Prevailing Wage Paperwork Filing Guide

Introduction to Prevailing Wage Paperwork

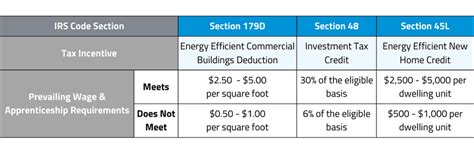

The process of filing prevailing wage paperwork can be complex and time-consuming, especially for contractors and subcontractors who are new to the process. Prevailing wage laws require that workers on public projects be paid a certain wage, which is determined by the government. This guide will walk you through the steps of filing prevailing wage paperwork, including the necessary forms, deadlines, and requirements.

Understanding Prevailing Wage Laws

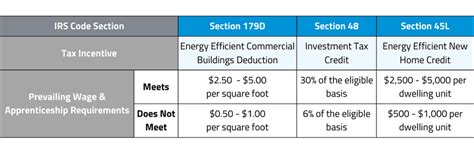

Before we dive into the paperwork filing process, it’s essential to understand the basics of prevailing wage laws. These laws are designed to protect workers on public projects by ensuring they receive a fair wage. The Davis-Bacon Act is a federal law that sets the prevailing wage rates for workers on public projects. The law requires that contractors and subcontractors pay their workers the prevailing wage rate for the specific trade or occupation.

Gathering Necessary Information

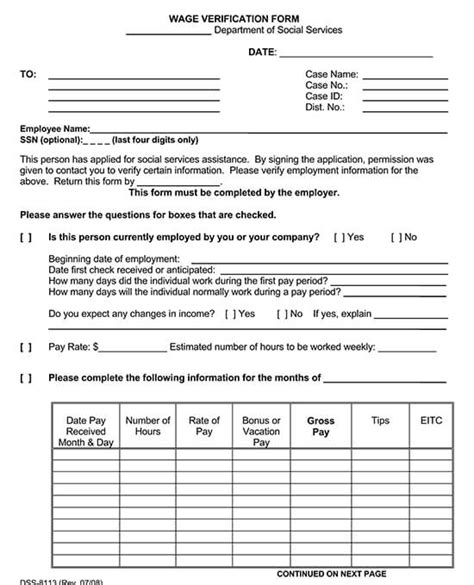

To file prevailing wage paperwork, you’ll need to gather certain information, including: * Project details: The project name, location, and contract number * Worker information: The names, social security numbers, and job classifications of all workers on the project * Wage rates: The prevailing wage rates for each trade or occupation * Hours worked: The number of hours worked by each worker on the project You can find the prevailing wage rates on the Department of Labor’s website or by contacting your local labor department.

Filing Prevailing Wage Paperwork

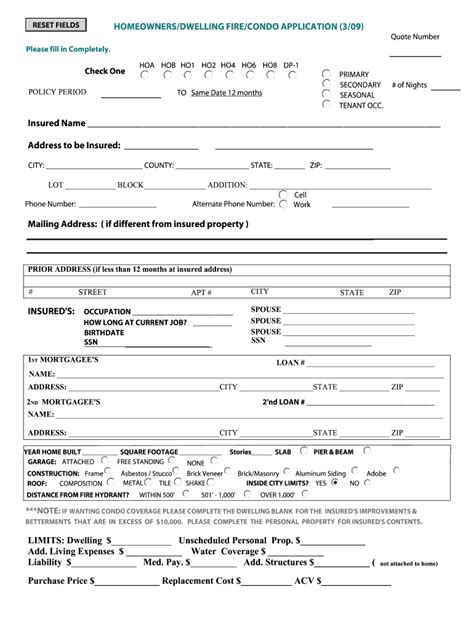

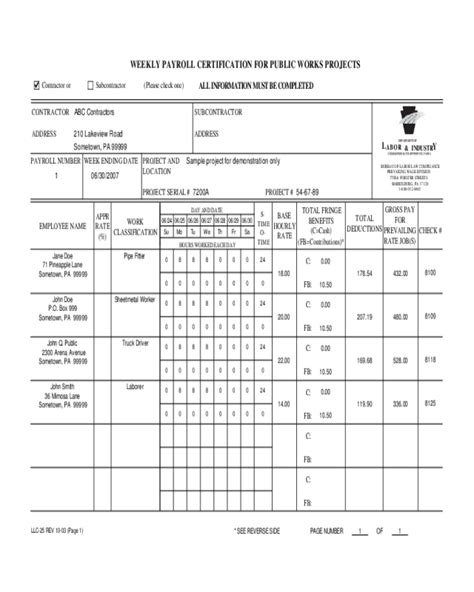

The prevailing wage paperwork filing process typically involves the following steps: * Step 1: Determine the prevailing wage rates: Research the prevailing wage rates for your project using the Department of Labor’s website or by contacting your local labor department. * Step 2: Complete the necessary forms: You’ll need to complete forms such as the Certified Payroll Form and the Prevailing Wage Compliance Form. These forms will require you to provide information about your project, workers, and wage rates. * Step 3: Submit the forms: Submit the completed forms to the relevant authorities, such as the Department of Labor or your local labor department. * Step 4: Maintain records: Keep accurate records of all payroll and wage information, including hours worked, wage rates, and deductions.

💡 Note: It's essential to submit the prevailing wage paperwork on time to avoid penalties and fines.

Common Forms and Requirements

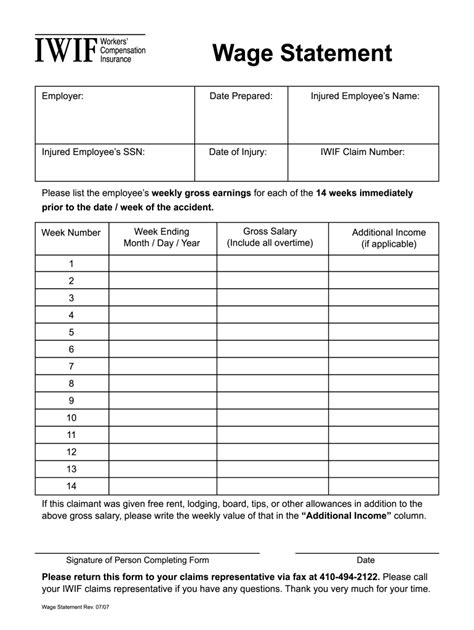

Here are some common forms and requirements you’ll need to complete when filing prevailing wage paperwork: * Certified Payroll Form: This form requires you to provide detailed information about your workers, including their names, social security numbers, and job classifications. * Prevailing Wage Compliance Form: This form requires you to certify that you’re paying your workers the prevailing wage rate for their trade or occupation. * Payroll records: You’ll need to maintain accurate payroll records, including hours worked, wage rates, and deductions.

| Form | Description |

|---|---|

| Certified Payroll Form | Requires detailed information about workers, including names, social security numbers, and job classifications |

| Prevailing Wage Compliance Form | Requires certification that workers are being paid the prevailing wage rate for their trade or occupation |

| Payroll records | Requires accurate records of hours worked, wage rates, and deductions |

Deadlines and Penalties

It’s essential to submit the prevailing wage paperwork on time to avoid penalties and fines. The deadlines for submitting the paperwork vary depending on the project and the authorities involved. Late submissions can result in penalties, fines, and even debarment from future public projects.

Maintaining Compliance

To maintain compliance with prevailing wage laws, you’ll need to: * Monitor wage rates: Keep track of changes to prevailing wage rates and update your payroll records accordingly * Conduct regular audits: Conduct regular audits to ensure you’re paying your workers the correct wage rate and maintaining accurate payroll records * Train employees: Train your employees on prevailing wage laws and the importance of maintaining accurate payroll records

In summary, filing prevailing wage paperwork requires careful attention to detail, accurate record-keeping, and a thorough understanding of prevailing wage laws. By following the steps outlined in this guide, you can ensure compliance with prevailing wage laws and avoid penalties and fines.

What is the Davis-Bacon Act?

+

The Davis-Bacon Act is a federal law that sets the prevailing wage rates for workers on public projects.

How do I determine the prevailing wage rates for my project?

+

You can determine the prevailing wage rates for your project by researching the rates on the Department of Labor’s website or by contacting your local labor department.

What are the consequences of late submissions or non-compliance with prevailing wage laws?

+

Late submissions or non-compliance with prevailing wage laws can result in penalties, fines, and even debarment from future public projects.