File Business Paperwork Easily

Introduction to Business Paperwork

Filing business paperwork is an essential task for any company, regardless of its size or industry. Effective document management is crucial for maintaining organization, ensuring compliance with regulatory requirements, and facilitating access to important information. In this article, we will explore the importance of filing business paperwork, discuss the different types of documents that need to be filed, and provide tips on how to file them easily and efficiently.

Importance of Filing Business Paperwork

Filing business paperwork is important for several reasons. Firstly, it helps to maintain organization and ensure that all documents are stored in a secure and accessible location. This makes it easier to locate specific documents when needed, reducing the time and effort required to search for them. Secondly, filing business paperwork helps to ensure compliance with regulatory requirements, such as tax laws and employment regulations. Failure to comply with these requirements can result in fines, penalties, and damage to the company’s reputation. Finally, filing business paperwork helps to facilitate access to important information, enabling business owners and managers to make informed decisions and respond to changing circumstances.

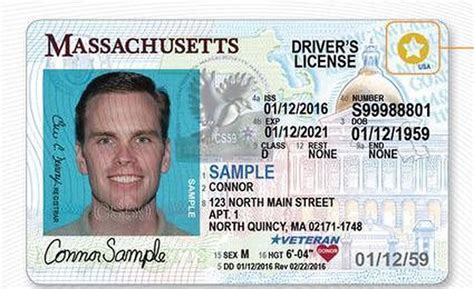

Types of Business Paperwork

There are many different types of business paperwork that need to be filed, including: * Financial documents, such as invoices, receipts, and bank statements * Employment documents, such as employee contracts, payroll records, and benefits information * Tax documents, such as tax returns, W-2 forms, and 1099 forms * Contractual documents, such as business agreements, leases, and licenses * Insurance documents, such as liability insurance policies and workers’ compensation insurance policies

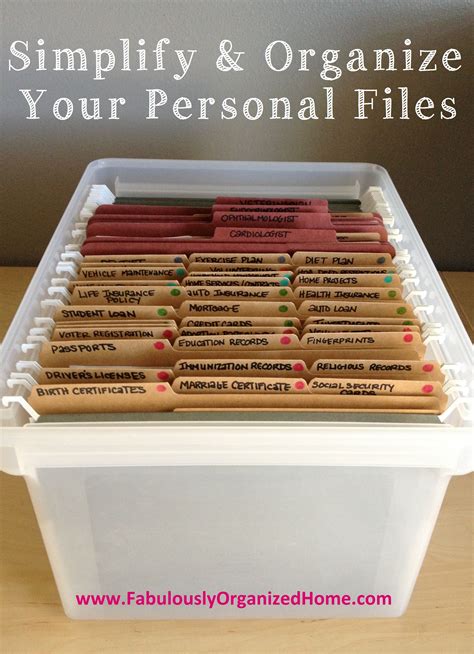

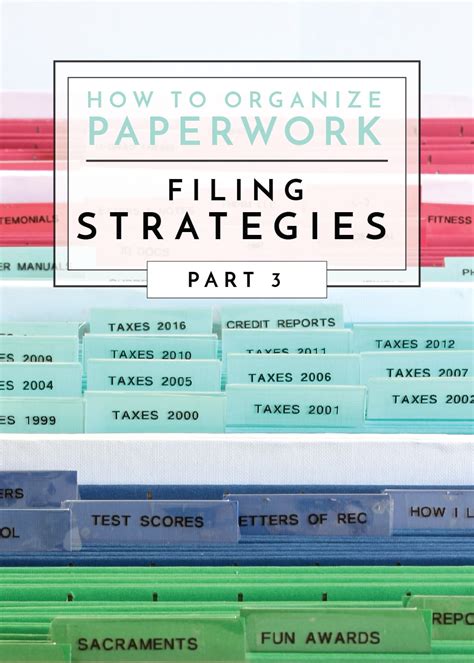

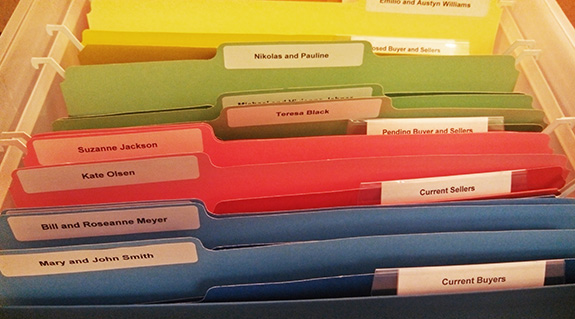

Steps to File Business Paperwork Easily

Filing business paperwork can be a time-consuming and tedious task, but there are several steps that can be taken to make it easier and more efficient. These include: * Creating a filing system, such as a folder or digital database, to store and organize documents * Setting up a regular filing schedule, such as weekly or monthly, to ensure that documents are filed in a timely manner * Using a document scanner to digitize paper documents and reduce storage space * Implementing a document management software to automate the filing process and improve access to documents * Training employees on the importance of filing business paperwork and how to use the filing system

Benefits of Digital Filing

Digital filing offers several benefits over traditional paper-based filing systems, including: * Increased storage capacity, enabling businesses to store larger amounts of data * Improved accessibility, enabling authorized personnel to access documents from anywhere * Enhanced security, protecting documents from loss, theft, or damage * Reduced costs, eliminating the need for physical storage space and reducing the risk of document loss or damage * Increased efficiency, automating the filing process and improving the speed of document retrieval

| Document Type | Retention Period |

|---|---|

| Financial documents | 7 years |

| Employment documents | 5 years |

| Tax documents | 3 years |

| Contractual documents | 10 years |

| Insurance documents | 5 years |

💡 Note: The retention periods listed in the table are general guidelines and may vary depending on the specific regulations and requirements of your business.

In summary, filing business paperwork is a critical task that requires attention to detail, organization, and efficiency. By creating a filing system, setting up a regular filing schedule, and using digital filing tools, businesses can ensure compliance with regulatory requirements, maintain organization, and facilitate access to important information. By following these steps and tips, businesses can file their paperwork easily and efficiently, freeing up time and resources to focus on core operations and growth.

What are the benefits of digital filing?

+

The benefits of digital filing include increased storage capacity, improved accessibility, enhanced security, reduced costs, and increased efficiency.

How long should I keep financial documents?

+

Financial documents should be kept for at least 7 years, depending on the specific regulations and requirements of your business.

What is the best way to organize business paperwork?

+

The best way to organize business paperwork is to create a filing system, set up a regular filing schedule, and use digital filing tools to automate the filing process and improve access to documents.