Paperwork

7 Mortgage Paperworks Needed

Introduction to Mortgage Paperwork

When applying for a mortgage, it’s essential to understand the various paperwork requirements. The process can be overwhelming, but being prepared and knowing what to expect can make it more manageable. In this article, we will discuss the necessary mortgage paperwork and provide a clear understanding of each document’s purpose.

Types of Mortgage Paperwork

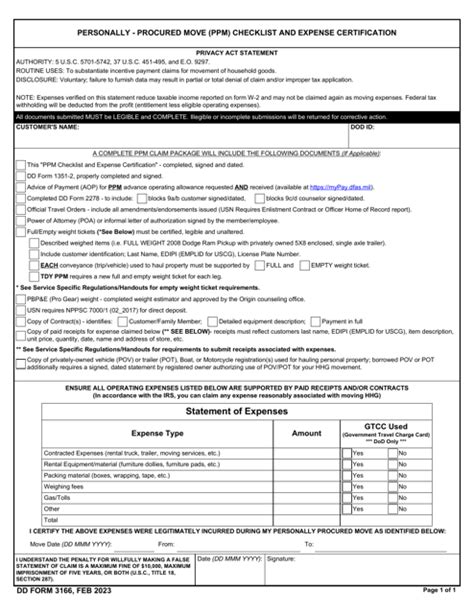

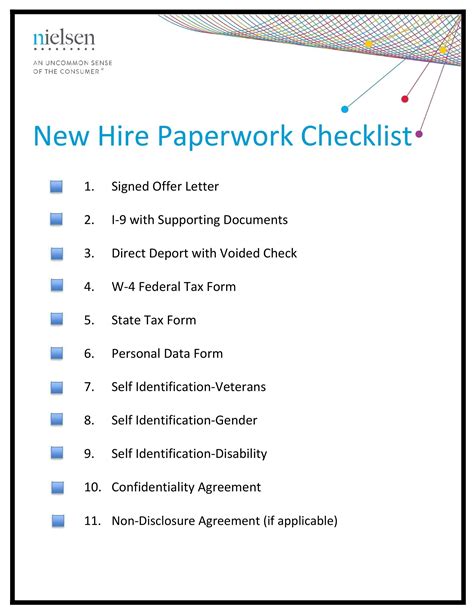

The following are the key mortgage paperwork needed for a smooth application process: * Pre-approval letter: This document confirms that a lender has agreed to lend a specific amount of money based on the borrower’s creditworthiness. * Identification documents: These include a valid passport, driver’s license, or state ID, which verify the borrower’s identity. * Income verification documents: Pay stubs, W-2 forms, and tax returns are used to confirm the borrower’s income and employment status. * Bank statements and asset documentation: These documents provide information about the borrower’s savings, investments, and other assets. * Credit reports: Lenders use credit reports to evaluate the borrower’s credit history and credit score. * Title report and insurance: A title report ensures the property’s title is clear, and title insurance protects the lender and borrower against any potential title issues. * Appraisal report: An appraisal report provides an independent assessment of the property’s value, which helps the lender determine the loan amount.

Understanding the Pre-approval Letter

A pre-approval letter is typically the first step in the mortgage application process. It confirms that a lender has reviewed the borrower’s creditworthiness and agreed to lend a specific amount of money. The letter usually includes the following information: * Loan amount * Interest rate * Loan term * Expiration date

📝 Note: A pre-approval letter is usually valid for 30 to 60 days and may require a credit check.

The Importance of Identification Documents

Identification documents are crucial in the mortgage application process. They help verify the borrower’s identity and prevent fraud. The most common identification documents required are: * Passport * Driver’s license * State ID

Income Verification Documents

Income verification documents are necessary to confirm the borrower’s income and employment status. The following documents are typically required: * Pay stubs * W-2 forms * Tax returns

Bank Statements and Asset Documentation

Bank statements and asset documentation provide information about the borrower’s savings, investments, and other assets. The following documents are usually required: * Bank statements * Investment accounts * Retirement accounts

Credit Reports and Scores

Credit reports and credit scores play a significant role in the mortgage application process. Lenders use credit reports to evaluate the borrower’s credit history and credit score. A good credit score can help borrowers qualify for better interest rates and terms.

Title Report and Insurance

A title report ensures the property’s title is clear, and title insurance protects the lender and borrower against any potential title issues. The title report typically includes: * Property description * Owner information * Liens and encumbrances

Appraisal Report

An appraisal report provides an independent assessment of the property’s value, which helps the lender determine the loan amount. The appraisal report typically includes: * Property description * Value assessment * Comparable sales

🏠 Note: An appraisal report is usually required for purchase transactions and may be waived for refinance transactions.

Conclusion and Final Thoughts

In conclusion, the mortgage application process involves various paperwork requirements. Understanding the purpose of each document and being prepared can make the process more manageable. By knowing what to expect, borrowers can avoid delays and ensure a smooth application process. Remember to review and understand each document carefully, and don’t hesitate to ask questions if you’re unsure about any aspect of the process.

What is the purpose of a pre-approval letter?

+

A pre-approval letter confirms that a lender has agreed to lend a specific amount of money based on the borrower’s creditworthiness.

What documents are typically required for income verification?

+

Pay stubs, W-2 forms, and tax returns are usually required to confirm the borrower’s income and employment status.

Why is a title report and insurance necessary?

+

A title report ensures the property’s title is clear, and title insurance protects the lender and borrower against any potential title issues.