Paperwork

Contractor Tax Paperwork Requirements

Introduction to Contractor Tax Paperwork Requirements

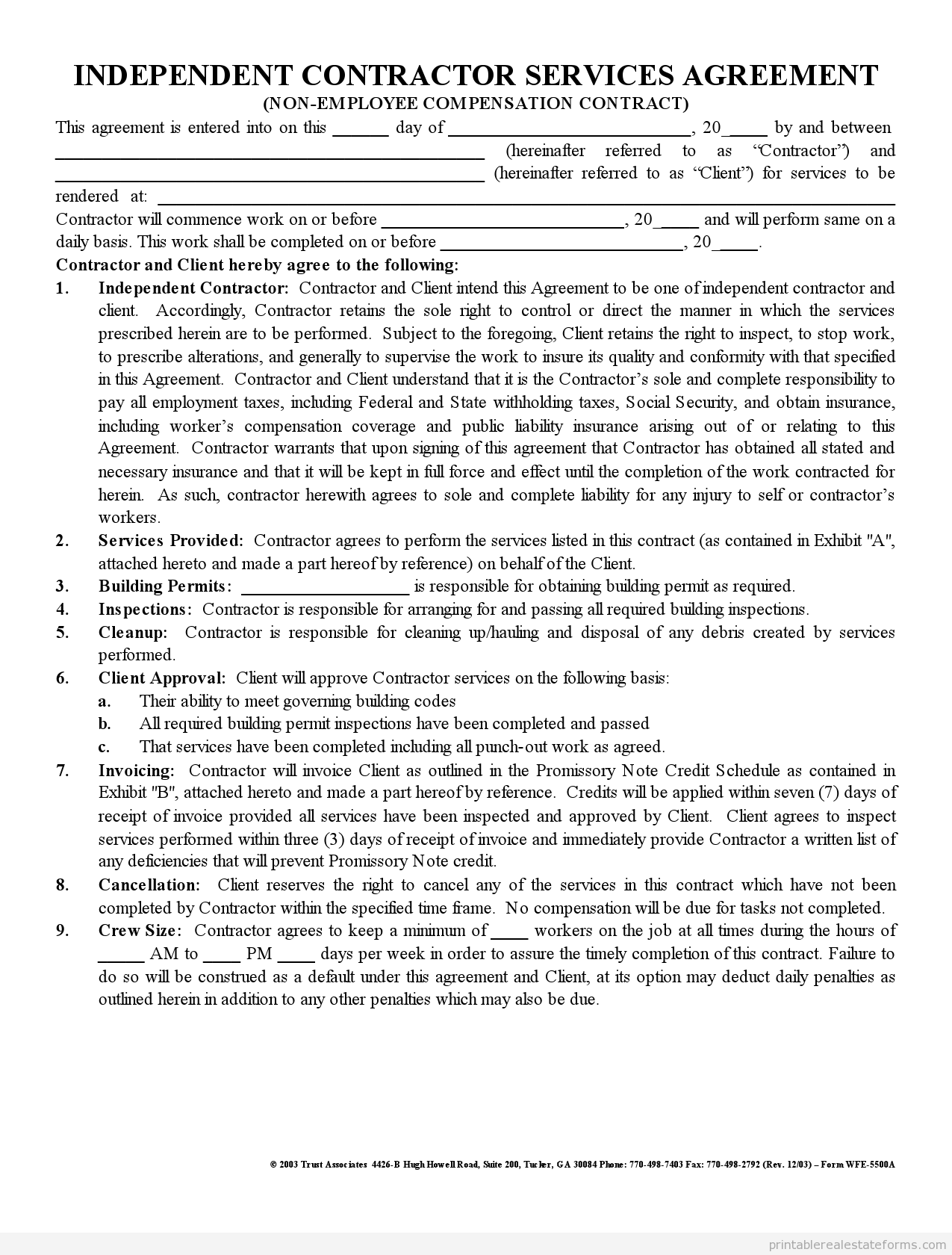

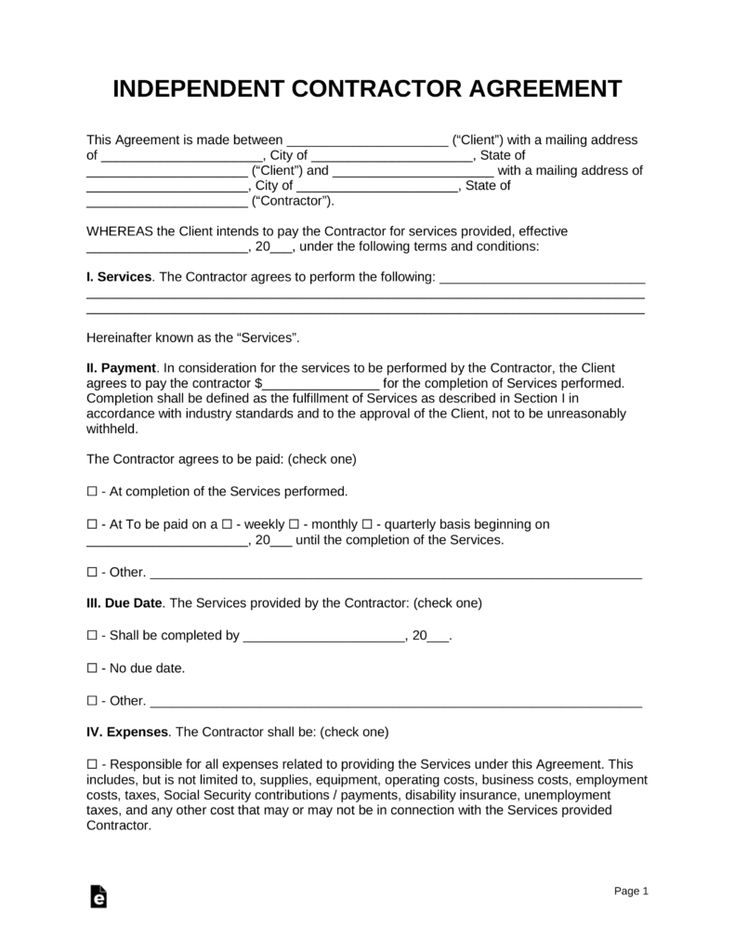

As a contractor, managing tax paperwork is a crucial aspect of your business operations. The requirements for tax paperwork can vary significantly depending on your location, the type of services you offer, and the structure of your business. Understanding these requirements is essential to ensure compliance with tax laws, avoid penalties, and maintain a smooth operation of your business. In this article, we will delve into the key aspects of contractor tax paperwork, including the necessary forms, deadlines, and best practices for record-keeping.

Understanding Your Business Structure

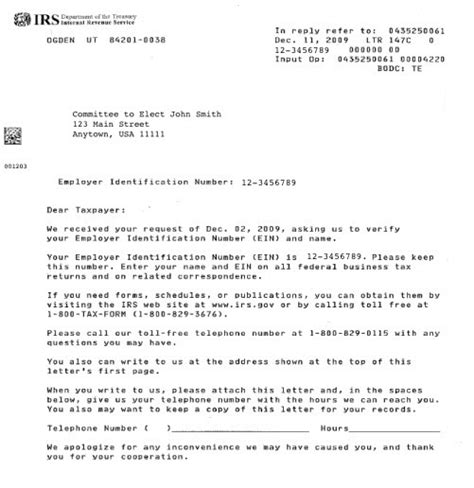

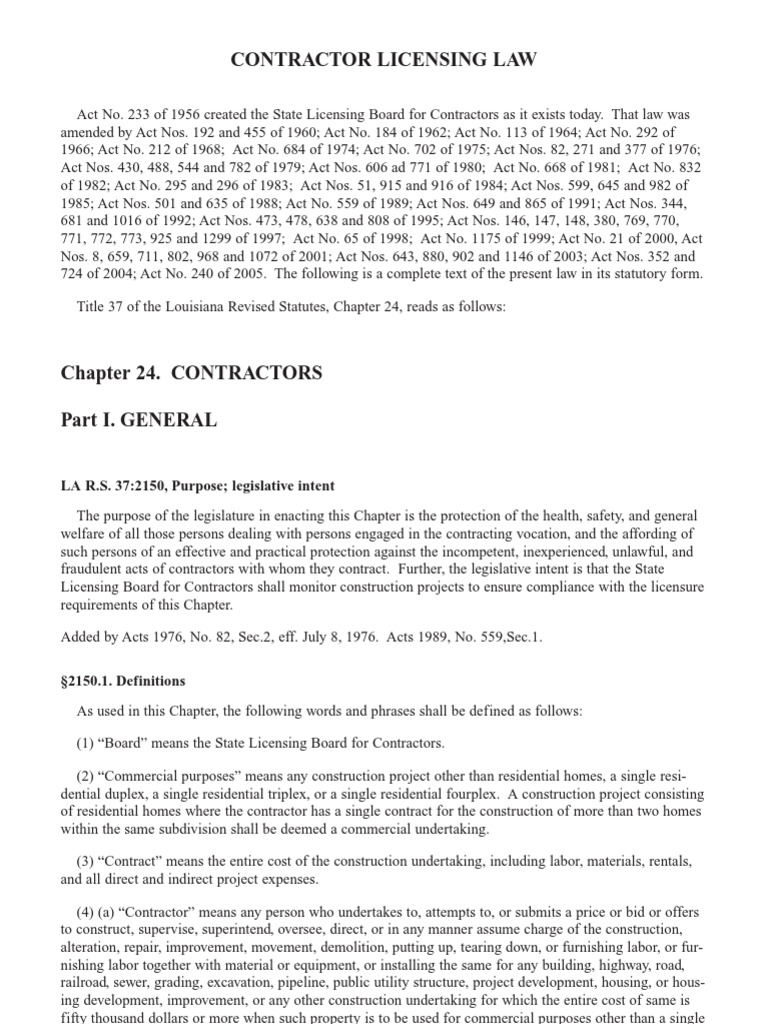

Before diving into the specifics of tax paperwork, it’s essential to understand the structure of your business. Contractors can operate as sole proprietors, partnerships, limited liability companies (LLCs), or corporations. Each structure has its own tax implications and requirements. For instance, sole proprietors report their business income and expenses on their personal tax return, using Form 1040 and Schedule C. In contrast, LLCs and corporations may need to file separate business tax returns.

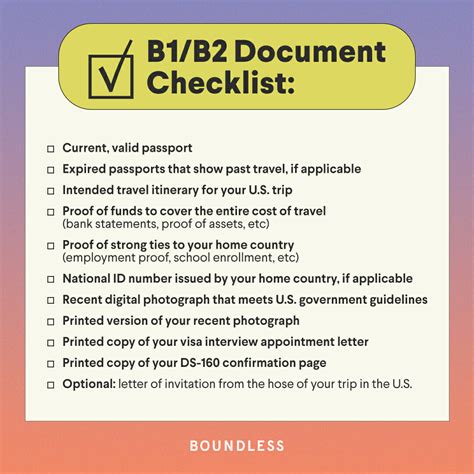

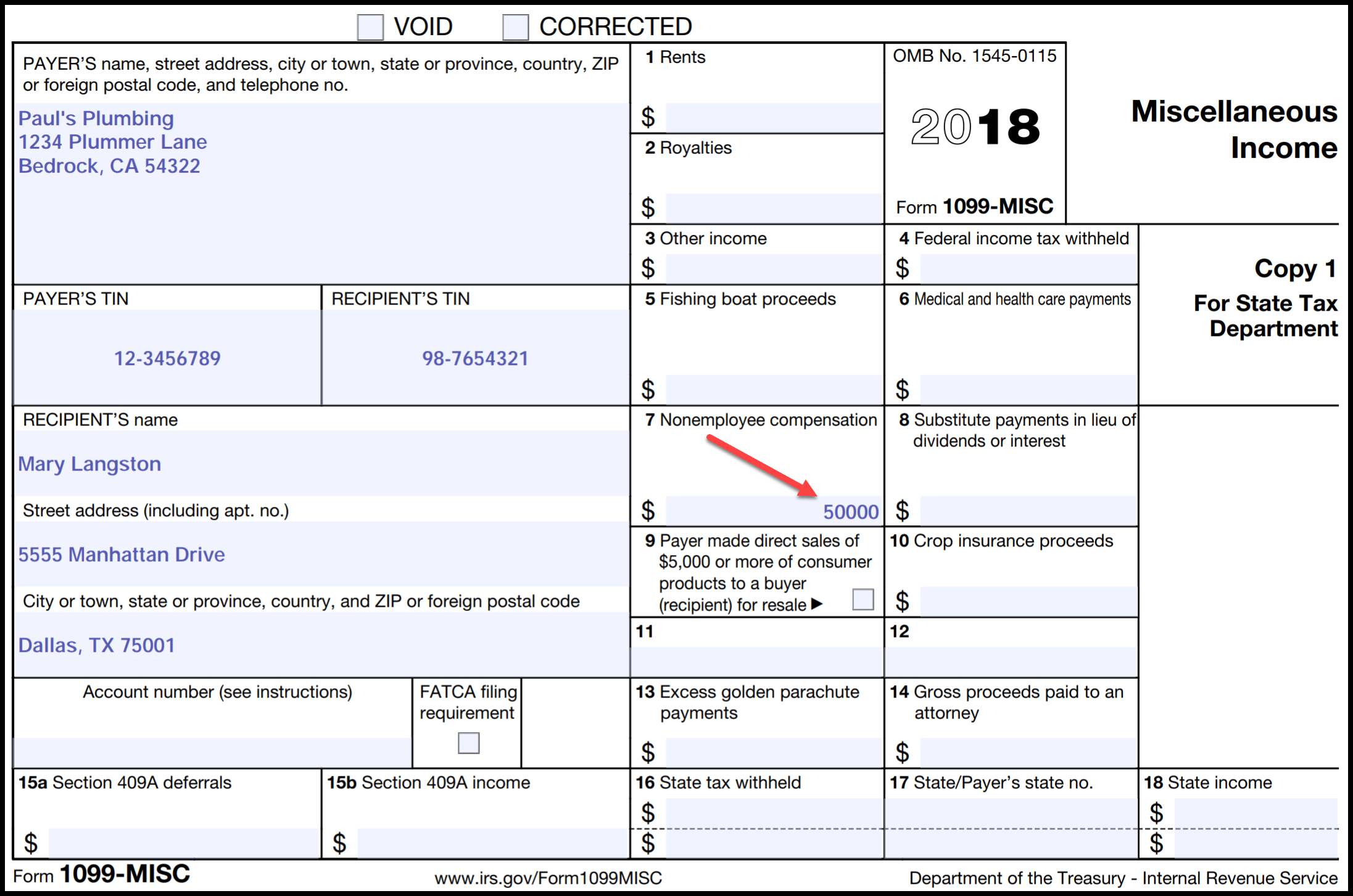

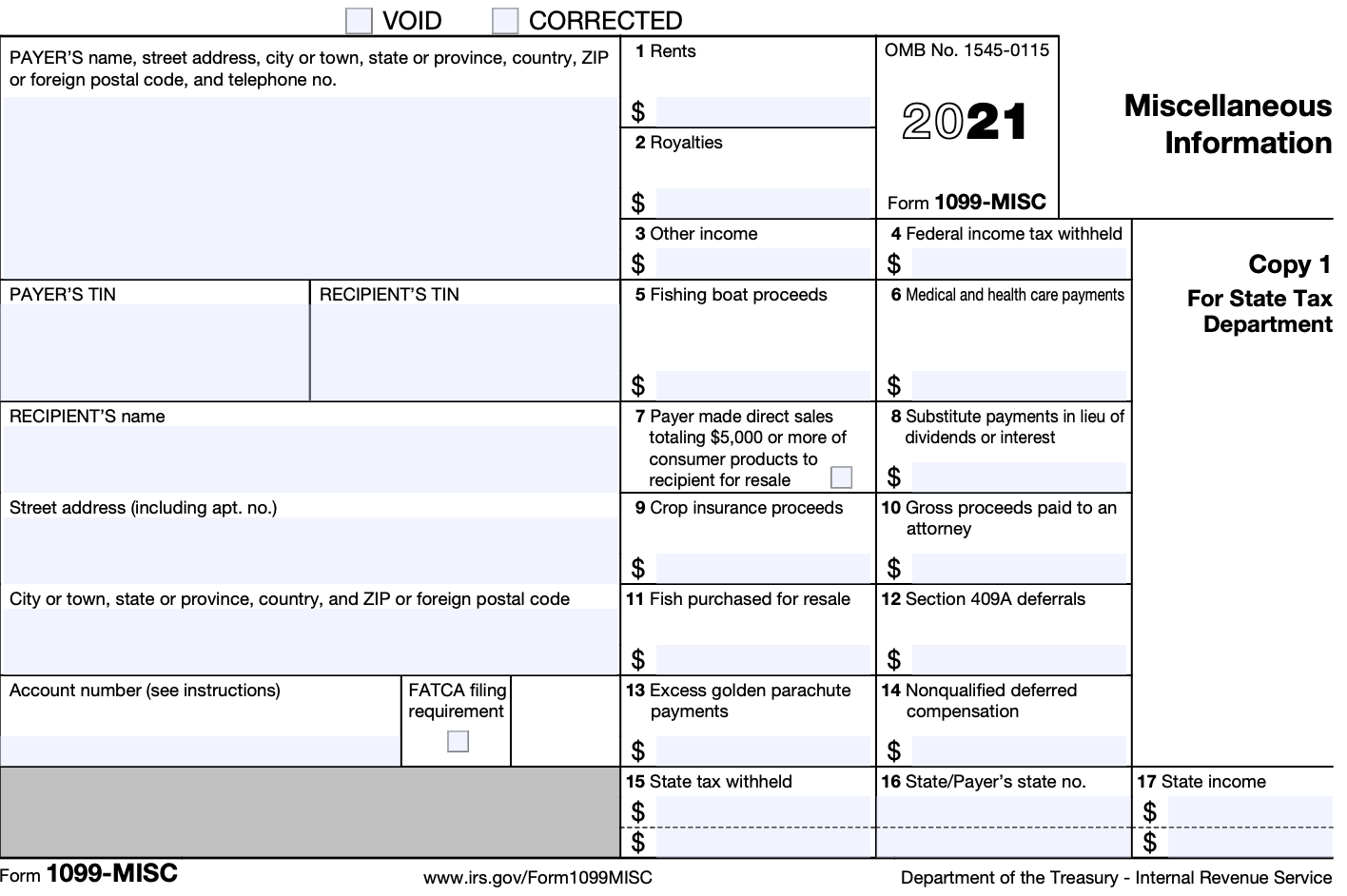

Necessary Tax Forms for Contractors

Contractors are required to file various tax forms with the IRS and possibly with their state government. The primary forms include: - Form 1099-MISC: This form is used to report miscellaneous income, such as freelance work or independent contracting. Clients are required to provide this form to contractors if they paid more than $600 in a calendar year. - Form W-9: Contractors provide this form to their clients to certify their identity and taxpayer identification number. - Form 1040 and Schedule C: Used by sole proprietors to report business income and expenses. - Form 1120 or Form 1120S: For corporations and S corporations, respectively, to report business income and claim deductions.

Record-Keeping Best Practices

Effective record-keeping is crucial for contractors to ensure they can accurately report their income and claim all eligible deductions. Best practices include: - Maintaining a Separate Business Bank Account: This helps in distinguishing personal from business expenses. - Using Accounting Software: Tools like QuickBooks or Xero can simplify the process of tracking income and expenses. - Keeping Receipts and Invoices: These documents are essential for proving business expenses if audited. - Regularly Reviewing Financial Records: This helps in identifying any discrepancies or areas for improvement.

Deadlines and Compliance

Compliance with tax deadlines is critical to avoid penalties and interest. Key deadlines for contractors include: - January 31st: Deadline for providing Form 1099-MISC to contractors and for filing with the IRS. - March 15th: Deadline for S corporations to file their tax return (Form 1120S). - April 15th: Deadline for individual tax returns, including Form 1040 and Schedule C for sole proprietors. - April 15th or October 15th (with extension): Deadline for C corporations to file their tax return (Form 1120).

Tax Deductions and Credits

Contractors can claim various deductions and credits to reduce their taxable income. Common deductions include: - Business Use of Home: Using a portion of your home for business can qualify as a deduction. - Business Use of Car: Mileage or actual expenses related to business use of a car can be deducted. - Equipment and Supplies: Expenses for business equipment, software, and supplies are deductible. - Travel Expenses: Meals, lodging, and transportation costs for business trips can be deducted, subject to certain limits and requirements.

📝 Note: It's essential to consult with a tax professional to ensure you're taking advantage of all eligible deductions and credits, as tax laws and regulations can change.

State and Local Tax Requirements

In addition to federal tax requirements, contractors must also comply with state and local tax laws. This may include filing state income tax returns, obtaining necessary business licenses, and paying local taxes. The requirements vary by state and locality, so it’s crucial to research the specific laws applicable to your business location.

Conclusion and Final Thoughts

Managing tax paperwork as a contractor requires careful attention to detail and adherence to deadlines. By understanding the necessary forms, maintaining accurate records, and being aware of deductions and credits, contractors can navigate the complex world of taxation with confidence. It’s also advisable to seek professional help when needed, as tax compliance can significantly impact the financial health and success of your business.

What is the deadline for providing Form 1099-MISC to contractors?

+

The deadline for providing Form 1099-MISC to contractors and for filing with the IRS is January 31st.

Can contractors claim business use of home as a deduction?

+

Yes, contractors can claim the business use of home as a deduction, using Form 8829 to calculate the deduction amount.

Do contractors need to file state income tax returns?

+

Yes, contractors may need to file state income tax returns, depending on the laws of the state where their business is located. Requirements vary by state.