Business Loan Paperwork Requirements

Introduction to Business Loan Paperwork

When it comes to applying for a business loan, one of the most critical aspects of the process is the paperwork required. Business loan paperwork can be overwhelming, with numerous documents and forms to fill out. Understanding what is required and being prepared can make a significant difference in the speed and success of your loan application. In this article, we will delve into the key documents and information needed for a business loan, helping you navigate the process more efficiently.

Understanding Business Loan Types

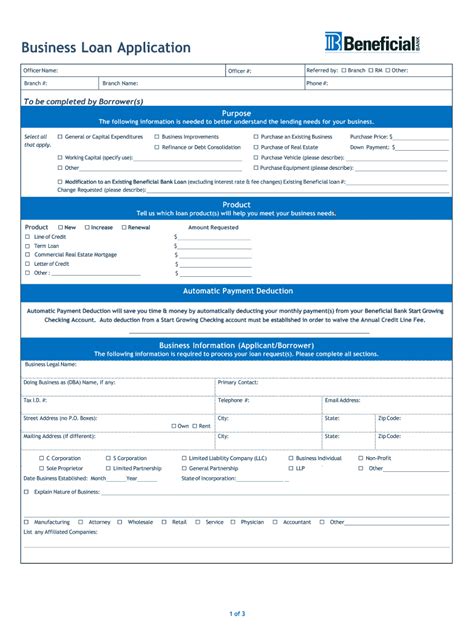

Before diving into the paperwork, it’s essential to understand the types of business loans available. Each type may have slightly different requirements, but there are common documents that lenders typically ask for. The main types include: - Term Loans: Traditional loans with a fixed repayment term. - Lines of Credit: Revolving credit that can be drawn upon as needed. - Invoice Financing: Loans based on outstanding invoices. - Mortgage Loans: Loans for purchasing or refinancing property. - Equipment Financing: Loans for purchasing equipment.

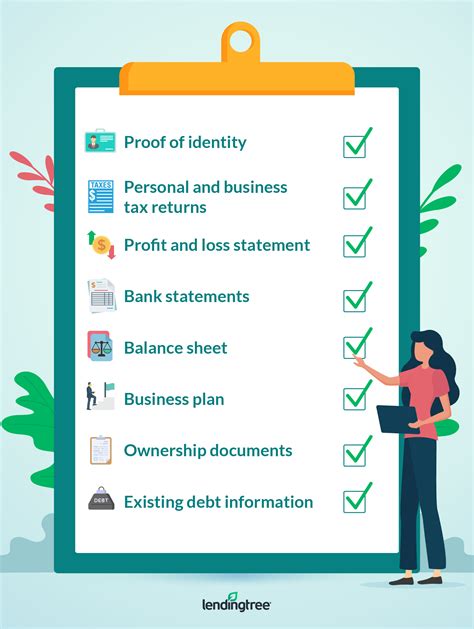

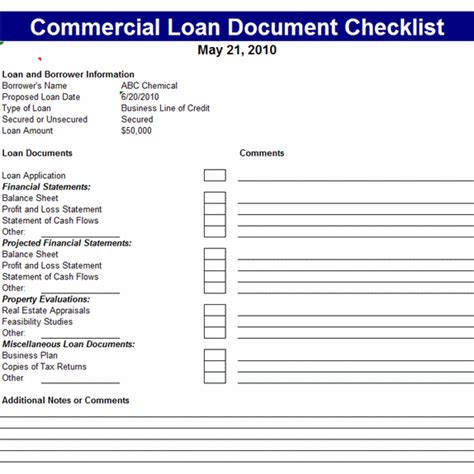

Basic Paperwork Requirements

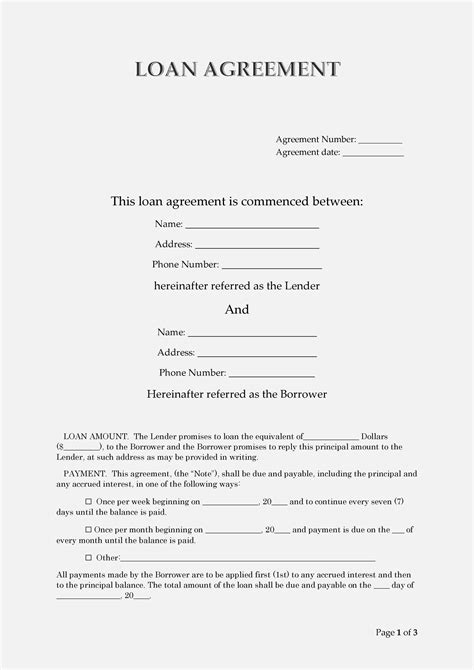

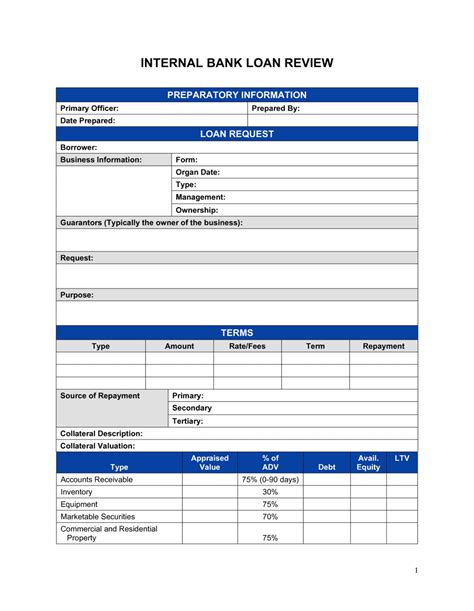

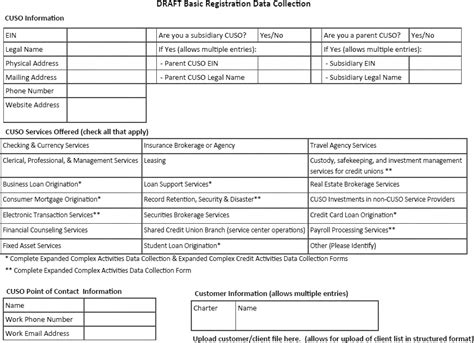

While specific requirements can vary by lender and loan type, there are several basic documents that are commonly needed for most business loan applications: - Business Plan: A detailed plan outlining your business goals, strategies, and financial projections. - Financial Statements: This includes balance sheets, income statements, and cash flow statements for your business. - Tax Returns: Both personal and business tax returns for the past few years. - Identification: Personal and business identification documents. - Credit Reports: Both personal and business credit reports. - Bank Statements: Recent bank statements for your business. - Collateral Documents: If you’re applying for a secured loan, you’ll need documents related to the collateral.

Detailed Financial Information

Lenders will also require detailed financial information to assess the creditworthiness and financial health of your business. This includes: - Accounts Receivable and Payable: Details about your business’s outstanding invoices and bills. - Asset Valuations: If you’re using assets as collateral, you’ll need professional valuations. - Debt Schedule: A list of all your business debts, including loan balances and payment terms.

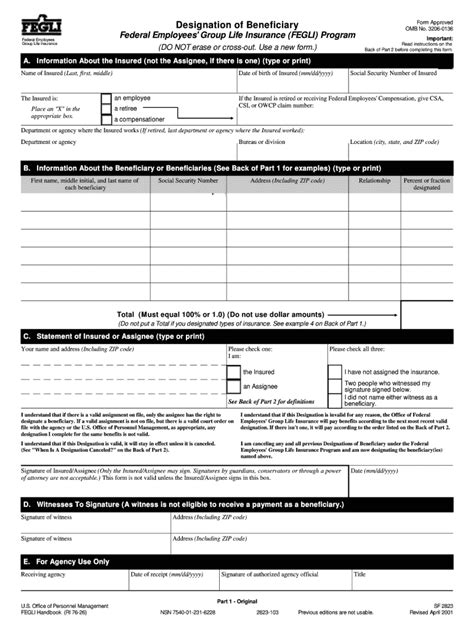

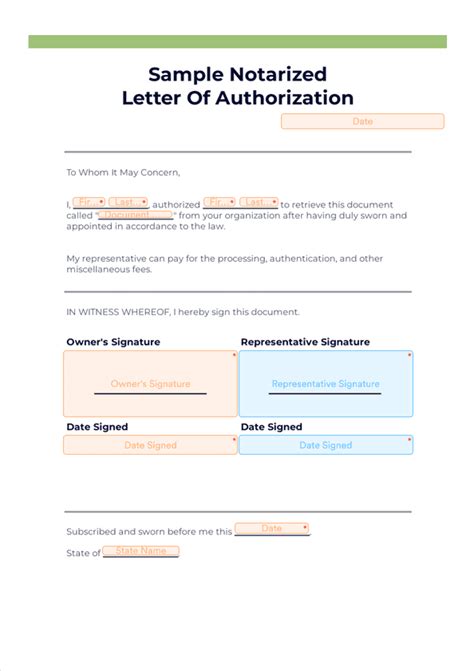

Legal and Structural Documents

In addition to financial documents, lenders may require legal and structural documents to understand the legal and operational structure of your business: - Business Licenses and Registrations: Proof of your business’s legal registration and any necessary licenses. - Articles of Incorporation or Organization: Documents that establish your business’s legal structure. - Partnership or Operating Agreements: If your business is a partnership or LLC, you’ll need these agreements.

Preparing Your Application

To prepare your application, make sure you have all the required documents ready and organized. Consider the following tips: - Review the Lender’s Requirements: Each lender may have specific requirements, so review these carefully. - Organize Your Documents: Use a folder or digital storage to keep all your documents in one place. - Seek Professional Advice: If you’re unsure about any aspect of the application, consider seeking advice from a financial advisor or attorney.

📝 Note: It's crucial to ensure all documents are accurate and up-to-date, as discrepancies can delay or even reject your loan application.

Conclusion and Next Steps

Applying for a business loan involves a significant amount of paperwork, but being prepared and understanding what’s required can simplify the process. By gathering all necessary documents and ensuring your application is complete and accurate, you can increase your chances of approval. Remember, the key to a successful loan application is thorough preparation and a clear understanding of your business’s financial situation and goals.

What is the most common reason for business loan application rejection?

+

The most common reason for business loan application rejection is poor credit history, either personal or business, followed by insufficient collateral or cash flow.

How long does the business loan application process typically take?

+

The length of the business loan application process can vary significantly depending on the lender and the complexity of the application. It can range from a few days for online lenders to several weeks or even months for traditional bank loans.

Can I apply for a business loan with bad credit?

+

Yes, it’s possible to apply for a business loan with bad credit, but your options may be limited, and you may face higher interest rates or stricter terms. Some lenders specialize in bad credit loans, and there are also alternative funding options like invoice financing or equipment financing that may not require a high credit score.