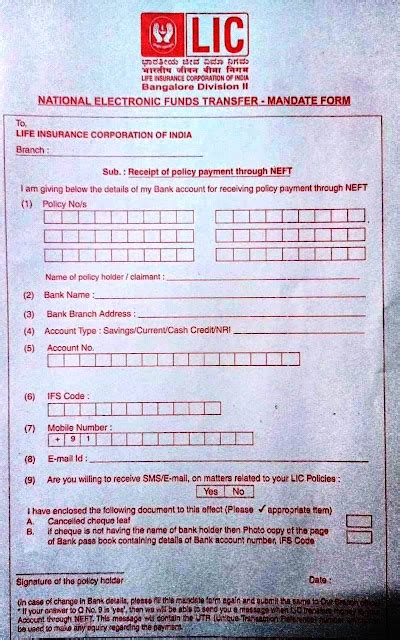

Get LIC Paperwork Requirements

Introduction to LIC Paperwork Requirements

When it comes to securing a life insurance policy from the Life Insurance Corporation of India (LIC), understanding the paperwork requirements is crucial. The LIC, being one of the most trusted and largest insurance companies in India, offers a wide range of life insurance products tailored to meet various needs and preferences of its customers. However, to ensure a smooth and hassle-free experience, it’s essential to be aware of the necessary documents and information required for the application process.

Overview of LIC Policies and Their Requirements

The LIC offers an array of policies, including term insurance plans, endowment plans, unit-linked insurance plans (ULIPs), pension plans, and more. Each type of policy may have slightly different paperwork requirements, but there are certain common documents that are generally required across most policies. Understanding these requirements can help in preparing the necessary documents beforehand, thereby simplifying the application process.

Necessary Documents for LIC Policy Application

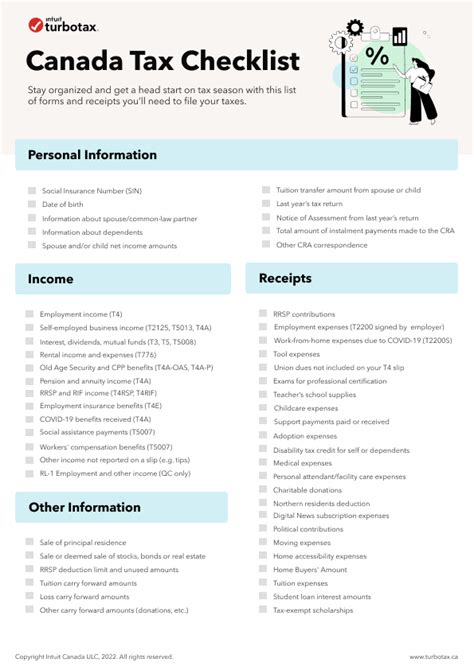

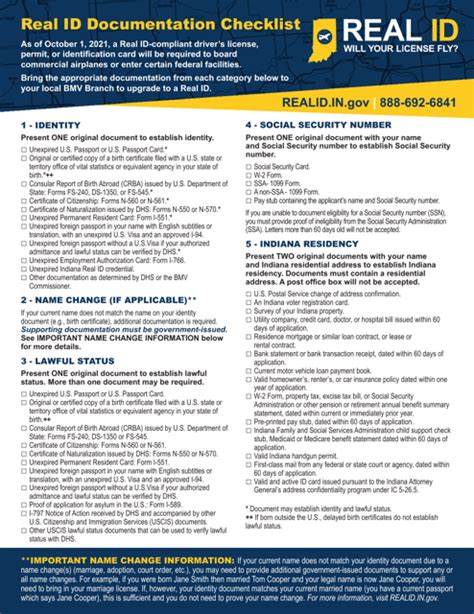

For applying to most LIC policies, the following documents are typically required: - Age Proof: This could be a birth certificate, passport, driving license, or any other government-issued document that confirms the applicant’s age. - Identity Proof: Documents like a passport, voter ID card, driving license, or Aadhaar card are accepted as identity proof. - Address Proof: Utility bills (not more than 3 months old), bank passbook, passport, or any other government-issued document that displays the applicant’s current address can serve as address proof. - Income Proof: This is usually required for policies where the premium amount is dependent on the applicant’s income. Salary slips, income tax return (ITR) documents, or a certificate from the employer can be used as income proof. - Medical Reports: For certain policies, especially those that cover critical illnesses or have a high sum assured, medical tests may be required. The reports of these tests are to be submitted along with the application. - Proposal Form: This is the main application form provided by the LIC, which needs to be filled accurately with all the required details.

Importance of Accurate Information

It is crucial to fill the proposal form and submit the documents with accurate and truthful information. Any discrepancy or misinformation can lead to the rejection of the application or complications in the future, including at the time of claim settlement.

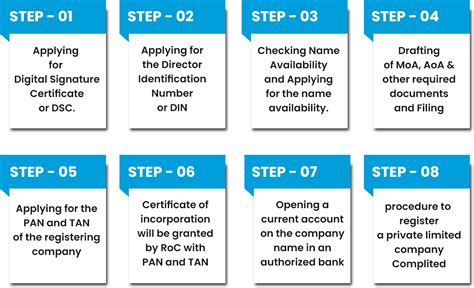

Application Process

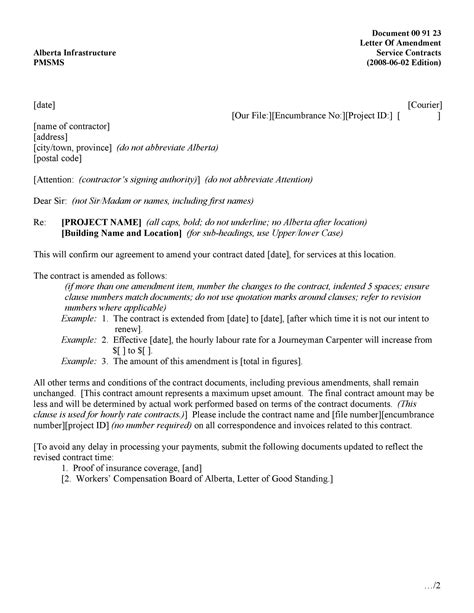

The application process for an LIC policy can be initiated either online or offline. For the online process, applicants can visit the LIC website, choose their desired policy, fill the proposal form, and upload the required documents. For the offline process, applicants can visit the nearest LIC branch or meet an authorized LIC agent, who will guide them through the application process.

Steps to Follow for a Smooth Application Process

Here are some steps to ensure a smooth application process: - Choose the Right Policy: Select a policy that best suits your needs and financial capabilities. - Gather All Documents: Ensure you have all the necessary documents ready before starting the application process. - Fill the Proposal Form Carefully: Double-check the information filled in the proposal form for accuracy. - Submit the Application: Once all documents are ready and the form is filled, submit the application. If applying online, ensure all documents are uploaded correctly. If applying offline, submit all physical documents to the agent or at the LIC branch.

Tips for a Hassle-Free Experience

To make the application process hassle-free: - Start Early: Don’t wait until the last minute to apply. Give yourself time to gather documents and fill the form. - Read the Policy Documents Carefully: Understand what is covered and what is not, along with the terms and conditions of the policy. - Ask Questions: If unsure about any aspect of the policy or application process, don’t hesitate to ask the LIC agent or customer care.

💡 Note: Always ensure that the information provided in the application form is accurate and matches the documents submitted to avoid any future complications.

Post-Application Process

After submitting the application, the LIC will review it, and if required, may ask for additional information or documents. Once the application is approved, the policy will be issued, and the applicant will receive the policy documents. It’s essential to review these documents carefully to ensure all details are correct.

In summary, applying for an LIC policy requires careful preparation and understanding of the necessary paperwork and information. By following the steps outlined and ensuring accuracy in the application, individuals can secure their desired policy without facing unnecessary complications. Understanding the policy terms and conditions is also vital for a satisfying experience with the LIC. As the process involves legal and financial commitments, it’s always beneficial to seek advice from LIC agents or financial advisors if needed.

What documents are typically required for an LIC policy application?

+

Typically, age proof, identity proof, address proof, income proof, and medical reports (if required) are needed. Additionally, a filled proposal form is mandatory.

Can I apply for an LIC policy online?

+

Yes, you can initiate the application process online through the LIC’s official website. You can choose your policy, fill the proposal form, and upload the required documents.

What if I provide incorrect information in the application form?

+

Providing incorrect information can lead to the rejection of your application or complications in the future, including at the time of claim settlement. It’s crucial to ensure the accuracy of the information provided.