File Nonprofit Organization Paperwork Legally

Introduction to Filing Nonprofit Organization Paperwork

Filing nonprofit organization paperwork is a crucial step in establishing a nonprofit organization. It involves submitting various documents to the relevant authorities to obtain tax-exempt status and comply with state and federal regulations. In this article, we will guide you through the process of filing nonprofit organization paperwork legally.

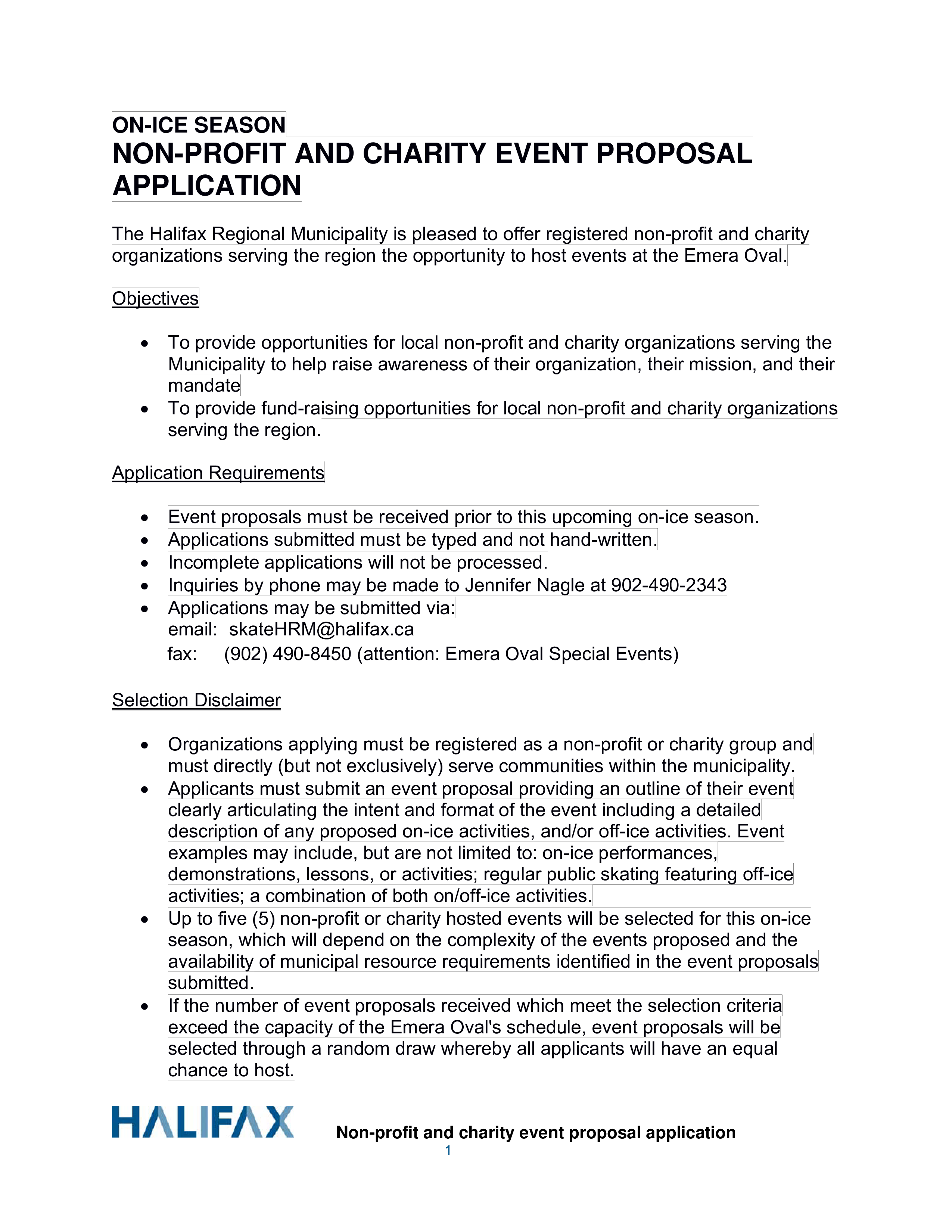

Step 1: Choose a Business Name and Register Your Nonprofit

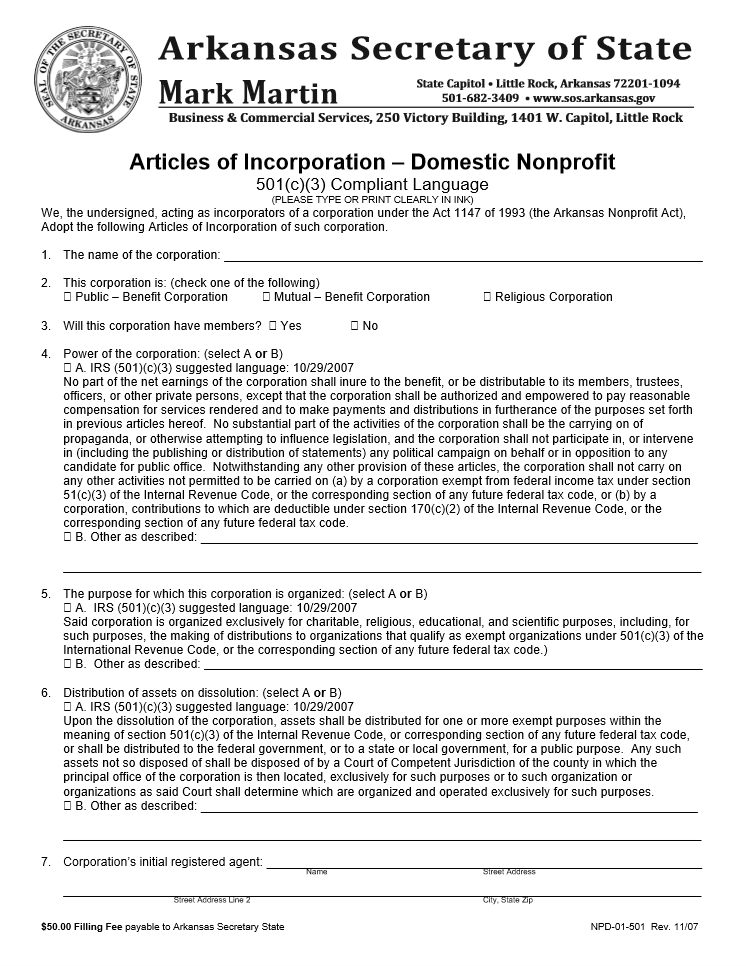

The first step in filing nonprofit organization paperwork is to choose a unique business name and register your nonprofit with the state. You can search for available business names on your state’s business registration website. Once you have chosen a name, you can register your nonprofit by filing Articles of Incorporation with your state’s business registration office. The registration process typically involves submitting a filing fee, which varies by state.

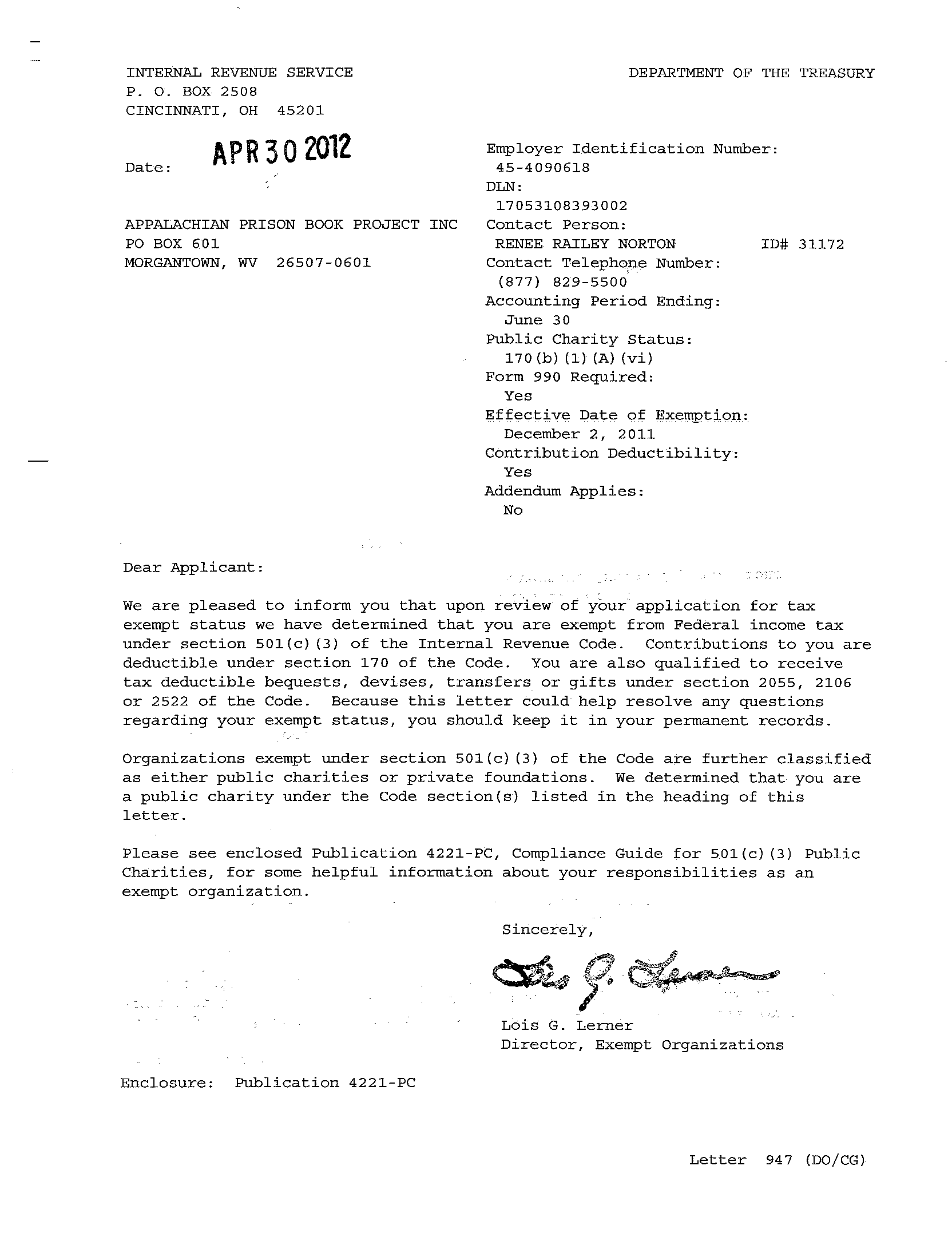

Step 2: Obtain an Employer Identification Number (EIN)

After registering your nonprofit, you need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). An EIN is a unique nine-digit number assigned to your nonprofit for tax purposes. You can apply for an EIN online through the IRS website or by mail using Form SS-4. The application process is free, and you will receive your EIN immediately after submitting your application.

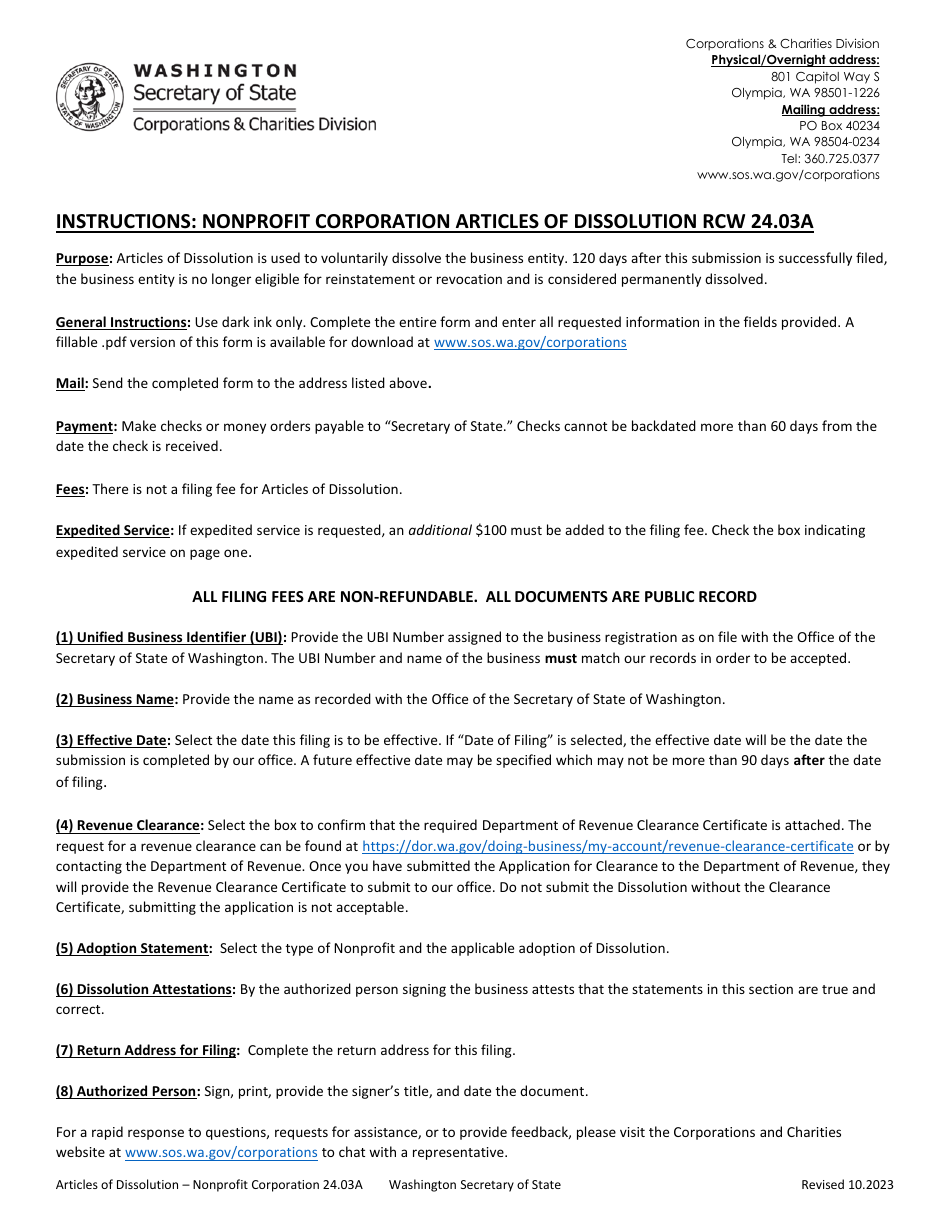

Step 3: File for Tax-Exempt Status

To obtain tax-exempt status, you need to file Form 1023 with the IRS. This form requires you to provide detailed information about your nonprofit, including its purpose, structure, and financial plans. The application process involves submitting a filing fee, which currently stands at $600 for most nonprofits. The IRS will review your application and may request additional information before approving your tax-exempt status.

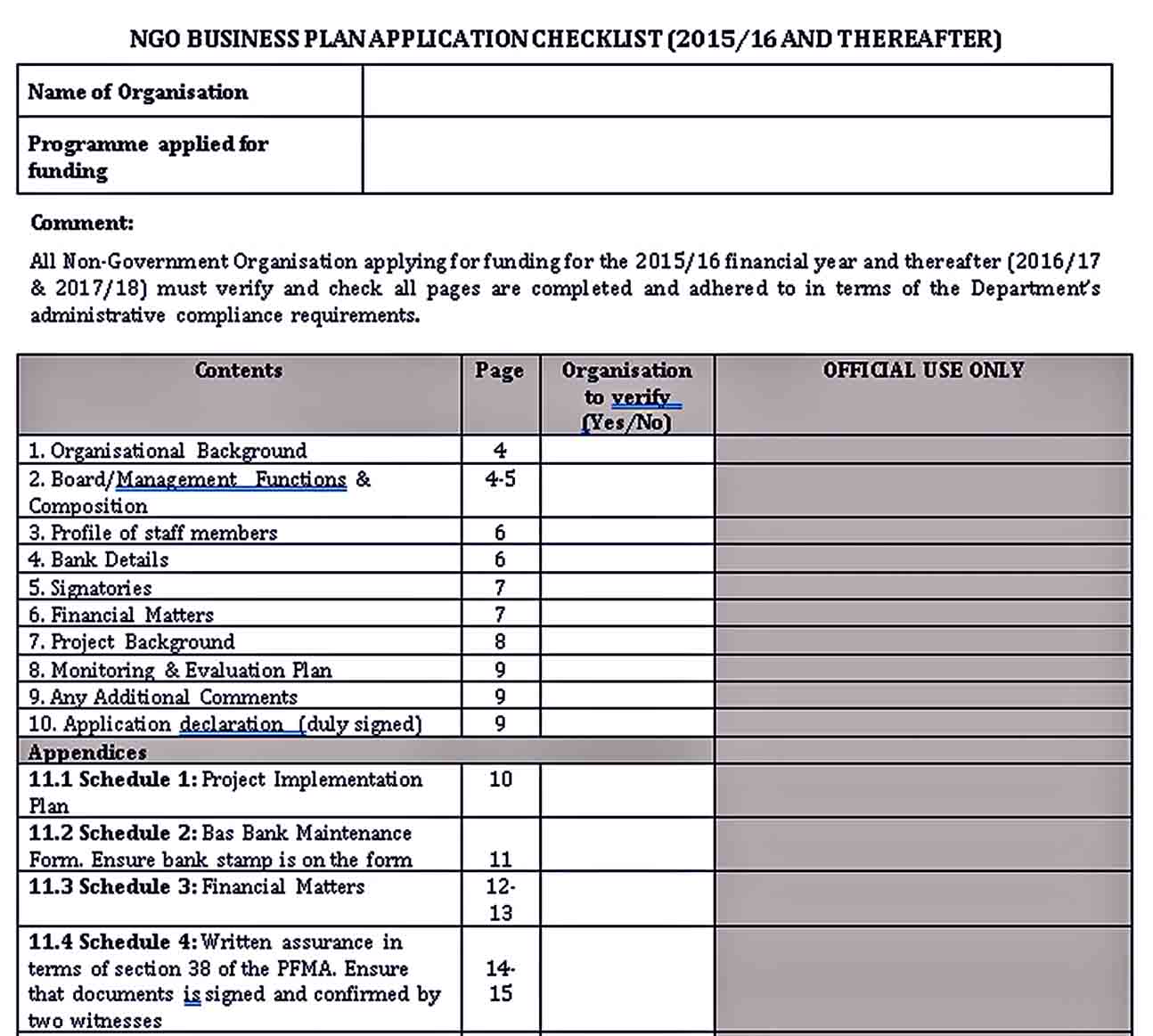

Step 4: Register with Your State Charity Office

In addition to filing for tax-exempt status, you may need to register with your state charity office. This registration process typically involves submitting a filing fee and providing information about your nonprofit’s purpose, finances, and governance structure. You can find more information about state charity registration requirements on your state’s charity office website.

Step 5: Obtain Any Necessary Licenses and Permits

Depending on your nonprofit’s activities and location, you may need to obtain additional licenses and permits. For example, if you plan to solicit donations, you may need to register with your state’s charity office and obtain a solicitation license. You can find more information about licensing and permitting requirements on your state’s business registration website.

📝 Note: The specific paperwork and registration requirements for nonprofits vary by state, so it's essential to check with your state's business registration office and charity office for specific requirements.

Benefits of Filing Nonprofit Organization Paperwork

Filing nonprofit organization paperwork provides several benefits, including: * Tax-exempt status, which allows your nonprofit to avoid paying income tax on its revenue * Ability to solicit tax-deductible donations from individuals and organizations * Increased credibility and transparency, which can help attract donors and volunteers * Ability to apply for grants and funding from foundations and government agencies

Common Mistakes to Avoid

When filing nonprofit organization paperwork, it’s essential to avoid common mistakes, such as: * Failing to register with the state or obtain necessary licenses and permits * Failing to file for tax-exempt status or renewing tax-exempt status on time * Providing inaccurate or incomplete information on registration forms * Failing to maintain accurate and transparent financial records

Conclusion

Filing nonprofit organization paperwork is a critical step in establishing a nonprofit organization. By following the steps outlined in this article, you can ensure that your nonprofit is properly registered and compliant with state and federal regulations. Remember to avoid common mistakes and seek professional advice if you’re unsure about any aspect of the registration process. With proper registration and compliance, your nonprofit can focus on its mission and achieve its goals.

What is the purpose of filing nonprofit organization paperwork?

+

The purpose of filing nonprofit organization paperwork is to obtain tax-exempt status, register with the state, and comply with state and federal regulations.

What is the difference between a nonprofit organization and a charity?

+

A nonprofit organization is a broad term that refers to any organization that is not operated for profit. A charity, on the other hand, is a specific type of nonprofit organization that is dedicated to providing relief to the poor, distressed, or underprivileged.

How long does it take to obtain tax-exempt status?

+

The time it takes to obtain tax-exempt status varies depending on the complexity of the application and the workload of the IRS. On average, it can take several months to a year or more to receive a determination letter from the IRS.