Dissolved Company Paperwork Retention Period

Introduction to Dissolved Company Paperwork Retention

When a company is dissolved, it can be a complex and time-consuming process, involving various legal and administrative tasks. One crucial aspect of dissolving a company is dealing with its paperwork and records. Proper retention and management of these documents are essential for complying with legal requirements, facilitating potential future audits, and maintaining a clear record of the company’s activities before its dissolution.

In this context, understanding the retention period for dissolved company paperwork is vital. The retention period refers to the length of time that a company, or its successors, must keep its records and documents after it has been dissolved. This period can vary depending on the jurisdiction, the type of documents, and other factors.

Factors Influencing Retention Periods

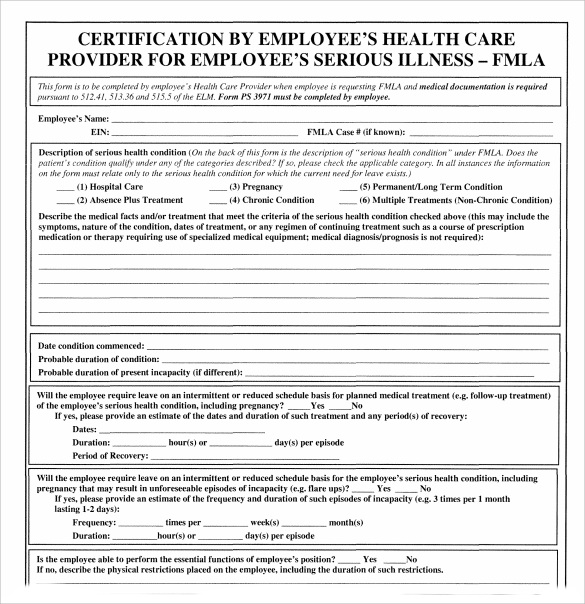

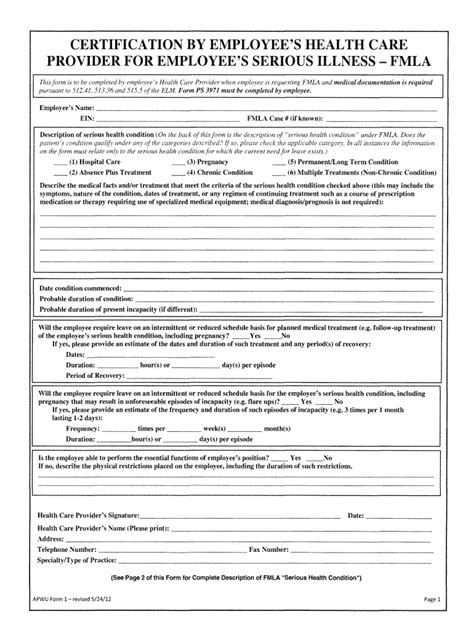

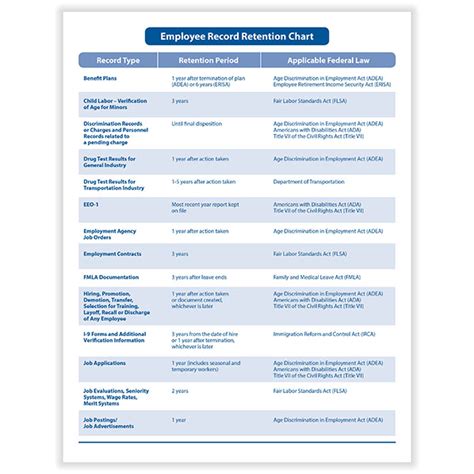

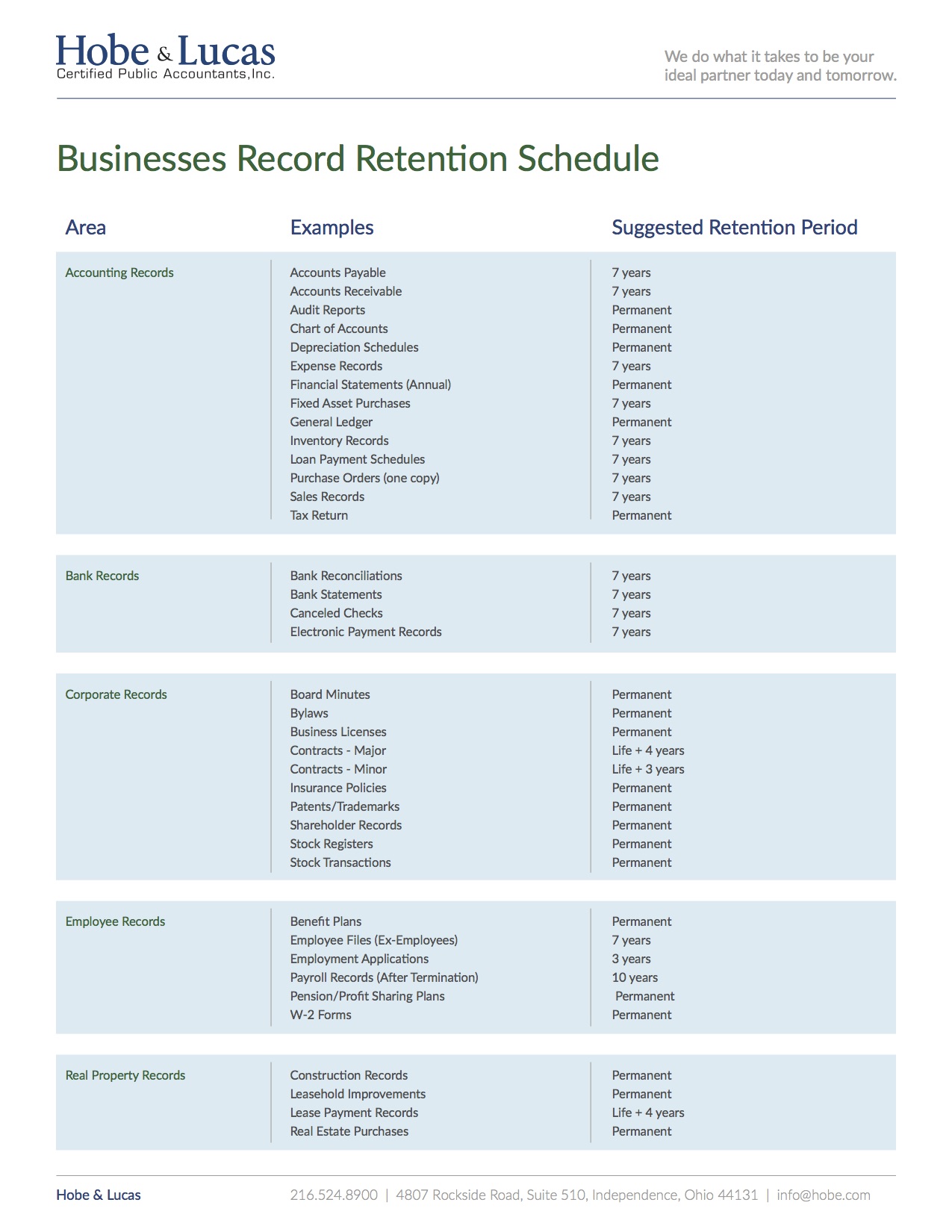

Several factors influence the retention period for dissolved company paperwork. These include: - Jurisdictional Requirements: Different countries and states have their own laws and regulations regarding document retention. For instance, tax authorities may require that financial records be kept for a certain number of years after the company’s dissolution. - Type of Documents: The nature of the documents also plays a significant role. Financial records, employee records, and legal documents often have different retention requirements. - Regulatory Bodies: Various regulatory bodies, such as tax authorities, labor departments, and corporate registries, may have specific requirements for document retention.

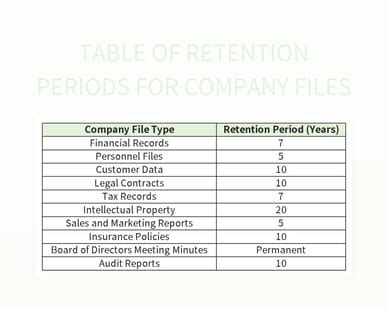

Common Retention Periods for Different Types of Documents

While specific requirements can vary, there are some general guidelines for the retention of common types of documents: - Financial Records: These often need to be kept for 6 to 10 years after the company’s dissolution, depending on the jurisdiction. This allows for potential audits and ensures compliance with tax laws. - Employee Records: The retention period for employee records can range from 3 to 6 years after the employee has left the company or after the company’s dissolution, whichever is later. These records are crucial for employment law compliance and potential legal disputes. - Legal Documents: Documents related to the company’s legal structure, such as articles of incorporation and minutes of meetings, should be kept permanently, as they provide a historical record of the company’s existence and decisions.

Best Practices for Document Retention

Given the complexity and variability of document retention requirements, it’s essential to follow best practices: - Centralized Storage: Keep all documents in a centralized, secure location. This could be physical storage for paper documents or a cloud-based storage solution for digital documents. - Digitalization: Consider digitizing paper documents to reduce storage space and improve accessibility. - Access Control: Ensure that access to documents is controlled, with permissions granted only to authorized personnel. - Regular Audits: Conduct regular audits to ensure compliance with retention policies and to purge documents that are no longer required to be kept.

Consequences of Non-Compliance

Failure to comply with document retention requirements can result in significant consequences, including: - Legal Penalties: Fines and other legal penalties can be imposed for non-compliance. - Audit Risks: Inadequate document retention can increase the risk and complexity of audits, potentially leading to further legal and financial issues. - Reputation Damage: Non-compliance can damage the reputation of the company’s directors and officers, affecting their future business endeavors.

📝 Note: It's crucial to consult with legal and financial advisors to ensure compliance with all relevant laws and regulations regarding document retention for dissolved companies.

Implementing a Document Retention Policy

Implementing a comprehensive document retention policy is essential for any company, especially one that is in the process of dissolution. This policy should: - Clearly outline which documents must be retained and for how long. - Specify the storage and security measures for these documents. - Detail the procedure for regularly reviewing and updating the policy to ensure compliance with changing regulations.

| Document Type | Retention Period | Purpose |

|---|---|---|

| Financial Records | 6-10 years | Tax compliance and audits |

| Employee Records | 3-6 years | Employment law compliance |

| Legal Documents | Permanently | Historical record and legal compliance |

In conclusion, the retention of dissolved company paperwork is a critical aspect of the dissolution process, requiring careful consideration of legal requirements, regulatory compliance, and best practices. By understanding the factors that influence retention periods, following guidelines for common document types, and implementing a robust document retention policy, companies can ensure they are adequately prepared for the eventualities of dissolution and beyond.

What are the general guidelines for retaining financial records after a company is dissolved?

+

Financial records typically need to be kept for 6 to 10 years after the company’s dissolution, depending on the jurisdiction and specific legal requirements.

Why is it important to retain employee records after a company has dissolved?

+

Retaining employee records is crucial for employment law compliance and potential legal disputes. These records can provide essential information about employment terms, compensation, and any disciplinary actions.

What are the consequences of not complying with document retention requirements for a dissolved company?

+

Non-compliance can lead to legal penalties, increased audit risks, and reputation damage for the company’s directors and officers. It’s essential to consult with legal and financial advisors to ensure all requirements are met.