5 Ways PA LLC Processing

Introduction to PA LLC Processing

Forming a Limited Liability Company (LLC) in Pennsylvania (PA) is a significant step for any business, offering liability protection and tax benefits. The process of establishing an LLC in PA involves several key steps, each crucial for ensuring that the business is set up correctly and operates legally. Understanding these steps is vital for entrepreneurs and small business owners looking to form an LLC in Pennsylvania.

Step 1: Choose a Business Name

The first step in PA LLC processing is to choose a unique and compliant business name. Business name compliance requires that the name includes the phrase “Limited Liability Company” or an abbreviation like “LLC” or “L.L.C.” It’s also essential to ensure the name isn’t already in use by another business in Pennsylvania. This can be checked through the Pennsylvania Department of State’s database. Additionally, it’s a good idea to reserve the business name if you’re not ready to file the LLC formation documents immediately.

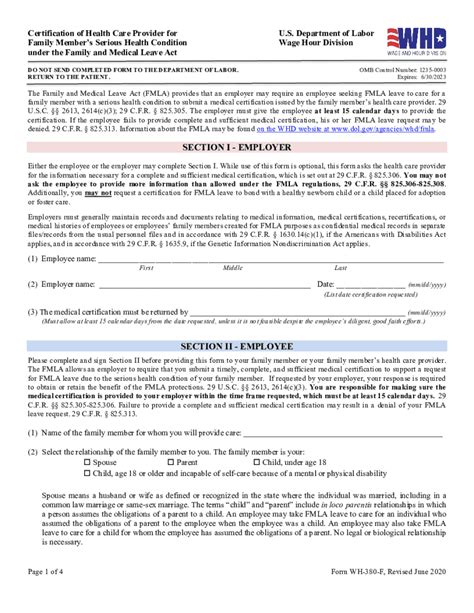

Step 2: Prepare and File Articles of Organization

After selecting a compliant business name, the next step is to prepare and file the Articles of Organization with the Pennsylvania Department of State. This document provides essential information about the LLC, including its name, address, purpose, and the names and addresses of its members or managers. The filing can be done online or by mail, and there is a filing fee associated with this step. Ensuring that the Articles of Organization are accurately completed is crucial for the successful formation of the LLC.

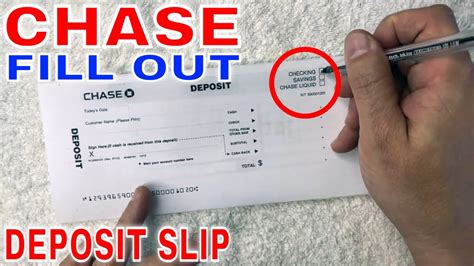

Step 3: Obtain an EIN

An Employer Identification Number (EIN) is a nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business for tax purposes. Obtaining an EIN is a critical step in the PA LLC processing as it is required for opening a business bank account, hiring employees, and filing taxes. The application for an EIN can be made online through the IRS website, and it’s free of charge. Having an EIN also helps in separating personal and business finances, which is an important aspect of maintaining the liability protection offered by an LLC.

Step 4: Draft an Operating Agreement

Although not required by Pennsylvania law, drafting an operating agreement is highly recommended for LLCs. This document outlines the ownership, management structure, and operational procedures of the LLC. It helps in preventing misunderstandings among members by clearly defining their roles, responsibilities, and rights. An operating agreement can also help in protecting the limited liability status of the business by demonstrating that the LLC is a separate entity from its members.

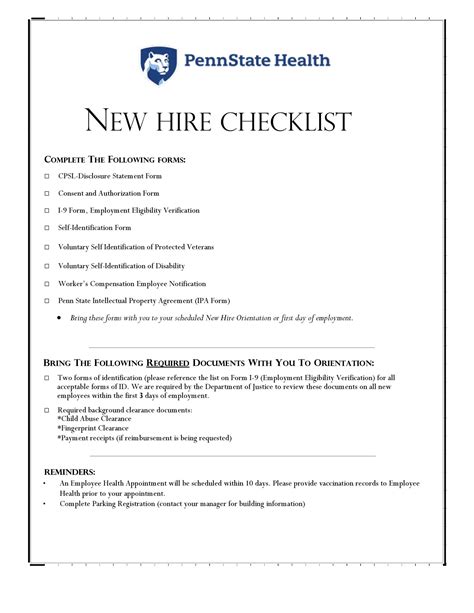

Step 5: Comply with Ongoing Requirements

After the LLC is formed, there are ongoing compliance requirements that must be met to keep the business in good standing. This includes filing annual reports with the Pennsylvania Department of State and maintaining accurate and detailed records of the business’s activities. Compliance with federal, state, and local regulations is also necessary, which may include obtaining licenses and permits, and filing taxes on time. Failing to comply with these requirements can result in fines, penalties, and even the dissolution of the LLC.

💡 Note: It's essential to consult with a legal or financial advisor to ensure all steps are correctly followed and that the LLC complies with all applicable laws and regulations.

In terms of time and cost, the PA LLC processing time can vary depending on the filing method chosen and the workload of the Department of State. Expedited services are available for an additional fee for those who need quicker processing. The cost includes the filing fee for the Articles of Organization and any additional services or fees associated with obtaining necessary licenses and permits.

To further illustrate the process, here is a summary of the key steps involved in PA LLC processing: - Choose a compliant business name and check its availability. - Prepare and file the Articles of Organization. - Obtain an Employer Identification Number (EIN) from the IRS. - Draft an operating agreement to outline the ownership and management structure. - Comply with ongoing requirements, including filing annual reports and maintaining business records.

When considering the formation of an LLC in Pennsylvania, it’s crucial to understand the importance of each step in the process. From choosing a compliant business name to complying with ongoing requirements, each aspect plays a significant role in ensuring the LLC is properly established and maintains its legal status.

To enhance the understanding of the costs involved, the following table provides a breakdown of the typical expenses associated with forming and maintaining an LLC in Pennsylvania:

| Expense | Cost |

|---|---|

| Filing Fee for Articles of Organization | $120 (online or by mail) |

| Expedited Filing Fee | Varies (depending on the expedited service chosen) |

| Obtaining an EIN | Free |

| Annual Report Filing Fee | $520 (due by April 15th each year) |

| Business Licenses and Permits | Varies (depending on the type of business and location) |

In conclusion, forming an LLC in Pennsylvania involves several critical steps, from selecting a compliant business name to ensuring ongoing compliance with state and federal regulations. Understanding these steps and the associated costs is essential for entrepreneurs and small business owners looking to establish a successful and legally sound LLC in PA. By following these steps and maintaining compliance, businesses can enjoy the benefits of limited liability protection and favorable tax treatment, setting them up for long-term success.

What is the primary purpose of an operating agreement in an LLC?

+

The primary purpose of an operating agreement is to outline the ownership, management structure, and operational procedures of the LLC, helping to prevent misunderstandings and ensure smooth operations.

How long does it take to process the formation of an LLC in Pennsylvania?

+

The processing time for LLC formation in Pennsylvania can vary, but typically, online filings are processed within a few days, while mail filings may take longer. Expedited services are available for an additional fee.

Is obtaining an EIN mandatory for all LLCs in Pennsylvania?

+

Yes, obtaining an Employer Identification Number (EIN) is mandatory for all LLCs in Pennsylvania, as it is required for opening a business bank account, hiring employees, and filing taxes.