Equity Issuance Paperwork Requirements

Introduction to Equity Issuance

Equity issuance is a crucial aspect of corporate finance, allowing companies to raise capital by issuing new shares of stock to investors. This process involves a series of complex steps, including preparation of paperwork, regulatory compliance, and investor relations. In this article, we will delve into the paperwork requirements for equity issuance, highlighting the key documents and filings necessary for a successful equity offering.

Pre-Issuance Paperwork

Before issuing equity, companies must prepare several key documents, including: * Private Placement Memorandum (PPM): A detailed document outlining the terms of the offering, including the number of shares to be issued, the offering price, and the use of proceeds. * Subscription Agreement: A contract between the company and the investor, outlining the terms of the investment, including the number of shares to be purchased and the payment terms. * Share Purchase Agreement: A contract between the company and the investor, outlining the terms of the share purchase, including the price, payment terms, and any warranties or representations made by the company.

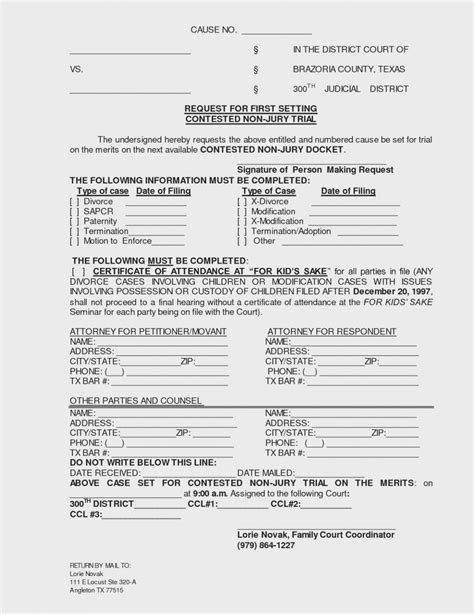

Regulatory Filings

In addition to the pre-issuance paperwork, companies must also comply with regulatory filings, including: * SEC Filings: Companies must file a registration statement with the Securities and Exchange Commission (SEC), which includes detailed information about the company, the offering, and the use of proceeds. * State Filings: Companies must also comply with state securities laws, which may require additional filings and registrations.

Post-Issuance Paperwork

After the equity issuance, companies must prepare and file several post-issuance documents, including: * Share Certificate: A document evidencing ownership of the shares, which must be issued to each investor. * Share Register: A record of all shareholders, including their names, addresses, and shareholdings. * Annual Reports: Companies must file annual reports with the SEC, which include detailed financial information and updates on the company’s operations.

Compliance with Securities Laws

Compliance with securities laws is critical to a successful equity issuance. Companies must ensure that they comply with all applicable laws and regulations, including: * Securities Act of 1933: Requires companies to register their securities with the SEC before offering them to the public. * Securities Exchange Act of 1934: Requires companies to file periodic reports with the SEC and to disclose certain information to investors.

📝 Note: Companies must also comply with state securities laws, which may require additional filings and registrations.

Best Practices for Equity Issuance

To ensure a successful equity issuance, companies should follow best practices, including: * Engaging experienced counsel: Companies should engage experienced counsel to assist with the preparation of paperwork and regulatory filings. * Conducting thorough due diligence: Companies should conduct thorough due diligence on potential investors to ensure that they are accredited and eligible to purchase the securities. * Disclosing all material information: Companies must disclose all material information to investors, including any risks or uncertainties associated with the investment.

| Document | Purpose |

|---|---|

| Private Placement Memorandum (PPM) | Outlines the terms of the offering |

| Subscription Agreement | Outlines the terms of the investment |

| Share Purchase Agreement | Outlines the terms of the share purchase |

In summary, equity issuance requires careful preparation and compliance with regulatory requirements. Companies must prepare and file several key documents, including the PPM, subscription agreement, and share purchase agreement. They must also comply with regulatory filings, including SEC and state filings. By following best practices and engaging experienced counsel, companies can ensure a successful equity issuance and raise the capital they need to grow and succeed.

What is the purpose of a Private Placement Memorandum (PPM)?

+

The PPM outlines the terms of the offering, including the number of shares to be issued, the offering price, and the use of proceeds.

What is the difference between a subscription agreement and a share purchase agreement?

+

A subscription agreement outlines the terms of the investment, while a share purchase agreement outlines the terms of the share purchase.

What are the regulatory filings required for equity issuance?

+

Companies must file a registration statement with the SEC and comply with state securities laws, which may require additional filings and registrations.