5 Tips Ohio Garnishment

Understanding Ohio Garnishment: 5 Essential Tips

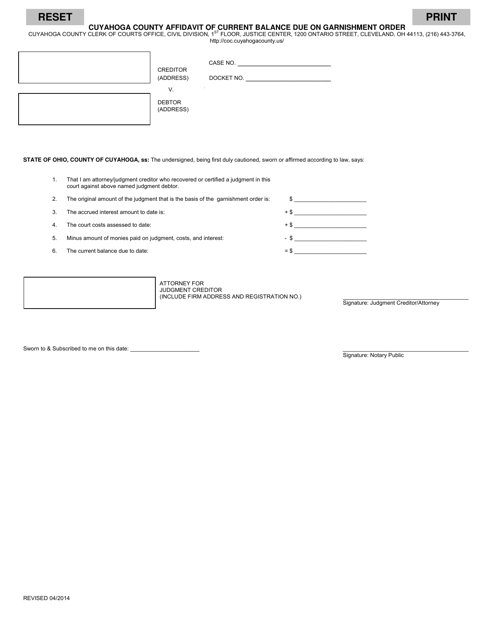

When faced with debt, one of the most daunting prospects is the possibility of wage garnishment. In the state of Ohio, garnishment laws are designed to protect both creditors and debtors, but navigating these laws can be complex. For individuals facing financial hardship, understanding the specifics of Ohio garnishment is crucial for managing debt effectively and making informed decisions about one’s financial future.

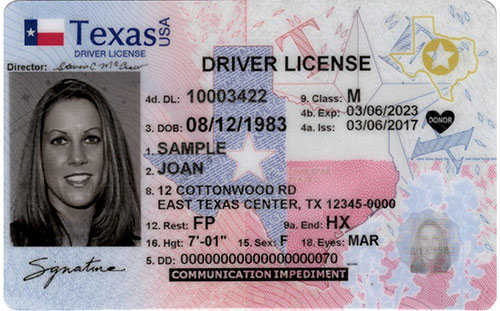

Tip 1: Know Your Rights

Ohio law sets limits on how much of your wages can be garnished. Federal law allows creditors to garnish up to 25% of your disposable earnings or the amount by which your weekly disposable earnings exceed 30 times the federal minimum wage, whichever is less. However, it’s essential to understand that Ohio follows federal guidelines closely in this regard. Knowing your rights can help you negotiate with creditors or contest a garnishment if it exceeds these limits.

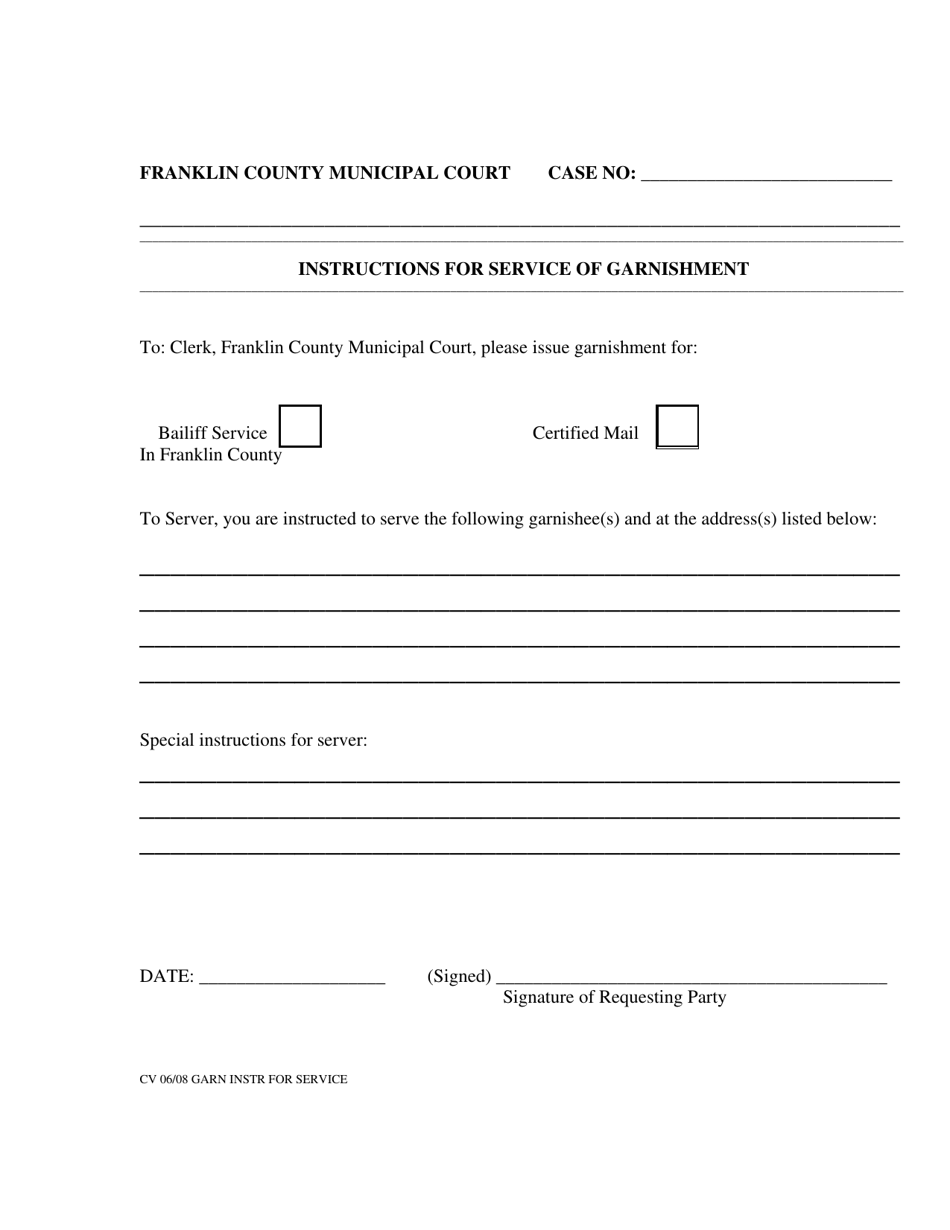

Tip 2: Understand the Types of Garnishment

There are primarily two types of garnishment in Ohio: - Income withholding, which involves taking a portion of your wages directly from your paycheck. - Bank garnishment, where funds are frozen and then taken from your bank account. Each type has its own set of rules and exemptions. For instance, certain types of income, such as Social Security benefits, are generally exempt from garnishment. Understanding the differences and potential exemptions can help you prepare and possibly mitigate the impact of a garnishment.

Tip 3: Exemptions and Protections

Ohio garnishment laws provide several exemptions and protections for debtors. For example, a certain amount of income is exempt from garnishment to ensure you have enough to live on. Additionally, personal property exemptions can protect essential items like your primary residence, vehicles, and household goods from creditors. Knowing what exemptions are available can help you protect your essential assets and income.

Tip 4: Negotiating with Creditors

Before a garnishment is put in place, it may be possible to negotiate with your creditors. This could involve setting up a payment plan that works for both parties, potentially avoiding the need for garnishment altogether. Effective communication and a willingness to negotiate can sometimes lead to more favorable terms than those imposed by a court-ordered garnishment. Being proactive and reaching out to creditors early on can make a significant difference in managing your debt.

Tip 5: Seeking Professional Help

Dealing with garnishment and debt can be overwhelming. If you’re facing the possibility of wage garnishment in Ohio, it might be beneficial to seek help from a financial advisor or attorney who specializes in debt management and consumer law. These professionals can provide guidance tailored to your specific situation, help you understand your rights and options, and possibly assist in negotiating with creditors or contesting a garnishment.

💡 Note: The specifics of Ohio garnishment law can change, so it's crucial to consult with a professional or check the latest legal resources for the most current information.

As you navigate the complexities of Ohio garnishment, remembering that you have rights and options is key. By understanding the laws, exemptions, and potential strategies for managing debt, you can take proactive steps towards securing your financial future. Whether through negotiation, seeking professional advice, or educating yourself on the latest laws and protections, there are ways to address debt and garnishment effectively.

In the end, managing debt and dealing with the possibility of garnishment requires a combination of knowledge, planning, and sometimes, professional guidance. By taking a proactive and informed approach, individuals can better protect their financial well-being and work towards a more stable future.

What is the maximum amount that can be garnished from my wages in Ohio?

+

The maximum amount that can be garnished is up to 25% of your disposable earnings or the amount by which your weekly disposable earnings exceed 30 times the federal minimum wage, whichever is less.

Can I negotiate with my creditors to avoid garnishment?

+

Yes, it is possible to negotiate with your creditors. Setting up a payment plan that works for both parties can sometimes avoid the need for garnishment altogether.

Are there any exemptions from garnishment in Ohio?

+

Yes, certain types of income and personal property are exempt from garnishment, including Social Security benefits and essential items like your primary residence and vehicles, under specific conditions.