5 Steps Refinance

Introduction to Refinancing

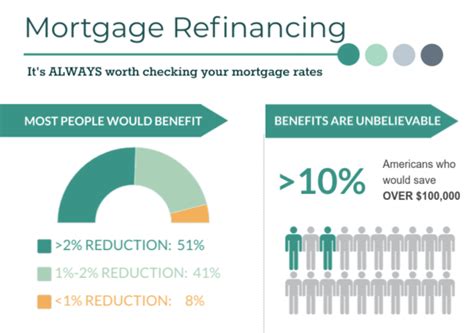

Refinancing a mortgage can be a great way to save money on interest, lower monthly payments, or tap into home equity. With interest rates constantly changing and new loan programs emerging, refinancing can be a viable option for many homeowners. However, the process can be complex and overwhelming, especially for those who are new to refinancing. In this article, we will break down the refinancing process into 5 simple steps, making it easier to understand and navigate.

Step 1: Determine Your Goals

Before starting the refinancing process, it’s essential to define your goals. What do you want to achieve through refinancing? Are you looking to: * Lower your monthly payments? * Save money on interest? * Tap into your home equity? * Switch from an adjustable-rate mortgage to a fixed-rate mortgage? * Remove private mortgage insurance (PMI)? Understanding your goals will help you determine the best refinancing option for your situation.

Step 2: Check Your Credit Score

Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for a refinance. Lenders use credit scores to assess the risk of lending to you. A good credit score can help you qualify for better interest rates, while a poor credit score may lead to higher interest rates or even loan rejection. You can check your credit score for free on various websites, such as AnnualCreditReport.com or CreditKarma.com.

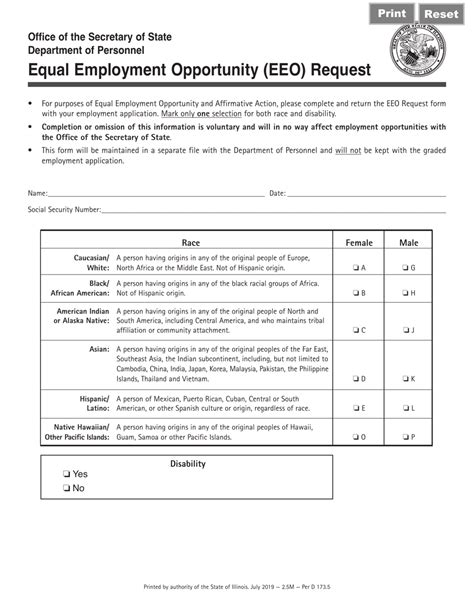

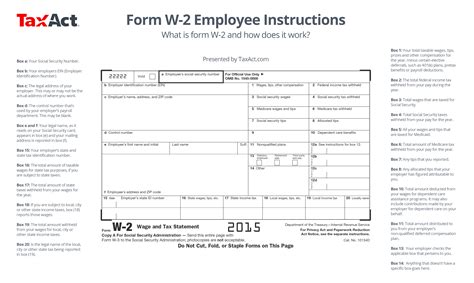

Step 3: Gather Financial Documents

To refinance your mortgage, you’ll need to provide financial documents to your lender. These documents may include: * Pay stubs * Bank statements * Tax returns * Identification documents (driver’s license, passport, etc.) * Mortgage statements * Homeowners insurance documents Having these documents ready will speed up the refinancing process and help you avoid delays.

Step 4: Choose a Refinancing Option

There are several refinancing options available, including: * Rate-and-term refinance: Replaces your existing loan with a new one, often with a lower interest rate or more favorable terms. * Cash-out refinance: Allows you to tap into your home equity and receive cash at closing. * Streamline refinance: A simplified refinance process for borrowers with an existing FHA, VA, or USDA loan. * Home equity loan: A separate loan that allows you to borrow against your home equity. Consider your goals and financial situation when choosing a refinancing option.

Step 5: Apply and Close

Once you’ve chosen a refinancing option, you’ll need to apply for the loan. Your lender will guide you through the application process, which may involve: * Submitting financial documents * Locking in an interest rate * Undergoing a home appraisal (if required) * Reviewing and signing loan documents After completing the application process, you’ll attend a closing meeting, where you’ll sign the final loan documents and complete the refinancing process.

📝 Note: Refinancing can be a complex process, and it's essential to work with a qualified lender or mortgage broker to ensure a smooth transaction.

As you’ve completed the 5 steps to refinance your mortgage, it’s essential to remember that refinancing can be a great way to save money, lower monthly payments, or tap into home equity. By following these steps and working with a qualified lender, you can navigate the refinancing process with confidence. In the end, refinancing can be a smart financial move, but it’s crucial to carefully consider your options and make an informed decision.

What are the benefits of refinancing a mortgage?

+

The benefits of refinancing a mortgage include saving money on interest, lowering monthly payments, tapping into home equity, and switching from an adjustable-rate mortgage to a fixed-rate mortgage.

How long does the refinancing process typically take?

+

The refinancing process can take anywhere from 30 to 60 days, depending on the complexity of the loan and the speed of the lender.

Can I refinance my mortgage with bad credit?

+

While it may be more challenging to refinance a mortgage with bad credit, it’s not impossible. You may need to work with a lender that specializes in subprime loans or consider alternative refinancing options.