5 HOA Insurance Requirements

Understanding HOA Insurance Requirements

When it comes to managing a homeowners association (HOA), one of the most critical aspects to consider is insurance. HOA insurance requirements can vary depending on the state, local laws, and the specific needs of the community. In this article, we will delve into the world of HOA insurance, exploring the different types of coverage, what is typically required, and why it is essential for the financial stability and risk management of the association.

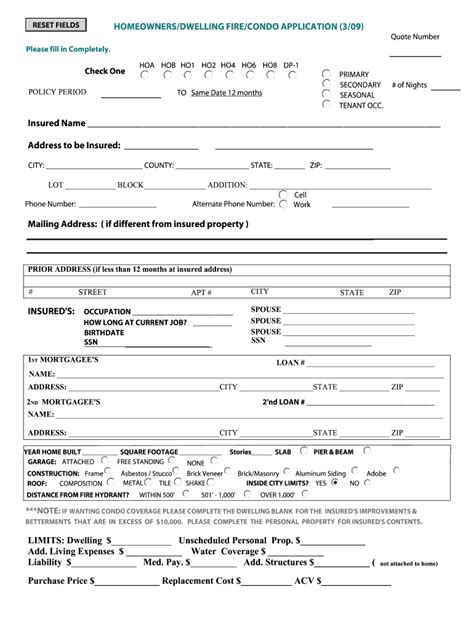

Types of HOA Insurance Coverage

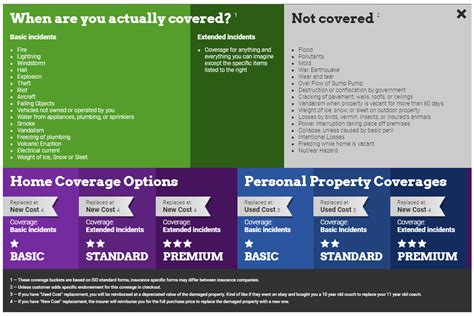

There are several types of insurance coverage that an HOA may need to consider. These include: * Liability Insurance: This type of insurance protects the HOA in case of lawsuits or claims arising from injuries or damages that occur on common areas, such as swimming pools, clubhouses, or parking lots. * Property Insurance: This coverage is for the physical assets of the HOA, including buildings, landscaping, and other common area features. It helps to repair or replace these assets in the event of damage or destruction. * Directors and Officers (D&O) Insurance: This type of insurance protects the HOA’s board members and officers from personal financial loss in case they are sued for their actions or decisions made on behalf of the association. * Fidelity Insurance: Also known as employee dishonesty insurance, this coverage protects the HOA from losses due to theft or dishonest acts by employees, volunteers, or contractors. * Umbrella Insurance: This is an additional layer of liability insurance that provides extra protection beyond the standard liability insurance policy.

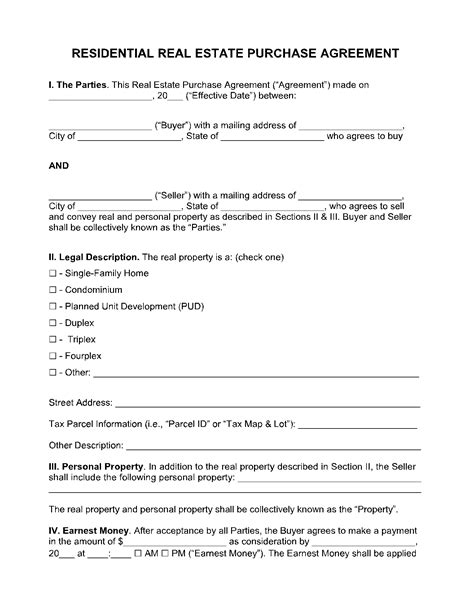

HOA Insurance Requirements by State

While there are federal laws that regulate certain aspects of insurance, the specific requirements for HOA insurance can vary significantly from state to state. Some states have laws that mandate certain types or levels of coverage, while others may leave these decisions up to the individual associations. For example: * In California, HOAs are required to have a minimum of 500,000 in liability insurance coverage. * In Florida, condominium associations must have insurance that covers a minimum of 1,000 per unit, up to a total of $200,000. * In Texas, there are no specific state-mandated insurance requirements for HOAs, but associations are still encouraged to secure adequate coverage to protect their assets and members.

Why HOA Insurance is Important

Having the right insurance coverage is crucial for the financial health and stability of an HOA. Without adequate insurance, the association and its members could be left with significant financial burdens in the event of a claim or lawsuit. Some of the key reasons why HOA insurance is important include: * Risk Management: Insurance helps to manage and mitigate risks that could result in financial losses. * Protection of Assets: Insurance protects the physical assets of the HOA, ensuring that they can be repaired or replaced if damaged. * Compliance with Laws and Regulations: In many cases, having certain types of insurance coverage is required by law or by the association’s governing documents. * Peace of Mind: Knowing that the HOA has adequate insurance coverage can provide peace of mind for both the board members and the community members.

📝 Note: It is essential for HOAs to review their insurance coverage regularly to ensure it remains adequate and compliant with all relevant laws and regulations.

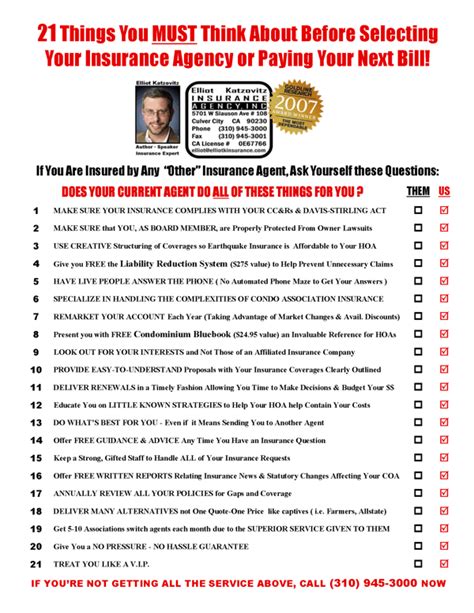

How to Choose the Right HOA Insurance

Choosing the right insurance for an HOA involves several steps, including: * Assessing the Association’s Needs: The first step is to assess the specific insurance needs of the association, considering factors such as the type and value of common areas, the number of units, and the level of risk. * Researching Insurance Providers: Next, the HOA should research different insurance providers to find those that offer the necessary types and levels of coverage. * Comparing Policies and Prices: The HOA should compare the policies and prices offered by different providers to find the best fit for their needs and budget. * Reviewing and Updating Coverage: Finally, the HOA should regularly review their insurance coverage to ensure it remains adequate and update their policies as necessary.

| Type of Insurance | Description | Typical Cost |

|---|---|---|

| Liability Insurance | Covers lawsuits and claims arising from injuries or damages on common areas | $500-$2,000 per year |

| Property Insurance | Covers physical assets of the HOA, including buildings and landscaping | $1,000-$5,000 per year |

| Directors and Officers (D&O) Insurance | Protects board members and officers from personal financial loss | $500-$2,000 per year |

In summary, HOA insurance requirements can vary, but having the right coverage is essential for managing risks, protecting assets, and ensuring compliance with laws and regulations. By understanding the different types of insurance coverage available and taking the time to choose the right policies for their specific needs, HOAs can provide peace of mind for their members and help ensure the long-term financial stability of the association.

What is the purpose of HOA insurance?

+

The purpose of HOA insurance is to protect the association and its members from financial losses due to lawsuits, property damage, and other risks.

What types of insurance coverage does an HOA typically need?

+

An HOA typically needs liability insurance, property insurance, directors and officers (D&O) insurance, fidelity insurance, and umbrella insurance.

How often should an HOA review its insurance coverage?

+

An HOA should review its insurance coverage at least annually to ensure it remains adequate and compliant with all relevant laws and regulations.