5 Nonprofit Filing Costs

Introduction to Nonprofit Filing Costs

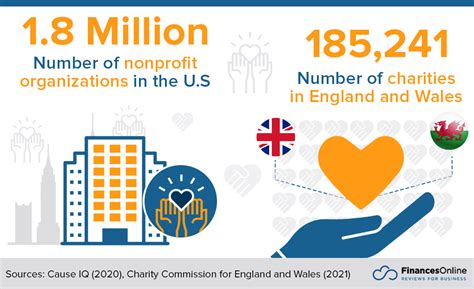

When starting a nonprofit organization, it’s essential to understand the various costs associated with filing and maintaining your nonprofit status. These costs can vary depending on the type of nonprofit, its size, and the state in which it operates. In this article, we’ll explore five key nonprofit filing costs that you should be aware of, including initial filing fees, annual reporting fees, tax exemption application fees, registered agent fees, and compliance and auditing fees.

Initial Filing Fees

The first cost to consider is the initial filing fee, which is required to form a nonprofit corporation in your state. This fee can range from 20 to 500, depending on the state. For example, in California, the initial filing fee is 30, while in New York, it's 75. It’s essential to check with your state’s secretary of state office to determine the exact fee.

Annual Reporting Fees

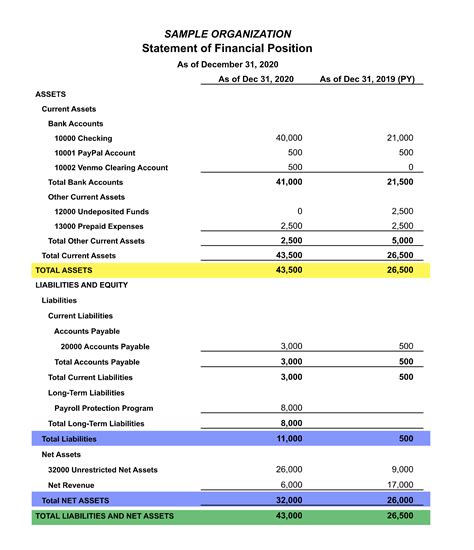

In addition to the initial filing fee, nonprofits are also required to file annual reports with their state, which can incur a fee. These fees can range from 10 to 200 per year, depending on the state. Annual reports typically require you to provide updated information about your nonprofit, such as its mission, board members, and financial statements.

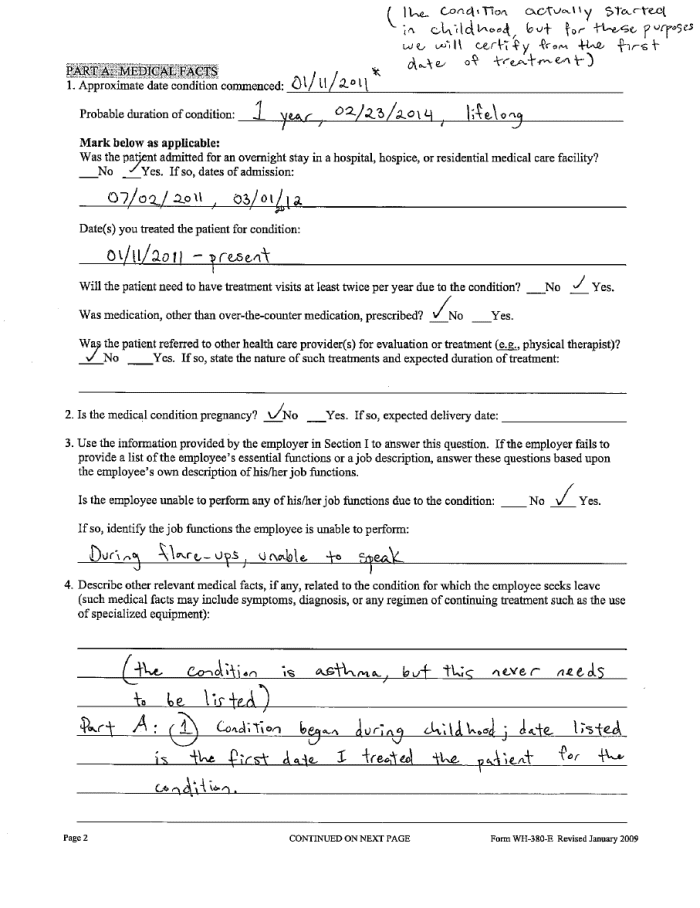

Tax Exemption Application Fees

To obtain tax-exempt status, nonprofits must file Form 1023 with the Internal Revenue Service (IRS), which requires a fee. The application fee for Form 1023 can range from 275 to 900, depending on the type of tax-exempt status you’re applying for. For example, if you’re applying for 501©(3) status, the fee is 600 for organizations with gross receipts of 10,000 or less, and 900 for organizations with gross receipts over 10,000.

Registered Agent Fees

Nonprofits are also required to have a registered agent in the state where they’re incorporated. A registered agent is responsible for receiving legal documents and notices on behalf of the nonprofit. The cost of a registered agent can range from 100 to 300 per year, depending on the state and the agent’s fees.

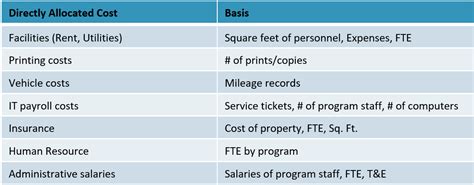

Compliance and Auditing Fees

Finally, nonprofits may need to pay compliance and auditing fees to ensure they’re meeting all the necessary regulatory requirements. These fees can range from 500 to 5,000 or more per year, depending on the complexity of the audit and the size of the nonprofit. Compliance and auditing fees may include costs associated with preparing financial statements, conducting internal audits, and ensuring compliance with state and federal regulations.

📝 Note: It's essential to factor in these costs when creating your nonprofit's budget to ensure you have sufficient funds to cover all the necessary fees and expenses.

Reducing Nonprofit Filing Costs

While nonprofit filing costs can be significant, there are ways to reduce them. Here are some tips: * Research and compare fees: Before hiring a registered agent or auditor, research and compare fees to ensure you’re getting the best value for your money. * File electronically: Filing electronically can save you time and money, and many states offer discounts for electronic filings. * Prepare your own documents: If you have the necessary expertise, preparing your own documents can save you money on legal and accounting fees. * Seek pro bono services: Some attorneys and accountants offer pro bono services to nonprofits, which can help reduce your costs.

| Fee Type | Cost Range |

|---|---|

| Initial Filing Fee | $20-$500 |

| Annual Reporting Fee | $10-$200 |

| Tax Exemption Application Fee | $275-$900 |

| Registered Agent Fee | $100-$300 |

| Compliance and Auditing Fee | $500-$5,000+ |

In summary, nonprofit filing costs can be significant, but by understanding the various fees involved and taking steps to reduce them, you can ensure your nonprofit has sufficient funds to focus on its mission and activities. By researching and comparing fees, filing electronically, preparing your own documents, seeking pro bono services, and budgeting for these costs, you can minimize your nonprofit’s filing expenses and maximize its impact.

As we’ve explored the key nonprofit filing costs, it’s clear that these expenses are a necessary part of maintaining a nonprofit organization. By being aware of these costs and taking steps to reduce them, you can help ensure your nonprofit’s financial sustainability and success. With careful planning and management, your nonprofit can navigate the complex world of filing costs and focus on making a positive difference in the world.

What is the average cost of forming a nonprofit corporation?

+

The average cost of forming a nonprofit corporation can range from 500 to 2,000, depending on the state and the complexity of the filing process.

How often do nonprofits need to file annual reports?

+

Nonprofits typically need to file annual reports with their state on a yearly basis, usually within a specific timeframe after the end of their fiscal year.

Can nonprofits file for tax-exempt status online?

+

Yes, nonprofits can file for tax-exempt status online using the IRS’s electronic filing system, but they may need to consult with an attorney or tax professional to ensure they’re meeting all the necessary requirements.