5 Tips Medicaid Divorce

Understanding Medicaid Divorce: A Complex yet Sometimes Necessary Decision

Medicaid divorce, a concept that may seem paradoxical or even controversial, has become a topic of discussion among families dealing with the financial burdens of long-term care for a loved one. The rising costs of healthcare, especially for conditions requiring ongoing care such as Alzheimer’s disease, can quickly deplete a family’s resources. In such situations, some couples consider divorce as a strategy to qualify for Medicaid, which can cover these exorbitant costs. This decision is never taken lightly and involves a deep understanding of the complexities of both divorce law and Medicaid eligibility.

Why Medicaid Divorce Happens

Medicaid divorce occurs when a couple decides to divorce, not due to marital problems, but to protect their assets from being spent on long-term care costs. Medicaid has strict income and resource limits for eligibility, which can force individuals to spend down their assets to qualify. By divorcing, one spouse (typically the one not needing care) can retain the majority of the couple’s assets, while the other spouse becomes eligible for Medicaid. This strategy is particularly considered when one spouse requires nursing home care or other forms of long-term care that are not fully covered by their current insurance or financial resources.

5 Tips for Considering Medicaid Divorce

For couples facing the daunting prospect of long-term care costs, here are five tips to consider when evaluating the option of a Medicaid divorce:

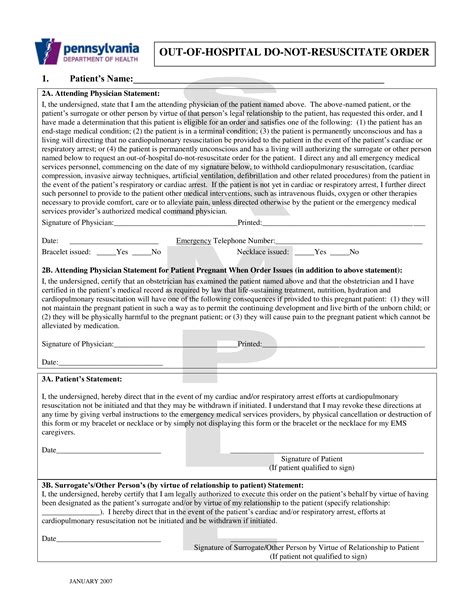

- Understand the Medicaid Eligibility Rules: Before making any decisions, it’s crucial to understand the Medicaid eligibility rules in your state. These rules can vary significantly, affecting how assets are counted and what exemptions may apply.

- Consult with an Elder Law Attorney: Given the complexity of both divorce and Medicaid laws, consulting with an elder law attorney who is experienced in these areas can provide valuable guidance. They can help navigate the process and ensure that the decision made is in the best interest of both spouses.

- Consider the Emotional Impact: While the financial aspects of Medicaid divorce are significant, the emotional and social impacts should not be overlooked. This decision can affect not just the couple but also their children, grandchildren, and other family members.

- Look into Alternative Solutions: Before opting for divorce, explore other financial planning strategies that might achieve Medicaid eligibility without ending the marriage. For example, Medicaid planning can involve converting countable assets into exempt assets or using trusts to protect assets.

- Evaluate the Potential for Spousal Refusal: In some states, a strategy known as spousal refusal can be used, where the community spouse refuses to contribute their income or resources towards the care of the institutionalized spouse, potentially allowing the latter to qualify for Medicaid without the need for divorce.

Important Considerations

When considering Medicaid divorce, it’s essential to weigh all factors carefully. The decision should be based on a thorough understanding of the financial, legal, and emotional implications. Long-term care planning should ideally start early, to explore all available options and strategies that can help protect assets while also ensuring that necessary care is accessible.

📝 Note: Medicaid rules and divorce laws vary by state, so it's crucial to consult with local experts to understand the specific regulations and how they apply to your situation.

In summary, while Medicaid divorce is a complex and sensitive topic, it represents a critical consideration for couples facing the significant financial burden of long-term care. By understanding the reasons behind Medicaid divorce, the process involved, and the alternatives available, families can make informed decisions that best support their loved ones while also protecting their assets and well-being.

What is Medicaid divorce, and why do couples consider it?

+

Medicaid divorce refers to the decision by a couple to divorce to qualify for Medicaid, typically to cover long-term care costs. Couples consider this option to protect their assets from being depleted by care costs, allowing one spouse to retain assets while the other becomes Medicaid eligible.

How does the Medicaid eligibility process work?

+

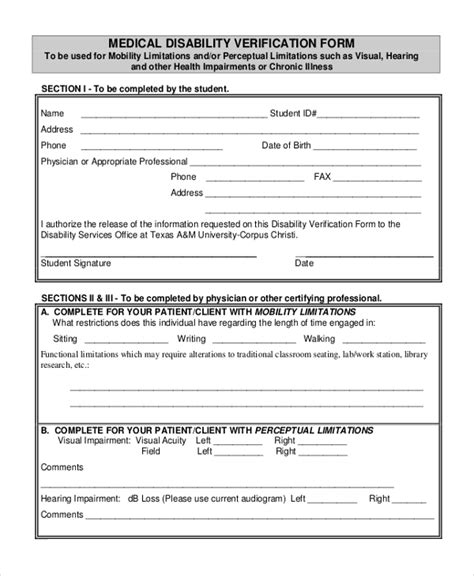

Medicaid eligibility involves assessing an individual’s income and resources against the program’s limits. The process can vary by state and may include strategies like spend-downs, trusts, or spousal refusal to achieve eligibility.

What role does an elder law attorney play in Medicaid planning?

+

An elder law attorney specializes in the legal issues affecting the elderly, including Medicaid planning. They can provide guidance on navigating Medicaid rules, protecting assets, and exploring strategies like Medicaid divorce or spousal refusal, ensuring that clients make informed decisions about their care and financial well-being.