5 Ways RI LLC

Forming a Rhode Island Limited Liability Company (LLC): A Step-by-Step Guide

When it comes to starting a business in Rhode Island, one of the most popular and versatile structures is the Limited Liability Company (LLC). An LLC offers personal liability protection, tax flexibility, and a relatively straightforward formation process. In this guide, we’ll explore the key steps and considerations for forming a Rhode Island LLC, focusing on five essential aspects: choosing a business name, registering the LLC, obtaining necessary licenses and permits, establishing a strong operational foundation, and maintaining compliance with state regulations.

1. Choosing a Business Name for Your Rhode Island LLC

Choosing a name for your Rhode Island LLC is a critical first step. The name must be unique, memorable, and compliant with state regulations. Here are some key considerations: - Uniqueness: Ensure the name is not already in use by another business in Rhode Island. You can check the availability of a name by searching the Rhode Island Secretary of State’s business database. - Compliance: The name must include a designation that indicates it is an LLC, such as “Limited Liability Company,” “LLC,” or “L.L.C.” - Reservation: If you find a name you like but are not ready to file your LLC, you can reserve the name with the Secretary of State for a certain period, usually for a fee.

2. Registering Your Rhode Island LLC

Registration involves filing Articles of Organization with the Rhode Island Secretary of State. This document provides basic information about your LLC, including its name, address, purpose, and the names and addresses of its members or managers. The process can typically be completed online or by mail, and there is a filing fee associated with the submission. It’s also a good idea to draft an Operating Agreement, which outlines the ownership, management, and operational structure of your LLC, although this is not filed with the state.

3. Obtaining Necessary Licenses and Permits

After your LLC is registered, you’ll need to obtain any necessary licenses and permits to operate legally in Rhode Island. These can vary widely depending on the nature of your business. Some businesses may need: - State Licenses: Issued by state agencies for specific types of businesses, such as food service, healthcare, or childcare. - Local Licenses and Permits: Issued by cities or towns for businesses operating within their jurisdictions, such as zoning permits or business registration certificates. - Federal Licenses and Permits: Required for businesses involved in activities regulated by federal agencies, such as agriculture, aviation, or firearms.

4. Establishing a Strong Operational Foundation

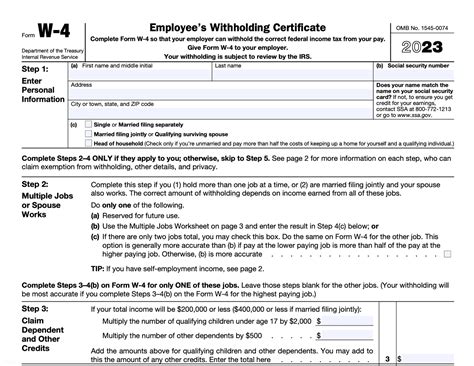

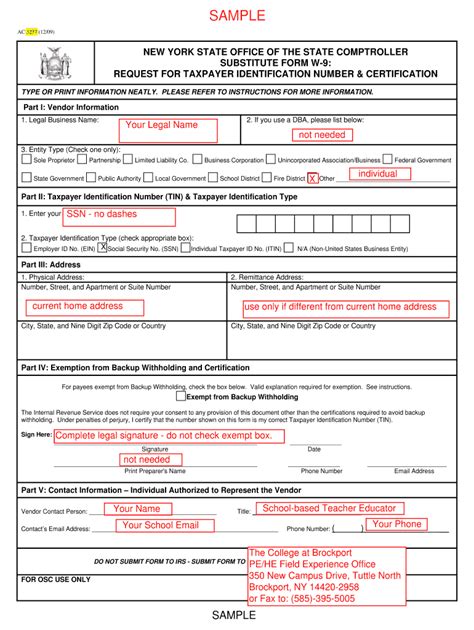

To ensure the success and compliance of your Rhode Island LLC, it’s essential to establish a strong operational foundation. This includes: - Obtaining an EIN: An Employer Identification Number (EIN) from the IRS is necessary for tax purposes, opening a business bank account, and hiring employees. - Opening a Business Bank Account: Separating personal and business finances is crucial for maintaining the liability protection offered by an LLC. - Setting Up Accounting and Tax Systems: Implementing a system for tracking income, expenses, and tax obligations will help you stay organized and compliant with tax laws.

5. Maintaining Compliance with State Regulations

After formation, your Rhode Island LLC must comply with ongoing state requirements, including: - Annual Reports: Filing an annual report with the Secretary of State to update your LLC’s information and pay the associated fee. - Taxes: Complying with state and federal tax laws, which may include filing annual tax returns and paying taxes on business income. - Record Keeping: Maintaining accurate and detailed records of your LLC’s activities, finances, and decisions.

📝 Note: It's crucial to stay informed about any changes in Rhode Island's laws and regulations that could affect your LLC's compliance and operational requirements.

In summary, forming a Rhode Island LLC involves several key steps, from choosing a compliant business name to maintaining ongoing compliance with state regulations. By understanding and following these requirements, you can set your business up for success and ensure it remains in good standing with the state. Whether you’re a seasoned entrepreneur or just starting out, the flexibility and protection offered by an LLC make it a popular choice for businesses in Rhode Island.

What is the main advantage of forming an LLC in Rhode Island?

+

The main advantage is the personal liability protection it offers to its members, shielding their personal assets from business debts and obligations.

How long does it take to form an LLC in Rhode Island?

+

The time it takes to form an LLC in Rhode Island can vary depending on the filing method. Online filings are typically processed more quickly than mail filings, often taking just a few days.

Do I need an Operating Agreement for my Rhode Island LLC?

+

While Rhode Island does not require an Operating Agreement to be filed with the state, it is highly recommended to have one. This document outlines the ownership, management structure, and operational rules of your LLC, helping to prevent disputes and ensure smooth operations.