Fill Out Insurance Paperwork Easily

Introduction to Insurance Paperwork

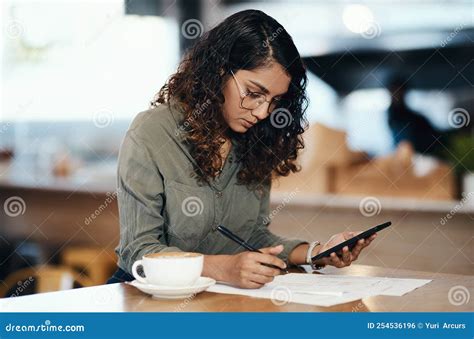

Filling out insurance paperwork can be a daunting task, especially when faced with complex terminology and lengthy forms. However, it is a crucial step in ensuring that you have the necessary coverage in case of unexpected events. In this article, we will guide you through the process of filling out insurance paperwork easily, highlighting the key points to consider and the benefits of getting it right.

Understanding the Types of Insurance

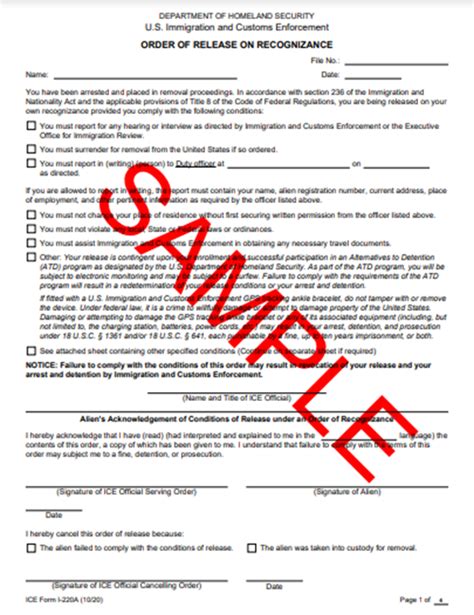

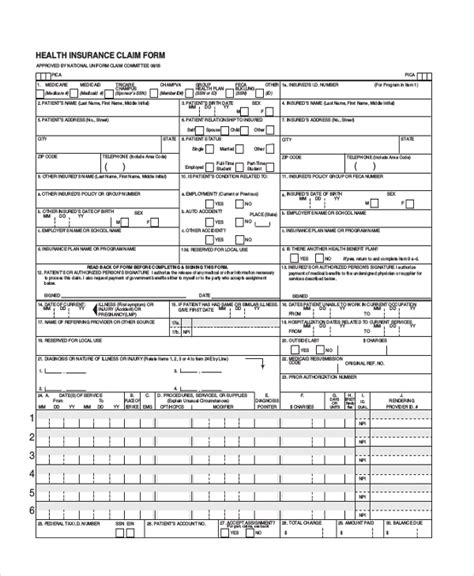

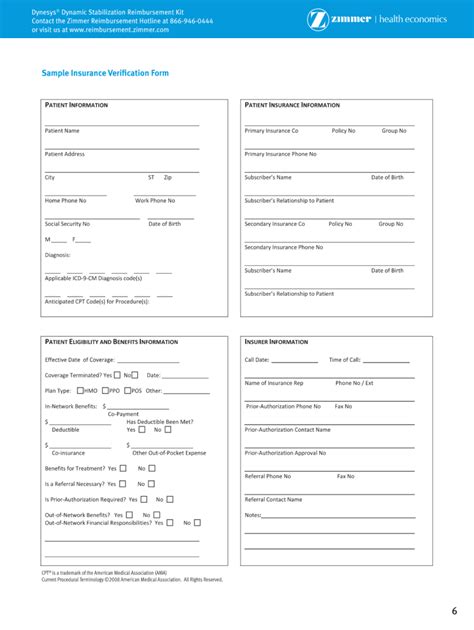

Before diving into the paperwork, it is essential to understand the different types of insurance available. These include: * Health insurance: covers medical expenses * Life insurance: provides financial protection for your loved ones in the event of your passing * Auto insurance: covers damages to your vehicle and other parties involved in an accident * Home insurance: protects your home and belongings from damage or loss Each type of insurance has its unique requirements and paperwork, so it’s crucial to understand what you’re getting into.

Gathering Necessary Documents

To fill out insurance paperwork, you will need to gather certain documents, including: * Identification (driver’s license, passport, etc.) * Proof of income (pay stubs, tax returns, etc.) * Proof of residence (utility bills, lease agreement, etc.) * Medical records (for health insurance) * Vehicle registration (for auto insurance) * Property deeds (for home insurance) Having these documents ready will make the process much smoother and less time-consuming.

Filling Out the Paperwork

When filling out the insurance paperwork, make sure to: * Read the questions carefully and answer them accurately * Provide all required information and documentation * Review the policy terms and conditions * Ask questions if you’re unsure about anything It’s also a good idea to have a checklist to ensure you don’t miss any important details.

Tips for Easy Paperwork Completion

Here are some additional tips to make filling out insurance paperwork easier: * Start early: don’t wait until the last minute to fill out the paperwork * Use online resources: many insurance companies offer online applications and tools to help you fill out the paperwork * Seek professional help: if you’re unsure about anything, consider consulting with an insurance agent or broker * Keep records: keep a copy of your completed paperwork and any supporting documents for your records

| Insurance Type | Required Documents |

|---|---|

| Health Insurance | Medical records, proof of income, identification |

| Life Insurance | Proof of income, identification, beneficiary information |

| Auto Insurance | Vehicle registration, driver's license, proof of income |

| Home Insurance | Property deeds, proof of income, identification |

📝 Note: Make sure to review your policy carefully before signing, as it can affect your coverage and benefits.

In the end, filling out insurance paperwork may seem like a chore, but it’s a necessary step in protecting yourself and your loved ones. By understanding the types of insurance, gathering necessary documents, and following the tips outlined above, you can make the process easier and less stressful. Remember to review your policy carefully and ask questions if you’re unsure about anything. With the right mindset and preparation, you can fill out insurance paperwork with confidence and ensure that you have the coverage you need.

What is the purpose of insurance paperwork?

+

The purpose of insurance paperwork is to provide the necessary information and documentation to obtain insurance coverage.

What documents do I need to fill out insurance paperwork?

+

The documents required to fill out insurance paperwork vary depending on the type of insurance, but may include identification, proof of income, medical records, and vehicle registration.

Can I fill out insurance paperwork online?

+

Yes, many insurance companies offer online applications and tools to help you fill out the paperwork.