5 California Filing Tips

Introduction to California Filing

When it comes to filing taxes or legal documents in California, the process can be complex and overwhelming. With numerous forms, deadlines, and regulations to navigate, it’s essential to have a clear understanding of the requirements to avoid any issues or penalties. In this article, we will provide you with five valuable tips to help you file successfully in California, ensuring that you comply with all the necessary regulations and avoid any potential problems.

Tip 1: Understand California Filing Requirements

Before you start the filing process, it’s crucial to understand the requirements for your specific situation. California has different filing requirements for individuals, businesses, and organizations, so make sure you’re aware of the rules that apply to you. For example, if you’re an individual, you’ll need to file a tax return with the California Franchise Tax Board (FTB), while businesses may need to file with the California Secretary of State. Take the time to research and understand the specific requirements for your situation to avoid any mistakes or delays.

Tip 2: Gather Necessary Documents

To ensure a smooth filing process, it’s essential to gather all the necessary documents and information before you start. This may include: * Identification documents, such as a driver’s license or passport * Financial documents, such as W-2 forms or 1099 forms * Business documents, such as articles of incorporation or a business license * Any other relevant documents or information required for your specific filing situation Make sure you have all the necessary documents and information readily available to avoid any delays or issues during the filing process.

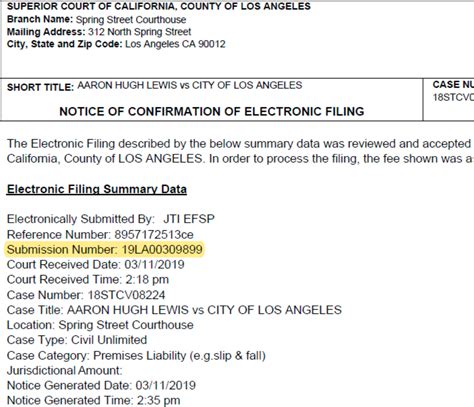

Tip 3: Choose the Right Filing Method

California offers several filing methods, including online filing, mail filing, and in-person filing. Choose the method that best suits your needs and situation. Online filing is often the quickest and most convenient option, but you may need to use a specific software or platform to complete the filing process. Mail filing can be a good option if you prefer to submit your documents by mail, but be sure to allow plenty of time for processing and delivery. In-person filing may be necessary for certain types of filings, such as those that require notarization or witness signatures.

Tip 4: Meet Filing Deadlines

Filing deadlines are critical in California, and missing a deadline can result in penalties, fines, or even loss of rights. Make sure you’re aware of the filing deadlines for your specific situation and plan accordingly. Some common filing deadlines in California include: * April 15th for individual tax returns * March 15th for business tax returns * Various deadlines for other types of filings, such as trademark registrations or court documents Create a calendar or reminder system to ensure you meet all the necessary filing deadlines and avoid any potential issues.

Tip 5: Seek Professional Help if Necessary

If you’re unsure about any aspect of the filing process or need help with a complex filing situation, consider seeking professional help. Attorneys, accountants, and filing services can provide valuable guidance and assistance to ensure that your filing is completed correctly and on time. Don’t be afraid to ask for help if you need it – it’s better to seek professional advice than to risk making mistakes or missing deadlines.

📝 Note: Always keep a record of your filings, including receipts, confirmations, and other relevant documents, to ensure that you can track the status of your filings and resolve any issues that may arise.

In summary, filing in California requires attention to detail, careful planning, and a clear understanding of the requirements and regulations. By following these five tips, you can ensure a successful filing experience and avoid any potential issues or penalties. Remember to stay organized, seek professional help if necessary, and always follow the rules and regulations to ensure compliance and avoid any problems.

What is the deadline for filing individual tax returns in California?

+

The deadline for filing individual tax returns in California is April 15th.

Can I file my tax return online in California?

+

Yes, you can file your tax return online in California using the California Franchise Tax Board’s (FTB) online filing system.

What documents do I need to file a business tax return in California?

+

To file a business tax return in California, you will need to provide financial documents, such as W-2 forms, 1099 forms, and a balance sheet, as well as business documents, such as articles of incorporation and a business license.