Change Address on Federal Perkins Loan Paperwork

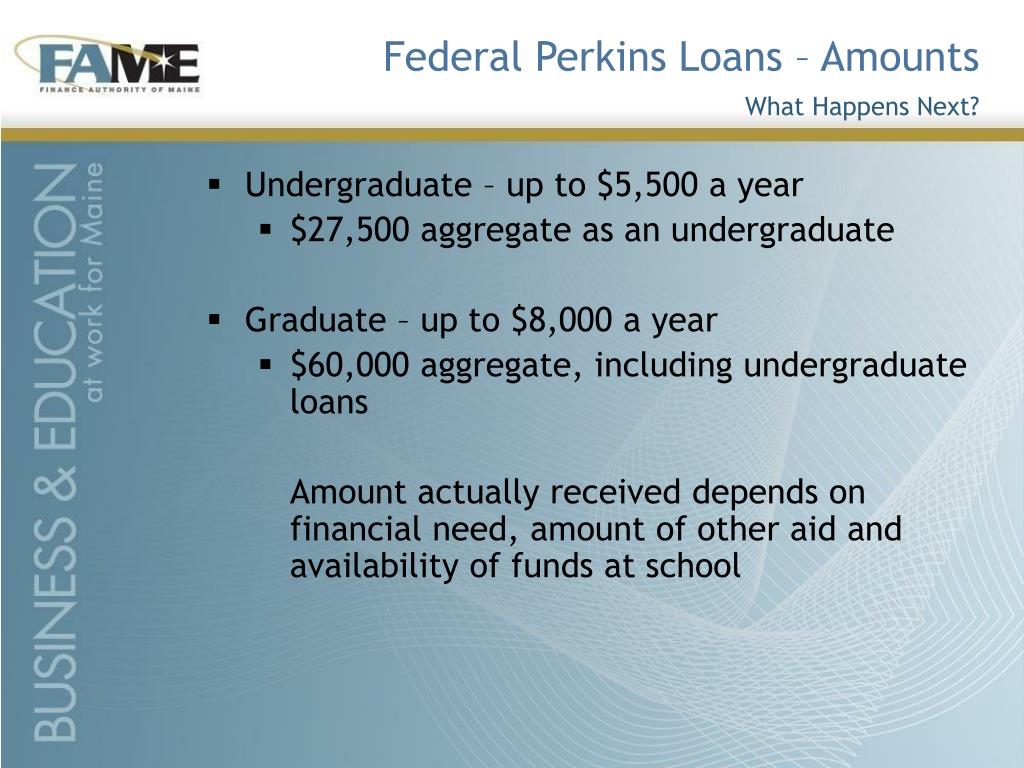

Introduction to Federal Perkins Loans

The Federal Perkins Loan is a type of low-interest loan provided by the federal government to undergraduate and graduate students who demonstrate exceptional financial need. These loans are administered by the schools that participate in the program, and the funds are limited. The loan has a fixed interest rate, and the repayment period typically begins nine months after the borrower graduates, leaves school, or drops below half-time enrollment. Managing the loan paperwork is crucial, including updating personal details such as the address.

Why Update Your Address?

It is essential to keep your address up to date on your Federal Perkins Loan paperwork for several reasons: - Communication: Your lender or the school’s financial aid office uses your address to send you important documents, notifications, and updates about your loan. - Payment Notifications: Once you enter repayment, you will receive statements and notices about your payment due dates and amounts. - Tax Benefits: You may be eligible for tax deductions on the interest paid on your student loan, and updated address information ensures you receive the necessary tax documents. - Default Prevention: Failing to receive important notices due to an incorrect address can lead to unintended default on your loan, which has severe consequences on your credit score and financial stability.

Steps to Change Your Address on Federal Perkins Loan Paperwork

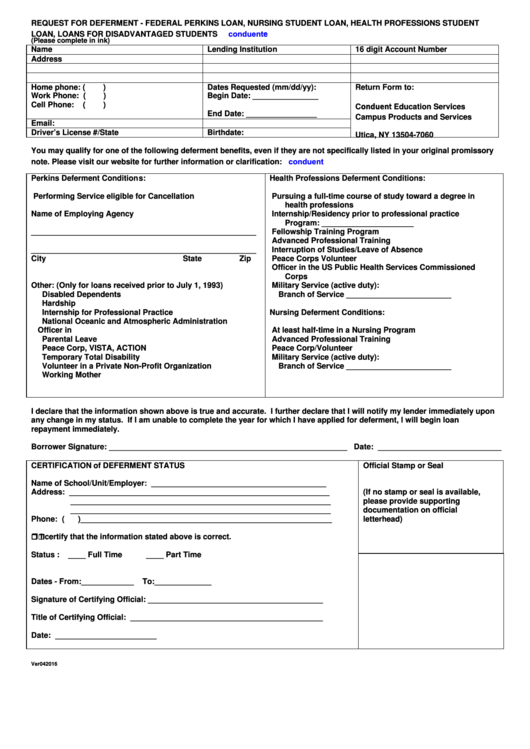

To update your address, follow these steps: - Step 1: Gather Necessary Information - Your loan account number or Social Security number - Your current address and the new address - Contact information for your school’s financial aid office or loan servicer - Step 2: Contact Your School or Loan Servicer - Reach out to the financial aid office at the school that administered your Federal Perkins Loan or your loan servicer directly - Explain that you need to update your address - Provide the required information and confirm the update process - Step 3: Complete and Submit the Update Form (If Required) - Some schools or servicers may require you to fill out a form to update your address - Ensure you complete the form accurately and submit it according to the provided instructions - Step 4: Verify the Update - After submitting your address change, verify with your school or loan servicer that the update has been successfully processed - Request confirmation or a reference number for your records

Tips for Managing Your Federal Perkins Loan

Here are some tips to help you manage your loan effectively: - Keep Detailed Records: Maintain a file with all your loan documents, including the master promissory note, loan disclosures, and payment history. - Communicate Proactively: Inform your school or loan servicer about any changes in your enrollment status, address, or financial situation that might affect your loan. - Understand Repayment Options: Familiarize yourself with the repayment plans available, including income-driven repayment plans, deferment, and forbearance. - Seek Help When Needed: If you’re facing difficulties in making payments, don’t hesitate to reach out to your loan servicer for assistance.

📝 Note: Always keep a record of your communications with your loan servicer or school, including dates, times, and the names of the representatives you speak with.

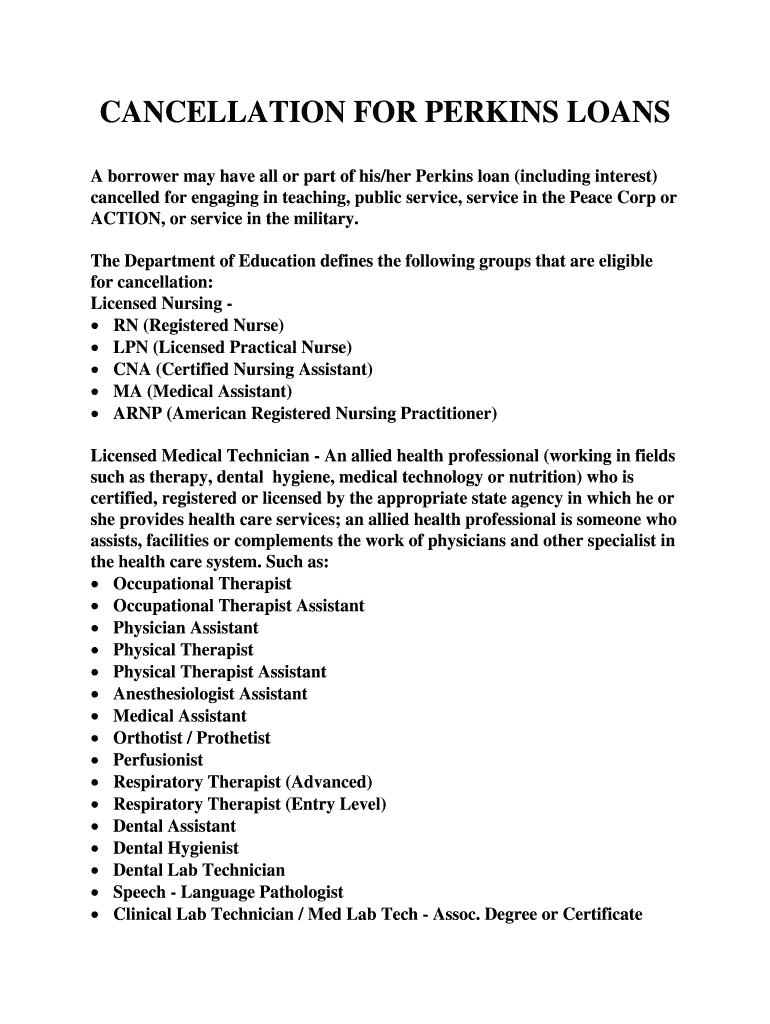

Address Update and Loan Forgiveness

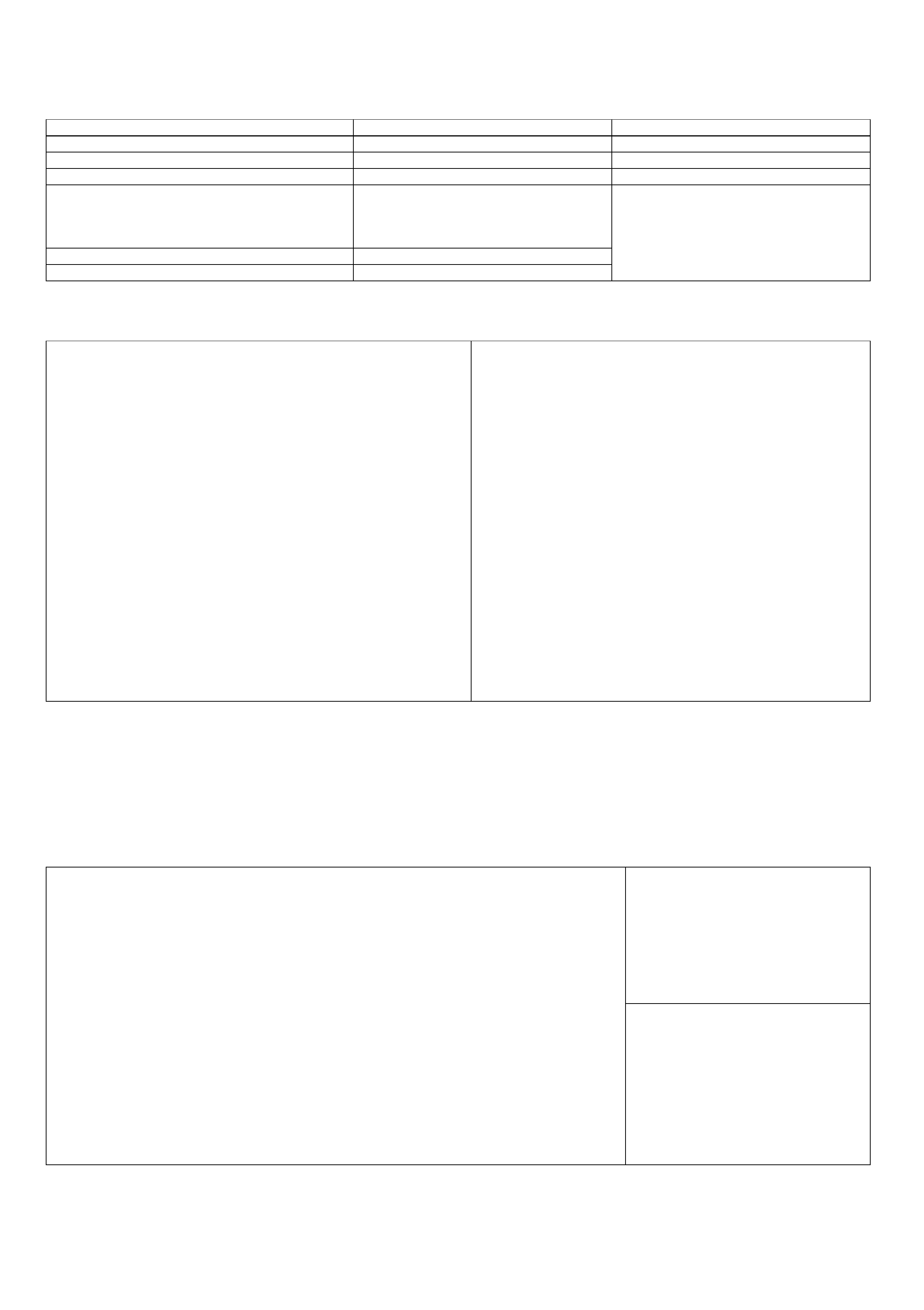

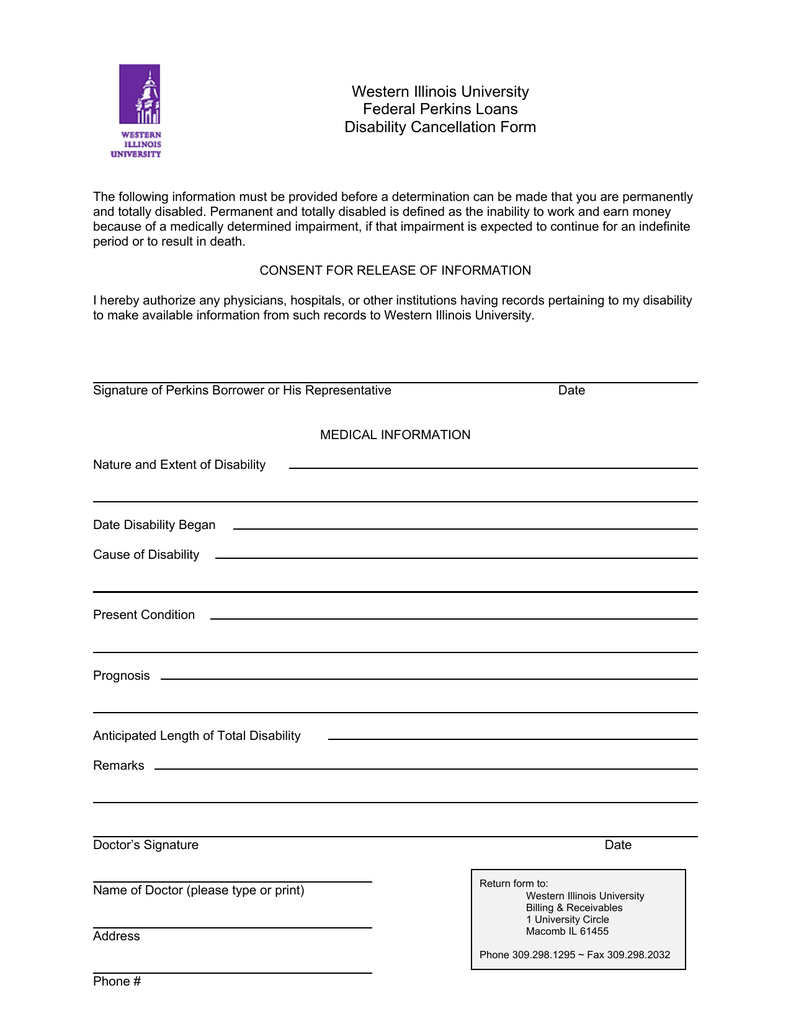

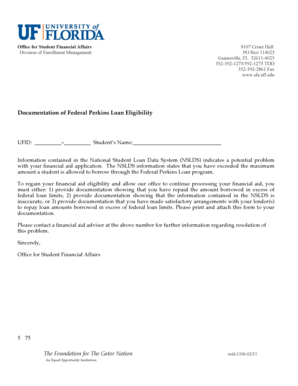

While updating your address is crucial for the management of your loan, it’s also important to understand the loan forgiveness options available for Federal Perkins Loans. These include: - Public Service Loan Forgiveness (PSLF): Available for borrowers who work full-time in public service jobs. - Teacher Loan Forgiveness: For teachers who work in low-income schools or in certain subject areas. - Perkins Loan Cancellation: Offers loan cancellation for borrowers in specific public service careers.

| Loan Forgiveness Program | Eligibility | Benefits |

|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Full-time public service workers | Forgiveness of the remaining balance after 120 qualifying payments |

| Teacher Loan Forgiveness | Teachers in low-income schools or specific subjects | Up to $17,500 in forgiveness |

| Perkins Loan Cancellation | Borrowers in specific public service careers | Cancellation of a portion or the entire loan |

In summary, managing your Federal Perkins Loan requires attention to detail, including keeping your address updated to ensure you receive critical communications. By understanding your loan terms, exploring repayment options, and staying informed about forgiveness programs, you can effectively navigate the loan process and make informed decisions about your financial future.

To wrap things up, the key to successfully managing your Federal Perkins Loan is a combination of proactive communication, detailed record-keeping, and a thorough understanding of your loan options and responsibilities. By following the steps outlined and staying vigilant, you can ensure a smoother loan experience and make the most of the financial assistance provided to support your educational pursuits.

How do I find out who my loan servicer is?

+

You can find out who your loan servicer is by checking your loan documents, contacting your school’s financial aid office, or looking up your loan information on the National Student Loan Data System (NSLDS) website.

Can I update my address online?

+

Yes, many loan servicers offer online account management where you can update your address and other contact information. Check your servicer’s website for this option.

What happens if I don’t update my address and miss a payment?

+

Failing to update your address and missing a payment can lead to late fees, negative reporting to credit bureaus, and potentially defaulting on your loan. It’s crucial to stay on top of your loan communications and payments.