5 Tax Form Tips

Understanding Tax Forms: A Comprehensive Guide

When it comes to filing taxes, the process can be overwhelming, especially with the numerous forms and deadlines to keep track of. However, with the right guidance, you can navigate through the complexities and ensure you’re taking advantage of all the deductions and credits you’re eligible for. In this article, we’ll delve into the world of tax forms, highlighting five essential tips to help you make the most out of your tax return.

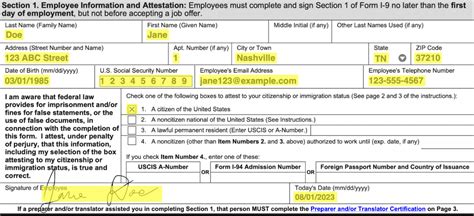

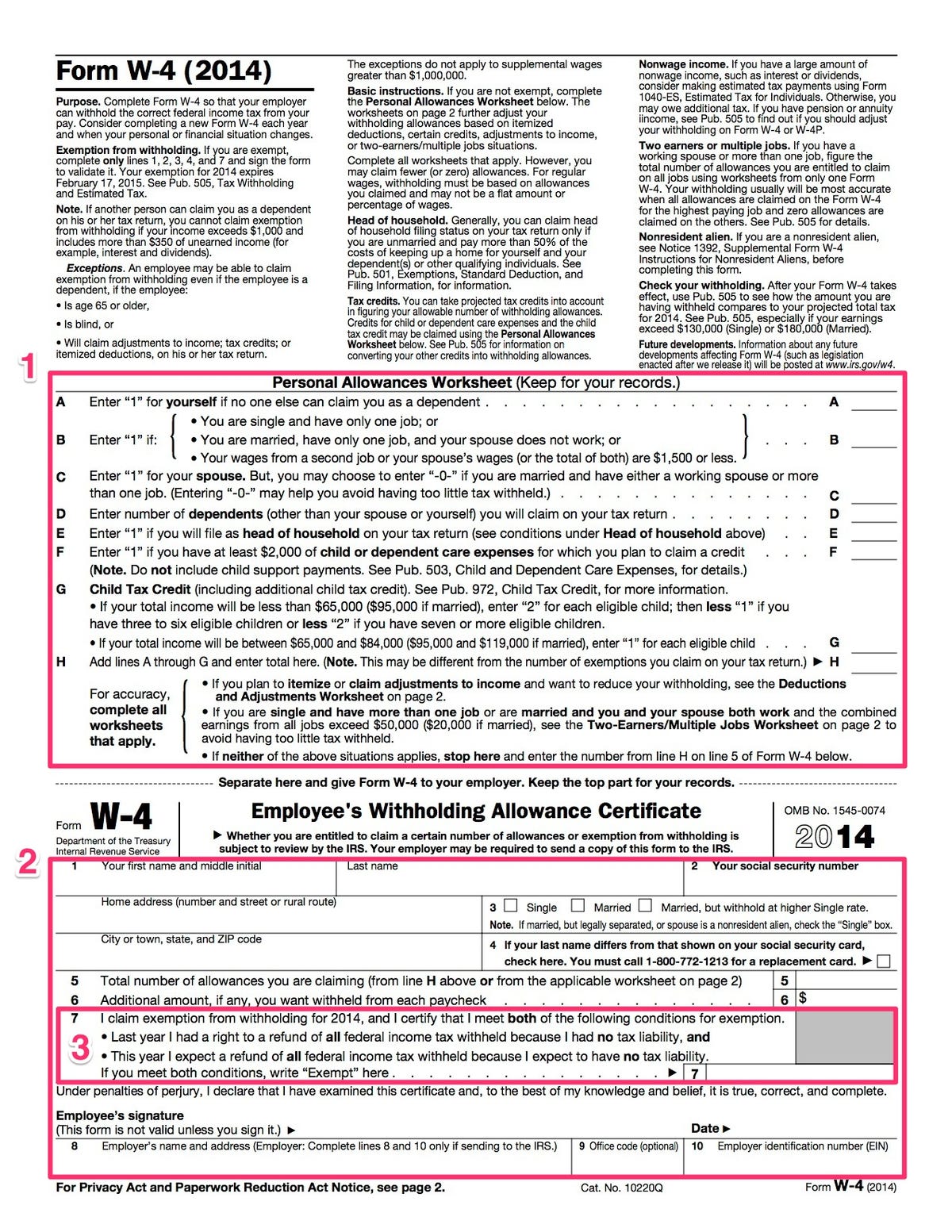

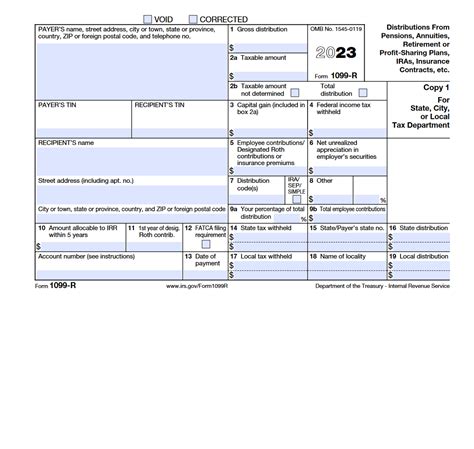

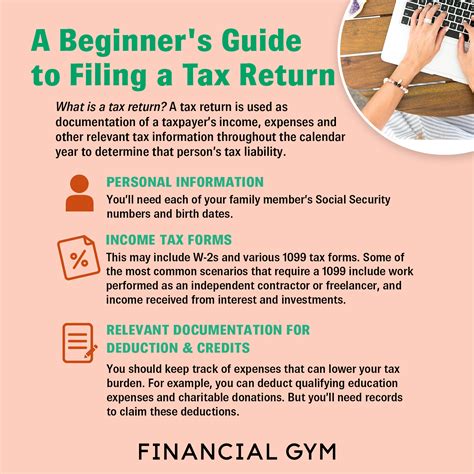

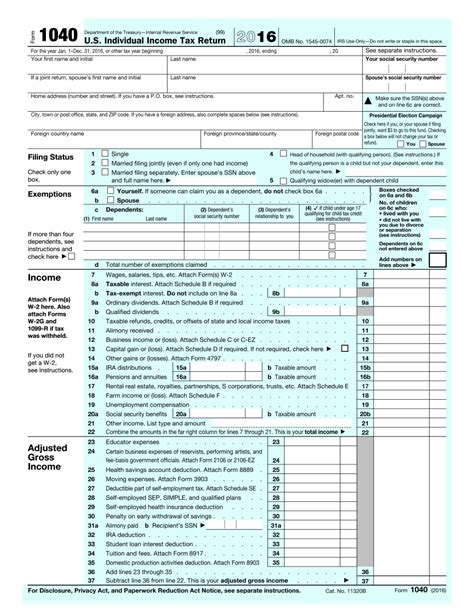

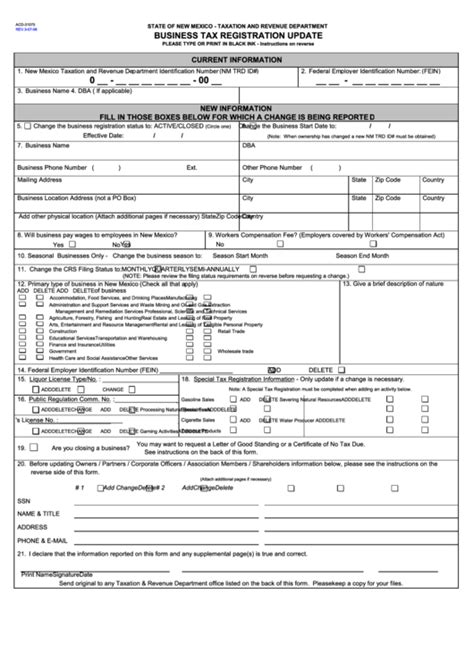

Tip 1: Familiarize Yourself with Common Tax Forms

The first step in mastering tax forms is to understand the different types that exist. The most common form for personal income tax is the Form 1040, which is used by individuals to report their income, deductions, and credits. Other notable forms include the W-2, which employers use to report employee income, and the 1099, used for reporting income from freelance work or self-employment. Being aware of these forms and their purposes can significantly simplify the tax filing process.

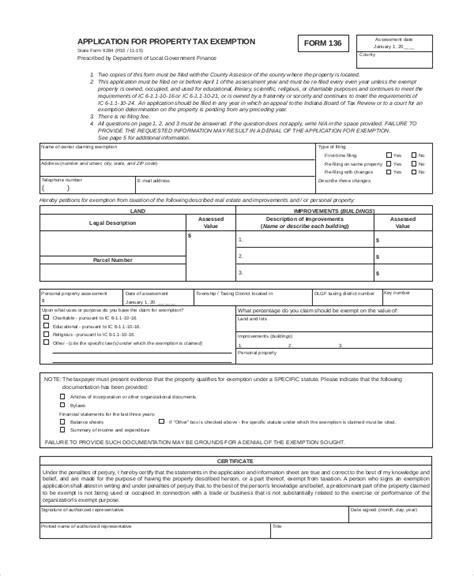

Tip 2: Maximize Your Deductions

Deductions are a crucial aspect of tax forms, as they can substantially reduce your taxable income. Common deductions include mortgage interest, charitable donations, and medical expenses. It’s essential to keep accurate records of these expenses throughout the year, as you’ll need them to fill out your tax forms. Additionally, consider consulting with a tax professional to ensure you’re taking advantage of all the deductions you’re eligible for.

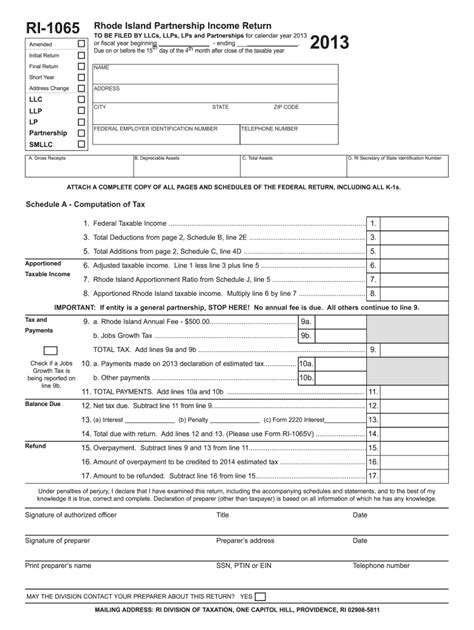

Tip 3: Take Advantage of Tax Credits

Unlike deductions, which reduce your taxable income, tax credits directly reduce the amount of tax you owe. There are various tax credits available, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit. These credits can be highly beneficial, especially for low-to-moderate-income families. When filling out your tax forms, make sure to explore the credits you might be eligible for, as they can lead to a significant reduction in your tax liability.

Tip 4: Stay Organized with Tax Software

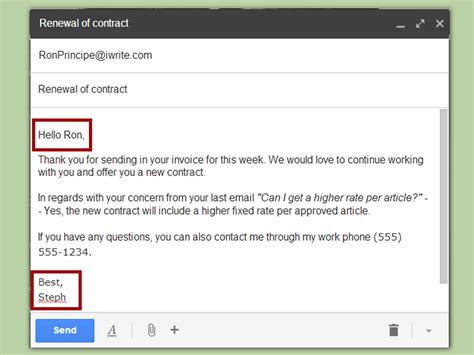

With the advancement of technology, tax software has become an indispensable tool for filing taxes. Programs like TurboTax and H&R Block guide you through the tax filing process, ensuring you don’t miss any critical deductions or credits. These software solutions also help you stay organized by storing your tax documents and information securely, making it easier to access them when needed.

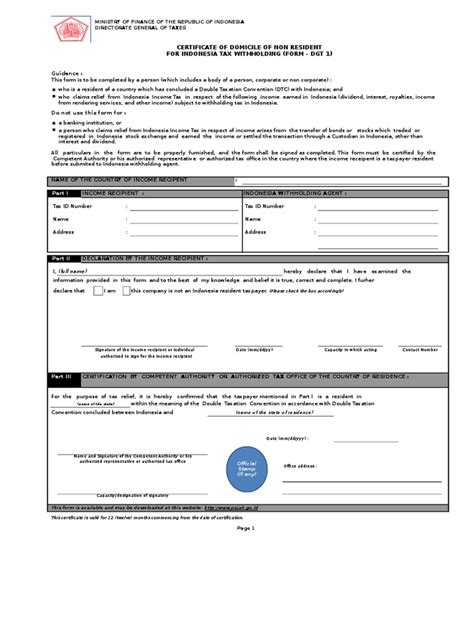

Tip 5: File Electronically and On Time

Finally, it’s crucial to file your tax forms electronically and before the deadline. Electronic filing, or e-filing, is faster, more accurate, and provides quicker refunds compared to traditional paper filing. Moreover, submitting your tax return on time helps avoid penalties and interest associated with late filing. If you’re unable to file by the deadline, consider requesting an extension to avoid any unnecessary penalties.

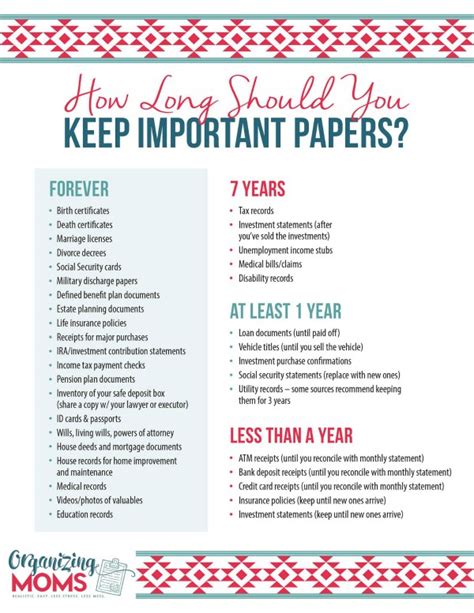

📝 Note: Always keep a copy of your filed tax return and supporting documents for at least three years in case of an audit.

In essence, understanding and navigating tax forms effectively can lead to a more streamlined and stress-free tax filing experience. By familiarizing yourself with common tax forms, maximizing deductions, taking advantage of tax credits, staying organized with tax software, and filing electronically on time, you’ll be well on your way to optimizing your tax return.

As we summarize the key points, it’s clear that mastering tax forms is a skill that can save you time, money, and frustration. Whether you’re a seasoned taxpayer or just starting out, following these tips can help you make the most out of your tax return. Remember, staying informed and organized is key to a successful tax filing experience.

What is the most common tax form for personal income tax?

+

The most common tax form for personal income tax is the Form 1040, which is used by individuals to report their income, deductions, and credits.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of tax you owe.

Why is it important to file tax forms electronically and on time?

+

Filing tax forms electronically and on time helps avoid penalties and interest associated with late filing, and also provides quicker refunds.