Chase Loan Paperwork Ink Color

Understanding the Importance of Chase Loan Paperwork Ink Color

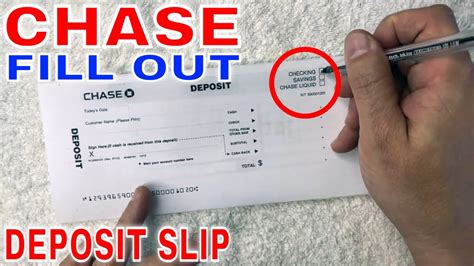

When dealing with financial institutions like Chase, the paperwork involved in loan applications can be overwhelming. One aspect that might seem insignificant at first glance but holds importance is the ink color used on these documents. The choice of ink color is not merely a matter of aesthetics; it has implications for the authenticity and validity of the documents. In this context, the use of blue ink is often recommended because it provides a clear distinction from the printed text, which is usually in black. This distinction is crucial for several reasons, including the prevention of fraud and the facilitation of the verification process.

The Significance of Blue Ink in Chase Loan Paperwork

The preference for blue ink stems from its visibility and the fact that it stands out against the backdrop of black printed text and potential photocopies. Black ink, while common, can sometimes be difficult to distinguish from printed text, especially in photocopies or scanned documents. This ambiguity can lead to issues in verifying the authenticity of signatures and handwritten notes. On the other hand, blue ink provides a clear visual cue that the signature or notation was added by hand, making it easier to verify the document’s authenticity.

Best Practices for Completing Chase Loan Paperwork

To ensure that your Chase loan paperwork is processed smoothly and without issues, follow these best practices: - Use blue ink for all signatures and handwritten notes. This helps in distinguishing between original signatures and printed or photocopied text. - Ensure all information is accurate and complete. Incomplete or inaccurate information can lead to delays or even the rejection of your loan application. - Keep a copy of your paperwork. Having a record of what you’ve submitted can be helpful in case any issues arise during the processing of your application. - Review your documents carefully before submitting them. Check for any errors, ensure all required fields are filled, and verify that all signatures are in place.

Preventing Fraud with Appropriate Ink Color

The use of distinctive ink, such as blue, in signing documents is also a measure to prevent fraud. When all parties use a consistent and distinguishable ink color for their signatures, it becomes more difficult for fraudulent alterations to go unnoticed. Red flags are raised when signatures or critical information appear in the same color as the printed text, suggesting potential tampering. By using blue ink, individuals can add an extra layer of security to their financial documents, making it harder for fraudsters to manipulate them without detection.

Table of Recommended Practices

| Practice | Recommendation |

|---|---|

| Ink Color for Signatures | Blue ink to differentiate from printed text |

| Document Review | Thoroughly review documents for accuracy and completeness before submission |

| Record Keeping | Keep a copy of all submitted documents for personal records |

📝 Note: Always check with Chase or the specific financial institution you are dealing with for their preferred practices, as requirements may vary.

As you navigate the process of completing Chase loan paperwork, remembering the small details such as the ink color used can make a significant difference. It’s not just about filling out forms; it’s about ensuring that your application is processed efficiently and that you’ve taken all necessary steps to protect yourself from potential fraud. By following the recommended practices, including the use of blue ink for signatures and handwritten notes, you can contribute to a smoother and more secure loan application process.

In wrapping up the discussion on the importance of ink color in Chase loan paperwork, it’s clear that this aspect, though often overlooked, plays a crucial role in document authenticity and security. By adopting the best practices outlined and being mindful of the ink color used, individuals can better safeguard their financial transactions and ensure a more reliable experience with financial institutions like Chase. This attention to detail, combined with a thorough understanding of the loan application process, can lead to a more positive and secure financial engagement.