5 Solo401k Paperwork Tips

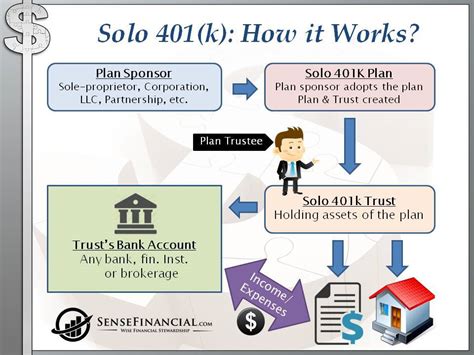

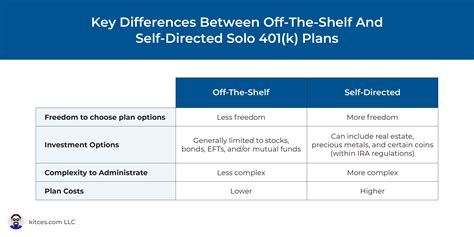

Understanding the Solo 401k Plan

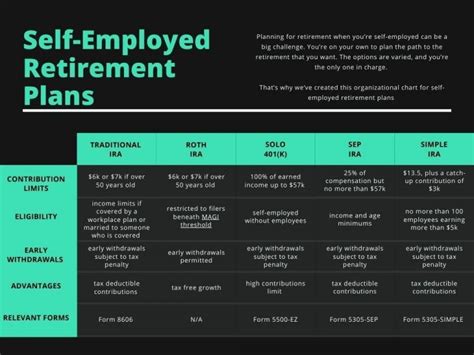

The Solo 401k plan, also known as the Individual 401k or Self-Directed 401k, is a type of retirement plan designed for self-employed individuals and small business owners. It offers high contribution limits and flexible investment options, making it an attractive choice for those looking to save for their retirement. However, setting up and maintaining a Solo 401k plan requires careful attention to paperwork and compliance with IRS regulations.

Key Components of Solo 401k Paperwork

When establishing a Solo 401k plan, it’s essential to understand the key components of the paperwork involved. These include: * Plan documents: The plan document is the foundation of the Solo 401k plan, outlining the terms and conditions of the plan. * Adoption agreement: The adoption agreement is a document that outlines the specific details of the plan, such as the plan name, effective date, and participation rules. * Trust agreement: The trust agreement establishes the trust that will hold the plan assets, ensuring that they are separate from the business and personal assets of the plan sponsor. * Annual filings: The plan sponsor must file annual reports with the IRS, including Form 5500 and Schedule SB.

Tips for Completing Solo 401k Paperwork

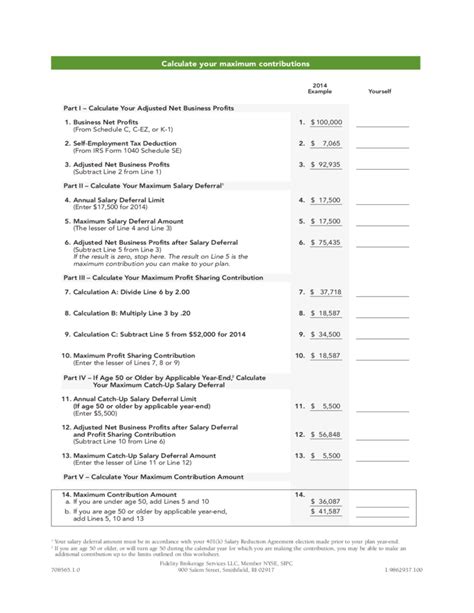

To ensure that your Solo 401k plan is set up and maintained correctly, follow these 5 Solo 401k paperwork tips: * Tip 1: Carefully review the plan document: The plan document is a critical component of the Solo 401k plan. It’s essential to review the document carefully to ensure that it meets your business needs and complies with IRS regulations. * Tip 2: Complete the adoption agreement accurately: The adoption agreement requires accurate and complete information. Ensure that you fill out the agreement correctly, including the plan name, effective date, and participation rules. * Tip 3: Establish a trust agreement: The trust agreement is essential for ensuring that the plan assets are separate from the business and personal assets of the plan sponsor. Establish a trust agreement that meets the requirements of the IRS. * Tip 4: Maintain accurate records: Accurate record-keeping is crucial for ensuring compliance with IRS regulations. Maintain detailed records of plan contributions, distributions, and investments. * Tip 5: File annual reports on time: The plan sponsor must file annual reports with the IRS, including Form 5500 and Schedule SB. Ensure that you file these reports on time to avoid penalties and fines.

📝 Note: It's essential to consult with a qualified plan administrator or tax professional to ensure that your Solo 401k plan is set up and maintained correctly.

Benefits of Proper Paperwork

Proper paperwork is essential for ensuring that your Solo 401k plan is compliant with IRS regulations. The benefits of proper paperwork include: * Reduced risk of penalties and fines: Accurate and complete paperwork reduces the risk of penalties and fines from the IRS. * Increased plan flexibility: A well-documented plan provides flexibility in terms of investment options and plan design. * Improved plan administration: Proper paperwork ensures that the plan is administered correctly, reducing the risk of errors and disputes.

| Component | Description |

|---|---|

| Plan Document | Outlines the terms and conditions of the plan |

| Adoption Agreement | Outlines the specific details of the plan |

| Trust Agreement | Establishes the trust that holds the plan assets |

| Annual Filings | Requires filing annual reports with the IRS |

In summary, proper paperwork is essential for ensuring that your Solo 401k plan is compliant with IRS regulations. By following the 5 Solo 401k paperwork tips outlined above, you can reduce the risk of penalties and fines, increase plan flexibility, and improve plan administration.

What is a Solo 401k plan?

+

A Solo 401k plan is a type of retirement plan designed for self-employed individuals and small business owners.

What are the key components of Solo 401k paperwork?

+

The key components of Solo 401k paperwork include the plan document, adoption agreement, trust agreement, and annual filings.

Why is proper paperwork essential for a Solo 401k plan?

+

Proper paperwork is essential for ensuring that the plan is compliant with IRS regulations, reducing the risk of penalties and fines, and increasing plan flexibility.