5 Tips Pull Bankruptcy Papers

Introduction to Pulling Bankruptcy Papers

Pulling bankruptcy papers is a significant step in the process of filing for bankruptcy, which can be a daunting and complex experience for individuals and businesses alike. The decision to file for bankruptcy is not taken lightly, and it requires careful consideration of one’s financial situation, the types of debt involved, and the potential long-term consequences. For those navigating this challenging landscape, understanding the process and the paperwork involved is crucial. In this article, we will delve into the specifics of pulling bankruptcy papers, highlighting key tips and considerations to keep in mind.

Understanding Bankruptcy

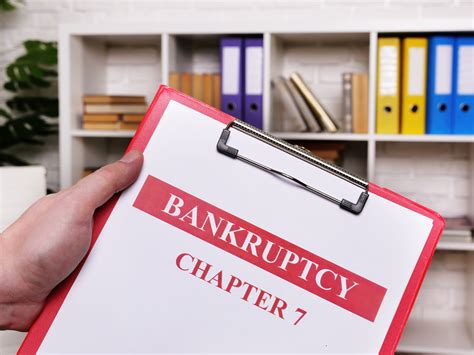

Before diving into the tips for pulling bankruptcy papers, it’s essential to have a basic understanding of what bankruptcy entails. Bankruptcy is a legal process that allows individuals or businesses to escape debt by distributing their assets to creditors or by creating a plan to repay a portion of the debt. There are several types of bankruptcy, with Chapter 7 and Chapter 13 being the most common for individuals. Chapter 7 involves liquidating assets to pay off creditors, while Chapter 13 involves creating a repayment plan. For businesses, Chapter 11 is often used, allowing the company to restructure its debts and continue operating.

Tips for Pulling Bankruptcy Papers

The process of pulling bankruptcy papers, or initiating the bankruptcy filing process, involves several critical steps. Here are five key tips to consider:

- Gather All Necessary Documents: This includes income statements, lists of assets and debts, and information about creditors. Having all documents in order can streamline the process and reduce the risk of errors or omissions that could delay the filing.

- Choose the Right Type of Bankruptcy: As mentioned, there are different types of bankruptcy. Choosing the right one depends on the individual’s or business’s specific financial situation, goals, and the types of debt involved. Consulting with a bankruptcy attorney can provide valuable insights and guidance in making this decision.

- Consider the Long-Term Implications: Filing for bankruptcy can have long-lasting effects on credit scores and financial stability. It’s crucial to weigh these implications against the immediate relief bankruptcy can provide. Sometimes, alternatives to bankruptcy, such as debt consolidation or negotiation with creditors, might be viable options.

- Work with a Bankruptcy Attorney: The bankruptcy process is complex and involves a lot of paperwork and legal nuances. Working with an experienced bankruptcy attorney can help ensure that the process is handled correctly and efficiently, reducing stress and the risk of costly mistakes.

- Be Prepared for the Process: Pulling bankruptcy papers is just the beginning. The bankruptcy process involves court appearances, meetings with creditors, and potentially dealing with issues that arise during the process. Being prepared, both financially and emotionally, can make a significant difference in navigating these challenges.

Additional Considerations

In addition to these tips, there are several other factors to consider when pulling bankruptcy papers. These include understanding the automatic stay, which temporarily halts most collection activities against the debtor, and being aware of the means test, which can determine eligibility for Chapter 7 bankruptcy. Furthermore, individuals should be prepared to provide detailed financial information and to potentially face questions from creditors or the trustee appointed to oversee the bankruptcy case.

Potential Challenges and Solutions

The process of pulling bankruptcy papers and navigating the bankruptcy system can be fraught with challenges. One common issue is dealing with creditor harassment, which the automatic stay is designed to prevent. However, some creditors may not immediately cease collection activities, requiring the debtor to take additional steps to enforce the stay. Another challenge can be the emotional toll of bankruptcy, which can be significant. Seeking support from financial advisors, attorneys, and sometimes mental health professionals can be beneficial.

| Type of Bankruptcy | Description |

|---|---|

| Chapter 7 | Liquidation of assets to pay off creditors. |

| Chapter 13 | Creation of a repayment plan to pay off a portion of debts. |

| Chapter 11 | Restructuring of debts for businesses to continue operating. |

💡 Note: Understanding the different chapters of bankruptcy and their implications is crucial for making an informed decision about which type to file under.

As individuals and businesses move forward with pulling bankruptcy papers and navigating the bankruptcy process, it’s essential to remain informed, prepared, and supported. The decision to file for bankruptcy is a significant one, with both immediate and long-term consequences. By understanding the process, the types of bankruptcy, and the tips for successfully navigating this complex legal landscape, individuals can make more informed decisions about their financial futures.

In the end, while bankruptcy can seem like a daunting and final resort, it can also be a powerful tool for achieving financial relief and rebuilding credit. By approaching the process with care, consideration, and the right guidance, individuals and businesses can set themselves on the path to financial recovery and stability. The key is to be well-informed, to plan carefully, and to seek the right support throughout the journey.

What is the main difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 involves the liquidation of assets to pay off creditors, while Chapter 13 involves creating a repayment plan to pay off a portion of debts over time.

Do I need a lawyer to file for bankruptcy?

+

While it’s possible to file for bankruptcy without a lawyer, it’s highly recommended to work with an experienced bankruptcy attorney to ensure the process is handled correctly and efficiently.

How long does bankruptcy stay on my credit report?

+

Bankruptcy can stay on your credit report for up to 10 years, although the impact on your credit score will diminish over time as you rebuild your credit.