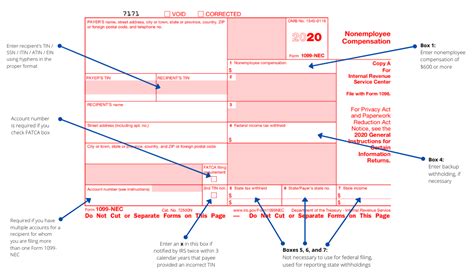

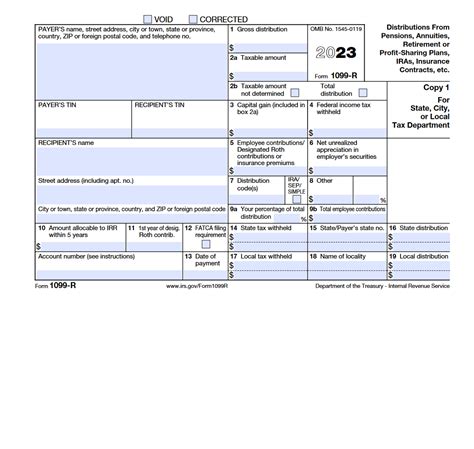

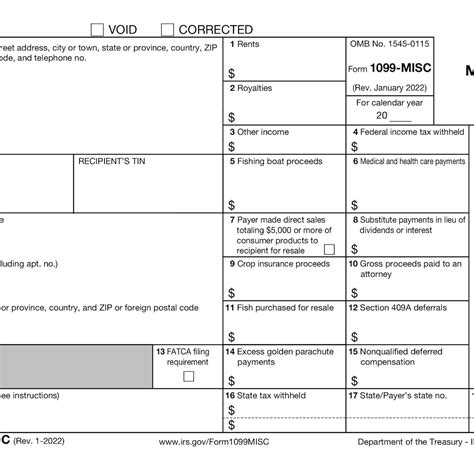

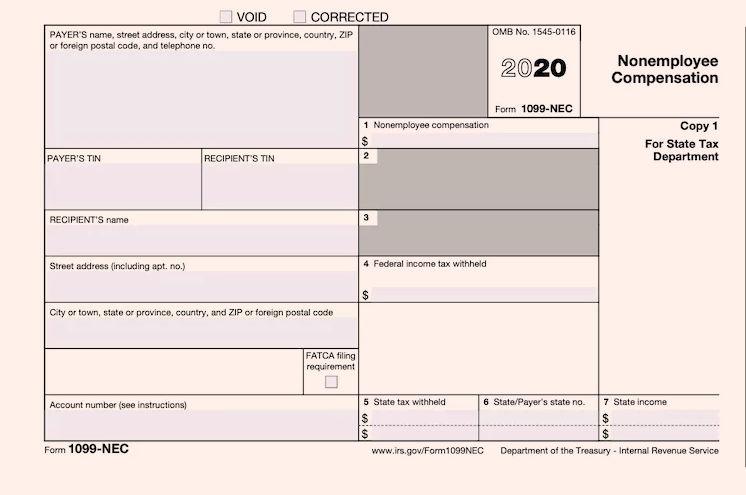

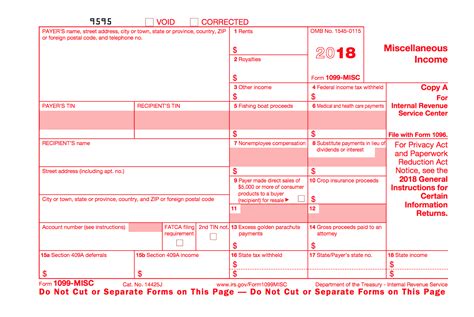

When it comes to hiring independent contractors or freelancers, businesses must navigate a complex set of paperwork requirements to ensure compliance with tax laws and regulations. One of the most critical documents in this process is the Form 1099-MISC, which is used to report miscellaneous income earned by non-employees. In this blog post, we will delve into the world of 1099 employee paperwork requirements, exploring the who, what, when, where, and why of this essential documentation.

Who Needs to File 1099 Forms?

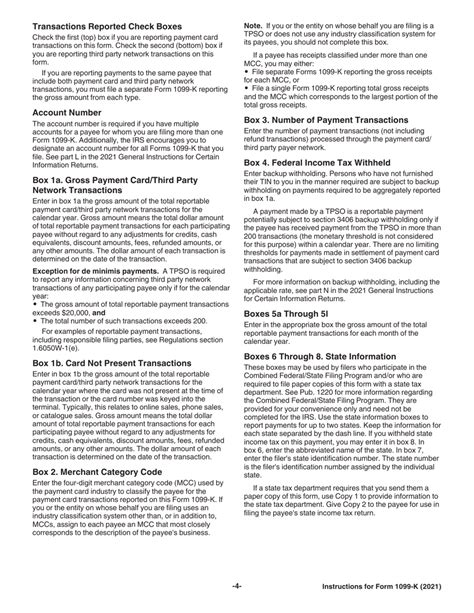

Any business that pays $600 or more in a calendar year to an independent contractor or freelancer is required to file a Form 1099-MISC with the Internal Revenue Service (IRS). This includes payments made to individuals, partnerships, and limited liability companies (LLCs) that are not corporations. The payer must also provide a copy of the form to the recipient by January 31st of each year.

What Information is Required on 1099 Forms?

The Form 1099-MISC requires the following information:

- Payer’s name, address, and tax identification number

- Recipient’s name, address, and tax identification number

- Amount of miscellaneous income paid

- Any federal income tax withheld

- Any state tax withheld

When Are 1099 Forms Due?

The deadline for filing Form 1099-MISC with the IRS is January 31st of each year. However, if the deadline falls on a weekend or federal holiday, the due date is the next business day. It is crucial to file on time to avoid penalties and fines.

Where to File 1099 Forms

The Form 1099-MISC must be filed with the IRS, and a copy must be provided to the recipient. The form can be filed electronically or by mail. The IRS encourages electronic filing, as it is faster and more accurate.

Why Are 1099 Forms Important?

The Form 1099-MISC is essential for several reasons:

- Accurate tax reporting: The form ensures that independent contractors and freelancers report their income accurately, which helps to prevent tax evasion and ensures that the government collects the correct amount of taxes.

- Compliance with tax laws: Filing the form demonstrates compliance with tax laws and regulations, which helps to avoid penalties and fines.

- Record-keeping: The form provides a record of payments made to independent contractors and freelancers, which can be useful for accounting and auditing purposes.

Penalties for Not Filing 1099 Forms

Failure to file the Form 1099-MISC or filing it late can result in penalties and fines. The penalties can range from 30 to 100 per form, depending on the circumstances. In severe cases, the IRS may impose additional penalties, such as negligence penalties or fraud penalties.

Best Practices for Managing 1099 Forms

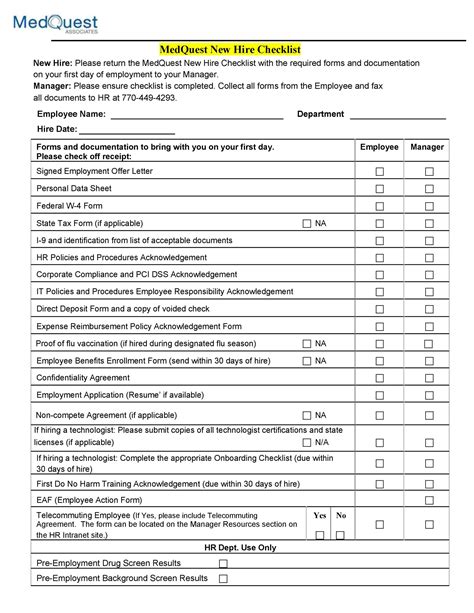

To ensure compliance with 1099 employee paperwork requirements, businesses should follow these best practices:

- Maintain accurate records: Keep accurate and complete records of payments made to independent contractors and freelancers.

- Verify recipient information: Verify the recipient’s name, address, and tax identification number to ensure accuracy.

- File on time: File the Form 1099-MISC on time to avoid penalties and fines.

- Use electronic filing: Use electronic filing to reduce errors and increase efficiency.

Common Mistakes to Avoid

When managing 1099 forms, businesses should avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete to avoid delays or penalties.

- Late filing: File the Form 1099-MISC on time to avoid penalties and fines.

- Failure to provide recipient copies: Provide a copy of the form to the recipient by January 31st of each year.

💡 Note: Businesses should consult with a tax professional or accountant to ensure compliance with 1099 employee paperwork requirements and to avoid any potential penalties or fines.

Conclusion and Final Thoughts

In conclusion, managing 1099 employee paperwork requirements is a critical aspect of running a business that hires independent contractors or freelancers. By understanding the who, what, when, where, and why of 1099 forms, businesses can ensure compliance with tax laws and regulations, avoid penalties and fines, and maintain accurate records. By following best practices and avoiding common mistakes, businesses can streamline their 1099 management process and focus on growth and success.

What is the deadline for filing Form 1099-MISC?

+

The deadline for filing Form 1099-MISC is January 31st of each year.

Who needs to file Form 1099-MISC?

+

Any business that pays $600 or more in a calendar year to an independent contractor or freelancer is required to file Form 1099-MISC.

What information is required on Form 1099-MISC?

+

The Form 1099-MISC requires the payer’s name, address, and tax identification number, the recipient’s name, address, and tax identification number, the amount of miscellaneous income paid, and any federal income tax withheld.