Paperwork

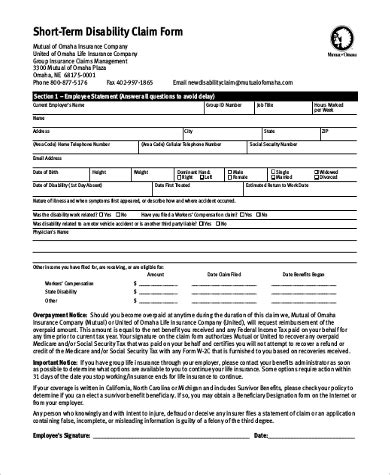

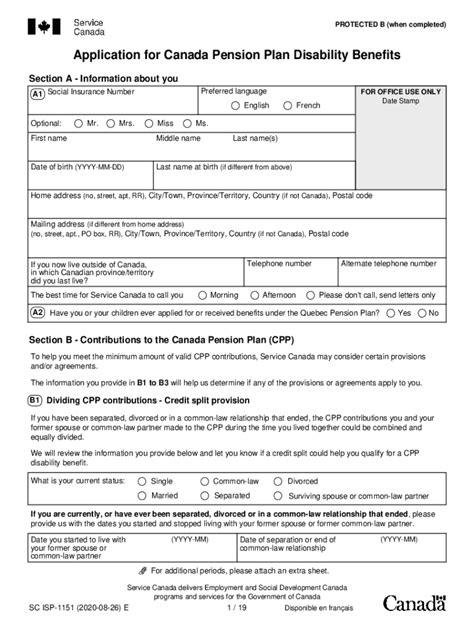

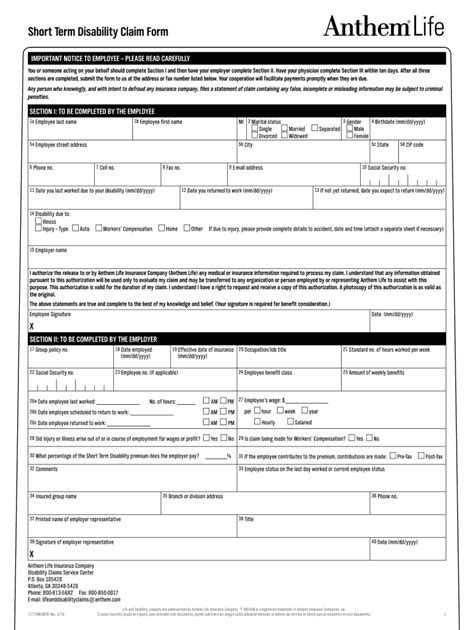

Fill Out Short Term Disability Agreement

Understanding Short Term Disability Agreements

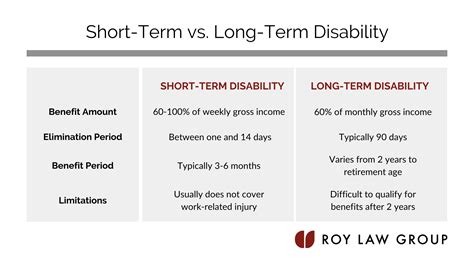

When an employee is unable to work due to illness, injury, or disability, a short-term disability (STD) agreement can provide them with a portion of their income. This agreement is typically offered by employers as part of their employee benefits package. The purpose of an STD agreement is to ensure that employees can still receive a portion of their salary while they are unable to work, helping them to maintain their financial stability during a challenging time.

Key Components of a Short Term Disability Agreement

A standard short-term disability agreement includes several key components: - Eligibility: This outlines who is eligible for the short-term disability benefits. It often includes full-time and sometimes part-time employees after they have completed a certain period of service. - Definition of Disability: This section defines what constitutes a disability under the agreement. It usually means that the employee is unable to perform the material duties of their own occupation due to illness or injury. - Benefit Amount: This specifies the amount of money the employee will receive while on short-term disability. It’s often a percentage of the employee’s weekly or monthly salary. - Duration of Benefits: This states how long the employee can receive short-term disability benefits. The duration can vary significantly between different plans. - Elimination Period: Also known as the waiting period, this is the time between when the employee becomes disabled and when the benefits start. It can range from a few days to several weeks. - Return to Work: This section outlines the process for an employee to return to work after being on short-term disability. It may include provisions for gradual return to work or modifications to the job to accommodate the employee’s health conditions.

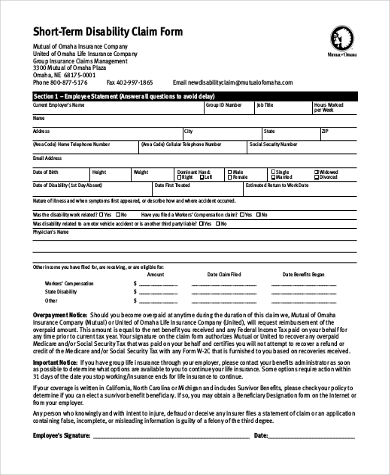

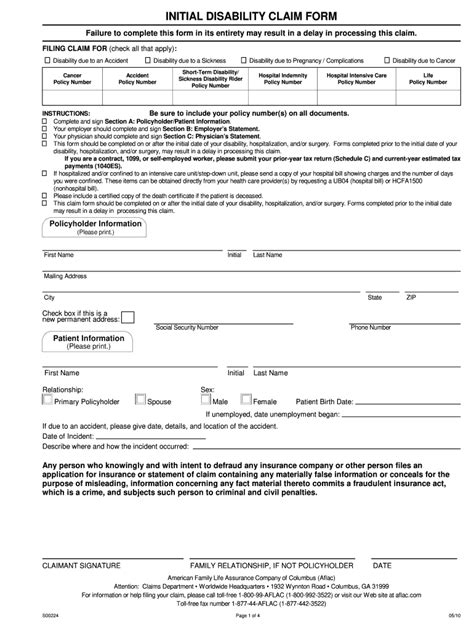

Steps to Fill Out a Short Term Disability Agreement

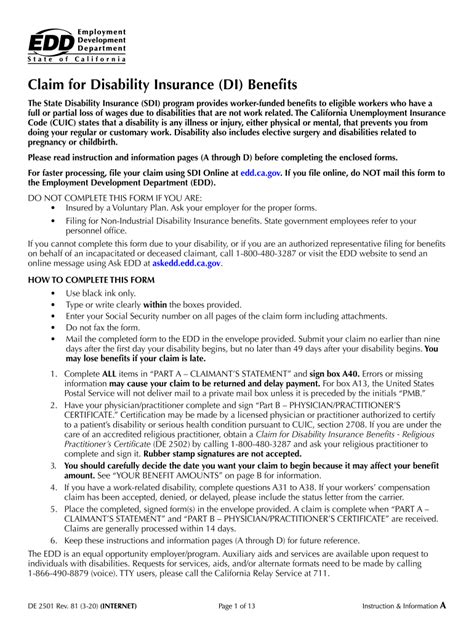

Filling out a short-term disability agreement involves several steps: - Review the Agreement: Carefully read through the entire agreement to understand all the terms and conditions. - Check Eligibility: Ensure you meet the eligibility criteria as outlined in the agreement. - Provide Medical Documentation: You will typically need to provide medical evidence from your healthcare provider to support your claim of disability. - Complete Claim Forms: Fill out the claim forms provided by your employer or the insurance company. Make sure to follow the instructions carefully and provide all required information. - Submit the Claim: Send in your claim along with all supporting documentation. Ensure you keep a copy of everything you submit for your records.

Important Considerations

When filling out a short-term disability agreement, there are several important considerations to keep in mind: - Understand the Tax Implications: Benefits may be taxable, depending on how the plan is structured and funded. - Review the Appeal Process: If your claim is denied, understand how you can appeal the decision. - Keep Records: Maintain detailed records of your claim, including all correspondence and medical documentation.

Benefits of Short Term Disability Agreements

Short-term disability agreements offer several benefits to both employers and employees: - Financial Protection: For employees, it provides financial protection during periods of illness or injury. - Talent Retention: For employers, offering such benefits can help in retaining talented employees, as it demonstrates a commitment to their well-being. - Return to Work Programs: Many agreements include provisions for helping employees return to work, which can be beneficial for both parties.

📝 Note: It's essential to thoroughly understand the terms and conditions of your short-term disability agreement to ensure you can navigate the process smoothly if you ever need to file a claim.

Common Mistakes to Avoid

When dealing with short-term disability agreements, there are common mistakes to avoid: - Not Reading the Fine Print: Failing to understand all the terms and conditions can lead to misunderstandings and potential disputes. - Delaying the Claim Process: Waiting too long to submit a claim can result in delays in receiving benefits. - Insufficient Documentation: Not providing adequate medical evidence can lead to a claim being denied.

Conclusion and Future Planning

In conclusion, short-term disability agreements are a vital part of employee benefits packages, offering financial security during unforeseen health issues. Understanding the agreement, following the claim process carefully, and avoiding common mistakes can ensure that employees receive the support they need. Planning ahead and being aware of the provisions of such agreements can make a significant difference in navigating challenging times.

What is typically the duration of short-term disability benefits?

+

The duration of short-term disability benefits can vary but often ranges from 13 to 26 weeks, depending on the employer’s plan.

How do I know if I’m eligible for short-term disability benefits?

+

Check your employee benefits package or consult with your HR department to understand the eligibility criteria for short-term disability benefits at your workplace.

Can I appeal if my short-term disability claim is denied?

+

Yes, most plans have an appeal process if your claim is denied. Review your plan documents or contact your HR department to understand the appeal process.