Paperwork

Get Your EIN Paperwork Copy

Understanding the Importance of EIN Paperwork

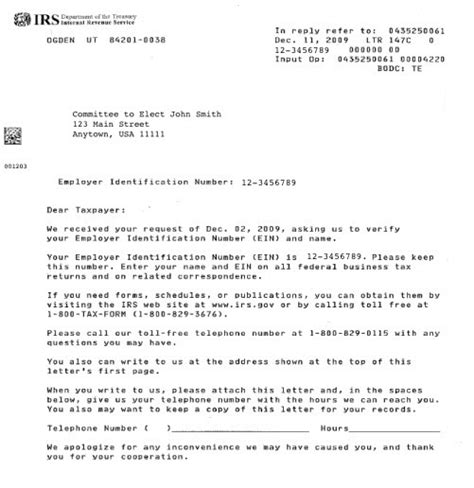

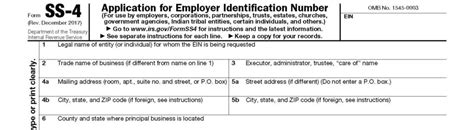

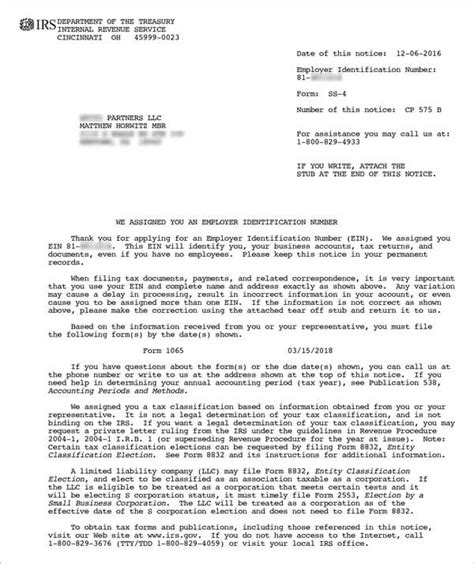

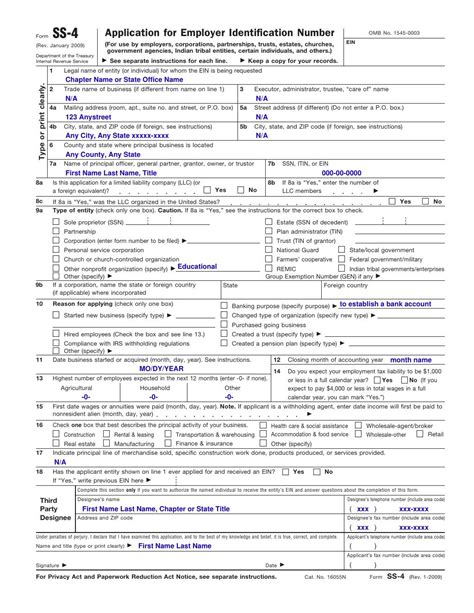

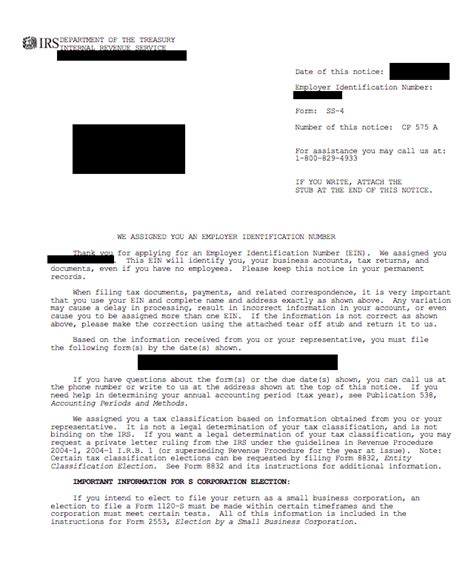

When you start a business, one of the crucial steps is obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is used to identify your business for tax purposes and is required for various business-related activities, such as hiring employees, opening a business bank account, and filing tax returns. After applying for an EIN, it’s essential to get a copy of your EIN paperwork, which serves as proof of your business’s identity.

Why You Need a Copy of Your EIN Paperwork

Having a copy of your EIN paperwork is vital for several reasons: * Verification purposes: A copy of your EIN paperwork can be used to verify your business’s identity when dealing with banks, creditors, or other organizations. * Tax compliance: You’ll need your EIN paperwork to file tax returns, claim refunds, or make estimated tax payments. * Business loans and credit: Lenders often require a copy of your EIN paperwork to process loan applications or credit requests. * Account openings: You may need to provide a copy of your EIN paperwork when opening a business bank account or setting up utilities in your business’s name.

How to Get a Copy of Your EIN Paperwork

If you’ve lost or misplaced your original EIN paperwork, you can obtain a copy from the IRS. Here are the steps to follow: * Call the IRS: Contact the IRS Business and Specialty Tax Line at (800) 829-4933 to request a copy of your EIN paperwork. * Fax a request: You can also fax a request to the IRS at (855) 214-2225. * Mail a request: Write to the IRS at the following address: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999. * Visit the IRS website: You can also visit the IRS website at www.irs.gov and follow the instructions to obtain a copy of your EIN paperwork.

📝 Note: Be prepared to provide your business name, address, and EIN number when requesting a copy of your EIN paperwork.

Tips for Maintaining Your EIN Paperwork

To avoid losing your EIN paperwork, consider the following tips: * Keep it in a safe place: Store your EIN paperwork in a secure location, such as a fireproof safe or a locked cabinet. * Make digital copies: Scan your EIN paperwork and save it to a secure digital storage device, such as an external hard drive or cloud storage service. * Update your records: If your business information changes, update your EIN paperwork and notify the IRS.

Common Mistakes to Avoid

When dealing with EIN paperwork, avoid the following common mistakes: * Using an incorrect EIN: Double-check your EIN to ensure it’s correct and up-to-date. * Not updating your records: Fail to update your EIN paperwork and notify the IRS when your business information changes. * Losing your EIN paperwork: Keep your EIN paperwork in a safe place and consider making digital copies to avoid losing it.

| Steps to Get EIN Paperwork Copy | Methods |

|---|---|

| 1. Call the IRS | (800) 829-4933 |

| 2. Fax a request | (855) 214-2225 |

| 3. Mail a request | Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999 |

| 4. Visit the IRS website | [www.irs.gov](http://www.irs.gov) |

In summary, getting a copy of your EIN paperwork is a straightforward process that can be done by contacting the IRS or visiting their website. It’s essential to keep your EIN paperwork in a safe place and make digital copies to avoid losing it. By following the tips outlined above, you can ensure that your business is compliant with tax regulations and avoid common mistakes. To finalize, having a copy of your EIN paperwork is crucial for verifying your business’s identity, complying with tax regulations, and accessing various business services.