Paperwork

Michigan Home Sale Paperwork Requirements

Introduction to Michigan Home Sale Paperwork Requirements

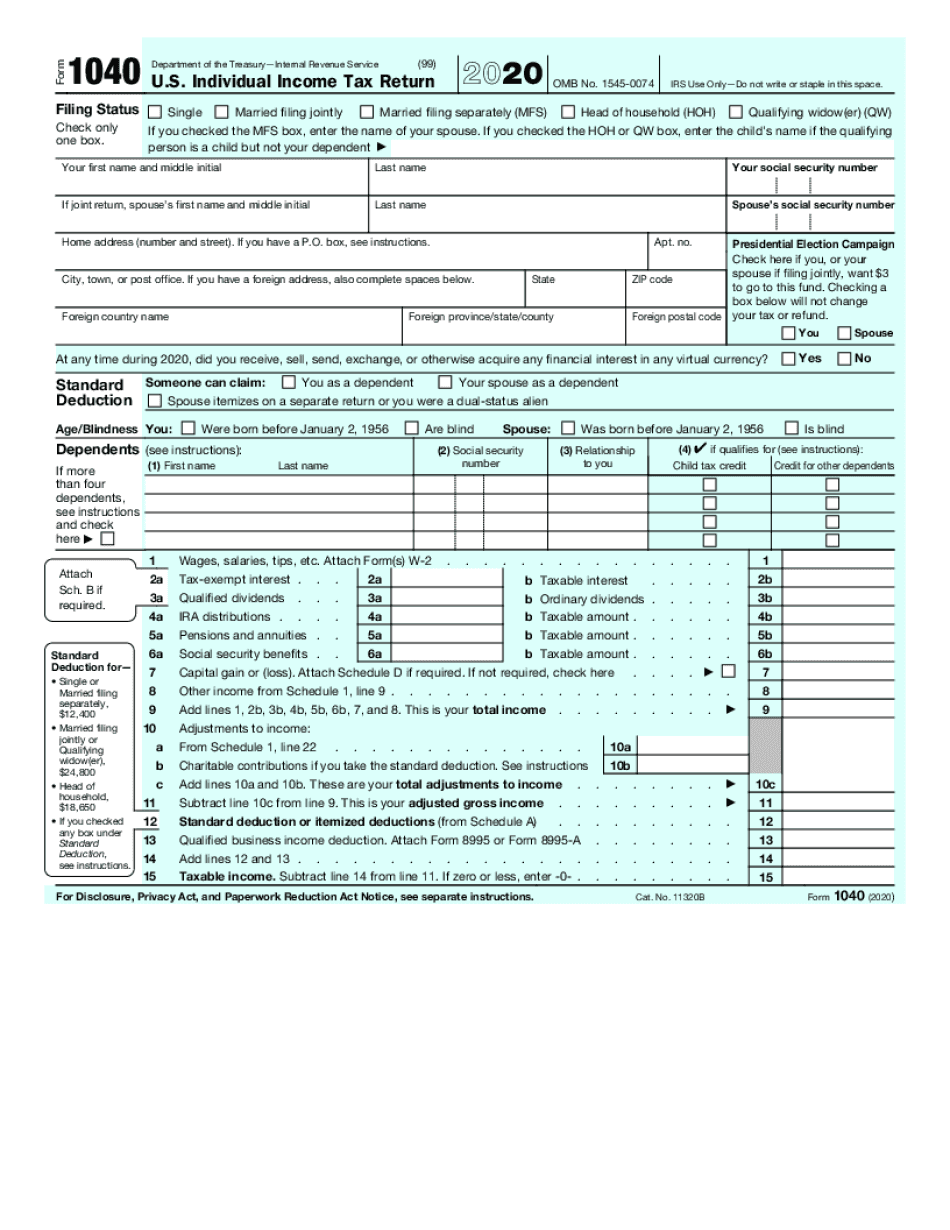

When it comes to selling a home in Michigan, there are several paperwork requirements that must be met to ensure a smooth and legally binding transaction. These requirements can vary depending on the specific circumstances of the sale, but there are some key documents that are always necessary. In this article, we will explore the different types of paperwork required for a home sale in Michigan, including the purchase agreement, title search, and transfer tax returns.

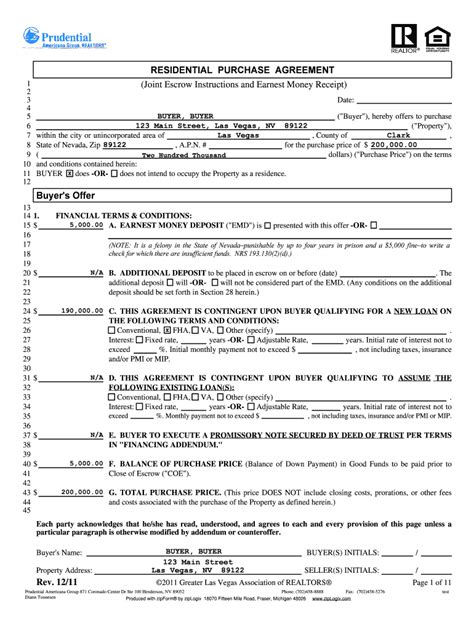

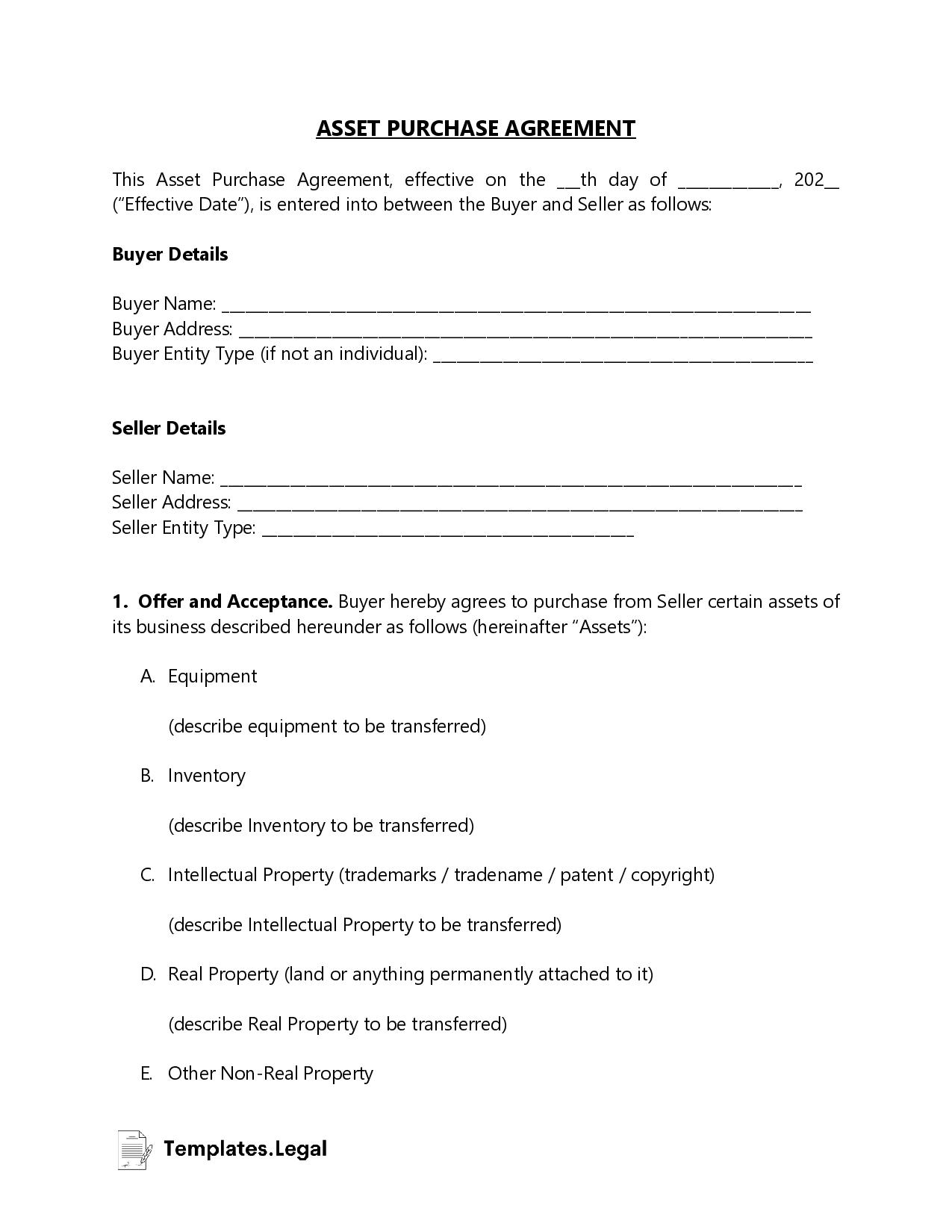

Understanding the Purchase Agreement

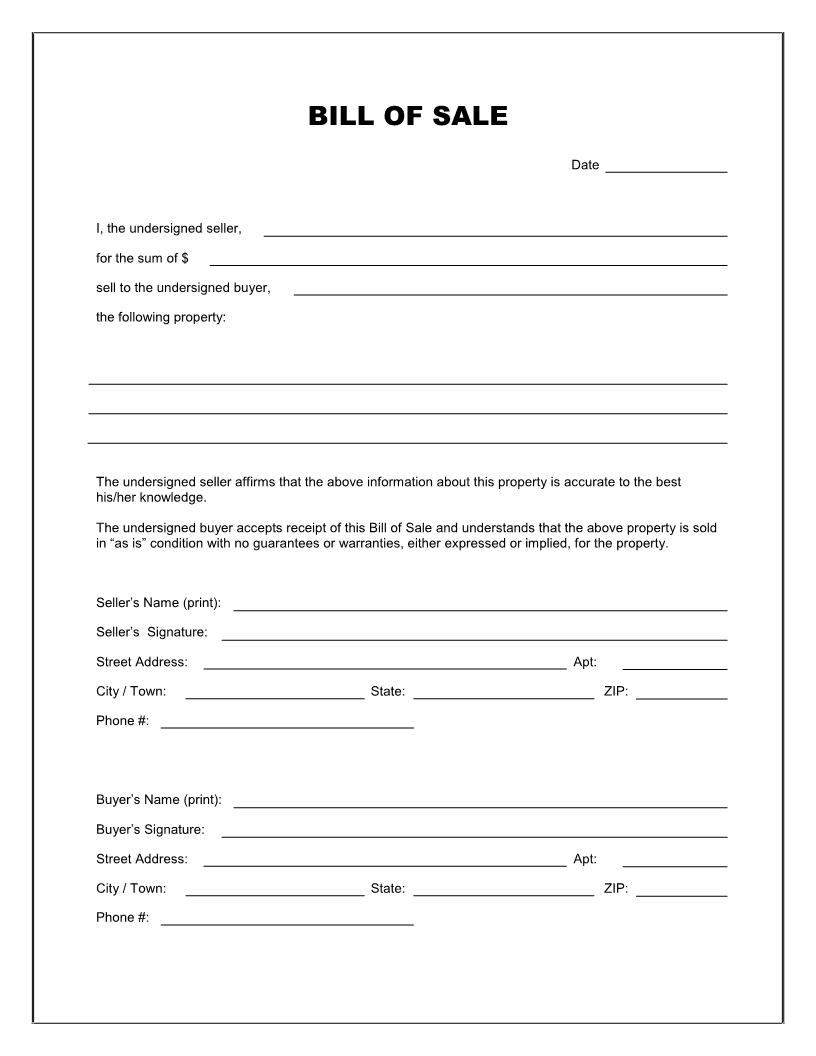

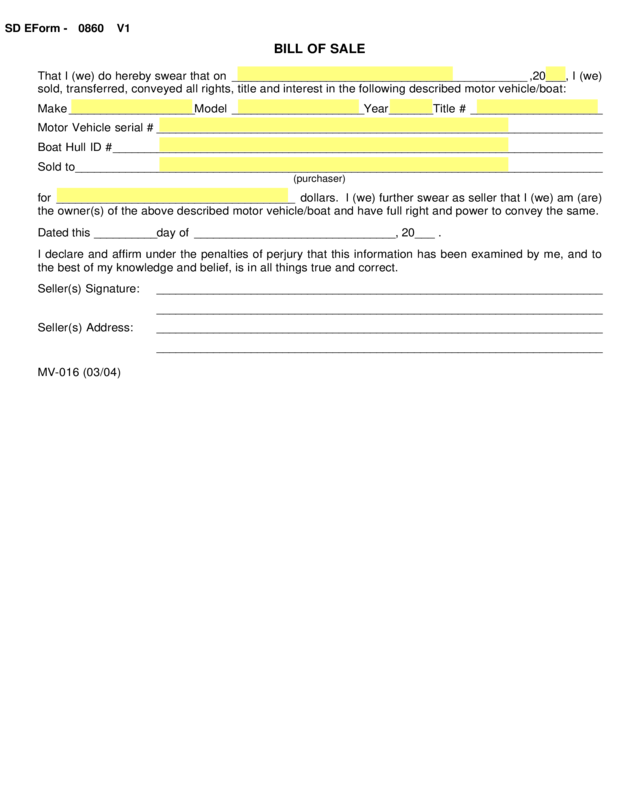

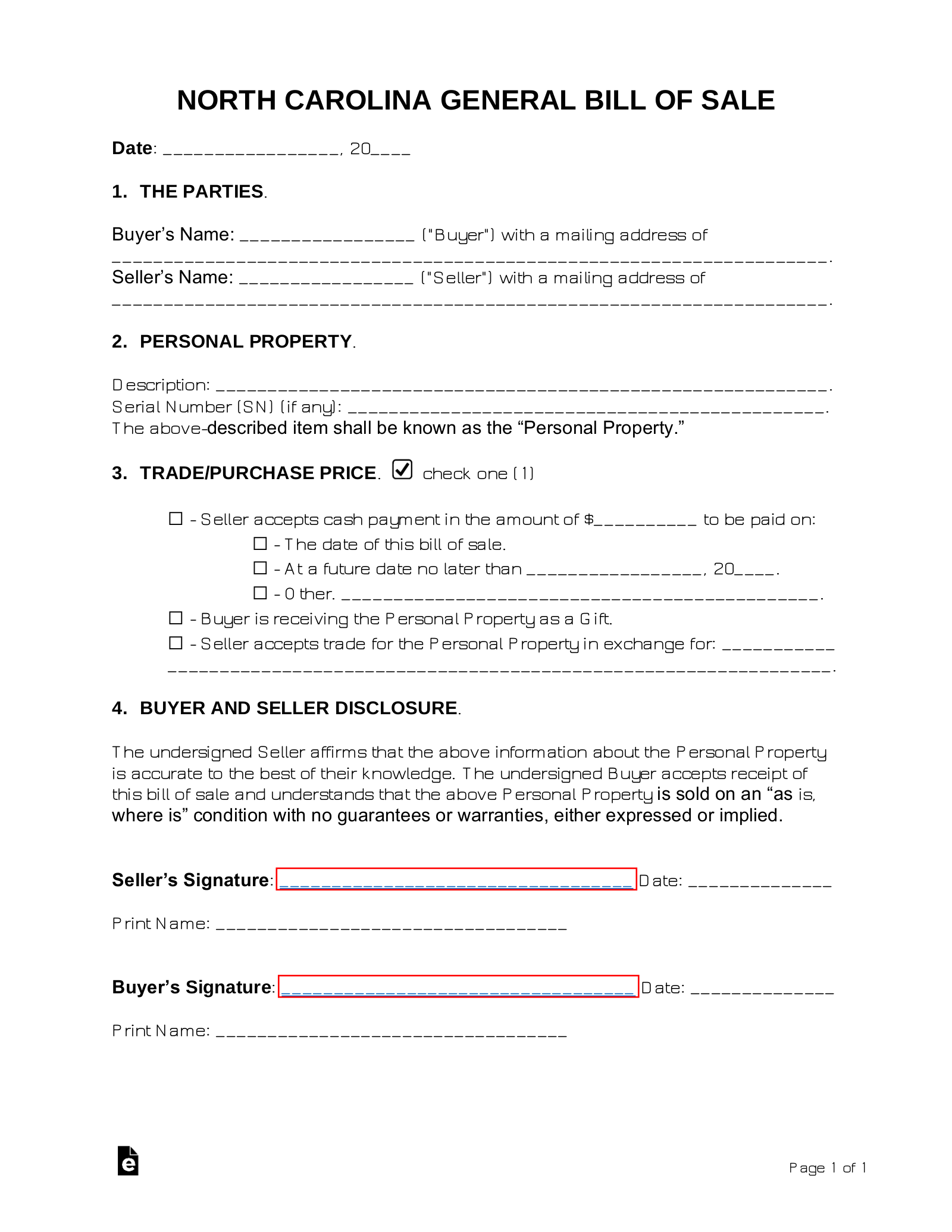

The purchase agreement is the central document in any home sale transaction. It outlines the terms of the sale, including the price, financing terms, and any contingencies. In Michigan, the purchase agreement must include certain key elements, such as: * The names and addresses of the buyer and seller * A description of the property being sold * The purchase price and payment terms * Any contingencies, such as a home inspection or financing contingency * The closing date and location

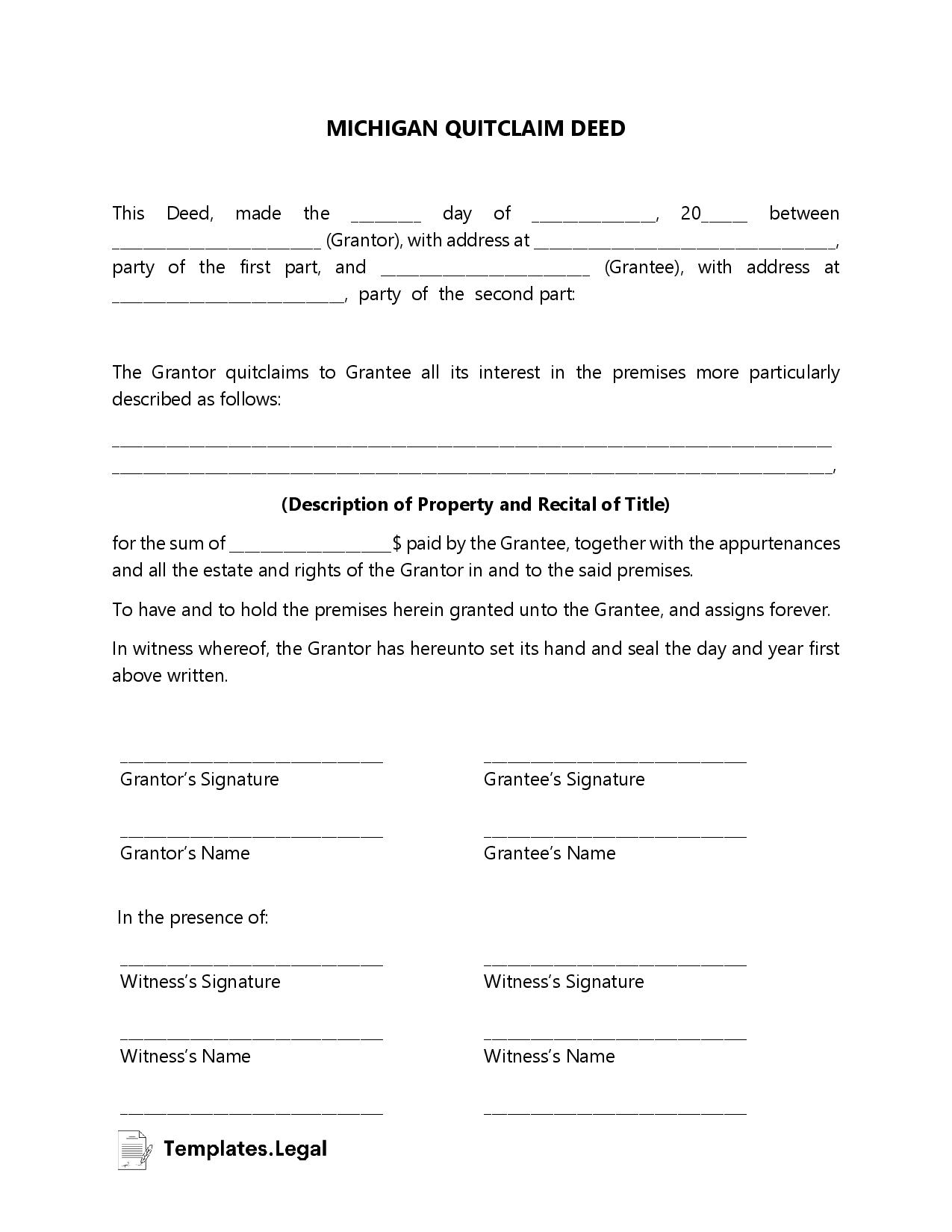

Title Search and Insurance

A title search is a critical step in the home sale process, as it ensures that the seller has clear ownership of the property and that there are no unexpected liens or encumbrances. In Michigan, a title search must be conducted by a licensed title insurance company, and the results must be provided to the buyer and seller. Title insurance is also required, as it protects the buyer and lender from any potential title defects.

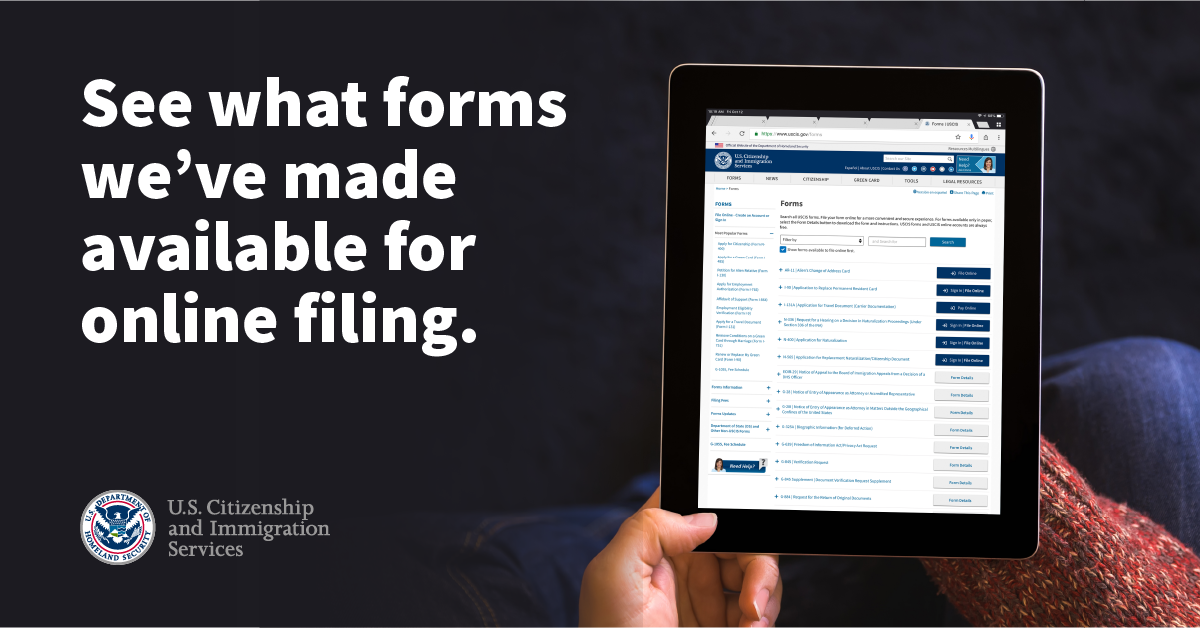

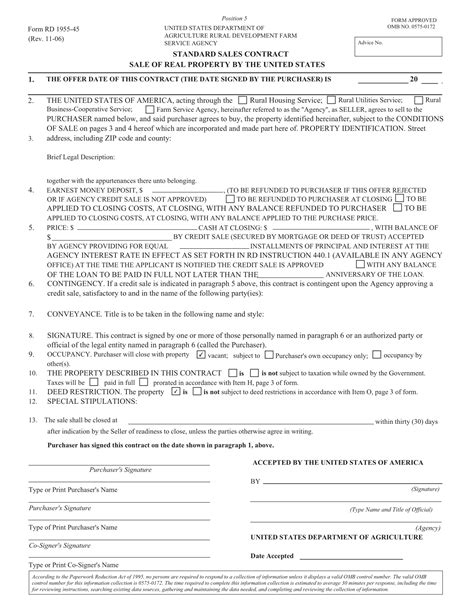

Transfer Tax Returns

In Michigan, a transfer tax return must be filed with the state and local government whenever a property is sold. The transfer tax return includes information about the sale, such as the purchase price, property description, and names of the buyer and seller. The transfer tax return is used to calculate the transfer tax, which is a fee paid by the seller to the state and local government.

Other Paperwork Requirements

In addition to the purchase agreement, title search, and transfer tax return, there are several other paperwork requirements that must be met in a Michigan home sale. These include: * Property disclosure statement: The seller must provide the buyer with a property disclosure statement, which outlines any known defects or issues with the property. * Lead-based paint disclosure: If the property was built before 1978, the seller must provide the buyer with a lead-based paint disclosure, which outlines the risks associated with lead-based paint. * HUD-1 settlement statement: The HUD-1 settlement statement is a document that outlines the final terms of the sale, including the purchase price, closing costs, and any prorations.

| Document | Description |

|---|---|

| Purchase Agreement | Outlines the terms of the sale |

| Title Search | Ensures clear ownership of the property |

| Transfer Tax Return | Calculates the transfer tax |

| Property Disclosure Statement | Outlines known defects or issues with the property |

| Lead-Based Paint Disclosure | Outlines the risks associated with lead-based paint |

| HUD-1 Settlement Statement | Outlines the final terms of the sale |

📝 Note: It's essential to work with a qualified real estate attorney or title company to ensure that all necessary paperwork is completed accurately and on time.

Conclusion and Final Thoughts

In conclusion, the paperwork requirements for a home sale in Michigan can be complex and time-consuming. However, by understanding the different types of documents required, including the purchase agreement, title search, and transfer tax return, buyers and sellers can navigate the process with confidence. It’s essential to work with a qualified real estate professional to ensure that all necessary paperwork is completed accurately and on time. By doing so, buyers and sellers can avoid potential pitfalls and ensure a smooth and successful transaction.

What is the purpose of a title search in a Michigan home sale?

+

The purpose of a title search is to ensure that the seller has clear ownership of the property and that there are no unexpected liens or encumbrances.

What is the transfer tax in Michigan, and who pays it?

+

The transfer tax is a fee paid by the seller to the state and local government, and it is calculated based on the purchase price of the property.

What is the purpose of a property disclosure statement in a Michigan home sale?

+

The purpose of a property disclosure statement is to outline any known defects or issues with the property, and to provide the buyer with a clear understanding of the property’s condition.