5 StepsToFilingNonProfit

Introduction to Filing a Non-Profit Organization

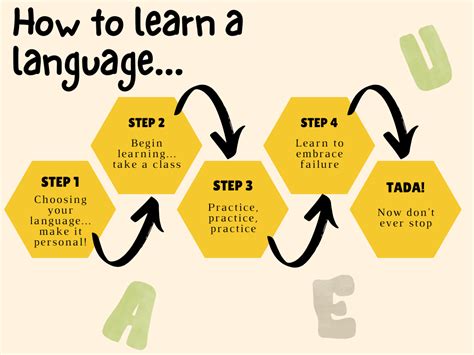

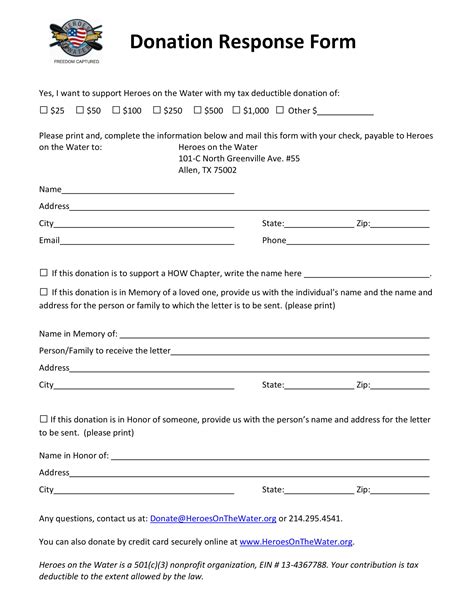

Filing a non-profit organization can be a complex and time-consuming process, but with the right guidance, it can be done efficiently. A non-profit organization is a type of organization that is tax-exempt and is formed to serve a public benefit. The process of filing a non-profit organization involves several steps, including choosing a business name, registering with the state, obtaining an Employer Identification Number (EIN), filing for tax-exempt status, and complying with ongoing requirements. In this article, we will break down the 5 steps to filing a non-profit organization and provide tips and resources to help you through the process.

Step 1: Choose a Business Name

Choosing a business name is an important step in filing a non-profit organization. The name must be unique and must not be confusingly similar to another organization’s name. It’s also important to ensure that the name is available as a web domain and social media handle. When choosing a business name, consider the following factors: * Uniqueness: The name must be unique and not already in use by another organization. * Memorability: The name should be easy to remember and spell. * Relevance: The name should reflect the mission and purpose of the organization. Some popular tools for checking business name availability include the Secretary of State website and GoDaddy.

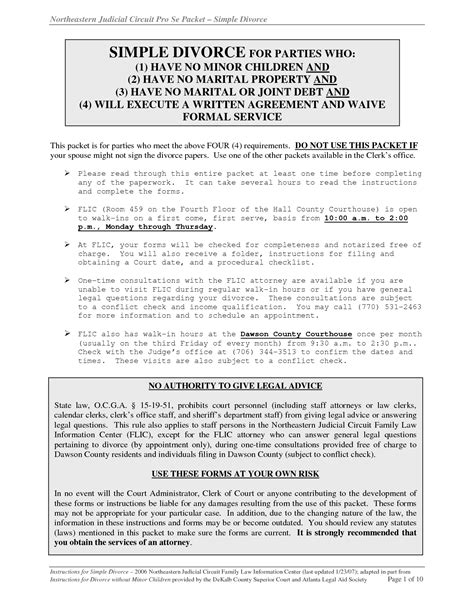

Step 2: Register with the State

Registering with the state is the next step in filing a non-profit organization. This involves filing Articles of Incorporation with the state and paying the required filing fee. The Articles of Incorporation must include the following information: * Business name and address * Purpose and mission of the organization * Names and addresses of the board of directors * Information about the organization’s structure and management The registration process typically takes several weeks to complete, and the filing fee varies by state.

Step 3: Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique identifier assigned to the organization by the Internal Revenue Service (IRS). The EIN is used to open a bank account, file tax returns, and apply for credit. To obtain an EIN, the organization must complete Form SS-4 and submit it to the IRS. The EIN is usually issued immediately, and there is no filing fee.

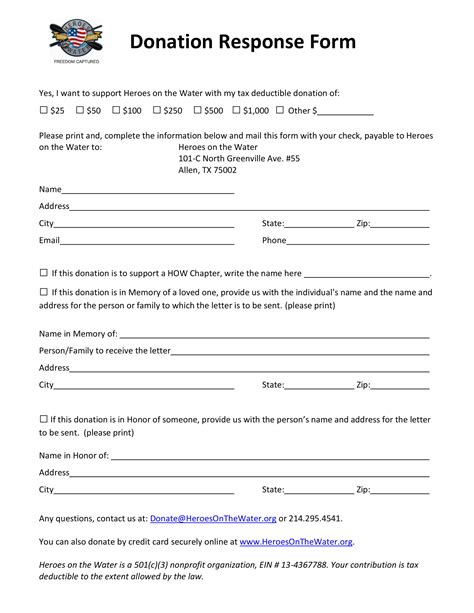

Step 4: File for Tax-Exempt Status

Filing for tax-exempt status is a critical step in the process of filing a non-profit organization. To be eligible for tax-exempt status, the organization must meet certain requirements, including: * Being organized and operated exclusively for a public benefit * Not being organized or operated for the benefit of private individuals * Not being involved in political campaigns or lobbying activities The organization must complete Form 1023 and submit it to the IRS, along with the required filing fee. The application process typically takes several months to complete.

| Form | Purpose | Filing Fee |

|---|---|---|

| Form SS-4 | Apply for EIN | None |

| Form 1023 | Apply for tax-exempt status | $275-$900 |

Step 5: Comply with Ongoing Requirements

Once the non-profit organization is filed and tax-exempt status is approved, there are ongoing requirements that must be met to maintain compliance. These requirements include: * Filing annual information returns with the IRS * Maintaining accurate and complete financial records * Holding annual board meetings and maintaining minutes * Complying with state and local regulations It’s essential to stay up-to-date with the latest requirements and regulations to avoid penalties and maintain tax-exempt status.

📝 Note: It's essential to consult with an attorney or tax professional to ensure compliance with all requirements and regulations.

In summary, filing a non-profit organization involves several steps, including choosing a business name, registering with the state, obtaining an EIN, filing for tax-exempt status, and complying with ongoing requirements. By following these steps and staying informed about the latest regulations and requirements, you can ensure a successful and compliant non-profit organization.

What is the purpose of a non-profit organization?

+

A non-profit organization is formed to serve a public benefit, such as providing charitable services, promoting education, or supporting the arts.

How long does it take to file a non-profit organization?

+

The filing process typically takes several weeks to several months to complete, depending on the complexity of the application and the speed of the state and IRS processing times.

What is the difference between a non-profit organization and a for-profit business?

+

A non-profit organization is tax-exempt and is formed to serve a public benefit, while a for-profit business is formed to generate profits for its owners and is subject to taxation.

In final consideration, the process of filing a non-profit organization requires careful planning, attention to detail, and compliance with ongoing requirements. By understanding the steps involved and seeking professional guidance when necessary, you can establish a successful and compliant non-profit organization that serves the public benefit.