5 IVA Paperworks Needed

Understanding IVA Paperworks: A Comprehensive Guide

When dealing with Individual Voluntary Arrangements (IVAs), it’s essential to understand the paperwork involved. IVA paperwork can be complex and time-consuming, but having the right documents is crucial for a successful arrangement. In this article, we’ll delve into the 5 IVA papers needed and provide a comprehensive guide to help you navigate the process.

What are the 5 IVA Papers Needed?

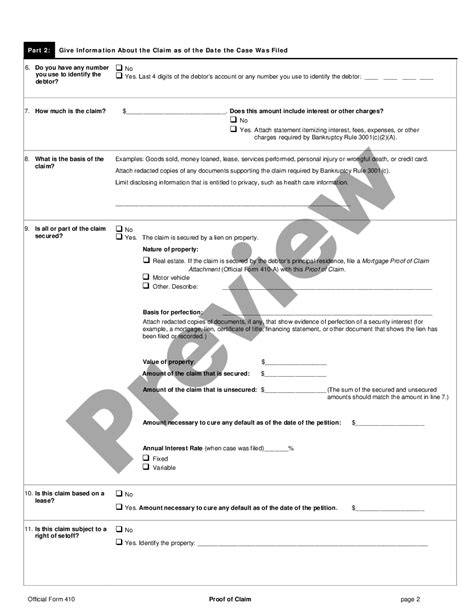

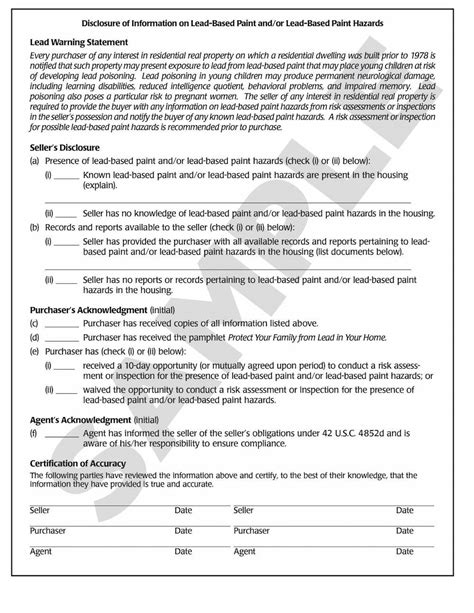

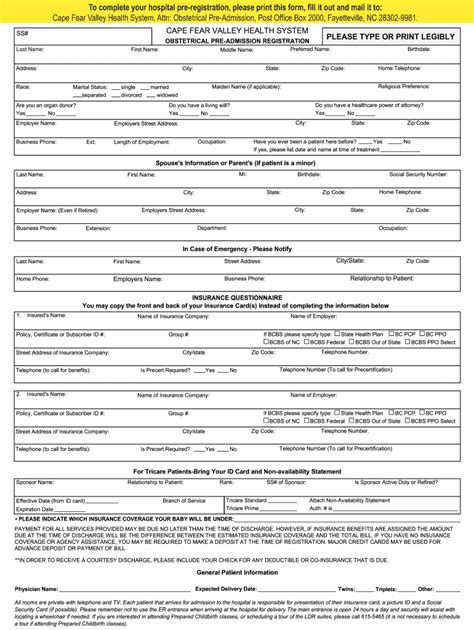

The following are the 5 IVA papers needed for a successful arrangement: * Proposal: A detailed document outlining the terms of the IVA, including the amount to be paid, the payment schedule, and the duration of the arrangement. * Statement of Affairs: A document providing a snapshot of your financial situation, including your assets, liabilities, income, and expenses. * Income and Expenditure Statement: A document detailing your monthly income and expenses, which helps determine how much you can afford to pay towards the IVA. * Asset Schedule: A document listing all your assets, including property, vehicles, and other valuables. * Creditors’ List: A document detailing all your creditors, including the amount owed to each creditor and their contact information.

Importance of Accurate IVA Paperwork

Accurate IVA paperwork is vital for a successful arrangement. Inaccurate or incomplete paperwork can lead to delays or even rejection of the IVA proposal. It’s essential to ensure that all paperwork is thoroughly reviewed and verified before submission.

How to Complete IVA Paperwork

To complete IVA paperwork, you’ll need to gather all the necessary information and documents. This includes: * Financial statements, such as bank statements and payroll slips * Asset valuations, such as property valuations and vehicle valuations * Creditor information, including account numbers and balances * Income and expenditure details, including monthly income and expenses

📝 Note: It's recommended that you seek the help of an insolvency practitioner to ensure that your IVA paperwork is accurate and complete.

Benefits of Using an Insolvency Practitioner

Using an insolvency practitioner can help ensure that your IVA paperwork is accurate and complete. They can also provide guidance and support throughout the IVA process, helping you navigate the complex paperwork and procedures.

IVA Paperwork Timeline

The IVA paperwork timeline can vary depending on the individual circumstances. However, here’s a general outline of what you can expect: * Week 1-2: Gather all necessary information and documents * Week 3-4: Complete and submit the IVA proposal and supporting documents * Week 5-6: Attend a creditors’ meeting to discuss the IVA proposal * Week 7-12: Wait for the IVA to be approved or rejected

Common Mistakes to Avoid

When completing IVA paperwork, it’s essential to avoid common mistakes, such as: * Inaccurate or incomplete information * Failure to disclose all assets and liabilities * Incorrect creditor information * Insufficient income and expenditure details

IVA Paperwork Fees

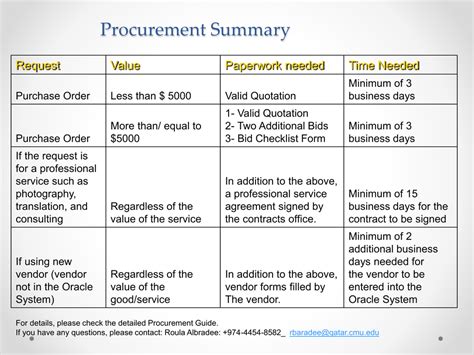

IVA paperwork fees can vary depending on the insolvency practitioner and the complexity of the case. However, here’s a general outline of what you can expect:

| Fee Type | Fee Amount |

|---|---|

| Initial Consultation | Free |

| IVA Proposal Fee | £500-£1,000 |

| IVA Administration Fee | £2,000-£5,000 |

In summary, IVA paperwork is a critical component of the IVA process. Accurate and complete paperwork is essential for a successful arrangement. By understanding the 5 IVA papers needed and seeking the help of an insolvency practitioner, you can ensure that your IVA paperwork is accurate and complete, and that you’re well on your way to a debt-free future.

To recap, the key points to take away from this article are the importance of accurate IVA paperwork, the benefits of using an insolvency practitioner, and the need to avoid common mistakes when completing IVA paperwork. By following these guidelines and seeking professional help, you can navigate the complex IVA process with confidence.

What is an IVA?

+

An Individual Voluntary Arrangement (IVA) is a formal agreement between you and your creditors to pay off a portion of your debts over a set period.

How long does an IVA last?

+

An IVA typically lasts for 5-6 years, although this can vary depending on the individual circumstances.

Can I cancel my IVA?

+

Yes, it is possible to cancel an IVA, but this should be done with caution and under the guidance of an insolvency practitioner.