Take Over Payments Paperwork

Understanding the Process of Taking Over Payments

When an individual takes over payments for a vehicle, property, or other asset, it’s essential to understand the process and the paperwork involved. This process, also known as assuming a loan, can be complex and requires careful consideration. Assuming a loan means taking on the debt obligations of the original borrower, including the principal amount, interest rate, and repayment terms.

Benefits of Taking Over Payments

There are several benefits to taking over payments, including:

- Lower Purchase Price: When assuming a loan, the buyer may be able to negotiate a lower purchase price for the asset, as they are taking on the existing debt obligations.

- Lower Interest Rates: If the original loan has a lower interest rate than current market rates, assuming the loan can save the buyer money on interest payments over the life of the loan.

- Faster Purchase Process: Taking over payments can speed up the purchase process, as the buyer does not need to secure new financing.

Types of Assets That Can Be Taken Over

Various types of assets can be taken over, including:

- Vehicles: Cars, trucks, motorcycles, and other types of vehicles can be taken over, including leases and loans.

- Properties: Houses, apartments, commercial properties, and land can be taken over, including mortgages and other types of property loans.

- Equipment and Machinery: Industrial equipment, farm equipment, and other types of machinery can be taken over, including loans and leases.

Take Over Payments Paperwork

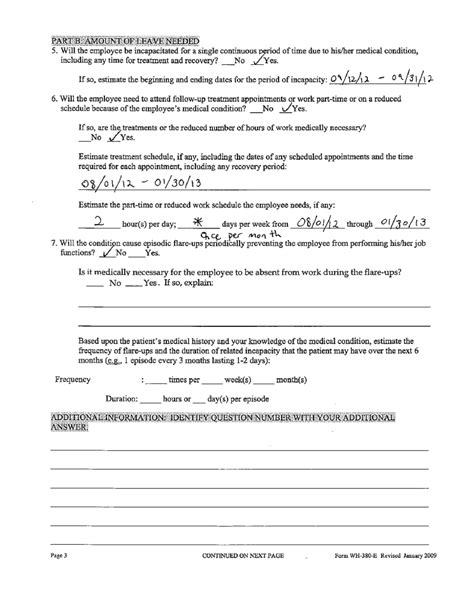

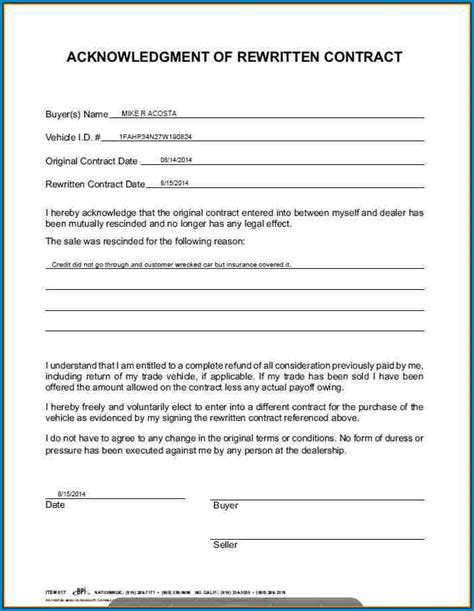

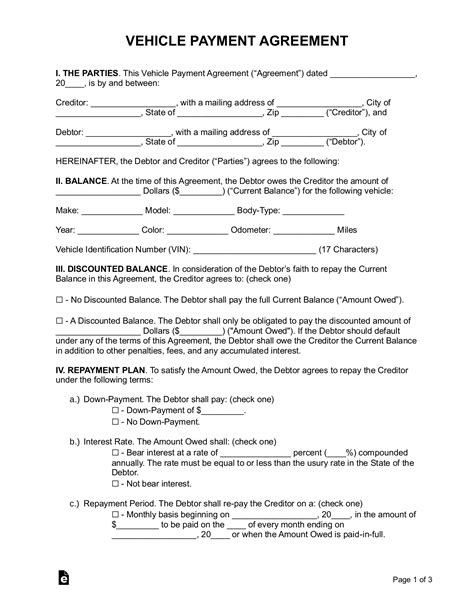

The paperwork involved in taking over payments can be extensive and may include:

| Document | Description |

|---|---|

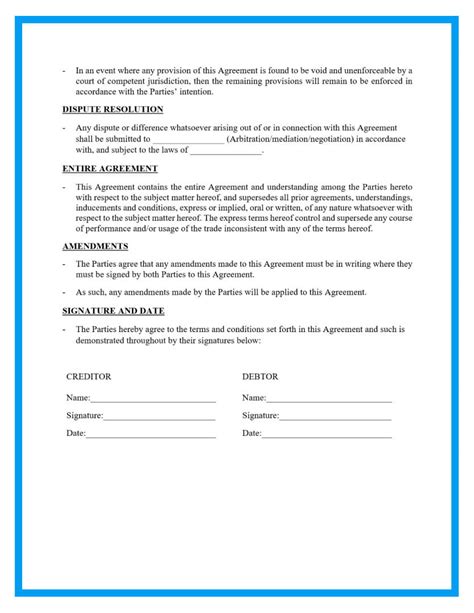

| Assumption Agreement | A contract between the buyer and seller that outlines the terms of the loan assumption, including the principal amount, interest rate, and repayment terms. |

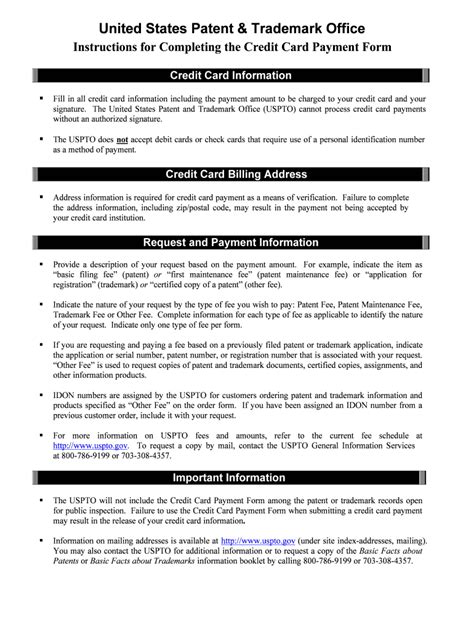

| Loan Assumption Application | An application to the lender to assume the loan, which may require credit checks, income verification, and other financial information. |

| Deed of Trust | A document that secures the loan and gives the lender a lien on the property or asset. |

| Promissory Note | A document that outlines the borrower’s promise to repay the loan, including the principal amount, interest rate, and repayment terms. |

📝 Note: It's essential to carefully review all paperwork and seek professional advice before taking over payments, as the process can be complex and may have long-term financial implications.

Risks and Considerations

Taking over payments can be a complex process, and there are several risks and considerations to be aware of, including:

- Credit Implications: Assuming a loan can affect the buyer’s credit score, particularly if the loan has a high balance or high interest rate.

- Financial Obligations: The buyer takes on the debt obligations of the original borrower, including the principal amount, interest rate, and repayment terms.

- Asset Condition: The buyer should carefully inspect the asset and review any maintenance or repair records to ensure they are aware of any potential issues or needed repairs.

In summary, taking over payments can be a complex process that requires careful consideration and a thorough understanding of the paperwork involved. It’s essential to seek professional advice and carefully review all documents before making a decision. By doing so, buyers can ensure a smooth transaction and avoid potential pitfalls. The key is to approach the process with caution and to be aware of the potential risks and benefits involved. Ultimately, taking over payments can be a viable option for those looking to acquire an asset, but it’s crucial to do so with a clear understanding of the process and the implications involved.