5 Tips USPS Retirement

Introduction to USPS Retirement

The United States Postal Service (USPS) offers its employees a comprehensive retirement package, which includes a pension, social security benefits, and access to health insurance. As a USPS employee, understanding the details of your retirement benefits is crucial for planning your post-work life. In this article, we will explore five tips to help you navigate the USPS retirement system and make the most of your benefits.

Tip 1: Understand Your Retirement Eligibility

To be eligible for USPS retirement benefits, you must meet certain age and service requirements. Generally, you can retire with full benefits at age 62 with five years of service, or at age 60 with 20 years of service. However, if you retire before age 62, your benefits may be reduced. It’s essential to review your personnel records and consult with a USPS retirement specialist to determine your eligibility for retirement.

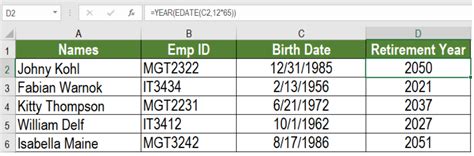

Tip 2: Choose the Right Retirement Plan

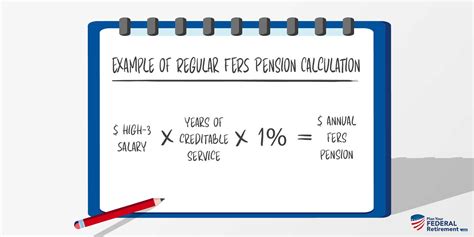

The USPS offers two main retirement plans: the Federal Employees Retirement System (FERS) and the Civil Service Retirement System (CSRS). FERS is a three-part plan that includes a pension, social security benefits, and a thrift savings plan. CSRS, on the other hand, is a more traditional pension plan that provides a guaranteed income stream. Understanding the differences between these plans and choosing the one that best suits your needs is vital for maximizing your retirement benefits.

Tip 3: Plan for Healthcare Costs

As a USPS retiree, you will be eligible for health insurance through the Federal Employees Health Benefits (FEHB) program. However, you will still need to pay premiums and out-of-pocket expenses. It’s essential to factor these costs into your retirement budget and consider options for reducing your healthcare expenses, such as enrolling in a Medicare Advantage plan or purchasing supplemental insurance.

Tip 4: Consider Your Retirement Income Options

As a USPS retiree, you will have several options for receiving your retirement income, including: * Lump Sum Payment: You can choose to receive a lump sum payment of your retirement benefits, which can provide a significant upfront payment. * Monthly Annuity: You can choose to receive a monthly annuity payment, which provides a guaranteed income stream for life. * Partial Lump Sum Payment: You can choose to receive a partial lump sum payment, which provides a combination of upfront and monthly payments. Understanding the pros and cons of each option and choosing the one that best suits your financial needs is crucial for ensuring a comfortable retirement.

Tip 5: Seek Professional Advice

Navigating the USPS retirement system can be complex, and making informed decisions about your benefits requires careful planning and consideration. Seeking professional advice from a financial advisor or retirement specialist can help you make the most of your benefits and ensure a secure and comfortable retirement.

📝 Note: It's essential to review and understand the USPS retirement rules and regulations, as they may change over time.

As you approach retirement, it’s essential to have a clear understanding of your benefits and options. By following these five tips, you can make informed decisions about your retirement and ensure a comfortable and secure post-work life. With careful planning and consideration, you can maximize your USPS retirement benefits and enjoy the fruits of your labor.

In the end, a successful retirement is all about planning and preparation. By taking the time to understand your benefits and options, you can create a secure and comfortable retirement that meets your needs and exceeds your expectations. Whether you’re just starting to plan for retirement or are nearing the end of your career, it’s essential to stay informed and make informed decisions about your benefits. With the right knowledge and planning, you can enjoy a happy and fulfilling retirement.

What is the Federal Employees Retirement System (FERS)?

+

The Federal Employees Retirement System (FERS) is a retirement plan that provides a pension, social security benefits, and a thrift savings plan to federal employees, including USPS employees.

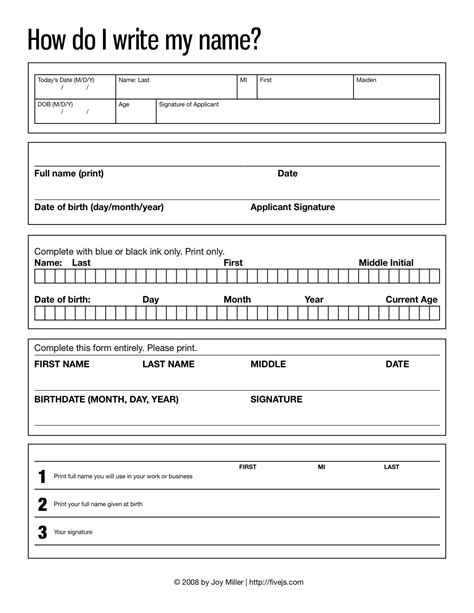

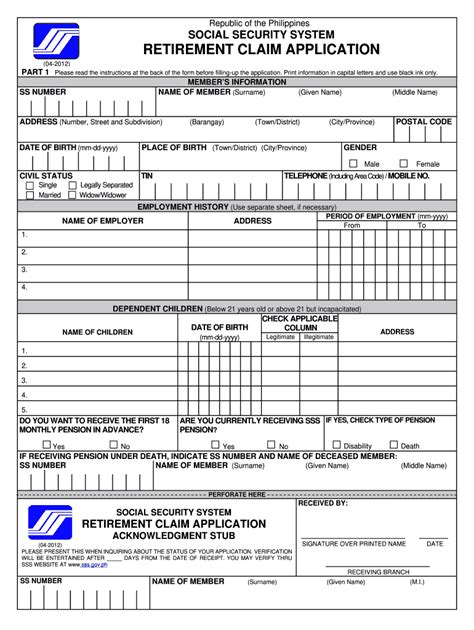

How do I apply for USPS retirement benefits?

+

To apply for USPS retirement benefits, you should submit an application to the USPS Office of Personnel Management (OPM) at least 30 days before your desired retirement date.

Can I retire from the USPS and still work?

+

Yes, you can retire from the USPS and still work, but you may be subject to certain restrictions and limitations on your earnings.