Paperwork

Complete Colorado LLC Paperwork Easily

Introduction to Colorado LLC Paperwork

Forming a Limited Liability Company (LLC) in Colorado involves several steps, including filing the necessary paperwork with the state. This process can seem daunting, but with a clear understanding of the requirements and a step-by-step approach, you can complete the Colorado LLC paperwork easily. In this guide, we will walk you through the process, highlighting key points and providing tips to ensure a smooth and successful filing.

Step 1: Choose a Business Name

Before you start filling out the paperwork, you need to choose a unique and compliant business name for your LLC. The name must include the phrase “Limited Liability Company” or the abbreviations “LLC” or “L.L.C.” and must be distinguishable from other business names on file with the Colorado Secretary of State. You can check the availability of your desired name by conducting a business entity search on the Secretary of State’s website. It’s also a good idea to reserve your business name to prevent others from using it while you prepare your LLC formation documents.

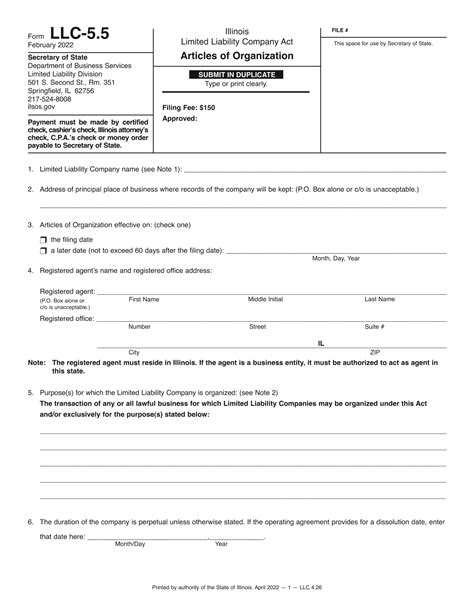

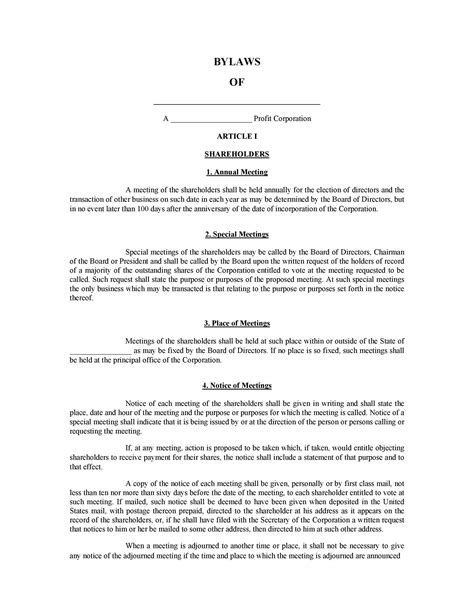

Step 2: Prepare and File Articles of Organization

The primary document for forming an LLC in Colorado is the Articles of Organization. This form requires basic information about your LLC, including: - Business name and address - Principal place of business - Registered agent and their address - Management structure (member-managed or manager-managed) - Purpose of the LLC (can be a general statement) You will need to file the Articles of Organization with the Colorado Secretary of State, either online or by mail. The filing fee is currently 50 for online filings and 50 for paper filings, though fees are subject to change, so it’s a good idea to check the Secretary of State’s website for the most current information.

Step 3: Obtain an EIN

After your LLC is approved, you will need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). The EIN is used to identify your business for tax purposes and is required for opening a business bank account, hiring employees, and filing tax returns. You can apply for an EIN online through the IRS website, and there is no filing fee.

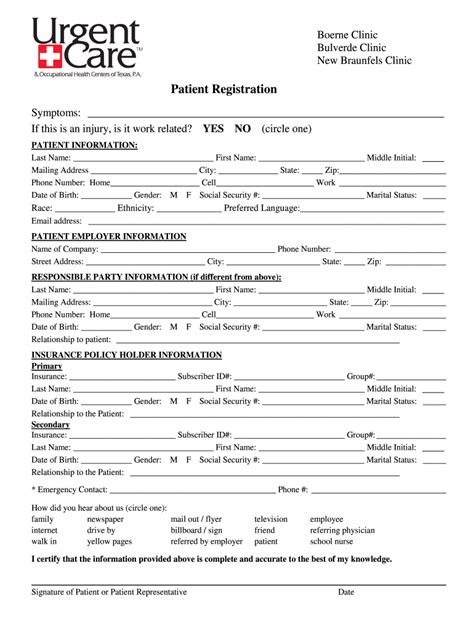

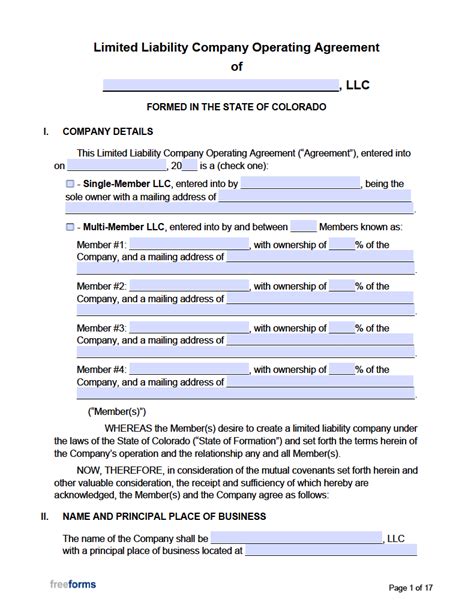

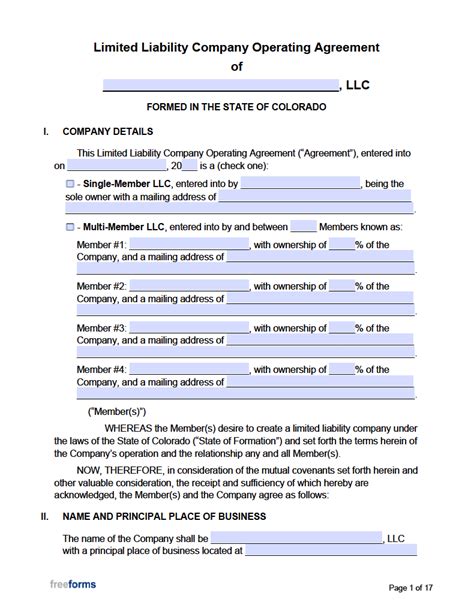

Step 4: Create an Operating Agreement

While not required by the state of Colorado, an operating agreement is a crucial document for your LLC. It outlines the ownership, management, and operation of your business, including the roles and responsibilities of members and managers, how profits and losses are distributed, and the process for making decisions and resolving disputes. An operating agreement helps protect your personal assets and ensures that all members are on the same page regarding the management and direction of the business.

Step 5: Comply with Ongoing Requirements

Once your LLC is formed, you will need to comply with ongoing requirements, including: - Annual Report Filing: Colorado LLCs must file an annual report with the Secretary of State, which includes updating your business information and paying a filing fee. - Tax Filings: You will need to file federal and state tax returns for your LLC, depending on your tax election (e.g., pass-through taxation or corporate taxation). - Business Licenses and Permits: Depending on your business activities and location, you may need to obtain additional licenses and permits from local, state, or federal authorities.

📝 Note: It's essential to stay informed about the specific requirements for your LLC, as compliance failures can result in fines, penalties, and even the dissolution of your business.

Using Online Services for LLC Formation

To simplify the process of forming an LLC in Colorado, you can use online services that specialize in business formation. These services can help you prepare and file your Articles of Organization, obtain an EIN, and create an operating agreement, among other tasks. They often provide step-by-step guidance, document templates, and expedited filing options, making it easier to complete the Colorado LLC paperwork quickly and accurately.

Conclusion

Completing the Colorado LLC paperwork involves several steps, from choosing a compliant business name to filing the Articles of Organization and obtaining necessary licenses and permits. By understanding these requirements and following a systematic approach, you can successfully form your LLC in Colorado. Remember to stay compliant with ongoing requirements to maintain the integrity and legal status of your business.

What is the filing fee for the Articles of Organization in Colorado?

+

The filing fee for the Articles of Organization in Colorado is currently $50 for both online and paper filings, though fees are subject to change.

Do I need to file an annual report for my Colorado LLC?

+

Yes, Colorado LLCs are required to file an annual report with the Secretary of State, which includes updating your business information and paying a filing fee.

Is an operating agreement required for a Colorado LLC?

+

An operating agreement is not required by the state of Colorado, but it is highly recommended as it outlines the ownership, management, and operation of your business, protecting your personal assets and ensuring clarity among members.