5 Ways to Co-sign

Understanding Co-signing

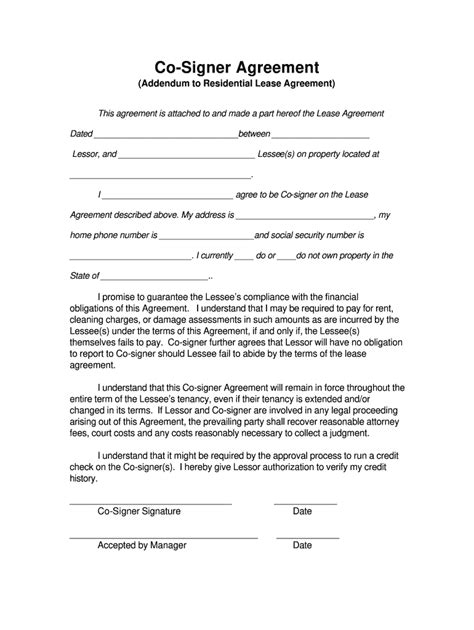

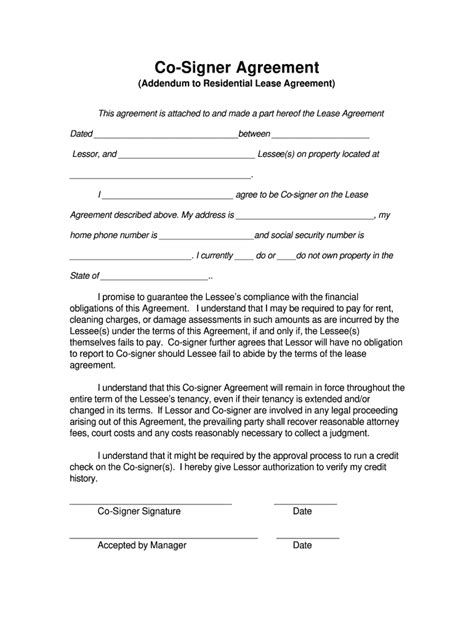

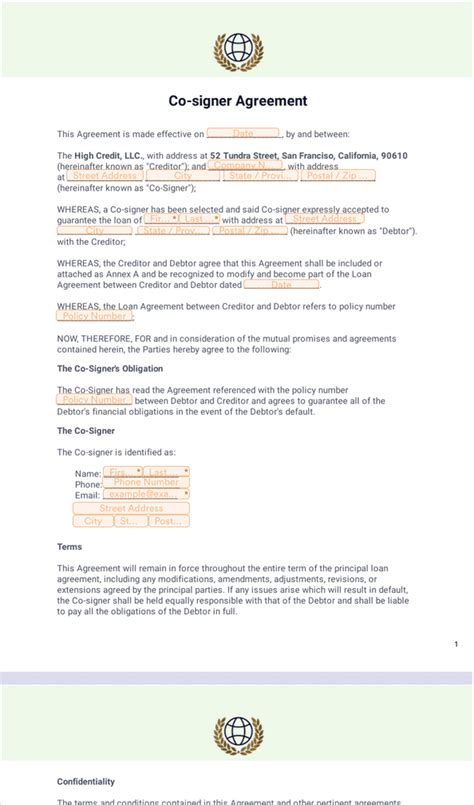

Co-signing a loan or credit agreement is a significant financial decision that can have long-lasting effects on one’s credit score and financial stability. It involves agreeing to take on the responsibility of paying back a loan or debt if the primary borrower fails to make payments. Co-signing can be a helpful way to assist a friend or family member in obtaining credit, but it’s essential to understand the risks and responsibilities involved. In this article, we will explore five ways to co-sign and provide guidance on how to make an informed decision.

Types of Co-signing

There are several types of co-signing arrangements, each with its own set of rules and regulations. Here are five common ways to co-sign: * Co-borrower: A co-borrower is equally responsible for the debt and has equal access to the funds or assets. * Co-signer: A co-signer is responsible for paying back the debt if the primary borrower defaults, but they may not have access to the funds or assets. * Guarantor: A guarantor agrees to pay back the debt if the primary borrower defaults, but they may not be equally responsible for the debt. * Co-applicant: A co-applicant applies for credit jointly with the primary borrower and is equally responsible for the debt. * Joint Account Holder: A joint account holder has access to the account and is responsible for any debts or overdrafts.

Risks and Responsibilities

Co-signing a loan or credit agreement can be risky, as the co-signer may be held responsible for the debt if the primary borrower defaults. It’s essential to understand the risks and responsibilities involved in co-signing, including: * Damage to credit score: If the primary borrower defaults, the co-signer’s credit score may be affected. * Financial liability: The co-signer may be responsible for paying back the debt, including interest and fees. * Lack of control: The co-signer may not have control over the account or the primary borrower’s actions.

Benefits of Co-signing

While co-signing can be risky, it can also have benefits, such as: * Helping a friend or family member: Co-signing can help a friend or family member obtain credit or access to funds. * Building credit: Co-signing can help the primary borrower build credit, especially if they have a limited credit history. * Lower interest rates: Co-signing can result in lower interest rates or better loan terms, as the lender may view the co-signer as a more reliable borrower.

How to Co-sign Safely

To co-sign safely, it’s essential to: * Understand the terms: Carefully review the loan or credit agreement and understand the terms and conditions. * Check the primary borrower’s credit: Review the primary borrower’s credit report and history to ensure they are reliable. * Set boundaries: Establish clear boundaries and expectations with the primary borrower, including payment schedules and communication channels. * Monitor the account: Regularly monitor the account and payments to ensure the primary borrower is meeting their obligations.

| Type of Co-signing | Risks and Responsibilities | Benefits |

|---|---|---|

| Co-borrower | Equal responsibility for the debt | Equal access to funds or assets |

| Co-signer | Responsibility for paying back the debt if the primary borrower defaults | Helping a friend or family member obtain credit |

| Guarantor | Agreeing to pay back the debt if the primary borrower defaults | Lower interest rates or better loan terms |

| Co-applicant | Equal responsibility for the debt | Building credit for the primary borrower |

| Joint Account Holder | Responsibility for any debts or overdrafts | Access to the account and funds |

📝 Note: Before co-signing, it's essential to carefully review the loan or credit agreement and understand the terms and conditions. It's also crucial to establish clear boundaries and expectations with the primary borrower to avoid any misunderstandings or disputes.

In the end, co-signing a loan or credit agreement can be a significant financial decision that requires careful consideration and planning. By understanding the different types of co-signing arrangements, the risks and responsibilities involved, and the benefits of co-signing, individuals can make an informed decision that meets their financial goals and needs. It’s essential to approach co-signing with caution and to prioritize responsible financial planning to avoid any potential pitfalls or negative consequences.

What is co-signing, and how does it work?

+

Co-signing involves agreeing to take on the responsibility of paying back a loan or debt if the primary borrower fails to make payments. It’s a way to help a friend or family member obtain credit, but it requires careful consideration and planning.

What are the risks and responsibilities of co-signing?

+

The risks and responsibilities of co-signing include damage to credit score, financial liability, and lack of control over the account or primary borrower’s actions. It’s essential to understand these risks and responsibilities before co-signing.

How can I co-sign safely and responsibly?

+

To co-sign safely and responsibly, it’s essential to understand the terms and conditions of the loan or credit agreement, check the primary borrower’s credit history, set clear boundaries and expectations, and regularly monitor the account and payments.