Rollover 401k Paperwork Management

Introduction to Rollover 401k Paperwork Management

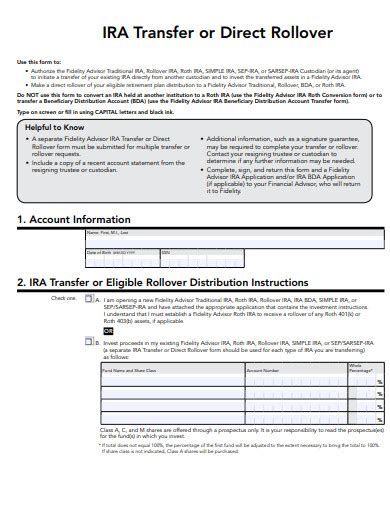

Managing rollover 401k paperwork can be a daunting task, especially for individuals who are not familiar with the process. The 401k rollover process involves transferring funds from a previous employer’s 401k plan to a new plan or an Individual Retirement Account (IRA). This process requires careful management of paperwork to ensure a smooth transition of funds. In this article, we will discuss the importance of managing rollover 401k paperwork and provide a step-by-step guide on how to do it.

Why is Rollover 401k Paperwork Management Important?

Rollover 401k paperwork management is crucial to avoid any potential issues that may arise during the transfer process. Some of the reasons why it is essential to manage paperwork carefully include: * Avoiding penalties: Incorrect or incomplete paperwork can result in penalties, such as taxes and fines. * Ensuring timely transfer: Proper management of paperwork ensures that the transfer process is completed on time, and funds are not delayed. * Maintaining account accuracy: Accurate paperwork management helps maintain the accuracy of account information, reducing the risk of errors or discrepancies.

Step-by-Step Guide to Rollover 401k Paperwork Management

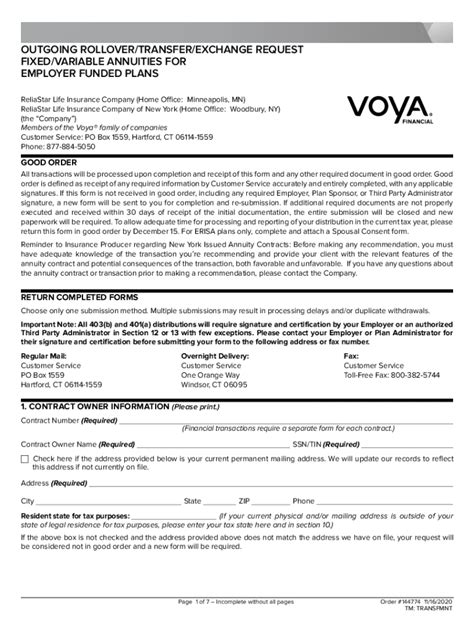

To manage rollover 401k paperwork effectively, follow these steps: * Gather required documents: Collect all necessary documents, including the previous employer’s 401k plan documents, account statements, and identification documents. * Choose a new plan or IRA: Select a new plan or IRA to transfer the funds to, and gather the required documents for the new account. * Complete the rollover form: Fill out the rollover form provided by the new plan or IRA, ensuring that all information is accurate and complete. * Submit the paperwork: Submit the completed paperwork to the new plan or IRA, along with any required supporting documents. * Verify the transfer: Confirm that the transfer has been completed successfully, and funds have been deposited into the new account.

Tips for Effective Rollover 401k Paperwork Management

To ensure a smooth and efficient rollover 401k paperwork management process, consider the following tips: * Use online tools: Utilize online tools and resources to streamline the paperwork process and reduce the risk of errors. * Seek professional help: Consult with a financial advisor or tax professional to ensure that all paperwork is completed correctly and in compliance with regulations. * Keep records organized: Maintain accurate and organized records of all paperwork and correspondence related to the rollover process.

📝 Note: It is essential to carefully review and understand all paperwork and documentation related to the rollover process to avoid any potential issues or penalties.

Common Mistakes to Avoid in Rollover 401k Paperwork Management

When managing rollover 401k paperwork, it is crucial to avoid common mistakes that can lead to delays or penalties. Some of the mistakes to avoid include: * Incomplete or inaccurate paperwork: Ensure that all paperwork is complete and accurate to avoid delays or rejection of the transfer request. * Missed deadlines: Be aware of all deadlines and timelines related to the rollover process to avoid missing critical dates. * Insufficient documentation: Ensure that all required documentation is provided to support the transfer request.

Best Practices for Rollover 401k Paperwork Management

To ensure effective rollover 401k paperwork management, consider the following best practices: * Create a checklist: Develop a checklist to ensure that all necessary paperwork and documentation are completed and submitted. * Use a secure online platform: Utilize a secure online platform to manage and submit paperwork, reducing the risk of errors or security breaches. * Maintain open communication: Establish open communication with the new plan or IRA provider to ensure that all issues are addressed promptly and efficiently.

| Document | Description |

|---|---|

| 401k plan documents | Documents outlining the terms and conditions of the previous employer's 401k plan |

| Account statements | Statements showing the current balance and activity in the 401k account |

| Identification documents | Documents verifying the identity of the account holder, such as a driver's license or passport |

In summary, managing rollover 401k paperwork requires careful attention to detail and a thorough understanding of the process. By following the steps outlined in this article and avoiding common mistakes, individuals can ensure a smooth and efficient transfer of funds from a previous employer’s 401k plan to a new plan or IRA.

The key takeaways from this article include the importance of managing rollover 401k paperwork carefully, the need to avoid common mistakes, and the benefits of using online tools and seeking professional help. By implementing these strategies, individuals can ensure a successful rollover 401k paperwork management process and maintain the accuracy and integrity of their retirement accounts.

What is a rollover 401k?

+

A rollover 401k refers to the process of transferring funds from a previous employer’s 401k plan to a new plan or an Individual Retirement Account (IRA).

Why is it important to manage rollover 401k paperwork carefully?

+

Managing rollover 401k paperwork carefully is essential to avoid potential issues, such as penalties, delays, or errors, and to ensure a smooth transition of funds.

What are some common mistakes to avoid in rollover 401k paperwork management?

+

Common mistakes to avoid include incomplete or inaccurate paperwork, missed deadlines, and insufficient documentation. It is crucial to carefully review and understand all paperwork and documentation related to the rollover process.