Paperwork

501c3 IRS Paperwork Filing Made Easy

Understanding the 501c3 IRS Paperwork Filing Process

The process of filing for 501c3 status with the IRS can seem daunting, but it’s a crucial step for non-profit organizations seeking tax-exempt status. The Internal Revenue Service (IRS) requires specific paperwork and information to determine whether an organization qualifies for this designation. In this article, we’ll break down the steps involved in filing for 501c3 status and provide tips to make the process smoother.

Step 1: Determine Eligibility

Before starting the application process, it’s essential to determine if your organization is eligible for 501c3 status. To qualify, your organization must be: * A corporation, trust, or association * Organized and operated exclusively for charitable, educational, scientific, or other purposes * Not a private foundation or a supporting organization * Not engaged in political campaigning or substantial lobbying

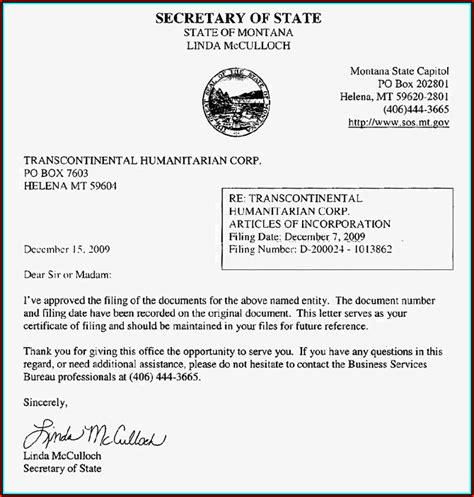

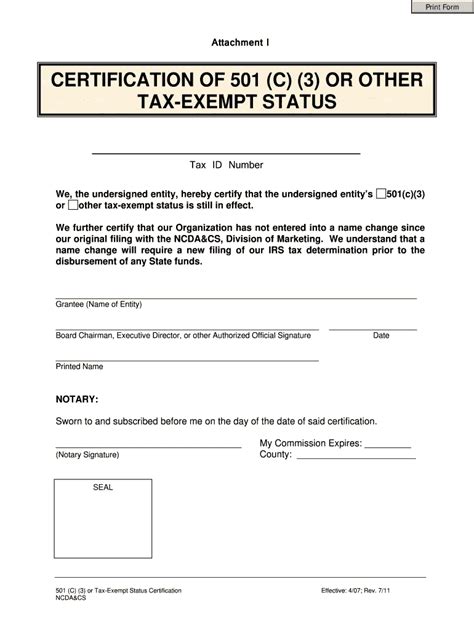

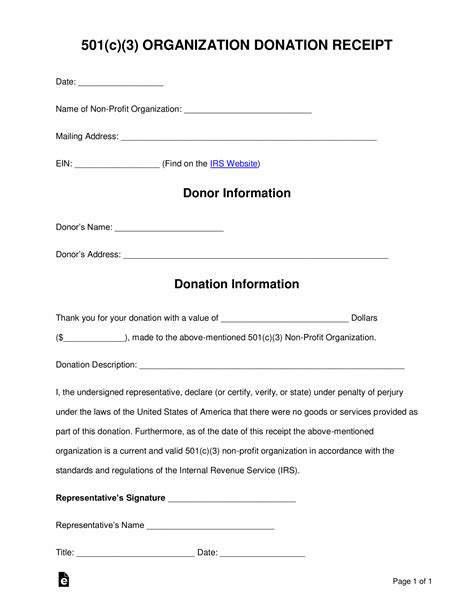

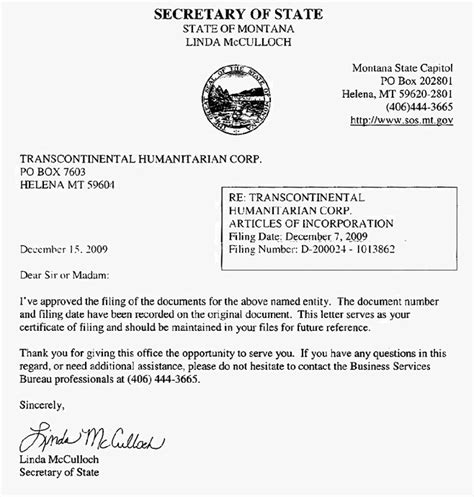

Step 2: Gather Required Documents

To apply for 501c3 status, you’ll need to gather the following documents: * Articles of Incorporation: A copy of your organization’s articles of incorporation, which should include the organization’s purpose, structure, and other relevant details * Bylaws: A copy of your organization’s bylaws, which outline the rules and procedures for governing the organization * Organizational Documents: Other documents, such as meeting minutes, resolutions, and financial statements, that demonstrate your organization’s structure and operations * Form 1023: The application for recognition of exemption, which can be downloaded from the IRS website or completed online

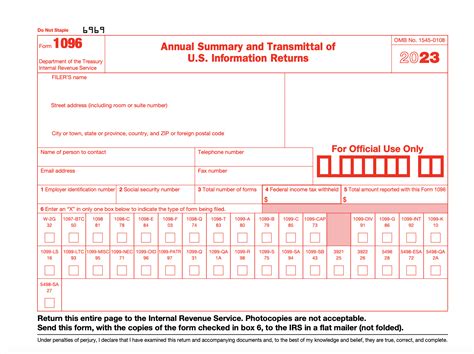

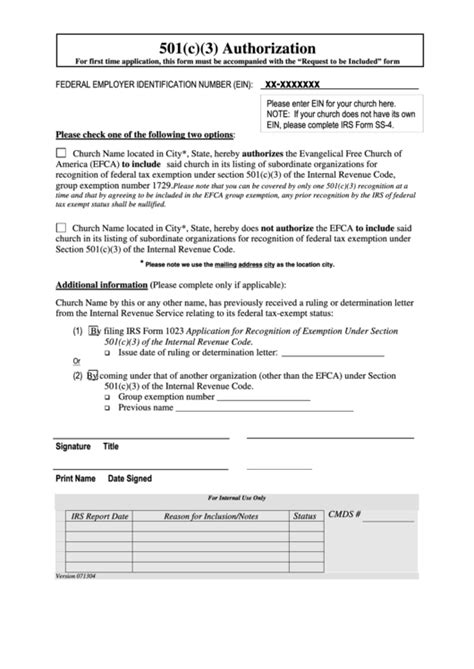

Step 3: Complete Form 1023

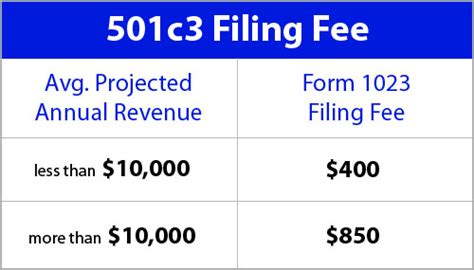

Form 1023 is the primary application for 501c3 status. The form requires detailed information about your organization, including: * Organization Information: Name, address, and contact information * Purpose and Activities: A detailed description of your organization’s purpose, activities, and goals * Financial Information: Financial statements, including balance sheets, income statements, and budgets * Governance and Management: Information about your organization’s governance structure, management, and leadership

Step 4: Submit the Application

Once you’ve completed Form 1023 and gathered all required documents, you can submit the application to the IRS. The application can be submitted online or by mail. Be sure to include all required documents and information to avoid delays or rejection.

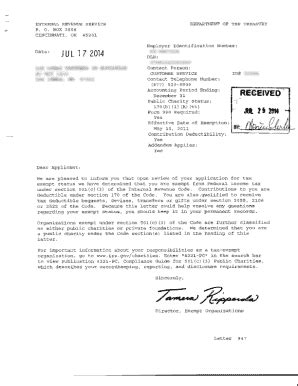

Step 5: Wait for IRS Review and Approval

After submitting the application, the IRS will review it to determine whether your organization qualifies for 501c3 status. This process can take several months, so be patient and prepared to respond to any follow-up questions or requests for additional information.

📝 Note: It's essential to ensure that your application is complete and accurate to avoid delays or rejection. If you're unsure about any aspect of the application process, consider consulting with a tax professional or attorney.

Tips for a Smooth Application Process

To make the application process as smooth as possible, consider the following tips: * Start early: Allow plenty of time to gather documents and complete the application * Seek professional help: Consider consulting with a tax professional or attorney to ensure your application is complete and accurate * Be thorough: Make sure to include all required documents and information to avoid delays or rejection * Follow up: If you haven’t heard back from the IRS within a few months, consider following up to check on the status of your application

Conclusion and Next Steps

In conclusion, filing for 501c3 status with the IRS requires careful planning, attention to detail, and a thorough understanding of the application process. By following the steps outlined in this article and seeking professional help when needed, you can ensure a smooth and successful application process. Once your organization has received 501c3 status, you’ll be eligible for tax-exempt status and can focus on pursuing your mission and goals.

What is the purpose of Form 1023?

+

Form 1023 is the application for recognition of exemption, which is used to apply for 501c3 status with the IRS.

How long does the application process typically take?

+

The application process can take several months, so it’s essential to start early and be patient.

Can I submit the application online or by mail?

+

Yes, you can submit the application online or by mail. Be sure to follow the instructions carefully and include all required documents and information.