Hire Independent Contractors Paperwork Required

Introduction to Hiring Independent Contractors

When a business decides to hire an independent contractor, it’s essential to understand the necessary paperwork required to ensure compliance with laws and regulations. Independent contractors are individuals who offer their services to clients without being part of the client’s company. They are responsible for their own taxes, benefits, and work schedules. In this article, we will explore the paperwork needed when hiring independent contractors, the benefits of hiring them, and the importance of maintaining accurate records.

Benefits of Hiring Independent Contractors

There are several benefits to hiring independent contractors, including: * Flexibility: Independent contractors can work on a project-by-project basis, allowing businesses to scale up or down as needed. * Cost savings: Businesses do not have to pay employment taxes, benefits, or provide equipment and supplies for independent contractors. * Access to specialized skills: Independent contractors often have specialized skills and expertise that can be valuable to businesses. * Increased productivity: Independent contractors are often motivated to complete projects efficiently, as their payment is tied to the project’s completion.

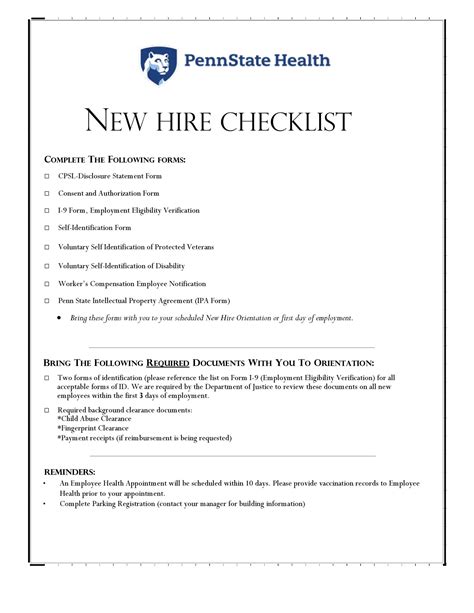

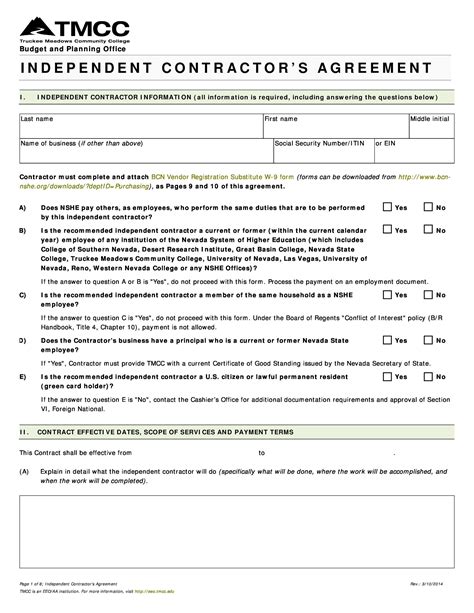

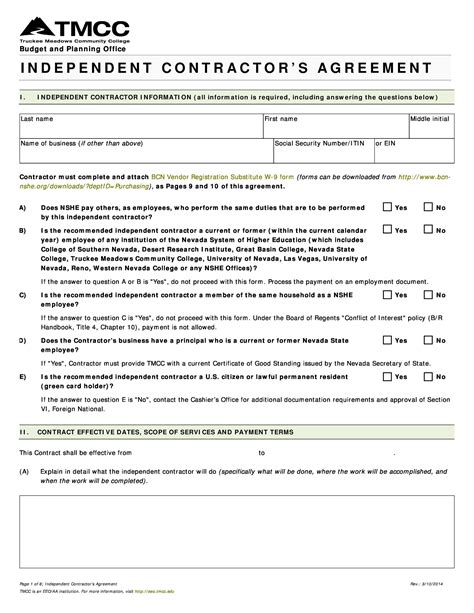

Paperwork Required for Independent Contractors

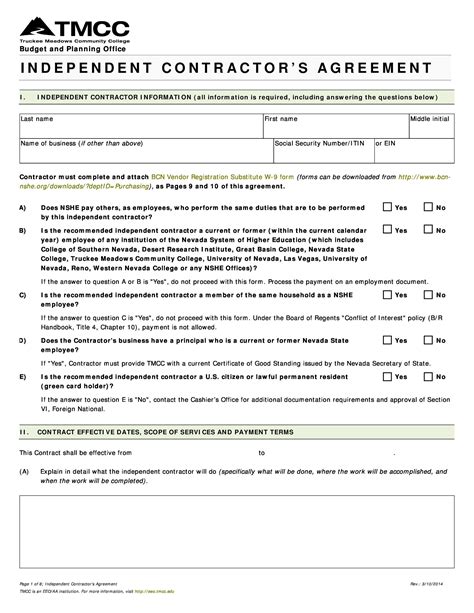

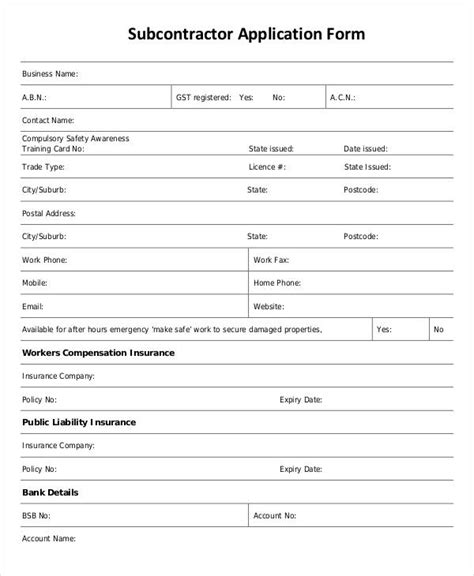

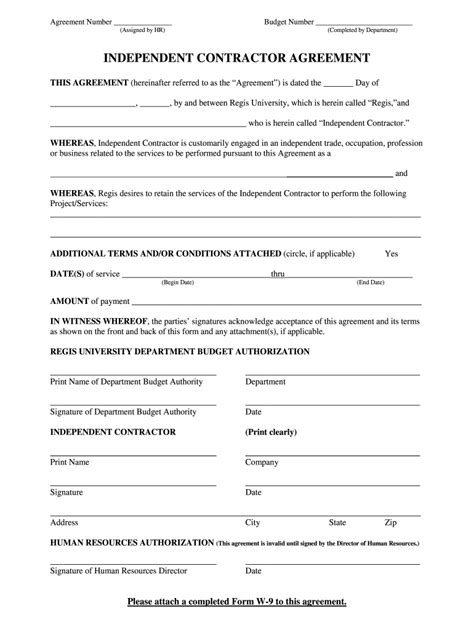

The following paperwork is typically required when hiring independent contractors: * Independent Contractor Agreement: This contract outlines the terms of the working relationship, including the scope of work, payment terms, and deadlines. * W-9 Form: This form is used to collect the independent contractor’s tax identification number and certify that they are not subject to backup withholding. * Invoice and Payment Records: Businesses must keep accurate records of invoices and payments made to independent contractors. * Contractor Classification: Businesses must properly classify independent contractors as non-employees to avoid misclassification penalties.

📝 Note: It's crucial to maintain accurate records and comply with all laws and regulations when hiring independent contractors to avoid potential penalties and audits.

Importance of Accurate Record-Keeping

Accurate record-keeping is essential when hiring independent contractors. This includes: * Maintaining contracts and agreements: Businesses must keep a copy of the independent contractor agreement and any amendments or updates. * Tracking invoices and payments: Businesses must keep accurate records of invoices and payments made to independent contractors. * Classifying contractors correctly: Businesses must properly classify independent contractors as non-employees to avoid misclassification penalties.

Best Practices for Hiring Independent Contractors

To ensure a successful working relationship with independent contractors, businesses should follow these best practices: * Clearly define the scope of work: Businesses should clearly outline the scope of work, including deadlines and expectations. * Establish a payment schedule: Businesses should establish a payment schedule and ensure timely payments to independent contractors. * Communicate effectively: Businesses should maintain open communication with independent contractors to ensure a smooth working relationship.

Common Mistakes to Avoid

When hiring independent contractors, businesses should avoid the following common mistakes: * Misclassifying contractors: Businesses must properly classify independent contractors as non-employees to avoid misclassification penalties. * Failing to maintain accurate records: Businesses must keep accurate records of contracts, invoices, and payments to avoid potential penalties and audits. * Not establishing clear expectations: Businesses should clearly outline the scope of work, including deadlines and expectations, to ensure a successful working relationship.

What is the difference between an independent contractor and an employee?

+

An independent contractor is an individual who offers their services to clients without being part of the client's company, whereas an employee is a person who works for a company and is paid a salary or wages.

What paperwork is required when hiring an independent contractor?

+

The paperwork required when hiring an independent contractor includes an independent contractor agreement, W-9 form, invoice and payment records, and contractor classification.

Why is accurate record-keeping important when hiring independent contractors?

+

Accurate record-keeping is essential when hiring independent contractors to avoid potential penalties and audits, and to ensure compliance with laws and regulations.

In summary, hiring independent contractors can be a great way for businesses to access specialized skills and expertise while maintaining flexibility and cost savings. However, it’s crucial to understand the necessary paperwork required, maintain accurate records, and follow best practices to ensure a successful working relationship. By avoiding common mistakes and following the guidelines outlined in this article, businesses can ensure compliance with laws and regulations and avoid potential penalties and audits. Ultimately, the key to a successful working relationship with independent contractors is clear communication, accurate record-keeping, and a thorough understanding of the laws and regulations that govern independent contractor relationships.