Deed Transfer Paperwork After Owner Death

Understanding the Process of Deed Transfer After an Owner’s Death

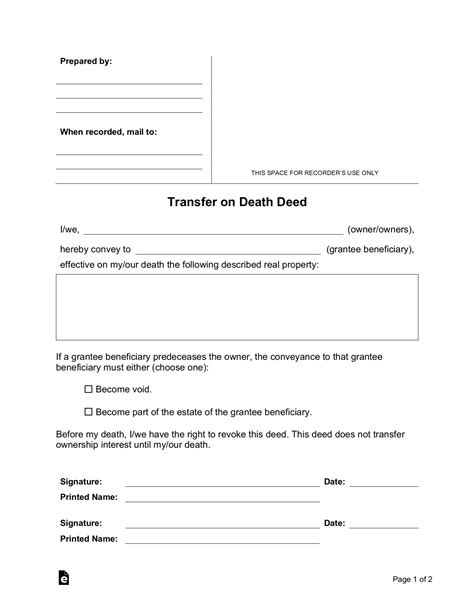

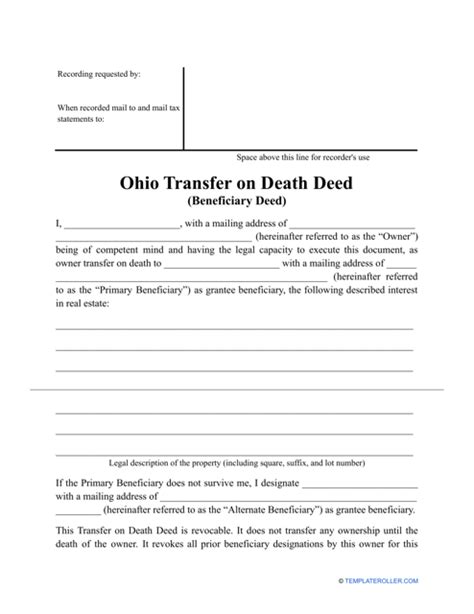

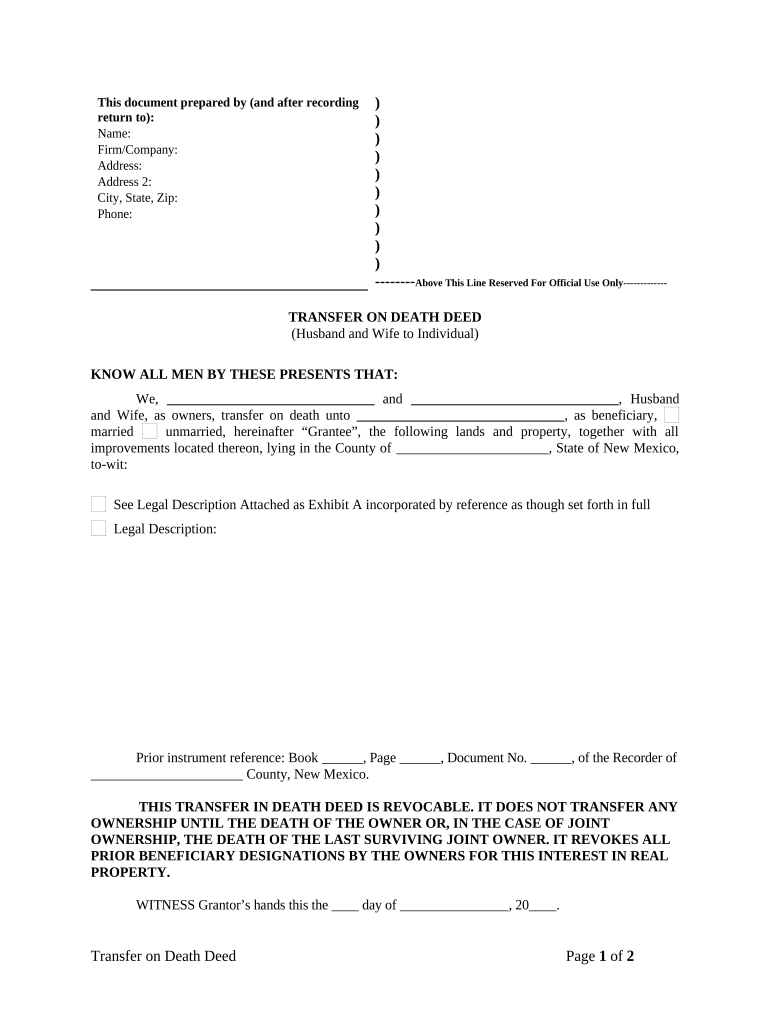

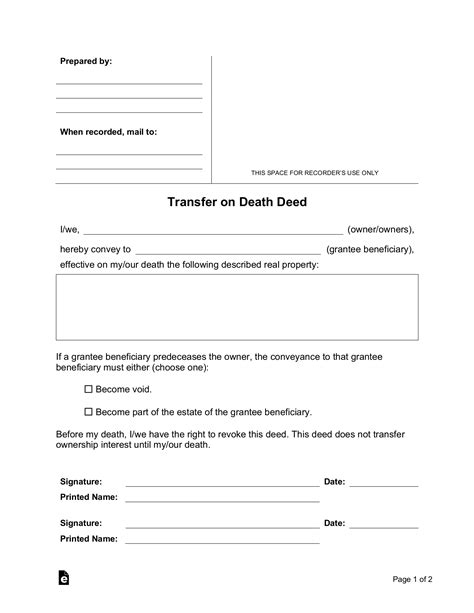

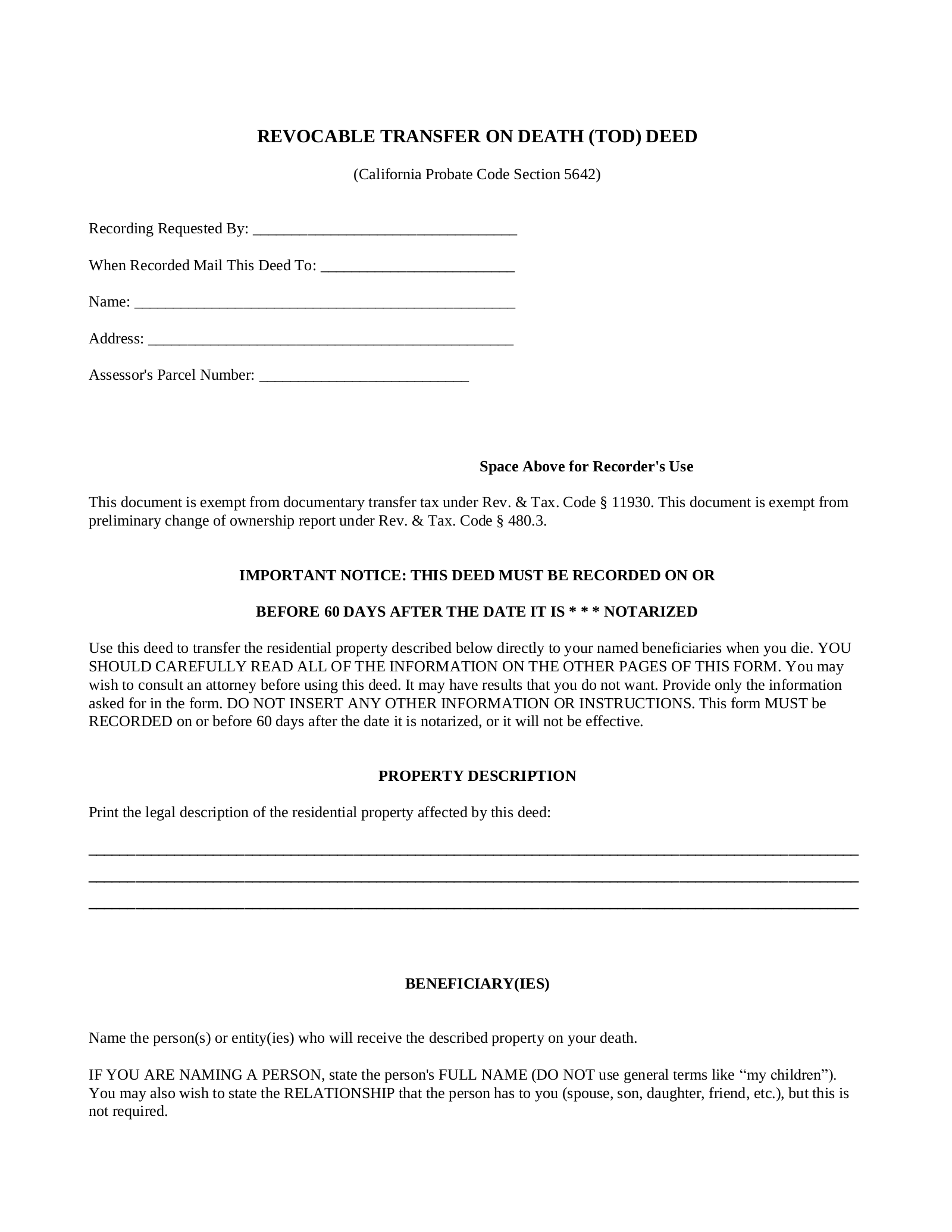

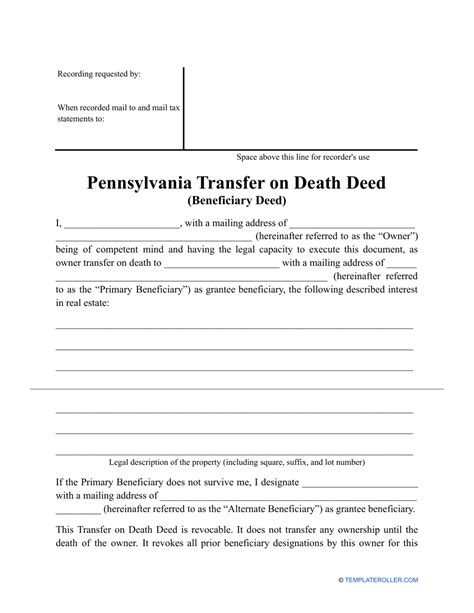

When a property owner passes away, the process of transferring the deed to the rightful heirs or beneficiaries can be complex and daunting. The transfer of property ownership after an owner’s death is a critical step to ensure that the property is legally passed on to the intended parties. This process involves several legal and administrative steps, which can vary depending on the jurisdiction and the specific circumstances of the case.

The first step in transferring a deed after an owner's death is to determine the type of ownership that was held by the deceased. If the property was owned jointly with another person, such as a spouse or business partner, the surviving owner may automatically inherit the property through right of survivorship. However, if the property was owned solely by the deceased, the transfer process will depend on the presence of a will or trust.

Role of a Will in Deed Transfer

A will is a legal document that outlines how a person’s assets, including real property, should be distributed after their death. If the deceased had a will, the executor of the estate will be responsible for carrying out the instructions outlined in the will. This may involve transferring the deed to the beneficiary named in the will. The process typically involves:

- Filing the will with the probate court

- Appointing an executor to manage the estate

- Notifying creditors and heirs

- Transferring assets, including real property, to the beneficiaries

In some cases, the will may not specifically address the transfer of the property, or the deceased may not have had a will at all. In these situations, the property will be distributed according to the laws of intestate succession in the relevant jurisdiction.

Intestate Succession and Deed Transfer

When a person dies without a will, their assets are distributed according to the laws of intestate succession. These laws vary by state but generally provide for the distribution of assets to the deceased’s closest relatives, such as spouses, children, and siblings. The transfer of property through intestate succession typically involves:

- Filing a petition with the probate court to open an estate

- Appointing an administrator to manage the estate

- Notifying heirs and creditors

- Distributing assets, including real property, according to the laws of intestate succession

It's worth noting that the process of transferring a deed through intestate succession can be more complex and time-consuming than transferring a deed through a will. Additionally, the distribution of assets may not align with the deceased's wishes, highlighting the importance of having a will or trust in place.

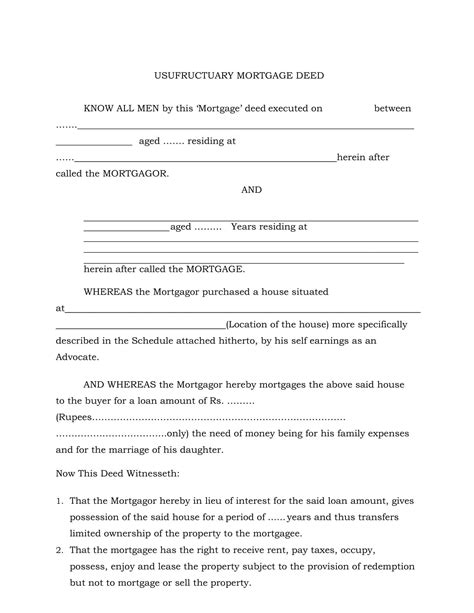

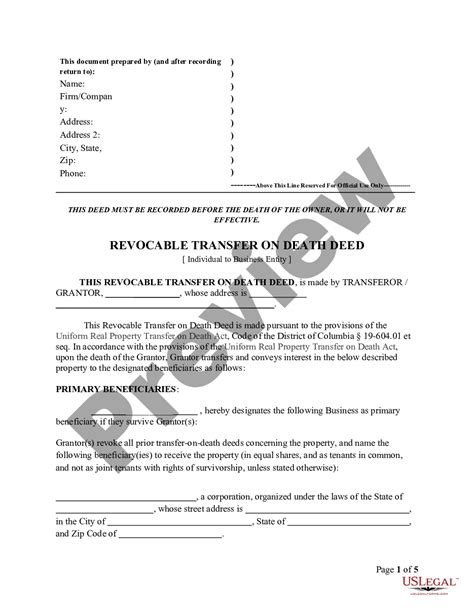

Trusts and Deed Transfer

A trust is a legal arrangement that allows a person to transfer assets, including real property, to a trustee who manages the assets for the benefit of the beneficiaries. If the deceased had a trust, the trustee will be responsible for transferring the deed to the beneficiaries according to the terms of the trust. The process typically involves:

- Notifying the trustee and beneficiaries of the deceased’s passing

- Transferring the deed to the beneficiaries according to the terms of the trust

- Managing any ongoing administrative tasks, such as property taxes and maintenance

Trusts can provide a more private and efficient way to transfer property, as they avoid the need for probate. However, the creation and management of a trust can be complex and require the assistance of an attorney.

| Type of Ownership | Transfer Process |

|---|---|

| Joint Ownership | Right of survivorship |

| Sole Ownership with a Will | Probate and transfer according to the will |

| Sole Ownership without a Will | Intestate succession |

| Trust | Transfer according to the terms of the trust |

Important Considerations

When transferring a deed after an owner’s death, there are several important considerations to keep in mind. These include:

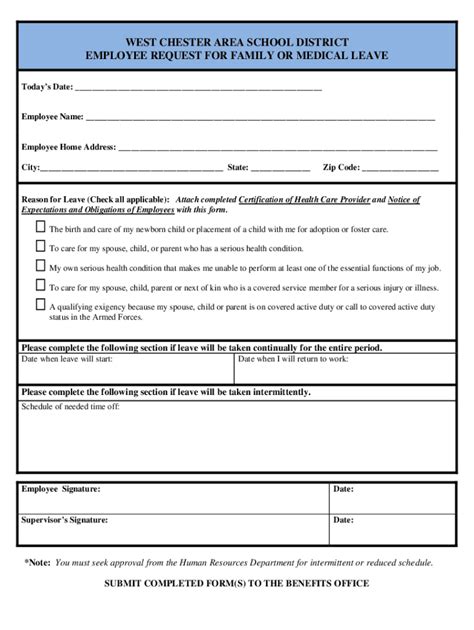

- Ensuring that all necessary paperwork and documentation are in order

- Notifying the relevant authorities, such as the county recorder’s office

- Managing any ongoing administrative tasks, such as property taxes and maintenance

- Seeking the assistance of an attorney if necessary

📝 Note: The transfer of a deed after an owner's death can be a complex and time-consuming process. It's essential to seek the assistance of an attorney if you're unsure about any aspect of the process.

In the end, transferring a deed after an owner’s death requires careful attention to detail and a thorough understanding of the relevant laws and regulations. By following the correct procedures and seeking the assistance of an attorney if necessary, you can ensure that the property is transferred smoothly and efficiently.

What is the difference between a will and a trust?

+

A will is a legal document that outlines how a person’s assets should be distributed after their death, while a trust is a legal arrangement that allows a person to transfer assets to a trustee who manages the assets for the benefit of the beneficiaries.

How do I transfer a deed after an owner’s death?

+

The process of transferring a deed after an owner’s death depends on the type of ownership and the presence of a will or trust. Generally, it involves filing the necessary paperwork, notifying the relevant authorities, and managing any ongoing administrative tasks.

Do I need an attorney to transfer a deed after an owner’s death?

+

While it’s possible to transfer a deed after an owner’s death without an attorney, it’s highly recommended that you seek the assistance of an attorney to ensure that the process is handled correctly and efficiently.