California Real Estate Paperwork Filing Guide

Introduction to California Real Estate Paperwork Filing

When dealing with real estate in California, understanding the paperwork and filing process is crucial for a smooth transaction. The state of California requires various documents to be filed with the appropriate authorities to ensure that property transactions are legitimate and comply with state laws. This guide will walk you through the necessary steps and documents required for filing real estate paperwork in California.

Understanding California Real Estate Laws

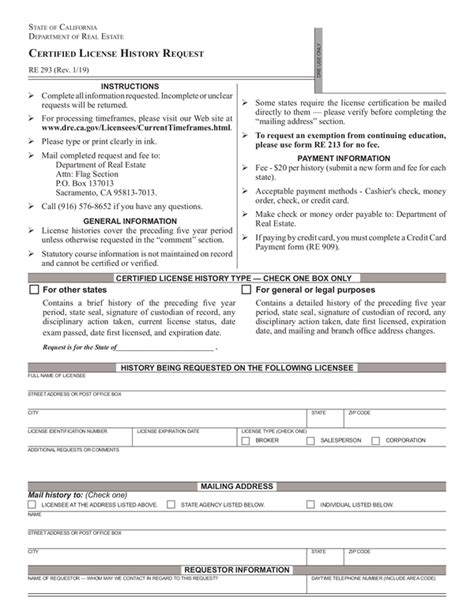

Before diving into the paperwork, it’s essential to have a basic understanding of California real estate laws. The California Department of Real Estate (DRE) and the California Secretary of State are the primary authorities responsible for overseeing real estate transactions. Key laws that govern real estate transactions in California include the California Real Estate Law, the Subdivision Map Act, and the California Environmental Quality Act (CEQA). These laws regulate various aspects of real estate transactions, including property disclosures, contract requirements, and environmental considerations.

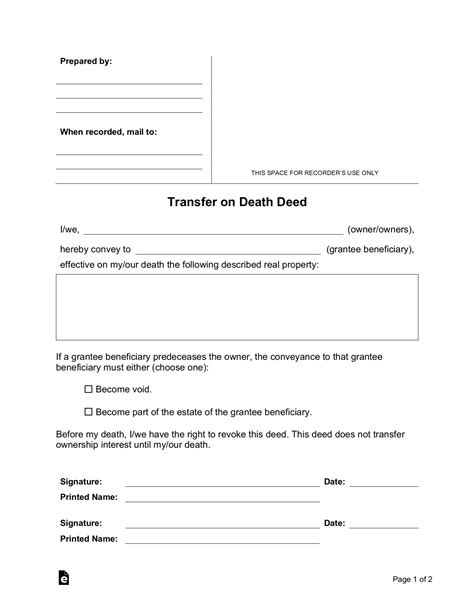

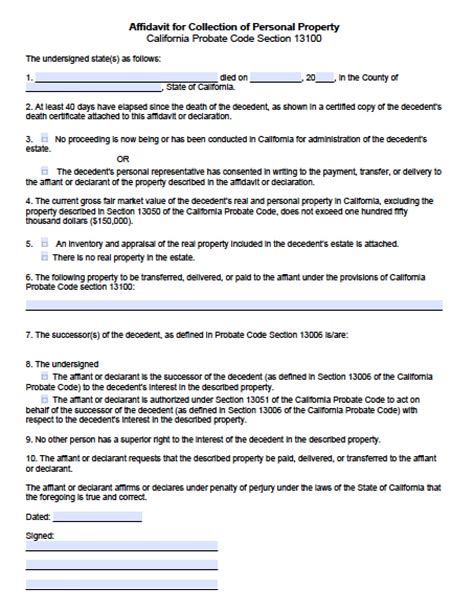

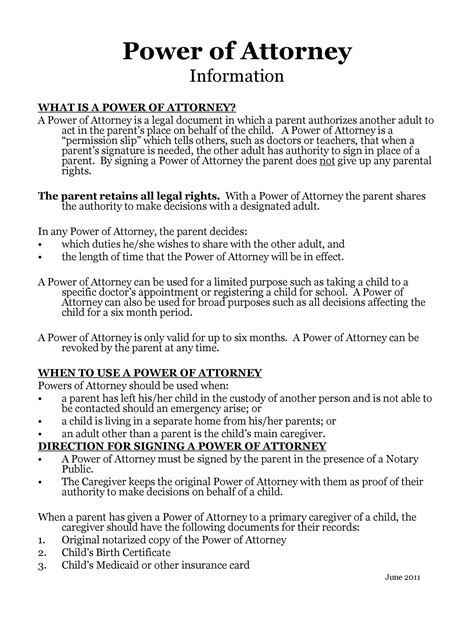

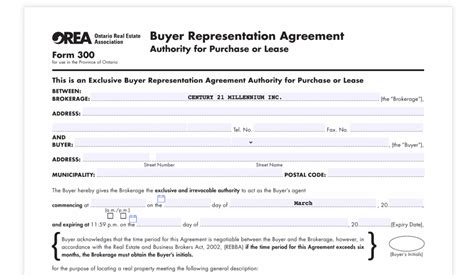

Required Documents for Filing

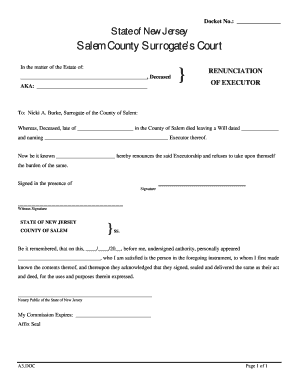

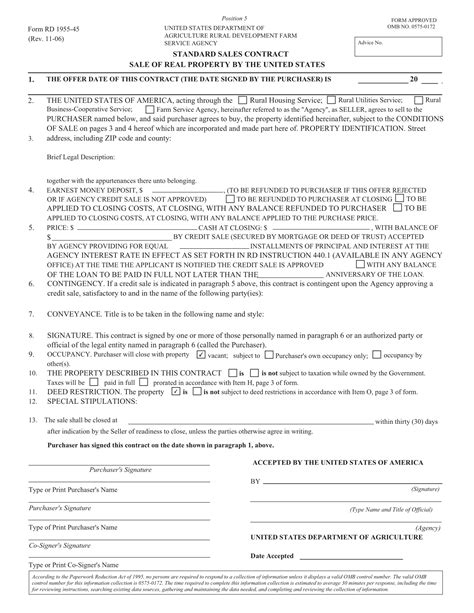

Several documents are required to be filed with the appropriate authorities when dealing with real estate transactions in California. Some of the key documents include: * Grant Deed: This document is used to transfer ownership of a property from one party to another. * Deed of Trust: This document is used to secure a loan with a property as collateral. * Notice of Default: This document is filed when a borrower defaults on a loan. * Notice of Sale: This document is filed when a property is scheduled for sale due to foreclosure. * Property Disclosure Statements: These statements provide information about the property’s condition, including any known defects or hazards.

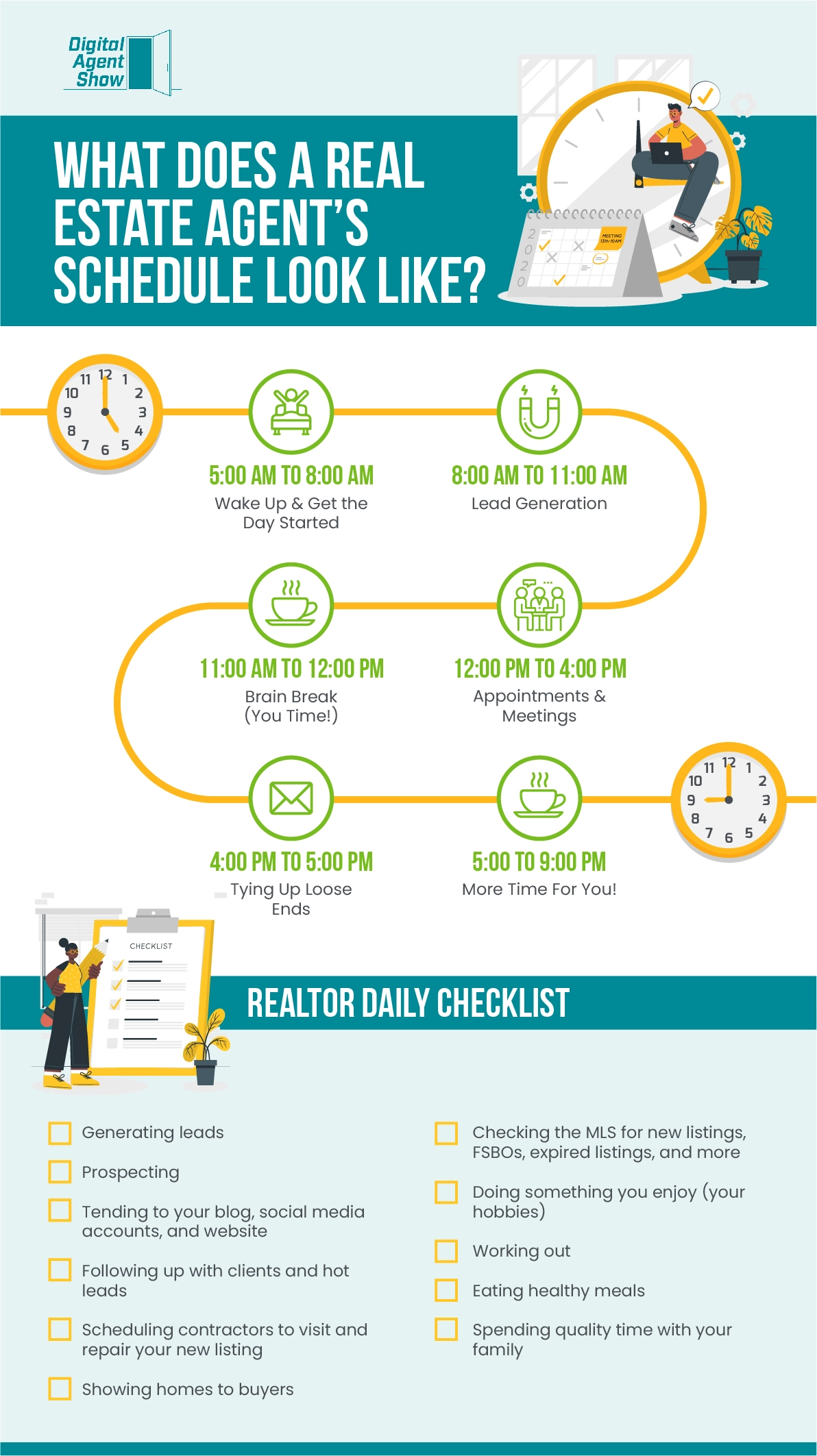

Step-by-Step Filing Guide

Filing real estate paperwork in California involves several steps: * Step 1: Prepare the necessary documents: Ensure that all required documents are complete and accurate. * Step 2: Determine the filing fee: The filing fee varies depending on the type of document and the county where the property is located. * Step 3: File the documents: Documents can be filed in person, by mail, or electronically, depending on the county’s requirements. * Step 4: Record the documents: Once the documents are filed, they must be recorded with the county recorder’s office.

County Recorder’s Office

The county recorder’s office is responsible for recording and maintaining real estate documents in California. Each county has its own recorder’s office, and the filing requirements may vary. It’s essential to check with the specific county recorder’s office for their requirements and fees.

| County | Recorder's Office | Filing Fee |

|---|---|---|

| Los Angeles | 12400 Imperial Hwy, Norwalk, CA 90650 | $15-$30 |

| San Diego | 1600 Pacific Hwy, San Diego, CA 92101 | $10-$25 |

| Orange | 12 Civic Center Plaza, Santa Ana, CA 92701 | $12-$28 |

📝 Note: The filing fees listed in the table are subject to change, and it's essential to check with the specific county recorder's office for their current fees and requirements.

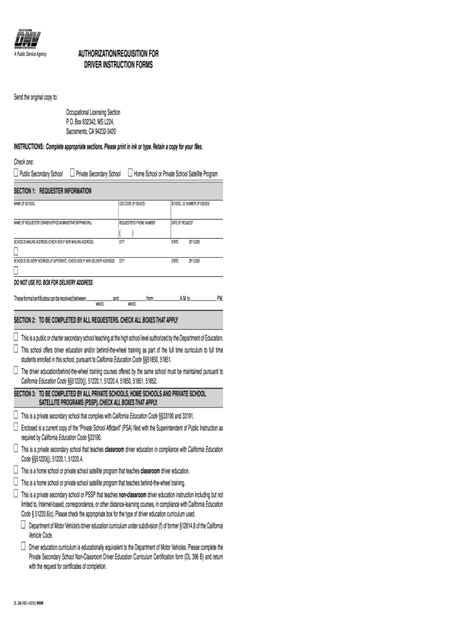

Electronic Filing

Many counties in California offer electronic filing options, which can streamline the process and reduce errors. Electronic filing allows documents to be submitted and recorded online, reducing the need for paper documents and in-person filings.

Common Mistakes to Avoid

When filing real estate paperwork in California, there are several common mistakes to avoid: * Inaccurate or incomplete documents: Ensure that all documents are complete and accurate to avoid delays or rejections. * Insufficient filing fees: Ensure that the correct filing fee is paid to avoid delays or rejections. * Failure to record documents: Ensure that all documents are recorded with the county recorder’s office to avoid potential disputes or issues.

In the final analysis, filing real estate paperwork in California requires careful attention to detail and adherence to state laws and regulations. By understanding the necessary documents, filing requirements, and potential pitfalls, individuals can navigate the process with confidence and ensure a smooth transaction. The key to a successful real estate transaction in California is to be well-prepared, organized, and informed about the state’s laws and regulations.

What is the purpose of the Grant Deed in California real estate transactions?

+

The Grant Deed is used to transfer ownership of a property from one party to another, providing a guarantee that the seller has the right to sell the property and that the property is free of any undisclosed liens or encumbrances.

How do I determine the correct filing fee for my real estate documents in California?

+

The filing fee varies depending on the type of document and the county where the property is located. You can check with the specific county recorder’s office to determine the correct filing fee for your documents.

Can I file my real estate documents electronically in California?

+

Yes, many counties in California offer electronic filing options. You can check with the specific county recorder’s office to see if they offer electronic filing and to determine the requirements and fees associated with this option.